North America Printed Signage Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 0.00 % |

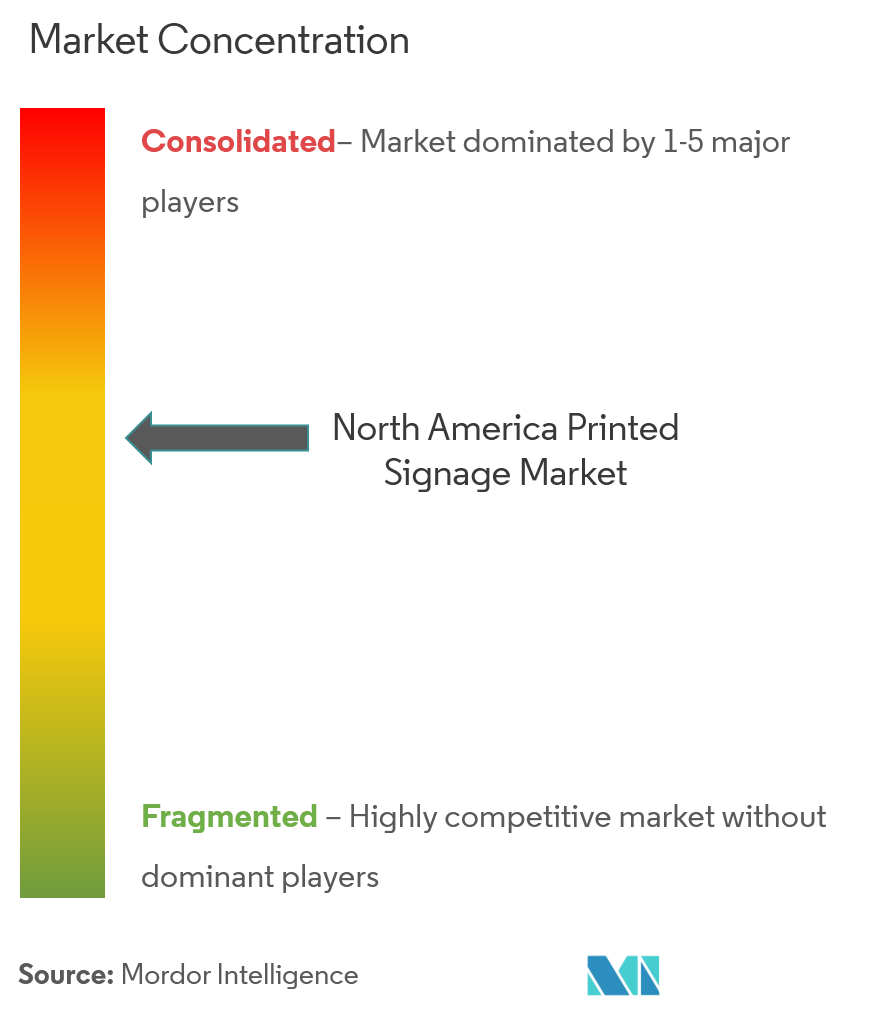

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

North America Printed Signage Market Analysis

The North American printed signage market was valued at about USD 11.061 billion in 2020, and it is expected to reach USD 10.61 billion in 2026, registering a CAGR of -0.68% over the forecast period (2021-2026).

- Cost-effectiveness was the primary factor driving market growth, as printed signages offer low-cost and efficient signage solutions for various industries. The low investment required for deploying printed signage and its longer lifespan are the major factors helping the printed signage market to survive, despite the intense competition from the emerging digital signage market. The prime reason behind most of the businesses and companies opting for printed signage solutions is the ease of deployment, without additional maintenance costs.

- Factors influencing the signage market trends include the nature of PoP suppliers, compliance with regulations, use of digitally printed signage, and employment of signage in the wider context of advertising.

- However, the North American region is known for its innovations in technology. Rapid technological innovation, along with the inclination toward a more dynamically feasible substitute, i.e., digital signage, and the growing demand for a more customized approach to advertising, has led to a decline in the adoption of printed signage solutions.

North America Printed Signage Market Trends

This section covers the major market trends shaping the North America Printed Signage Market according to our research experts:

