North America Food Hydrocolloids Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 4.90 % |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

North America Food Hydrocolloids Market Analysis

North America Food Hydrocolloids Market is forecasted to grow at a CAGR of 4.9% during the forecast period of (2020-2025).

- North America is one of the largest marketfor hydrocolloids; the specific demand for the substance for oil and fat reduction exists in the region given the food habit and eating practices of the consumers. It acts as a barrier for oils and fats in breaded/fried foods consumed heavily in US.

- By using hydrocolloids, calorie-dense fats and oils can be replaced with what is essentially structured water. Therefore, consumers would prefer products low in oil and fat, which possible through proper use of hydrocolloids.

- The major types of hydrocolloids in the North America hydrocolloid market are gellan gum, xanthan gum, guar gum, locust bean gum, and pectin, among others.

North America Food Hydrocolloids Market Trends

This section covers the major market trends shaping the North America Food Hydrocolloids Market according to our research experts:

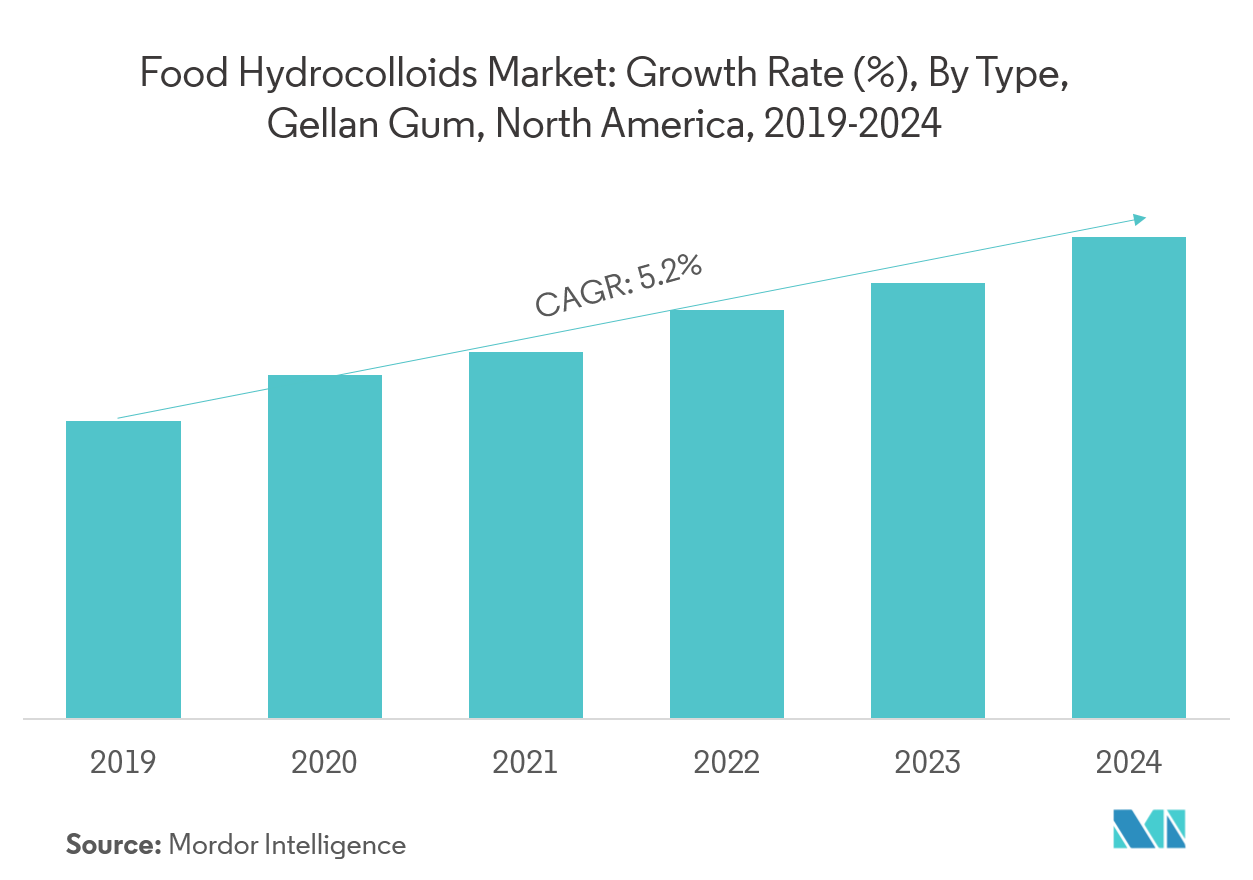

Gellan Gum is the Largest Market Segment

North America is the largest market for gelatin-based hydrocolloids. Gellan gum is an important hydrocolloid in the food industry and is widely used as a food additive in healthy food due to its high content of protein and amino acid. The hydrocolloidal nature of gellan gum has numerous applications in confectionery products (for imparting chewiness, texture, and foam stabilization), jelly deserts (for creaminess, fat reduction, and mouthfeel), dairy products (for stabilization and texturization), and meat products (for water-binding). Owing to the high prices, gellan gum is witnessing a slow growth from the last few years. In the US market, gellan gum is seeing competition from low priced xanthan gum and hence, witnessing slow growth.

