Optical Ceramics Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 15.00 % |

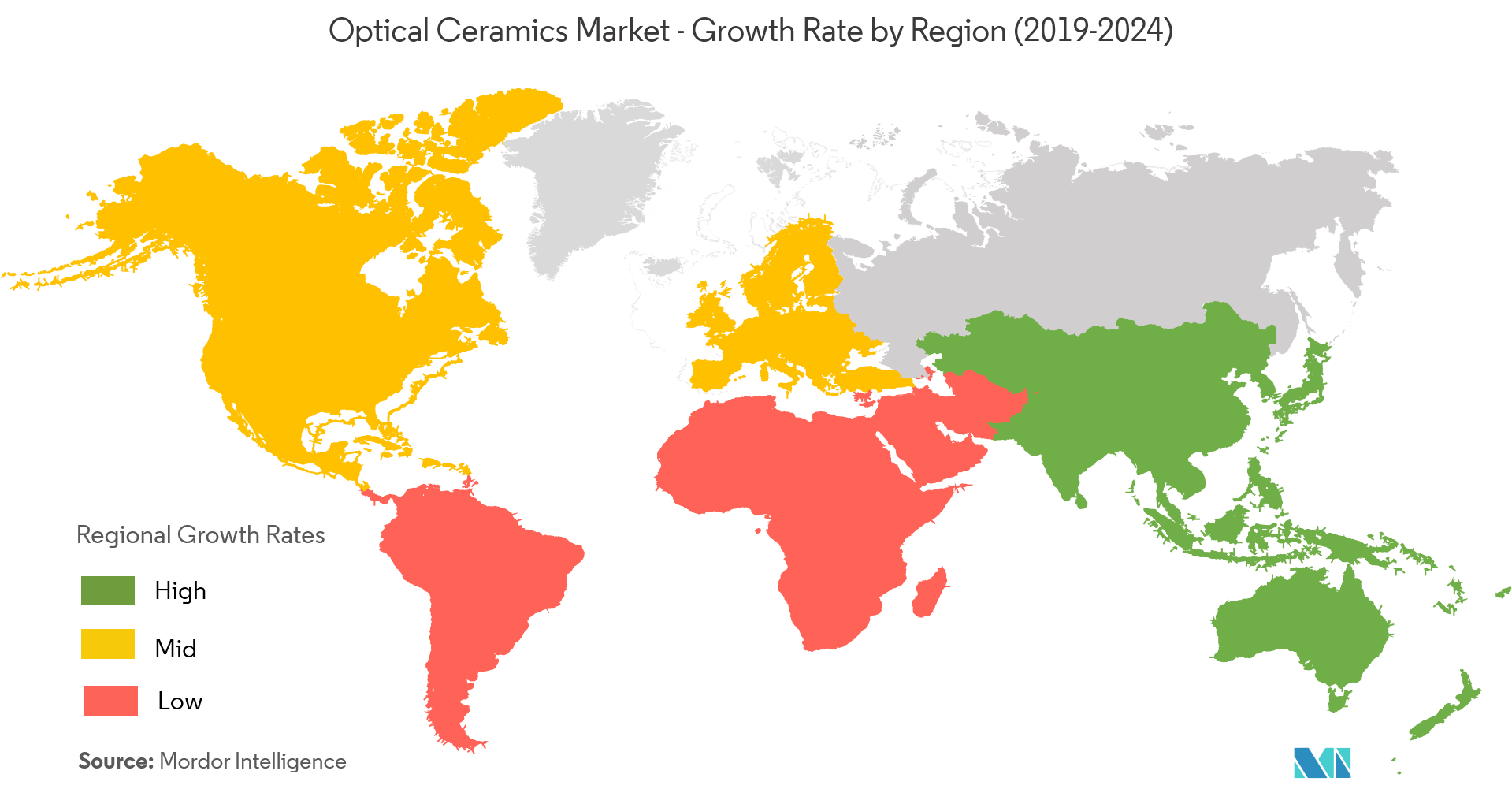

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

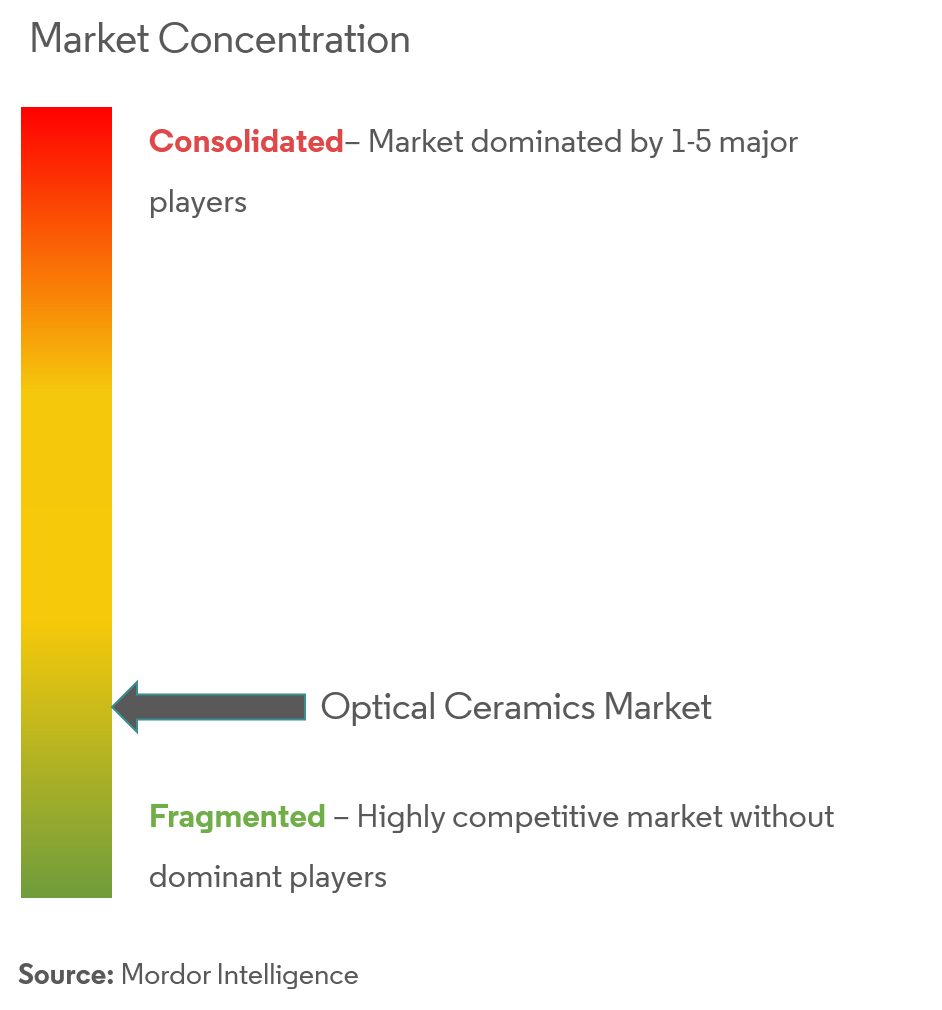

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Optical Ceramics Market Analysis

The optical ceramics market is expected to register a CAGR of 15% over the forecast period (2021 - 2026). Optical ceramics offer high transmission over the Visible-MWIR wavelength range, excellent refractive index homogeneity, and outstanding environmental durability.

- The optical ceramics market growth is attributed to the increasing use of optical ceramics in the aerospace industry and in the defense and security industry. There is continuous research and development going in this field which has led to achieving better efficiencies.

- Technological advancements and innovations in the defense and security industry, such as body armours and helmets as well as vehicles and aircrafts have been some of the significantly encouraging factors for the market.

- Optical ceramics are relatively lightweight and have strong durability. These features attract many industries. Some companies have started offering optical ceramics with several customization features such as embedded conductive grids, specialty coatings, tight dimensional tolerance, etc. The biggest advantage of optical ceramics market is the possibility of reasonably priced and large-sized materials.

Optical Ceramics Market Trends

This section covers the major market trends shaping the Optical Ceramics Market according to our research experts:

