North American Seasonings & Spices Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Market Size (2024) | USD 4.20 Billion |

| Market Size (2029) | USD 5.26 Billion |

| CAGR (2024 - 2029) | 4.65 % |

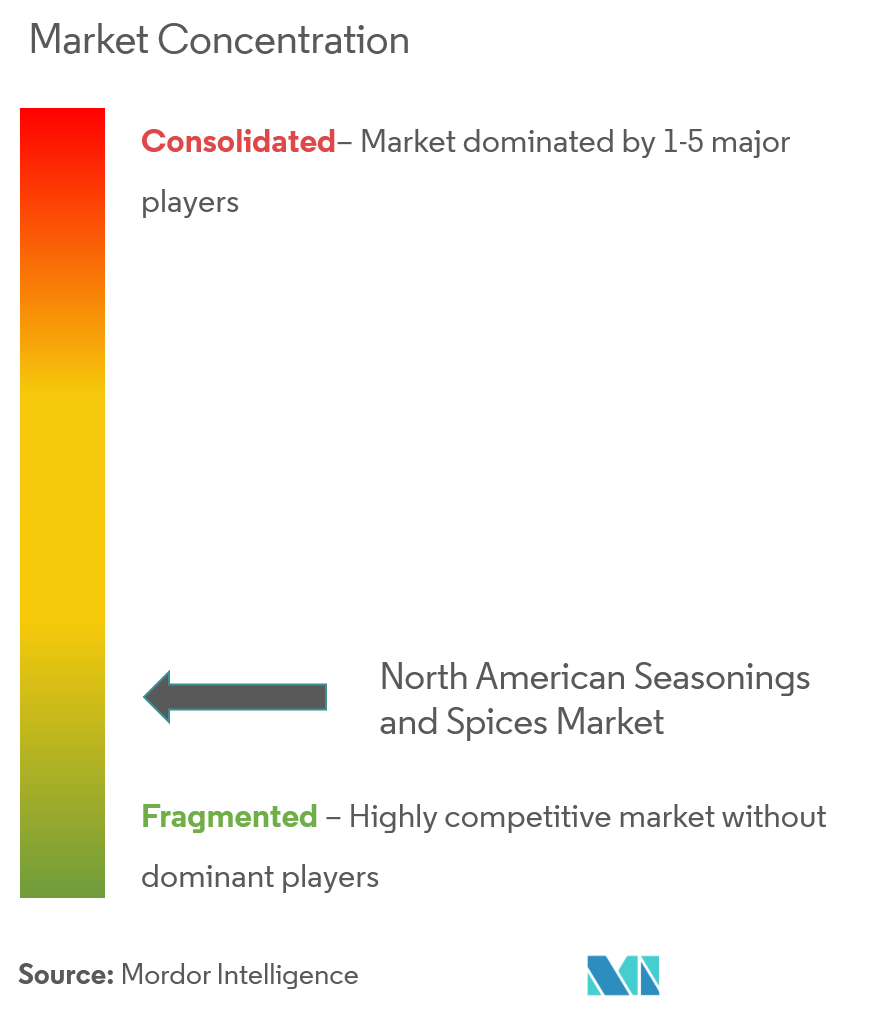

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

North American Seasonings & Spices Market Analysis

The North American Seasonings and Spices Market size is estimated at USD 4.20 billion in 2024, and is expected to reach USD 5.26 billion by 2029, growing at a CAGR of 4.65% during the forecast period (2024-2029).

The North American seasoning and spice market has been affected by preventive measures imposed by the local governments of various nations in the wake of the COVID-19 pandemic. It led to the closure of trade or transportation in the international and local markets. For instance, according to the Trade Promotion Council of India, India is the largest producer, exporter, and consumer of spices in the world, but the United States is the largest importer, and it faced logistics and sourcing issues of spices such as pepper. Moreover, due to the COVID-19 pandemic, consumers weren't dining away from home much. However, consumers sought bold flavors and spices reminiscent of restaurant-quality food for at-home consumption.

