North America Fermented Ingredient Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| CAGR | 6.40 % |

| Largest Market | United States |

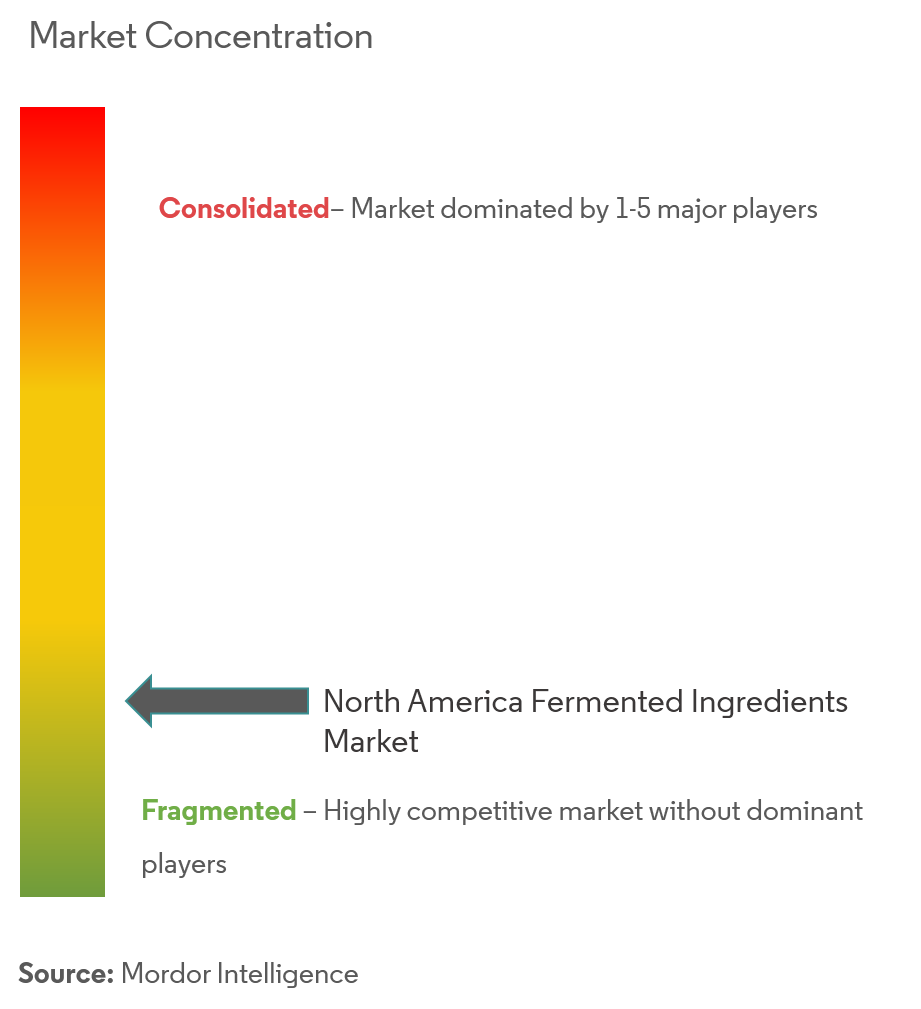

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

North America Fermented Ingredient Market Analysis

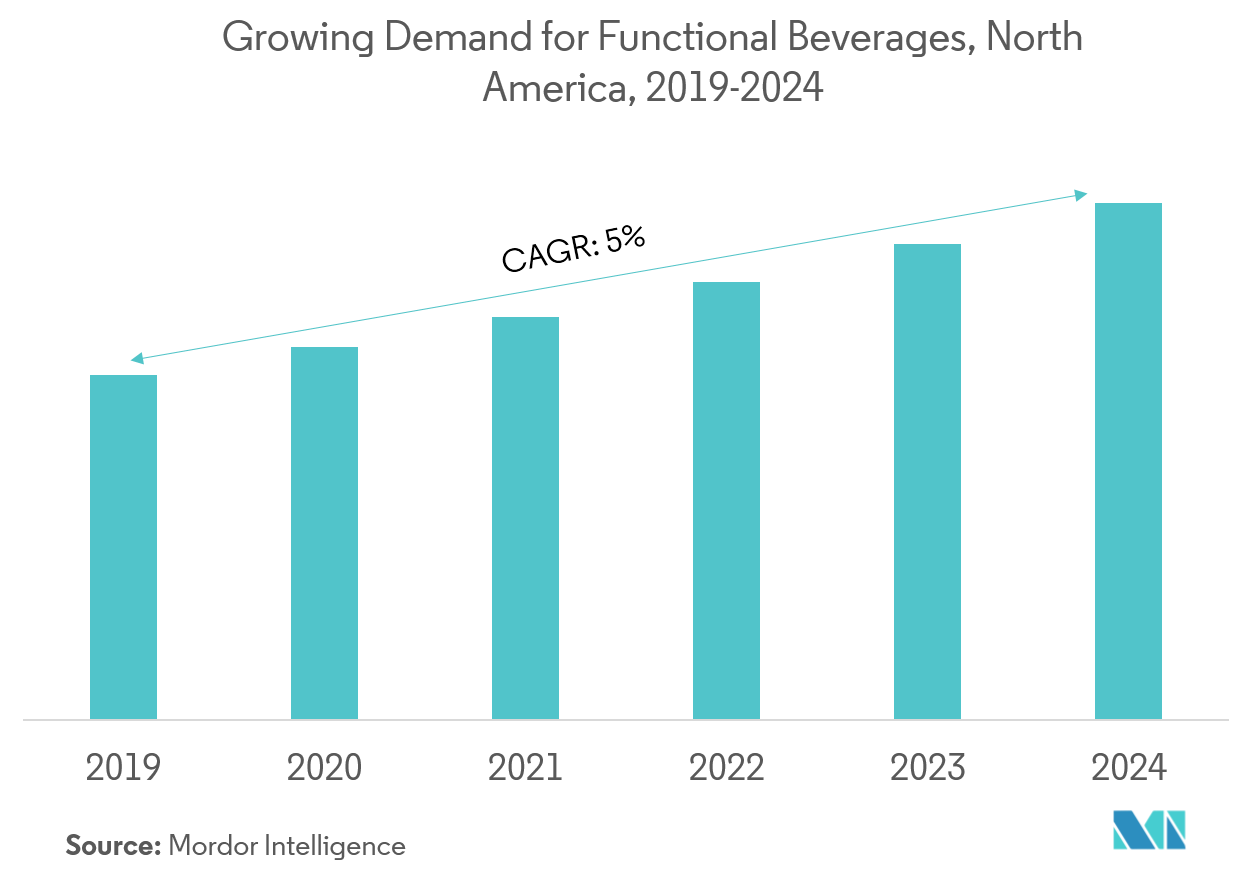

North American fermented ingredient market is anticipated to register a CAGR of 6.4% during the forecast period 2019-2024.

- Increasing innovation in the fermentation equipment and process is supporting the market growth in the North American region, especially in developed economies, like the United States.

- In North America, the food and beverage market is growing at a fast pace due to the increasing demand for fermented food products with a variety of flavors and nutritional value, which is playing a major role to drive the application of fermented ingredients in the food and beverage segment.

North America Fermented Ingredient Market Trends

This section covers the major market trends shaping the North America Fermented Ingredient Market according to our research experts:

Increase in Demand for Fermented Functional Beverage

United States and Canada Witness a Significant Growth in Fermented Ingredients Market

