North America Stevia Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 9.80 % |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

North America Stevia Market Analysis

North American stevia market is estimated to record a CAGR of 9.8%, during the forecast period (2020-2025).

- Stevia is widely used in a variety of food products, such as dairy, bakery, andconfectionery, beverages, and pharmaceuticals, as it can be easily incorporated,impartinga sweet taste,usingvery littlecalories.

- The increasing cases of diabetes, obesity, and other health problems have shifted the focus toward low-calorie sweeteners, which act as sugar substitutes.

- A major threat to this market is the prompt availability ofother low-calorie sweeteners.

North America Stevia Market Trends

This section covers the major market trends shaping the North America Stevia Market according to our research experts:

Rapid Growth in the North America Stevia Market

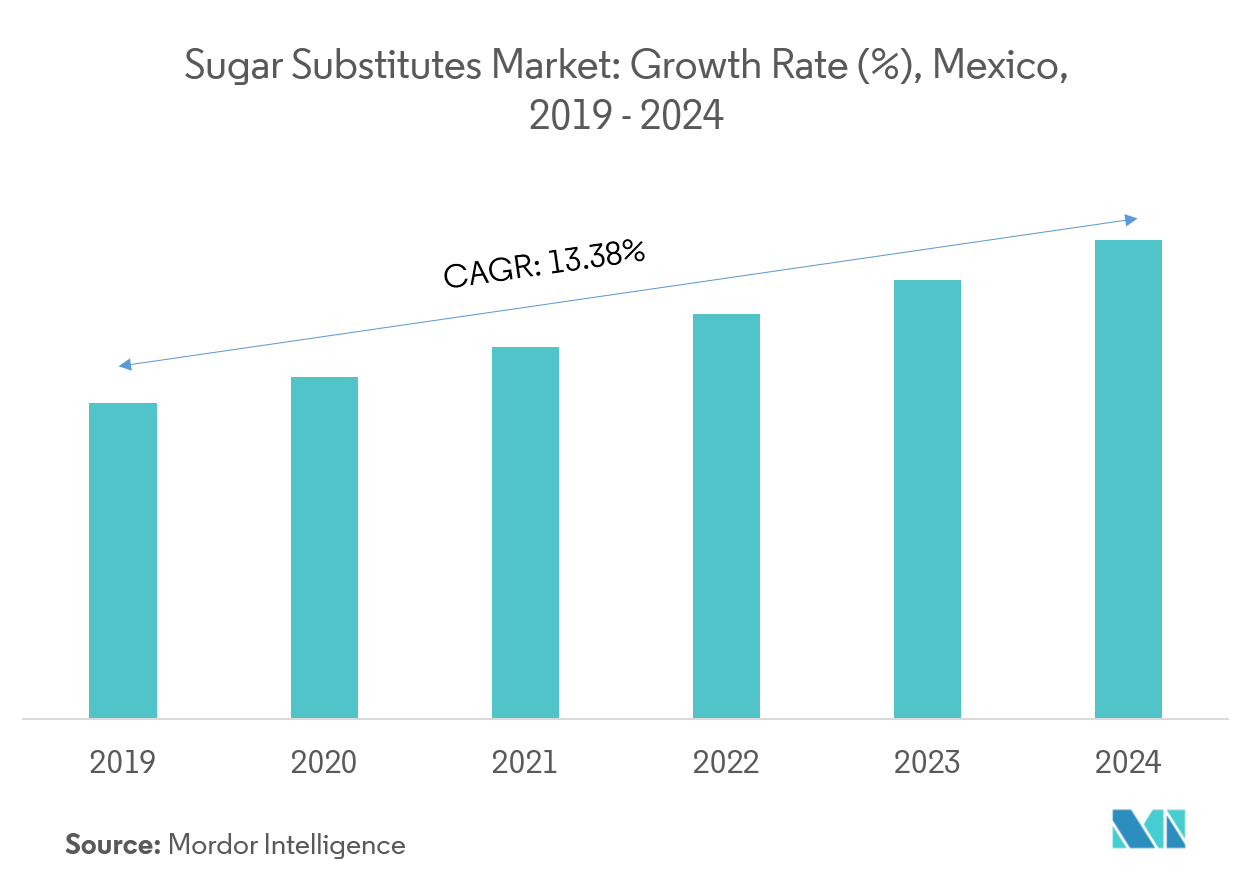

According to the OECD Health Statistics 2017, Mexico had one of the highest obesity rates in the world. In 2014, Mexico introduced a sugar tax. Since then, food and beverage manufacturers have been increasingly looking forward to using natural sweetners, which have zero calories and are potential substitutes for sugar. This trend has contributed to the rapidly growing stevia market in Mexico. Stevia helps reduce dietary sugar and calories, and has a wider consumer acceptance because of its taste and health quotient. In Mexico, the diabetic population in the age group of 20 years to 79 years is about 10 million, which is expected to grow at a rate of 60%, over the next 20 years. This is a contributing factor to the rapidly expanding stevia market in Mexico.