The demand from consumers for high-quality, healthy food ingredients, along with the increased preference for trying out new flavors in the foodservice sector and processed food products, is supporting the overall spices and seasonings market's growth in North America, leading to an upward trend. Hence, this is driving the market's growth during the forecast period. Stringent food regulations and the spices adulteration act are likely to hinder the growth of the economy. The introduction of blended spices has witnessed demand from various strata of the population, as blended spices are convenient across various applications, such as savory snacks and ready meals, amongst others.

North American Seasonings & Spices Market Trends

This section covers the major market trends shaping the North American Seasonings & Spices Market according to our research experts:

Increased Demand for Spice Blends in the Food Industry

Blended spices have witnessed a huge demand from various strata of the population in the region as they are convenient across various applications, such as savory snacks and ready meals, among others. Recently, there has been a lot of interest in blends containing Middle Eastern and Mediterranean spices in North American cuisines, such as a mix of turmeric, coriander, and warm brown spices. Greater mainstream acceptance of seasonings, like North Africa's harissa and Ethiopia's berbere, have paved the way for the emerging demand for the spice blend. It is a blend of crushed ground peanuts and spices, like ginger, cayenne, garlic, and onion, which have gained popularity among the American population in recent years.

Moreover, during the COVID-19 pandemic, consumers weren't dining away from home as much. However, consumers sought bold flavors and spices reminiscent of restaurant-quality food for at-home consumption. As a result, companies are increasingly innovating in the spice blends category to capture the rising consumer demand. Various studies have depicted that 50% of US consumers seek to try new, exciting flavors. This is indirectly supported by the rising demand for ethnic cuisine food offerings that include different gravies and sauces, driving the demand for spice blends across the region.

The United States Dominates the Market

North Americans are becoming increasingly aware of health issues, resulting in a shift in their attitude toward natural products due to a powerful 'green wave,' a strong driving force for herbs like basil, oregano, and parsley. California and Florida, with their favorable weather conditions, remain leading regions for domestically-produced fresh herbs. Hawaii and New Jersey are important second-tier sources of domestically-produced herbs, although buyers' demand for reliable year-round supplies limits the ability of the Northern regions to compete in the market. In North America, fresh herbs are primarily marketed through wholesale channels, whereas smaller volumes are sold directly to consumers through farmer's markets. The market players are also engaging in mergers and acquisitions with companies to strengthen their portfolios. For instance, in April 2022, Kerry Group Inc. completed the acquisition of US-based Natreon Inc., a leading supplier of branded Ayurvedic botanical ingredients. Natreon supplies branded and scientifically studied and tested Ayurvedic extracts to the dietary supplement and functional food and beverage industries globally.

North American Seasonings & Spices Industry Overview

The North American seasonings and spices market is dominated by players like McCormick, Kerry Group, Sensient Natural Ingredients, Döhler Gmbh, and others. The strong distribution networks and acquisition of distribution companies are major strategies used by players to expand their retail presence. McCormick has a highly optimized supply chain with a separate unit formulated especially for keeping the supply chain in place and intact. Global diversity and inclusion remain a core value for and strategic business priority of McCormick. The major players have been focusing on expanding their production facilities to gain a competitive edge. They also have been focussing on innovating new products to expand their product portfolios and consolidate their position in the market.

North American Seasonings & Spices Market Leaders

-

McCormick & Company, Inc.

-

Kerry Inc.

-

Döhler Gmbh

-

Ajinomoto

-

Olam International

*Disclaimer: Major Players sorted in no particular order

North American Seasonings & Spices Market News

- June 2021: Kerry opened a new taste facility in Mexico. Located in Irapuato, Mexico, the new state-of-the-art facility will significantly increase Kerry's capacity in the region and further support customers in delivering local and sustainable taste solutions, which also include the production of innovative seasonings.

- April 2021: Olam Food Ingredients (OFI) acquired US-based private-label spices and seasonings manufacturer Olde Thompson at an enterprise value of USD 950 million through its wholly-owned subsidiary Olam Holdings Inc. The acquisition helped expand OFI's private label capabilities and enabled the business to provide consumers with a comprehensive range of bold, authentic, and natural tastes and flavors with end-to-end traceability and sustainability.

- January 2021: Cargill launched a purified sea salt flour. The ingredient is ultra-fine cut, powder-like sodium chloride. It is suitable for applications that require extremely fine sizing for blending, including dry soup, cereal, flour, and spice mixes, as well as for topping snack foods.

