One-Box Testers Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 0.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

One-Box Testers Market Analysis

The one-box tester market is expected to grow at a CAGR of 6.0% over the forecast period 2021-2026. One-box testers are extensively used for the application of validating the functioning of automation equipment. The increase in the volume of mobile devices including smartphones and tablets across the industries for mobility and remote controlling is one of the factors driving the market for one box testers as it allows the validation of wireless networks, wireless devices, as well as semiconductors operations. Vodafone has estimated that, by the year 2022, there will more than 3.8 billion smartphone users globally.

- Upgrading the transport network includes the cost of equipment and services and requires at least 30% of the overall project cost. This high cost is mainly due to the high price of equipment for the optical transport-based network. The growing LTE adoption in Asia-Pacific is also driving the studied market growth.

- According to Ericsson, operators in the region added 656 million new LTE subscriptions in the twelve months to the end of Q1 2018, representing a 46% growth rate. The Asia-Pacific now accounts for 65% of all LTE subscriptions worldwide.

- The growing 5G adoption also brings enormous opportunity into the market. But most vendors need to upgrade or develop testing equipment, which is compatible with the 5G technology. The emergence of Industrial Internet of Things (IIoT) and machine-to-machine (M2M) communication solutions is also expected to boost the growth further of the studied market, especially for telecommunications applications.

One-Box Testers Market Trends

This section covers the major market trends shaping the One-Box Testers Market according to our research experts:

Telecommunication Industry to Witness Significant Growth

- The telecommunication industry is expected to witness significant growth due to the increasing number of cellular network subscriptions across the world. The innovation trend in the industry is moving towards faster and more responsive connections. Hence the testing equipment is increasing needs in the span of these domains. The design-system level for test and validate the design, as well as at the research and development stage, adoption of one box tester is gaining popularity to perform pre-conformance and conformance testing, build manufacturing test capacity, and optimize the performance of deployed networks with our comprehensive cellular solutions.

- Currently, LTE is the most widely developed and deployed wireless technology across the world. Additionally, with the evolution of this technology with LTE Advanced (LTE-A) and LTE Advanced Pro (LTE-A Pro) for supporting wider bandwidth, increased carrier aggregation, and multi-gigabit data rates, the companies are growing using the one box testers to optimize their LTE performance to 4.9G.

- In recent years, the 5G network is gaining traction in the telecommunication industry for enhancing the massive machine communications with low-latency, and high-reliability applications. Also, the 5G equipment manufacturers have to follow the latest 5G NR compliance, which is fueling the demand for one box testers in the telecommunication industry.