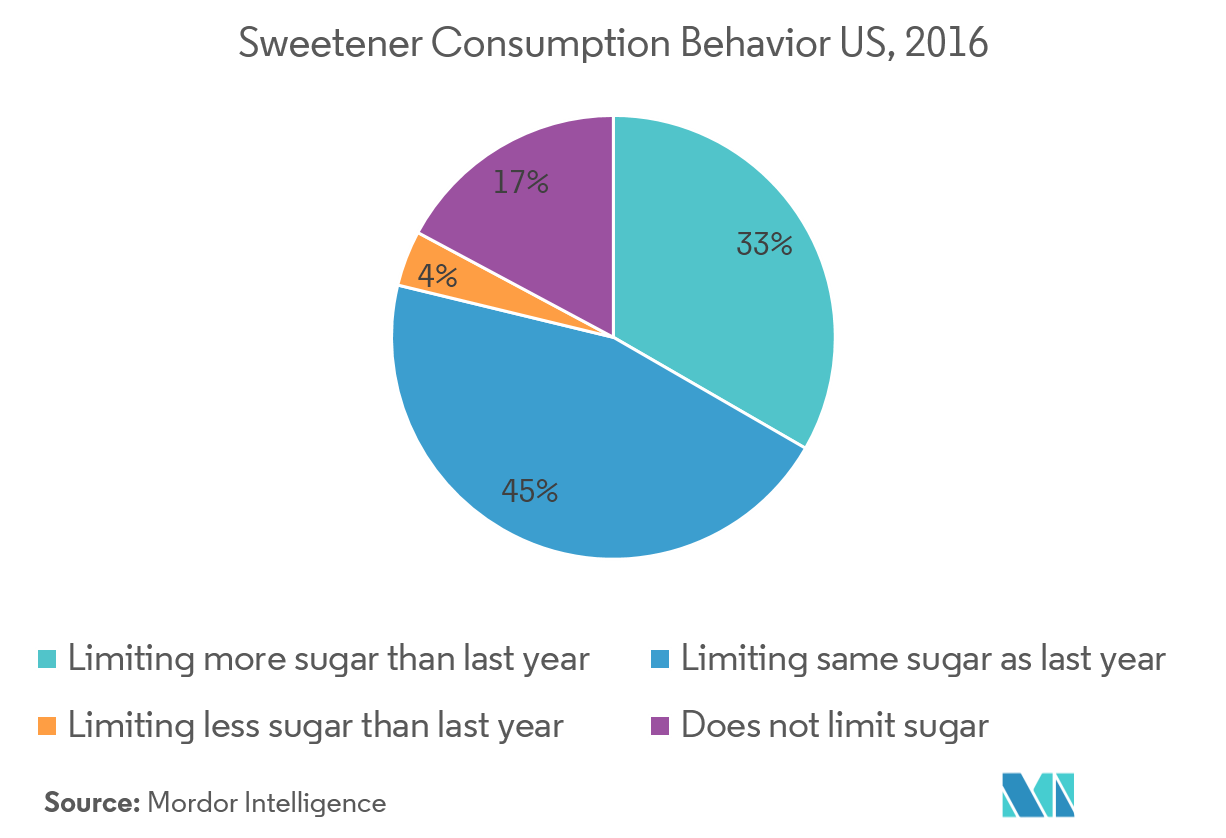

Sweetener Consumption Behavior in the United States, in 2016

In 2016, 33% of the US consumers claimed that they had limited their sugar consumption more than they did in the previous year. About 45% of the US consumers said that they had limited the same amount of sugar consumption as they did in the previous year. While 4% said that they had limited their sugar consumption less than they did in the previous year, 17% of them said that they did not limit their sugar consumption. Therefore, 83% of the US consumers are limiting their sugar consumption, which creates an opportunity for the stevia market to expand, as it is a natural, zero-calorie subtitute for sugar, and comes with various health benefits.

North America Stevia Industry Overview

Owing to the presence of numerous small and large vendors, the market is highly fragmented. Most of the companies engage inaggressive promotion of stevia-based products, to improve their product positioning and visibility. Some of the major players in the market areCargill Inc., Tate & Lyle, PureCircle,Ingredion Incorporated, and Archer Daniels Midland Company.

North America Stevia Market Leaders

-

PureCircle

-

Ingredion Incorporated

-

Tate & Lyle

-

Cargill Incorporated

-

Archer Daniels Midland Company

*Disclaimer: Major Players sorted in no particular order

North America Stevia Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Powder

- 5.1.2 Liquid

- 5.1.3 Leaf

-

5.2 By Application

- 5.2.1 Bakery

- 5.2.2 Dairy Food Products

- 5.2.3 Beverages

- 5.2.4 Pharmaceuticals

- 5.2.5 Confectionery

- 5.2.6 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market-share Analysis

-

6.4 Company Profiles

- 6.4.1 PureCircle

- 6.4.2 Ingredion Inc.

- 6.4.3 Tate & Lyle

- 6.4.4 Cargill

- 6.4.5 Archer Daniels Midland Company

- 6.4.6 GLG Life Tech Corp.

- 6.4.7 S&W Seed Co.

- 6.4.8 PureSweet

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityNorth America Stevia Industry Segmentation

The North American stevia market is segmented on the basis of type, into powder, liquid, and leaf. By application, the market is segmented into bakery, dairy food products, beverages, pharmaceuticals, and other applications.

| By Type | Powder | |

| Liquid | ||

| Leaf | ||

| By Application | Bakery | |

| Dairy Food Products | ||

| Beverages | ||

| Pharmaceuticals | ||

| Confectionery | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America |

North America Stevia Market Research FAQs

What is the current North America Stevia Market size?

The North America Stevia Market is projected to register a CAGR of 9.80% during the forecast period (2024-2029)

Who are the key players in North America Stevia Market?

PureCircle, Ingredion Incorporated, Tate & Lyle, Cargill Incorporated and Archer Daniels Midland Company are the major companies operating in the North America Stevia Market.

What years does this North America Stevia Market cover?

The report covers the North America Stevia Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the North America Stevia Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

North America Stevia Industry Report

Statistics for the 2024 North America Stevia market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. North America Stevia analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.