North American Seasonings & Spices Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Salt and Salt Substitutes

- 5.1.2 Herbs and Seasonings

- 5.1.2.1 Thyme

- 5.1.2.2 Basil

- 5.1.2.3 Oregano

- 5.1.2.4 Parsley

- 5.1.2.5 Other Herbs and Seasonings

- 5.1.3 Spices

- 5.1.3.1 Pepper

- 5.1.3.2 Cardamom

- 5.1.3.3 Cinnamon

- 5.1.3.4 Clove

- 5.1.3.5 Nutmeg

- 5.1.3.6 Turmeric

- 5.1.3.7 Other Spices

-

5.2 By Application

- 5.2.1 Bakery and Confectionery

- 5.2.2 Soup, Noodles, and Pasta

- 5.2.3 Meat and Seafood

- 5.2.4 Sauces, Salads, and Dressing

- 5.2.5 Savory Snacks

- 5.2.6 Other Applications

-

5.3 By Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Positioning Analysis

-

6.3 Company Profiles

- 6.3.1 McCormick & Company Incorporated

- 6.3.2 Olam International

- 6.3.3 Kerry Group PLC

- 6.3.4 Döhler GmbH

- 6.3.5 All Seasonings Ingredients Inc.

- 6.3.6 Ajinomoto Co. Inc.

- 6.3.7 Cargill Incorporated

- 6.3.8 Associated British Foods PLC

- 6.3.9 Horton Spice Mills Limited (Canada)

- 6.3.10 Newly Weds Foods Inc.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityNorth American Seasonings & Spices Industry Segmentation

Spices are vegetation products that have an aromatic or pungent taste quality and are used for flavoring while cooking. On the other hand, seasoning is a mixture of several flavoring components, such as sugars, salts, spices, and herbs. The North American seasonings and spices market is segmented by product type into salt and salt substitutes, herbs and seasonings, and spices. The herbs and seasonings covered in the report include thyme, basil, oregano, parsley, and other herbs and seasonings. The spices segment includes pepper, cardamom, cinnamon, clove, nutmeg, turmeric, and other spices. The market is segmented by application into bakery and confectionery, soup, noodles and pasta, meat and seafood, sauces, salads, and dressings, savory snacks, and other applications. By geography, it is segmented into the United States, Canada, Mexico, and the rest of North America. For each segment, the market sizing and forecasts have been done on the basis of value in USD million.

| By Product Type | Salt and Salt Substitutes | |

| Herbs and Seasonings | Thyme | |

| Basil | ||

| Oregano | ||

| Parsley | ||

| Other Herbs and Seasonings | ||

| Spices | Pepper | |

| Cardamom | ||

| Cinnamon | ||

| Clove | ||

| Nutmeg | ||

| Turmeric | ||

| Other Spices | ||

| By Application | Bakery and Confectionery | |

| Soup, Noodles, and Pasta | ||

| Meat and Seafood | ||

| Sauces, Salads, and Dressing | ||

| Savory Snacks | ||

| Other Applications | ||

| By Geography | United States | |

| Canada | ||

| Mexico | ||

| Rest of North America |

North American Seasonings & Spices Market Research FAQs

How big is the North American Seasonings and Spices Market?

The North American Seasonings and Spices Market size is expected to reach USD 4.20 billion in 2024 and grow at a CAGR of 4.65% to reach USD 5.26 billion by 2029.

What is the current North American Seasonings and Spices Market size?

In 2024, the North American Seasonings and Spices Market size is expected to reach USD 4.20 billion.

Who are the key players in North American Seasonings and Spices Market?

McCormick & Company, Inc., Kerry Inc., Döhler Gmbh, Ajinomoto and Olam International are the major companies operating in the North American Seasonings and Spices Market.

What years does this North American Seasonings and Spices Market cover, and what was the market size in 2023?

In 2023, the North American Seasonings and Spices Market size was estimated at USD 4.01 billion. The report covers the North American Seasonings and Spices Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the North American Seasonings and Spices Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

North American Seasonings & Spices Industry Report

Statistics for the 2024 North American Seasonings & Spices market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North American Seasonings & Spices analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.