North America Sports Nutrition Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 11.67 % |

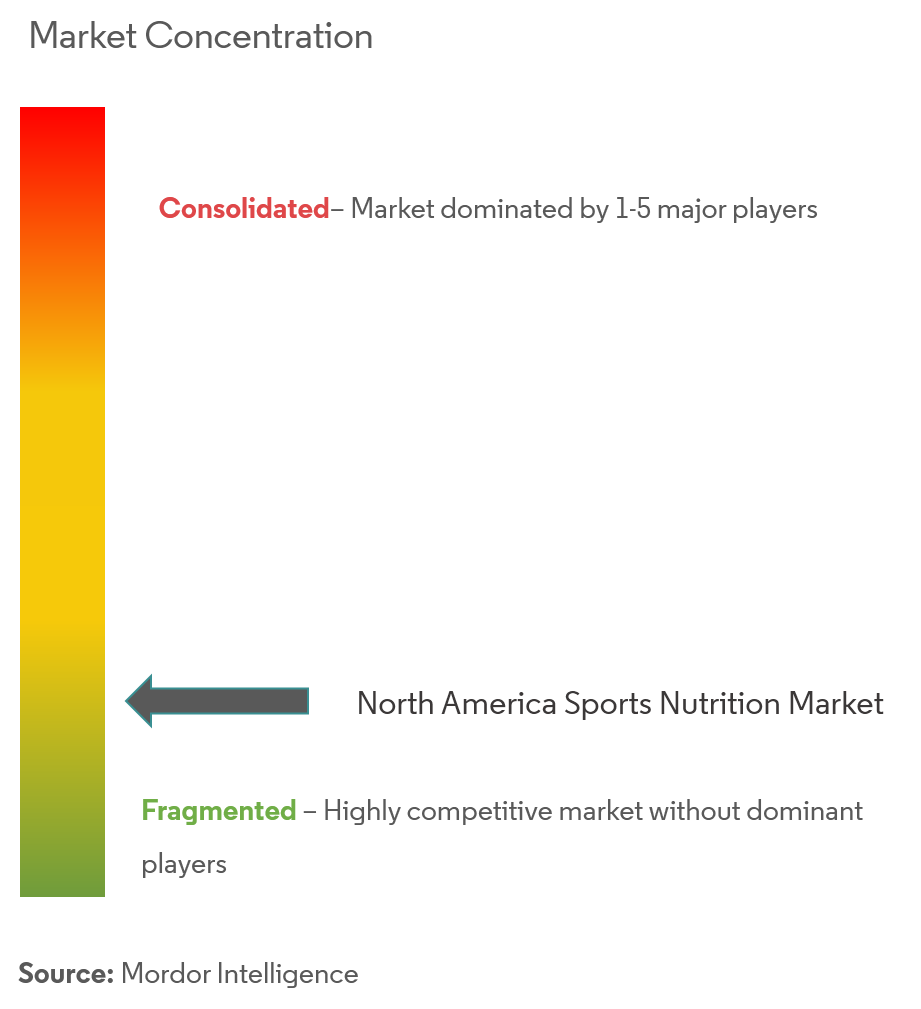

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

North America Sports Nutrition Market Analysis

The North American sports nutrition market is expected to register a CAGR of 11.67% during the forecast period.

The sports nutritional product market is shifting away from traditionally targeted consumers, especially male athletes, and toward women and everyday active consumers. Consumers are becoming more interested in broader health outcomes, and nutrients other than proteins for muscle building are gaining attention, with a strong emphasis on branded ingredients.

A new generation of athletes and active consumers seeks products that will improve their physical and mental well-being rather than muscle-building supplements. Consumers are looking for new benefits such as weight management, muscle recovery, joint support, cognitive/focus support, novel approaches to energy profiles, and more. On the other hand, these formulations are gaining popularity among a more mainstream active audience who want all of these benefits. The sports/active nutrition industry is helping to shape the mainstream market's future.

The demand for high protein is one of the main reasons for sports nutrition products that are becoming more popular among everyday consumers. Moreover, increasing health awareness, a healthy lifestyle, a rising number of health clubs and fitness centers, and changing consumer preferences for nutritional products are the key growth drivers for the North American sports nutrition market.

Refrigerated protein bars are a relatively new category that is still growing in popularity among consumers. Nick's launched its smart bar this year and marketed it as the first Swedish-style refrigerated protein bar. According to the Physical Activity Council's 2021 report, high percentages of Americans aged six and above were involved in fitness sports (67%), individual sports (43.3%), and outdoor sports (52.9%), with a healthy number (22.1%) participating in team sports. The market for sports nutrition supplements is benefiting as consumers become more aware of the importance of healthy eating and hectic lifestyles.

North America Sports Nutrition Market Trends

Increasing Trend of Athleticism

The North American sports nutrition market is driven by growing awareness and demand from young adults and athletes. With the growing concerns for diabetes and obesity in the region, consumers in this region are giving equal importance to nutritional value and taste profile. The increasing demand for sports nutrition is majorly due to the wide customer base, greater detailing of manufacturers towards innovative products, and use of cross-marketing strategies by key players in the market.