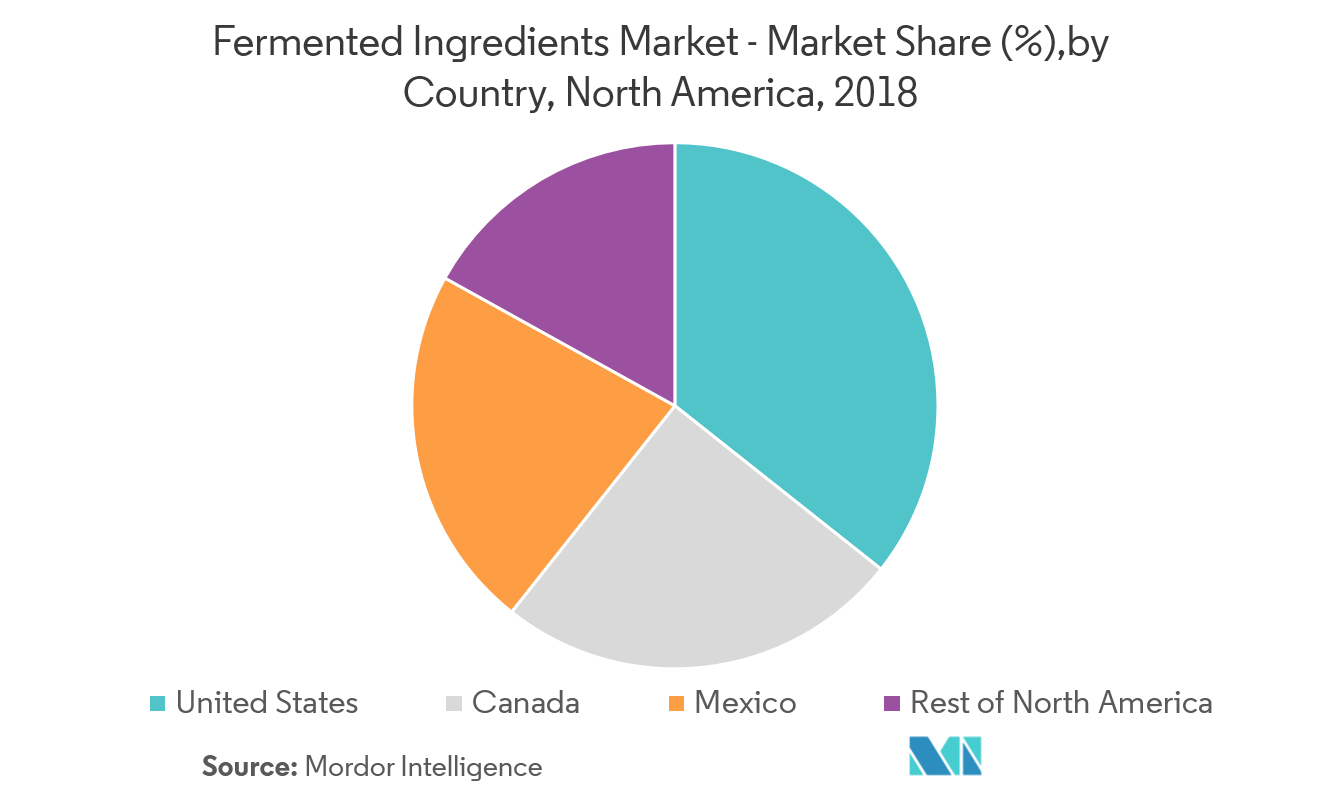

Developed countries, such as the United States and Canada are expected to drive the demand for fermented ingredients in North America during the forecast period, owing to rising demand for high-quality food and personal care products in the countries. Moreover, in addition to beverages, dairy’s clean-label ingredients are popping up in applications, such as soups, snacks, and dips, which is expected to influence the sales of fermented ingredients in the North American region. In North America, the Japanese firm, Ajinomoto holds a significant market share in the amino acid market, whereas, DSM and BASF also hold substantial shares in the fermented ingredient market.

North America Fermented Ingredient Industry Overview

Some of the major players in fermented ingredients market in North America are DowDuPont Inc., Chr. Hansen Inc., Ajinomoto Co. Inc., Koninklijke DSM NV, BASF SE, Kerry Inc., Lallemand Inc., Cargill Inc., Lonza Inc., and CSK Food Enrichment BV, among others.

North America Fermented Ingredient Market Leaders

-

DowDuPont Inc

-

Chr. Hansen Inc

-

Ajinomoto Co. Inc

-

Koninklijke DSM NV

-

BASF SE

*Disclaimer: Major Players sorted in no particular order

North America Fermented Ingredient Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Ingredient Type

- 5.1.1 Acetic Acid Bacteria (AAB)

- 5.1.2 Lactic Acid Bacteria (LAB)

- 5.1.3 Yeast

-

5.2 By Application

- 5.2.1 Food

- 5.2.2 Beverages

- 5.2.2.1 Alcoholic Beverages

- 5.2.2.2 Non-Alcoholic Beverages

- 5.2.3 Feed

- 5.2.4 Pharmaceutical

- 5.2.5 Others

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Ajinomoto Co., Inc.

- 6.4.2 DowDuPont Inc.

- 6.4.3 Koninklijke DSM N.V.

- 6.4.4 Chr. Hansen, Inc.

- 6.4.5 Kerry Inc.

- 6.4.6 BASF Corporatio

- 6.4.7 Lallemand Inc.

- 6.4.8 Cargill, Inc.

- 6.4.9 Lonza Inc.

- 6.4.10 CSK Food Enrichment B.V.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityNorth America Fermented Ingredient Industry Segmentation

North American fermented ingredient market is segmented by Ingredient Type Acetic Acid Bacteria (AAB), Lactic Acid Bacteria (LAB), Yeast); by Application as Food, Beverages, Feed, Pharmaceutical, and Others. Also, the study provides an analysis of the fermented ingredients market in the emerging and established markets across the region, including United States, Mexico, Canada, and rest of the North America

| By Ingredient Type | Acetic Acid Bacteria (AAB) | |

| Lactic Acid Bacteria (LAB) | ||

| Yeast | ||

| By Application | Food | |

| Beverages | Alcoholic Beverages | |

| Non-Alcoholic Beverages | ||

| Feed | ||

| Pharmaceutical | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America |

North America Fermented Ingredient Market Research FAQs

What is the current North America Fermented Ingredient Market size?

The North America Fermented Ingredient Market is projected to register a CAGR of 6.40% during the forecast period (2024-2029)

Who are the key players in North America Fermented Ingredient Market?

DowDuPont Inc, Chr. Hansen Inc, Ajinomoto Co. Inc, Koninklijke DSM NV and BASF SE are the major companies operating in the North America Fermented Ingredient Market.

Which region has the biggest share in North America Fermented Ingredient Market?

In 2024, the United States accounts for the largest market share in North America Fermented Ingredient Market.

What years does this North America Fermented Ingredient Market cover?

The report covers the North America Fermented Ingredient Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the North America Fermented Ingredient Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

North America Fermented Ingredient Industry Report

Statistics for the 2024 North America Fermented Ingredient market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Fermented Ingredient analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.