North America Managed Mobility Service Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 20.54 % |

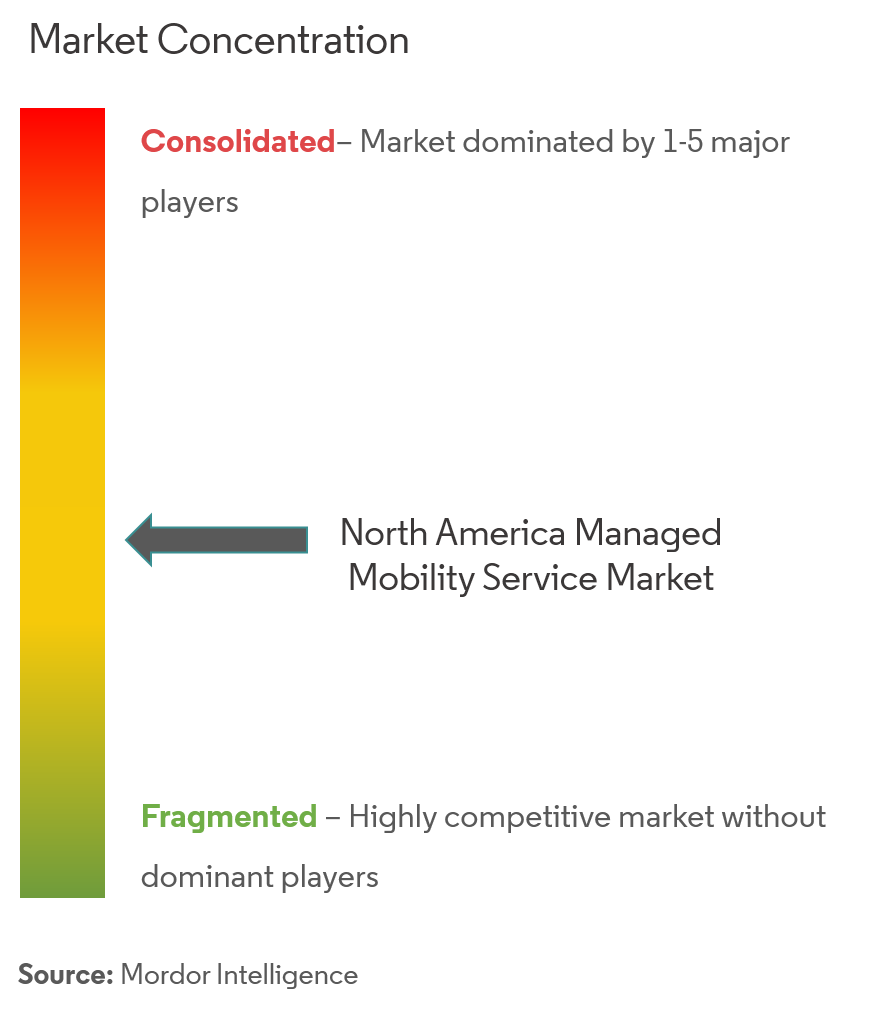

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

North America Managed Mobility Service Market Analysis

The North American managed mobility market was valued at USD 3.22 billion in 2020 and is expected to register a CAGR of 20.54% over the forecast period of 2021 - 2026.

- The primary driver for the managed mobility services market is the increasing adoption of BYOD (Bring-Your-Own-Device) policies across various industries.

- Organizations are adopting BYOD policies in a bid to enhance productivity, without compromising the security and privacy at the workplace. The increasing dependency on IT services for enterprise operations has compelled many organizations to look for alternatives to outsource their non-core activities.

- Furthermore, the rapid incorporation and adoption of the Internet of Things (IoT) devices among the organizations are projected to fuel the market's growth.

North America Managed Mobility Service Market Trends

This section covers the major market trends shaping the North America Managed Mobility Service Market according to our research experts:

Mobile Application Management to Hold Major Share

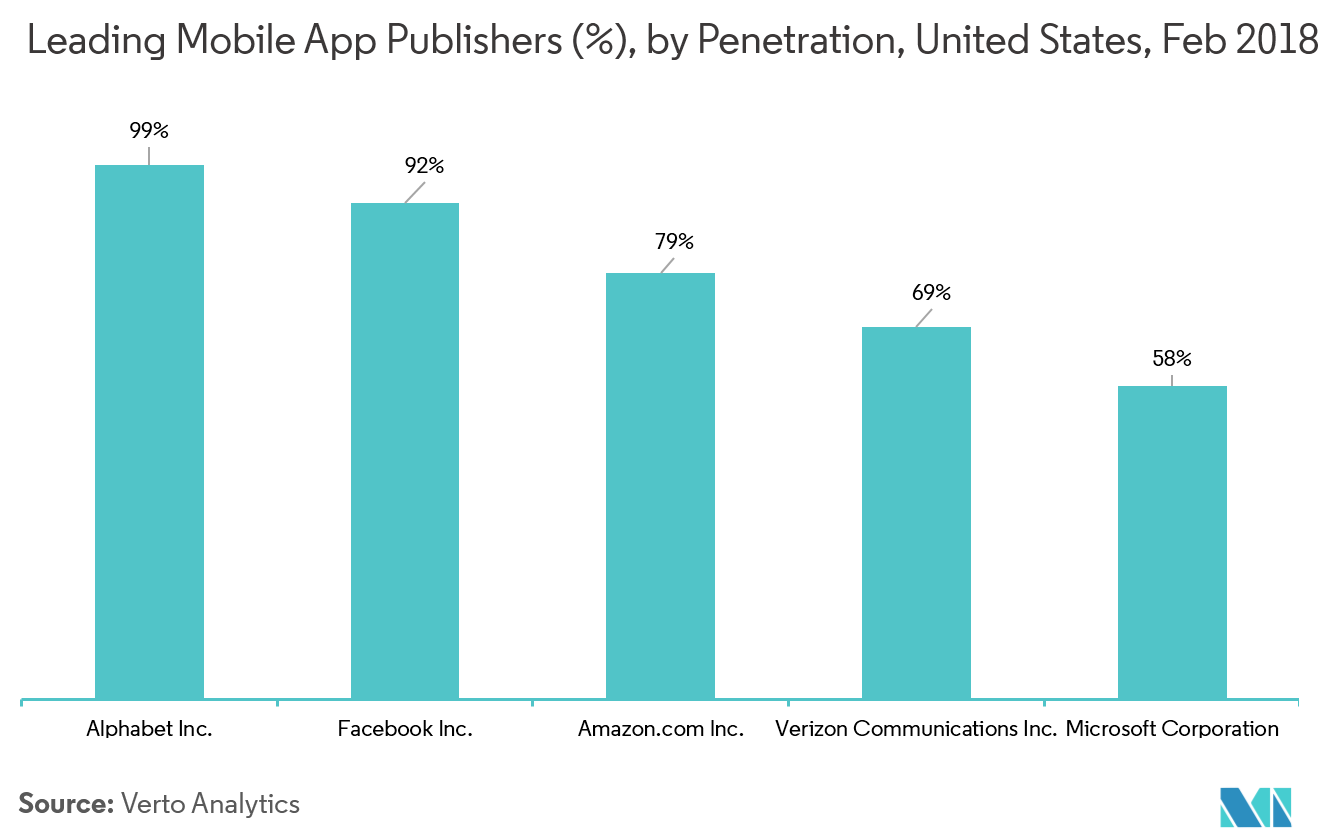

- The significant amount of investment in mobile advertisements, as well as the popularity of mobile advertisements, is encouraging hackers to use this to their advantage. With the increasing number of apps and advertisements, the possibility of mobile users downloading malicious content is increasing.

- The total number of applications on Google Play exceeded 3.5 million by the end of 2017. Apart from these applications, which are primarily concentrated for public use, there are various custom-built applications that are tailor-made for corporate requirements and are deployed across several platforms and devices.

- With the increasing number of commercial applications, the need to maintain and ensure the security of these applications is expected to propel the mobile application management solutions over the forecast period.

North America Managed Mobility Service Industry Overview

The North American managed mobility market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent share in the market are focusing on expanding their customer bases across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market shares and increase their profitability.

- December 2018 -AT&T and IBM collaborated their resources in mobility, to offer IBM MobileFirst for iOS apps to AT&T’s business customers. It is focused on industrial segments. Moreover, these made-for-business apps connect to an organization’s enterprise processesto provide an enhanced mobile experience.

- January 2018 -Fujitsu and Polaris Group signed a contractual agreement for Fujitsu to transfer the shares in Fujitsu Connected Technologies Limited, as well as the shares in a new company (that Polaris will establish)that will take over the mobile device business of Fujitsu.

North America Managed Mobility Service Market Leaders

-

AT&T Inc.

-

IBM Corporation

-

Orange SA

-

Telefonica SA

-

Hewlett Packard Enterprise Company

*Disclaimer: Major Players sorted in no particular order

North America Managed Mobility Service Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Acceptability for BYOD in Organizations

- 4.3.2 Companies Outsourcing IT Activities

-

4.4 Market Restraints

- 4.4.1 Lack of Control over Operations and Cost Visibility

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Mobile Device Management

- 5.1.2 Mobile Security

- 5.1.3 Mobile Application Management

- 5.1.4 Other Type

-

5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-premise

-

5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Retail

- 5.3.3 Power and Energy

- 5.3.4 Manufacturing

- 5.3.5 IT and Telecom

- 5.3.6 Education

- 5.3.7 Healthcare

- 5.3.8 Other End-user Industry

-

5.4 By Country

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 AT&T Inc.

- 6.1.2 Fujitsu Ltd

- 6.1.3 IBM Corporation

- 6.1.4 Wipro Ltd

- 6.1.5 Orange SA

- 6.1.6 Telefonica SA

- 6.1.7 Citrix System Inc.

- 6.1.8 Hewlett Packard Enterprise Company

- 6.1.9 DELL Technologies

- 6.1.10 Accenture PLC

- 6.1.11 Tech Mahindra Limited

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityNorth America Managed Mobility Service Industry Segmentation

Managed mobility services (MMS) is defined as the procurement, deployment, and management of mobile devices and apps, and PC software and services for connecting out-of-office workers to the enterprise environment.

| By Type | Mobile Device Management | |

| Mobile Security | ||

| Mobile Application Management | ||

| Other Type | ||

| By Deployment | Cloud | |

| On-premise | ||

| By End-user Industry | BFSI | |

| Retail | ||

| Power and Energy | ||

| Manufacturing | ||

| IT and Telecom | ||

| Education | ||

| Healthcare | ||

| Other End-user Industry | ||

| By Country | North America | United States |

| Canada |

North America Managed Mobility Service Market Research FAQs

What is the current NA Managed Mobility Service Market size?

The NA Managed Mobility Service Market is projected to register a CAGR of 20.54% during the forecast period (2024-2029)

Who are the key players in NA Managed Mobility Service Market?

AT&T Inc., IBM Corporation, Orange SA, Telefonica SA and Hewlett Packard Enterprise Company are the major companies operating in the NA Managed Mobility Service Market.

What years does this NA Managed Mobility Service Market cover?

The report covers the NA Managed Mobility Service Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the NA Managed Mobility Service Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

NA Managed Mobility Service Industry Report

Statistics for the 2024 NA Managed Mobility Service market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. NA Managed Mobility Service analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.