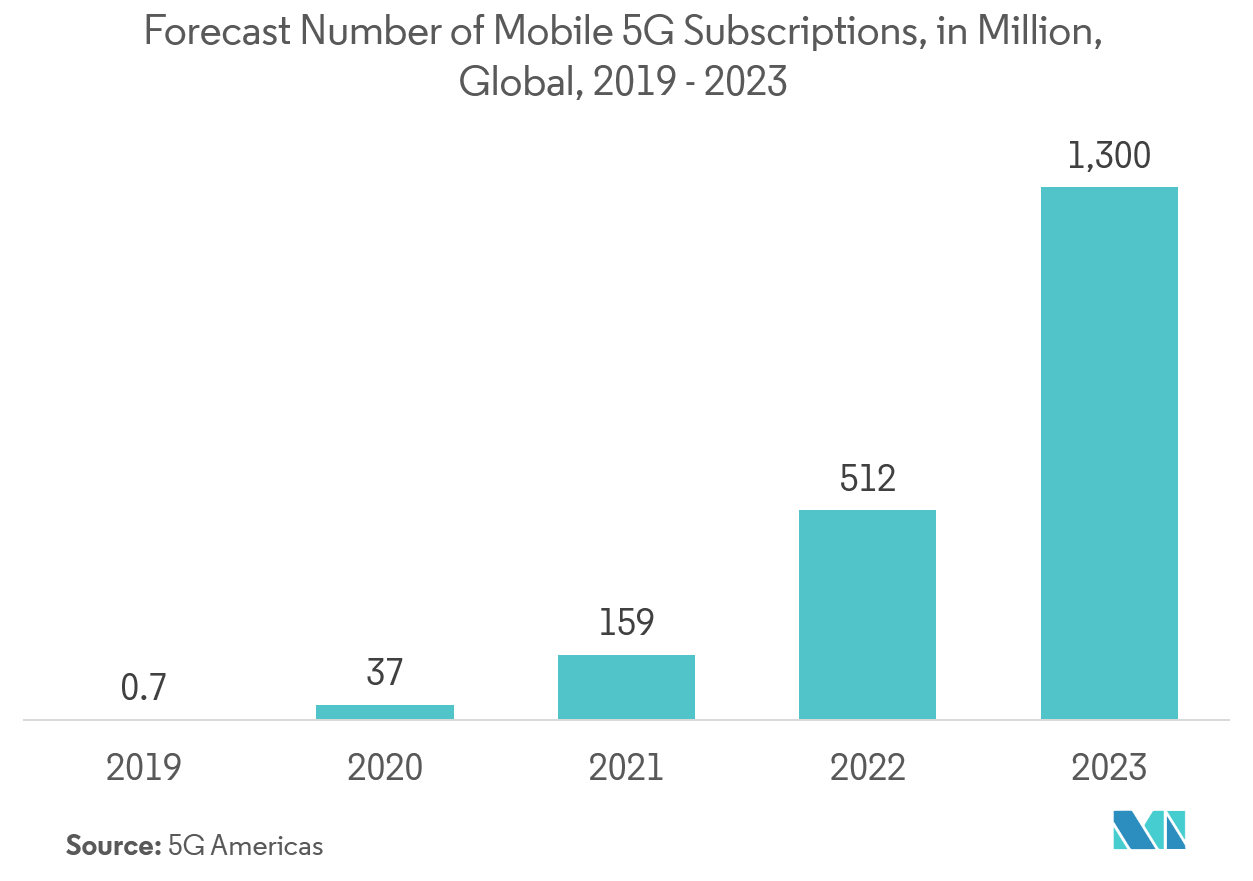

- Moreover, the 5G network is required to co-exist with 4G and other wireless communications without causing interference. The one-box tester enables the comapny to validate the isolation of their 5G network. According to 5G Americas, the worldwide 5G subscribers is estimated to increase from 0.7 million to 1.3 billion by the year 2023.