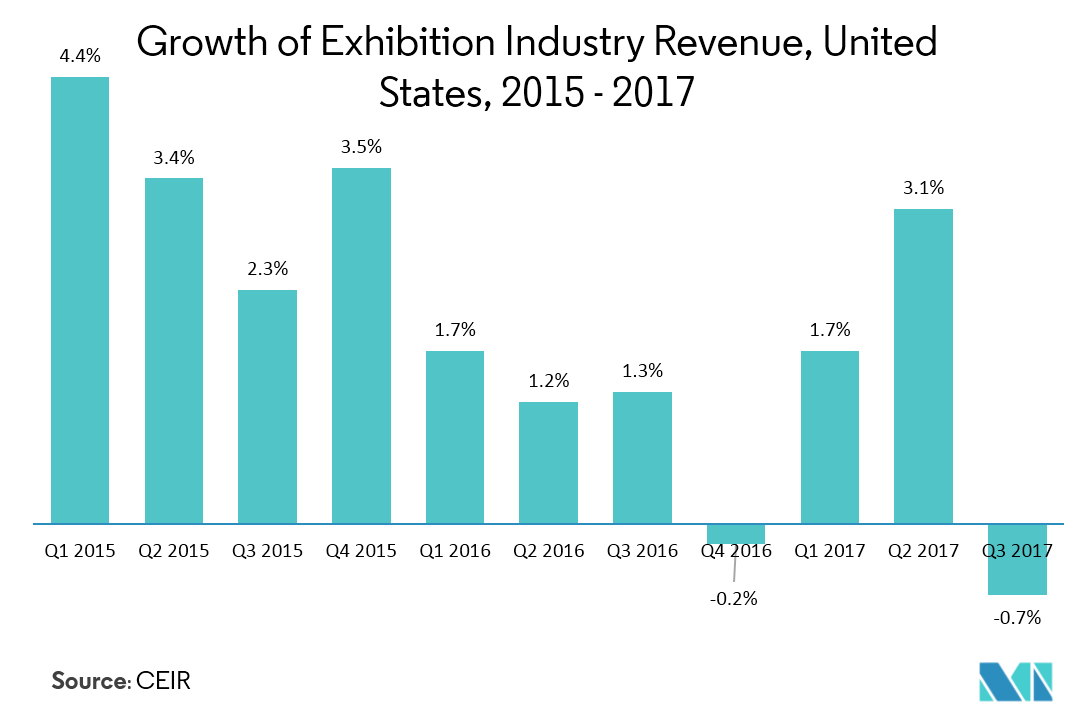

Corporate Graphics, Exhibition, and Trade Show Material to Witness Downfall

- Corporate graphics are a collection of various assets used for promoting the organization’s products or services at an expo. Appropriate corporate graphics printing aids are helpful for the better positioning of the organization. Hence, organizations tend to choose vendors based on the experience, variety of services, and the range of printing capabilities.

- Window banners, custom wallpapers, floor graphics, trade show displays, wall murals, corporate environmental graphics, corporate fabric graphics, and many other forms of signage are available in the market. These serve the purpose of setting up a stall at an expo.

- A trade show or an exhibition is a place where many vendors meet to showcase their products. Generally, these events are held in large spaces, with designated stalls for each participant. A vendor has to showcase the product's full potential, in the limited space, by differentiating it from the rest of the stalls in the expo.

- Graphic banners and other types of signage have to be used creatively to conserve space, and at the same time, they should be able to attract the interest of customers.

North America Printed Signage Industry Overview

The North American printed signage market is witnessing lower competitiveness due to a declining market. Few of the major players currently dominate the market share. These major players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging their strategic collaborative initiatives to increase their market share and profitability.

North America Printed Signage Market Leaders

-

Avery Dennison Corporation

-

Sabre Digital Creative

-

James Printing and Signs

-

Chandler Inc.

-

Accel Group Inc.

*Disclaimer: Major Players sorted in no particular order

North America Printed Signage Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Cost Effectiveness of Printed Signage

-

4.4 Market Restraints

- 4.4.1 Advent of Digital Signage

- 4.4.2 Drawbacks of Screen Printing

- 4.5 Industry Supply Chain Analysis

-

4.6 Industry Attractiveness Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technology Snapshot

5. MARKET SEGMENTATION

-

5.1 by Product

- 5.1.1 Billboard

- 5.1.2 Backlit Display

- 5.1.3 Pop Display

- 5.1.4 Banner, Flag, and Backdrop

- 5.1.5 Corporate Graphics, Exhibition, and Trade Show Material

- 5.1.6 Other Products

-

5.2 by Type

- 5.2.1 Indoor Printed Signage

- 5.2.2 Outdoor Printed Signage

-

5.3 by End-user Vertical

- 5.3.1 BFSI

- 5.3.2 Retail

- 5.3.3 Sports and Leisure

- 5.3.4 Entertainment

- 5.3.5 Transportation and Logistics

- 5.3.6 Healthcare

- 5.3.7 Other End-user Verticals

-

5.4 by Country

- 5.4.1 United States

- 5.4.2 Canada

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Avery Dennison Corporation

- 6.1.2 Sabre Digital Creative

- 6.1.3 James Printing and Signs

- 6.1.4 Kelly Signs Inc.

- 6.1.5 Chandler Inc.

- 6.1.6 RGLA Solutions Inc.

- 6.1.7 Accel Group Inc.

- 6.1.8 AJ Printing & Graphics Inc.

- 6.1.9 Southwest Printing Co.

- 6.1.10 Vistaprint

- *List Not Exhaustive

7. INVESTMENT SCENARIO

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityNorth America Printed Signage Industry Segmentation

Printed signage is the most widely used form of signage solution, across the world. It is majorly employed for marketing and advertisement, to attract consumers and expand knowledge regarding the availability of product and features through billboards and backlit displays, among others.

| by Product | Billboard |

| Backlit Display | |

| Pop Display | |

| Banner, Flag, and Backdrop | |

| Corporate Graphics, Exhibition, and Trade Show Material | |

| Other Products | |

| by Type | Indoor Printed Signage |

| Outdoor Printed Signage | |

| by End-user Vertical | BFSI |

| Retail | |

| Sports and Leisure | |

| Entertainment | |

| Transportation and Logistics | |

| Healthcare | |

| Other End-user Verticals | |

| by Country | United States |

| Canada |

North America Printed Signage Market Research FAQs

What is the current NA Printed Signage Market size?

The NA Printed Signage Market is projected to register a CAGR of 0% during the forecast period (2024-2029)

Who are the key players in NA Printed Signage Market?

Avery Dennison Corporation, Sabre Digital Creative, James Printing and Signs, Chandler Inc. and Accel Group Inc. are the major companies operating in the NA Printed Signage Market.

What years does this NA Printed Signage Market cover?

The report covers the NA Printed Signage Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the NA Printed Signage Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

North America Printed Signage Industry Report

Statistics for the 2024 North America Printed Signage market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Printed Signage analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.