Sports nutritional products were once classified as a niche category - designed particularly for athletes and hardcore full-time sports personnel. The scenario has altered quite significantly, with such products getting popular and being demanded by diverse consumer groups, as regular exercisers and everyday consumers are looking for an extra boost in their workouts. In February 2023, Fastfood, a wide range of high-performance sports nutrition products to fuel elite and amateur athletes, was launched by US Food Innovation Lab Chew. The product line includes beverage mixes that release optimal electrolytes and micronutrients and premium hydration formula blends that contain food-based ingredients.

According to the US Bureau of Labor Statistics, the majority of those who practice yoga 62%, running 56%, and hiking 55%, are between the ages of 25 and 54. Moreover, adults over the age of 55 account for a significant share of those who played golf or walked for exercise. Bowling was the most age-neutral of the activities, with at least 30% of participants coming from each age group.

United States Dominates the Sports Nutrition Market

The increasing health awareness, busy lifestyle, and growing consumer awareness regarding the health benefits of sports nutrition are steering the demand for sports nutritional products in the United States. Consumption of sports nutrition has turned into a status symbol, especially for the youth in the country. With more preference in terms of flavors in sports nutrition from the millennial population, companies are introducing new products with various flavors and types. A rising focus on health and wellness and intense research by key players is going to propel the sales of products during the forecast period.

Approximately more than 70% of consumers are influenced by a sports nutrition product's flavor while making the purchase decision. Consumers today are highly impacted by new flavors and seek excitement and innovation. Innovative flavors offerings help the manufacturers to stand out in the highly competitive market.

North America Sports Nutrition Industry Overview

Key players engaged in the manufacturing of sports nutrition are focused on launching new products to satisfy the growing demand of consumers regards several purposes. Manufacturers are also striving to strengthen their product offerings through mergers and acquisitions. For instance, in December 2022, Applied Nutrition launched Body Fuel, a sugar-free, electrolyte-water sports drink. Sports drinks with electrolyte minerals are an easy way for people to replenish the electrolytes they lose via perspiration during exercising while also staying hydrated. Some of the major players in sports nutrition in the North American market are PepsiCo Inc., Glanbia PLC, Mondelēz International Inc., The Coca-Cola Company, and Abbott Nutrition Inc.

North America Sports Nutrition Market Leaders

-

PepsiCo Inc.

-

Glanbia plc

-

Mondelēz International, Inc.

-

The Coca-Cola Company

-

Abbott Nutrition Inc

*Disclaimer: Major Players sorted in no particular order

North America Sports Nutrition Market News

- Jun 2022: RSP Nutrition launched its newest and strongest pre-workout supplement, AminoLean MAX. The product was developed to help people train harder and take their workouts to the next level by containing innovative and clinically studied ingredients.

- Sept 2021: Element Nutritional Sciences Inc. launched JAKTRX pro amino essential amino acids in the sports nutrition sector in the United States. JAKTRX Pro Amino is estimated to improve muscle protein synthesis by 76% when compared to an average whey-based protein powder and improves muscle protein synthesis by 35%.

- Mar 2021: GoodSport Nutrition launched dairy-based sports drinks as a source of essential electrolytes and carbohydrates. The product can be availed from the company's website and Amazon.com.

North America Sports Nutrition Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Sports Food

- 5.1.2 Sports Drink

- 5.1.3 Sports Supplements

-

5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Drug Store

- 5.2.4 Online Retailers

- 5.2.5 Others

-

5.3 Country

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

6. COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Nestle S.A

- 6.3.2 Glanbia plc

- 6.3.3 Abbott Nutrition Inc.

- 6.3.4 Yakult Honsha Co Ltd

- 6.3.5 The Coca-Cola Company

- 6.3.6 Reckitt Benckiser Group Plc.

- 6.3.7 GNC Holdings

- 6.3.8 PepsiCo Inc.

- 6.3.9 Now Foods

- 6.3.10 Swanson

- 6.3.11 RSP Nutrition

- 6.3.12 GoodSport Nutrition

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityNorth America Sports Nutrition Industry Segmentation

Sports nutrition products are available in liquid, powder, or any other form, primarily made for athletes. Sports nutrition contains various kinds of nutrients such as vitamins, minerals, supplements, and organic substances that include carbohydrates, proteins, and fats.

The North American sports nutrition market is segmented by Type (Sports Foods, Sports Drinks, and Sports Supplements), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Pharmacies/Drug Stores, Specialty Stores, Online Retail Stores, and Other Distribution Channels), and Country (United States, Canada, Mexico, and Rest of North America). The report offers the market size and values in (USD Million) during the forecast years for the above segments.

| Type | Sports Food | |

| Sports Drink | ||

| Sports Supplements | ||

| Distribution Channel | Supermarkets/Hypermarkets | |

| Convenience Stores | ||

| Drug Store | ||

| Online Retailers | ||

| Others | ||

| Country | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America |

North America Sports Nutrition Market Research FAQs

What is the current North America Sports Nutrition Market size?

The North America Sports Nutrition Market is projected to register a CAGR of 11.67% during the forecast period (2024-2029)

Who are the key players in North America Sports Nutrition Market?

PepsiCo Inc., Glanbia plc, Mondelēz International, Inc., The Coca-Cola Company and Abbott Nutrition Inc are the major companies operating in the North America Sports Nutrition Market.

What years does this North America Sports Nutrition Market cover?

The report covers the North America Sports Nutrition Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the North America Sports Nutrition Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

North America Sports Nutrition Industry Report

Statistics for the 2024 North America Sports Nutrition market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Sports Nutrition analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.