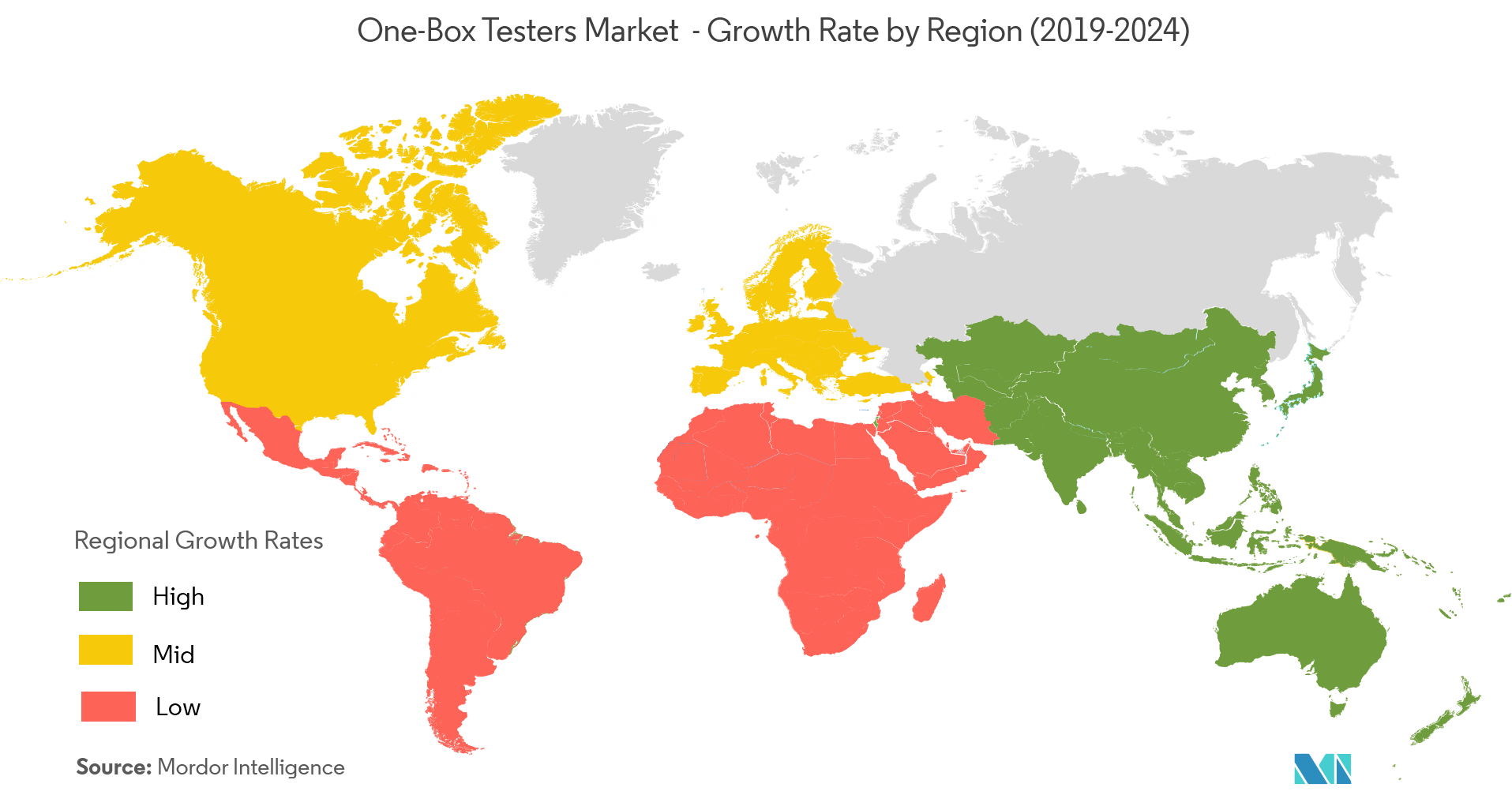

North America Region to Account for the Largest Share

- Augmented demand from telecommunication and consumer electronics sector is the principal factor driving the market. Having test equipment with exceptional technologies integrated into it has been a boosting factor to the telecom industry in North America. The North America region is predicted to contribute massively to the global market owing to the presence of various instrumentation and testing tools manufacturers. The high adoption rates of latest smartphones conforming to the latest wireless standards are expected to bode well for the region.

- The automotive industry is also increasingly adopting the one box testers for validating the operations of electronic and communications in the vehicle. The automotive has evolved with the proliferation in the use of electronics and automation systems. Also, the emerging ADAS and electric vehicles have increased the adoption of one box testers.

- Additionally, the international automotive manufacturers are expanding their facilities in the region for batteries as well as autonomous vehicles. For instance, in April 2019, Ford announced to build a new factory in Michigan to manufacture autonomous vehicles. For the same, the company has planned to invest USD 900 million and is expected to complete within the next two year.

- Moreover, the United States government is the highest spender on its military and defense activities, including adopting new technologies, which is mostly manufactured in the North America region. The high demand for defense and aerospace structures in the region is expected to drive the one box testers in the market.

One-Box Testers Industry Overview

The market for one box tester is moderately consolidated due to the presence of a few companies dominating in the market. Also, these companies have gained expertise across the industrial requirements and are continuously seeking opportunities to make strategic acquisitions and partnerships with end-users to gain more market share.

- June 2019 - Keysight Technologies acquired PRISMA Telecom Testing. With this acquisition, the companyplanned to offer comprehensive, innovative 5G solution portfolio for advanced communications.

- February 2019 - Rohde & Schwarz launched one-box tester for Bluetooth 5.1 to be used in verifying the performance of location services that have been significantly improved with the 5.1 Bluetooth specification. The company stated the use of the angle of arrival (AoA) and angle of departure (AoD) methods enables position determination with accuracy down to centimeter-level in both the transmit and receive direction.

One-Box Testers Market Leaders

-

Keysight Technologies Inc.

-

Anritsu AS

-

Rohde & Schwarz GmbH & Co KG

-

National Instruments Corporation

-

Viavi Solutions Inc. (Cobham Wireless)

*Disclaimer: Major Players sorted in no particular order

One-Box Testers Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Growing Automation Using Wireless Communication Across the Industries

- 4.3.2 Worldwide Proliferation of 5G Network

-

4.4 Market Restraints

- 4.4.1 Lack of Skilled workforce

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By End-user Application

- 5.1.1 Telecommunication

- 5.1.2 Consumer Electronics

- 5.1.3 Automotive

- 5.1.4 Aerospace & Defense

- 5.1.5 Industrial

- 5.1.6 Research & Education

- 5.1.7 Other End-user Applications

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Keysight Technologies Inc.

- 6.1.2 Anritsu AS

- 6.1.3 Rohde & Schwarz GmbH & Co KG

- 6.1.4 National Instruments Corporation

- 6.1.5 Viavi Solutions Inc. (Cobham Wireless)

- 6.1.6 Teradyne Inc.

- 6.1.7 Chroma ATE Inc.

- 6.1.8 Teledyne LeCroy, Inc.

- 6.1.9 Good Will Instrument Co., Ltd.

- 6.1.10 Tektronics Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityOne-Box Testers Industry Segmentation

The scope of the study for one box testers marker has considered the products offered by the vendors for the application of testing semiconductors, production boards, wireless devices and wireless networks, among other across a wide range of industries globally.

| By End-user Application | Telecommunication |

| Consumer Electronics | |

| Automotive | |

| Aerospace & Defense | |

| Industrial | |

| Research & Education | |

| Other End-user Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

One-Box Testers Market Research FAQs

What is the current One-Box Testers Market size?

The One-Box Testers Market is projected to register a CAGR of 0% during the forecast period (2024-2029)

Who are the key players in One-Box Testers Market?

Keysight Technologies Inc., Anritsu AS, Rohde & Schwarz GmbH & Co KG, National Instruments Corporation and Viavi Solutions Inc. (Cobham Wireless) are the major companies operating in the One-Box Testers Market.

Which is the fastest growing region in One-Box Testers Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in One-Box Testers Market?

In 2024, the North America accounts for the largest market share in One-Box Testers Market.

What years does this One-Box Testers Market cover?

The report covers the One-Box Testers Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the One-Box Testers Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

One-Box Testers Industry Report

Statistics for the 2024 One-Box Testers market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. One-Box Testers analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.