North America Dairy Protein Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 6.21 % |

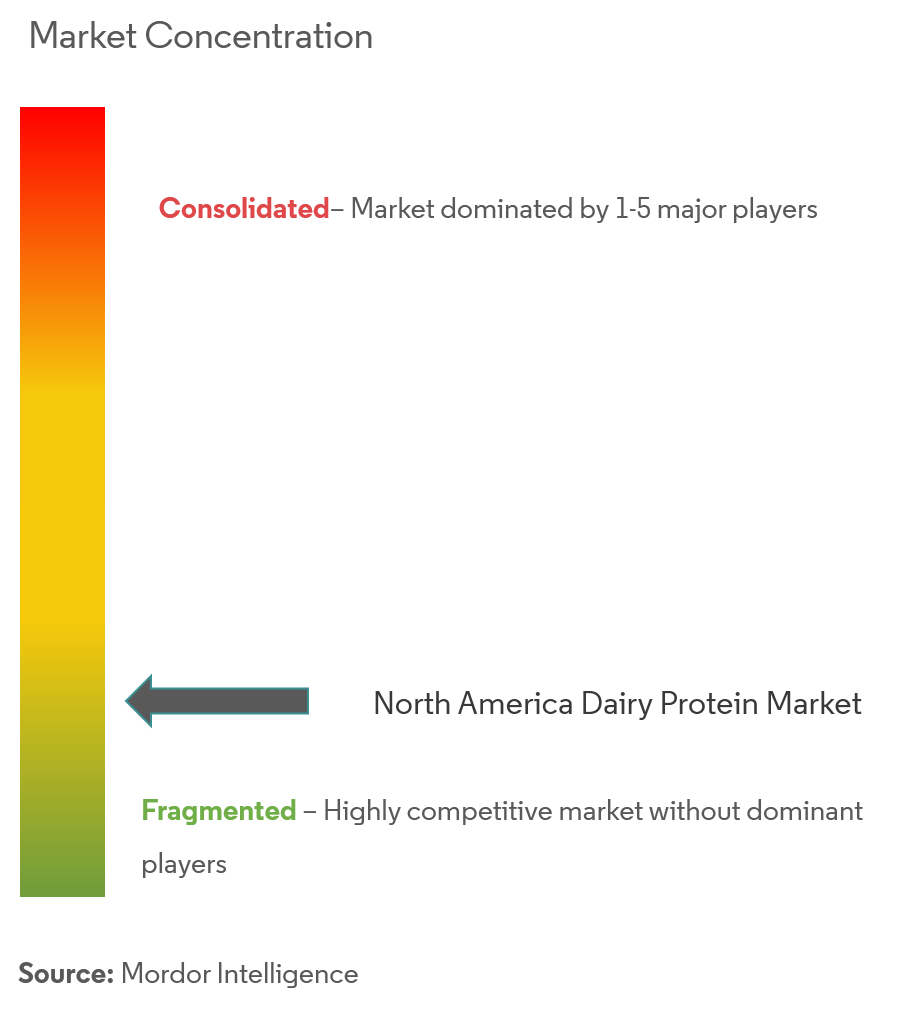

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

North America Dairy Protein Market Analysis

North America Dairy Protein Market is projected to register a CAGR of 6.21%, during the forecast period (2021-2026).

North America is a highly matured market for whey protein, with over 1,000 whey-containing products, entering the market every year. The North America dairy industry can help formulators meet consumer demand for clean labels and day-to-day convenience at production scale. Consumers can easily incorporate whey protein into their diets, by directly combining it with smoothies, yogurt, oatmeal, pasta, and more, to increase their protein consumption throughout the day.

Increasing consumer awareness, especially for functional foods and dietary supplements, has been a major factor for market development in recent times.

North America Dairy Protein Market Trends

This section covers the major market trends shaping the North America Dairy Protein Market according to our research experts:

Widespread Applications of Dairy Protein in Performance Nutrition to Boost Revenues

Dairy proteins are uniquely positioned to add nutrition to food products with low protein content. North America dairy protein manufacturers are finding ways to provide consumers with more options, and are developing innovative products that incorporate dairy proteins into various snacks, baking mixes, beverages, sports nutrition products, and more. For example, whey protein-based products are increasingly being used in the sports nutrition industry. This includes products such as whey protein bars, powders, and drinks.

Consumers in the current market place are affected more by interactive labelling. Manufacturers in the sports nutrition industry are focusing more on the packaging of the products, including an appealing labelling, making it easy for the consumers to know what ingredients they are consuming, and ensuring the safety of product to themselves.