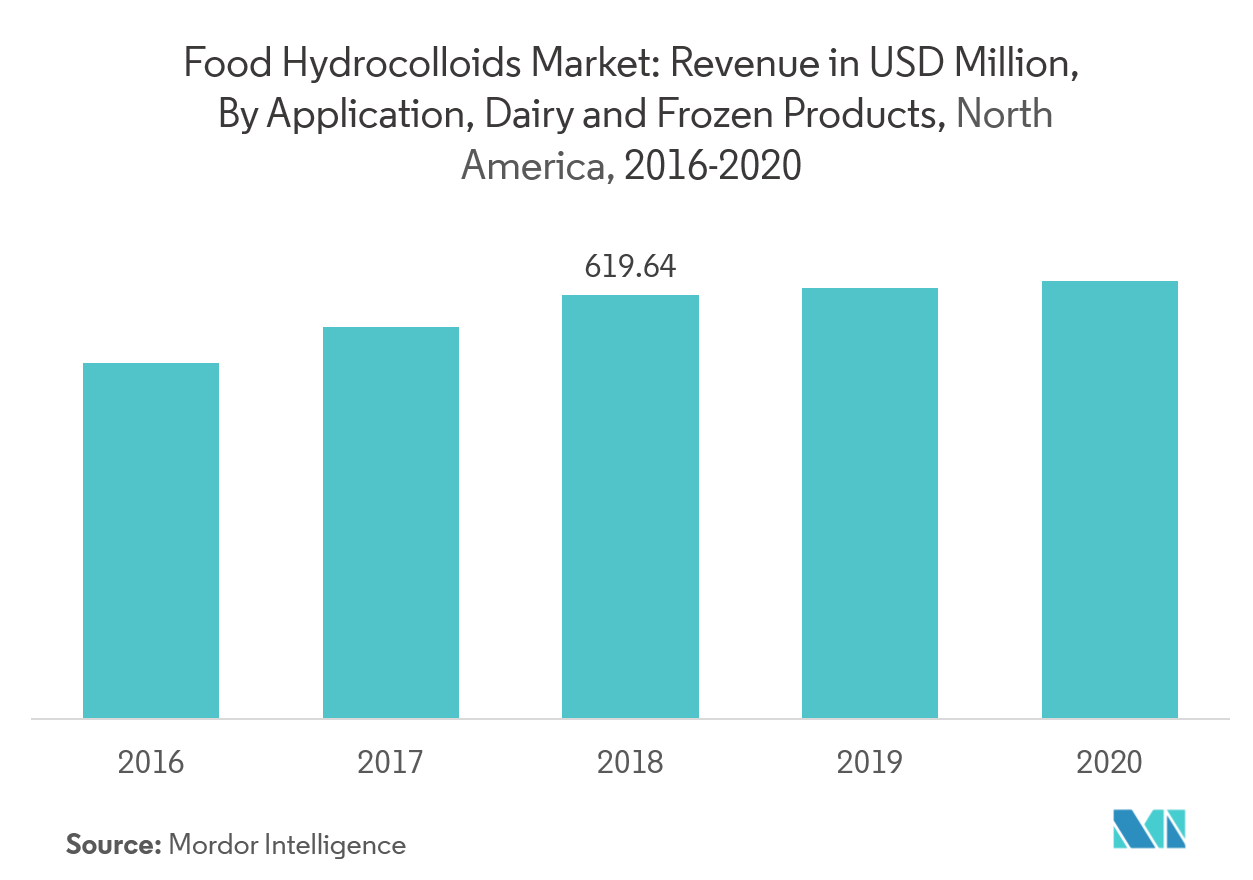

Dairy & Frozen Products Holds the Largest Market Share by Application

Dairy & frozen products and confectionery are the highest in North America market followed by meat, poultry & seafood products, beverages, and bakery. In the United States, the current trend toward new, low-fat dairy products with lower total solids contents has created a further scope of demand for stabilizers; a combination of hydrocolloids can be more effective, rather than applying a single stabilizer in dairy and frozen products. This led to the development of a large number of blended hydrocolloids formulated for specific dairy products. Beyond white milk and natural cheese, almost all dairy products may benefit from the addition of hydrocolloids. In yogurt, sour cream and other cultured dairy products, hydrocolloids modify texture by emulsifying, thickening and gelling, in addition to controlling syneresis.

North America Food Hydrocolloids Industry Overview

With several players existing in the market, the global market is highly competitive. The leading players of the market are Cargill, CP Kelco U.S., Inc. and Kerry Group. Strategies of leading players focus on developing innovative solutions that address the taste, texture, and nutritional profile of processed foods, in turn, extending the shelf-life of the final consumer product.

North America Food Hydrocolloids Market Leaders

-

Cargill, Incorporated

-

CP Kelco U.S., Inc.

-

Koninklijke DSM N.V.

-

Kerry Group

*Disclaimer: Major Players sorted in no particular order

North America Food Hydrocolloids Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Gellan Gum

- 5.1.2 Carrageenan

- 5.1.3 Pectin

- 5.1.4 Xanthan Gum

- 5.1.5 Guar Gum

- 5.1.6 Gelatin

- 5.1.7 Others

-

5.2 By Application

- 5.2.1 Dairy and Frozen Products

- 5.2.2 Bakery

- 5.2.3 Beverages

- 5.2.4 Confectionery

- 5.2.5 Meat and Seafood Products

- 5.2.6 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Cargill, Incorporated

- 6.4.2 CP Kelco U.S., Inc

- 6.4.3 DuPont

- 6.4.4 Koninklijke DSM N.V.

- 6.4.5 Archer Daniels Midland Company

- 6.4.6 Ashland Global Holdings Inc.

- 6.4.7 Behn Meyer Holding AG

- 6.4.8 J.F. Hydrocolloids, Inc.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityNorth America Food Hydrocolloids Industry Segmentation

The market has been segmented by type, application, and geography. Based on type, the market is further segmented into gellan gum, pectin, xanthan gum, guar gum, carrageenan, gelatin, and other types. Based on application, the market is further segmented into dairy and frozen products, bakery, beverages, confectionery, meat and seafood products, and other applications. By geography, market covers developed countries of the region including the United States, Canada, and Mexico.

| By Type | Gellan Gum | |

| Carrageenan | ||

| Pectin | ||

| Xanthan Gum | ||

| Guar Gum | ||

| Gelatin | ||

| Others | ||

| By Application | Dairy and Frozen Products | |

| Bakery | ||

| Beverages | ||

| Confectionery | ||

| Meat and Seafood Products | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America |

North America Food Hydrocolloids Market Research FAQs

What is the current North America Food Hydrocolloids Market size?

The North America Food Hydrocolloids Market is projected to register a CAGR of 4.90% during the forecast period (2024-2029)

Who are the key players in North America Food Hydrocolloids Market?

Cargill, Incorporated, CP Kelco U.S., Inc., Koninklijke DSM N.V. and Kerry Group are the major companies operating in the North America Food Hydrocolloids Market.

What years does this North America Food Hydrocolloids Market cover?

The report covers the North America Food Hydrocolloids Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the North America Food Hydrocolloids Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

North America Food Hydrocolloids Industry Report

Statistics for the 2024 North America Food Hydrocolloids market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Food Hydrocolloids analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.