United States Leads the North America Dairy Market

North America Dairy Protein Industry Overview

Some of the Major players in the North America Dairy Protein Market are Dairiconcepts, Devondale Murray Goulburn Co-Operative, Erie, Foods Inc., Fonterra, Grassland, Glanbia, Idaho Milk, Laïta Group, Milk Specialties Inc., Sole Mizo, and Tatura Milk Ind, among others.

North America Dairy Protein Market Leaders

-

Dairiconcepts

-

Devondale Murray Goulburn

-

Laïta Group

-

Erie Foods Inc.

-

Fonterra

*Disclaimer: Major Players sorted in no particular order

North America Dairy Protein Market News

In 2019, Arla group introduced whey protein hydrolysate without the bitter taste, across all its operating countries including United States. Its' new 100% whey protein hydrolysate Lacprodan® HYDRO. PowerPro is 50% less bitter than comparable products, with a similar degree of hydrolysis

In 2017, Arla foods, a Denmark based dairy products manufacturing company, launched a new whey protein solution to ensure that the protein bars stay soft for at least a year. The company developed Nutrilac PB-8420, a whey protein to ensure that the protein bars retain a cohesive texture for 12 months.

North America Dairy Protein Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Ingredients

- 5.1.1 Milk Protein Concentrates (MPCs)

- 5.1.2 Whey Protein Concentrates (WPCs)

- 5.1.3 Whey Protein Isolates (WPIs)

- 5.1.4 Milk Protein Isolates (MPIs)

- 5.1.5 Casein and Caseinates

- 5.1.6 Others

-

5.2 By Application

- 5.2.1 Food

- 5.2.1.1 Infant Nutrition

- 5.2.1.2 Dairy Based Food

- 5.2.1.3 Bakery, Confectionary and Frozen Desserts

- 5.2.1.4 Sports and Performance Nutrition

- 5.2.1.5 Others

- 5.2.2 Beverage

- 5.2.3 Personal care & cosmetics

- 5.2.4 Animal Feed

- 5.2.5 Others

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Mexico

- 5.3.1.3 Canada

- 5.3.1.4 Reat of North America

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Dairy Farmers of America

- 6.4.2 Devondale Murray Goulburn Co-Operative

- 6.4.3 Laita Group

- 6.4.4 Erie Foods Inc.

- 6.4.5 Fonterra

- 6.4.6 Grassland

- 6.4.7 Glanbia

- 6.4.8 Idaho Milk

- 6.4.9 Tatura Milk Ind

- 6.4.10 United Dairymen of Arizona

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityNorth America Dairy Protein Industry Segmentation

North Americandairy protein markethas been segmented based on the ingredients, applications, and geography. The ingredients segment consistswhey protein concentrates and isolates, milk protein concentrates and isolates, casein and caseinates, as the major products. TheNorth American market share of whey dairy proteinis largely followed by casein and others.Based on theapplication of dairy proteins,the various sectors are food & beverage, infant formulations, personal care, and animal feed to name a few.Also, the study provides an analysis of the dairy protein market in the emerging and established markets across the region, including United States, Mexico, Canada, and rest of the North America.

| By Ingredients | Milk Protein Concentrates (MPCs) | |

| Whey Protein Concentrates (WPCs) | ||

| Whey Protein Isolates (WPIs) | ||

| Milk Protein Isolates (MPIs) | ||

| Casein and Caseinates | ||

| Others | ||

| By Application | Food | Infant Nutrition |

| Dairy Based Food | ||

| Bakery, Confectionary and Frozen Desserts | ||

| Sports and Performance Nutrition | ||

| Others | ||

| By Application | Beverage | |

| Personal care & cosmetics | ||

| Animal Feed | ||

| Others | ||

| Geography | North America | United States |

| Mexico | ||

| Canada | ||

| Reat of North America |

North America Dairy Protein Market Research FAQs

What is the current North America Dairy Protein Market size?

The North America Dairy Protein Market is projected to register a CAGR of 6.21% during the forecast period (2024-2029)

Who are the key players in North America Dairy Protein Market?

Dairiconcepts, Devondale Murray Goulburn, Laïta Group, Erie Foods Inc. and Fonterra are the major companies operating in the North America Dairy Protein Market.

What years does this North America Dairy Protein Market cover?

The report covers the North America Dairy Protein Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the North America Dairy Protein Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

North America Milk Protein Industry Report

Statistics for the 2024 North America Milk Protein market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Milk Protein analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.