Aerospace & Defense Expected to Witness Significant Growth

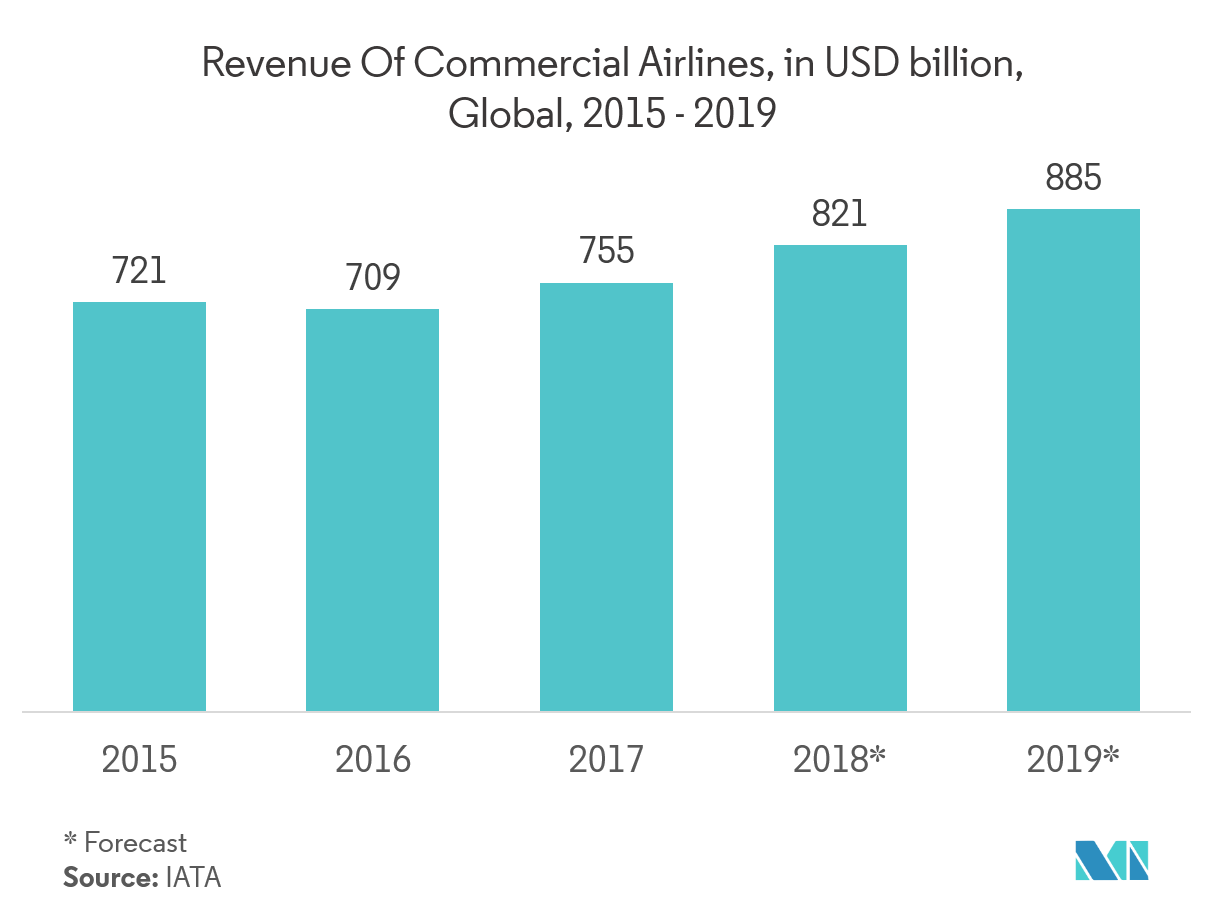

- The aerospace sector continually looks forward to new technologies being employed in everything from the latest commercial jetliners and advanced fighter jets to next-generation missile systems. For virtually all of these platforms, optical ceramics play a vital role in several onboard systems and components.

- In the aerospace and defense segment, optical ceramics are used for advanced optical domes, conformal optical windows, and transparent armor. Sapphire is the most commonly used optical ceramic material in this segment. Materials such as magnesium aluminate spinel, polycrystalline alumina, and yttrium oxide are used for manufacturing optical windows in the aerospace industry.

- The defense aerospace sector will witness an increase in investments, as security threats increasingly burden governments. Increasing production and growing demand for new aircraft in the aerospace sector is expected to trigger the growth of the market.

- Companies such as CeraNova have developed and continues to improve innovative and cost-effective manufacturing processes for spherical and aspheric components made from ceramics. These include hemispherical domes for legacy missile systems as well as aerodynamic dome geometries for next-generation platforms. The advanced optical ceramic materials developed by CeraNova provide high strength, abrasion resistance, and extended operating temperature range for a wide range of next-generation aerospace and defense systems.

Asia-Pacific Expected to Witness Significant Growth

- Asia-Pacific is expected to witness significant growth for the optical ceramics market. The spending in defense has been increasing in the region in recent years, owing to the rise in terrorism and an urge to dominate the region.

- Rising security threats in China are expected to increase the national spending on defense, which may, in turn, directly affect the market, positively, during the forecast period.

- Additionally, China has the world’s largest electronics production base. Electronic products, such as smartphones, tablets, tempered glasses, etc., have the highest growth in the electronics segment. The country not only serves the domestic demand for electronics but also exports electronic output to other countries.

- Furthermore, the Indian government announced an increase of over INR 3 lakh crore, for the fiscal year 2019-2020, in its interim budget. Additionally, with an aim to boost India's defense production, the country has planned to manufacture 200 helicopters with Russian collaboration, for the intensification and diversification of their strategic ties.

- Therefore, with the increasing demand and government initiative in various sectors in the region, the demand for optical ceramics will surge during the forecast period.

Optical Ceramics Industry Overview

The optical ceramics market is fragmentedwith several manufacturers, as they strive to maintain a competitive edge in the market, thereby intensifying the competition in the market. Various innovations are taking place in the market, thus enhancing the growth of the optical ceramics market.

- March 2019 - Murata expanded its production facility in Okayama, Japan. The expansion helped in increasing the production capacity of ceramics to meet the increased demand for electronic components used in smartphones and other devices. This will play a significant role in strengthening the product portfolio of the company and emerge as a key manufacturer of optoelectronic components in the near future.

- June 2018 - Kyocera set up a new manufacturing plant for ceramic microelectronic packages in Kagoshima, Japan. This new facility, which Kyocera plans to make operational in August 2019, will bring a 25% increase in the company's total production capacity for ceramic packages and allow the company to expand production for other items depending on future needs.

Optical Ceramics Market Leaders

-

CeraNova Corporation

-

Ceramtec GmbH

-

Surmet Corporation

-

CoorsTek Corporation

-

Murata Manufacturing Co. Ltd.

*Disclaimer: Major Players sorted in no particular order

Optical Ceramics Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Substitute to Glass, Metals, and Plastics

- 4.3.2 Increasing Defense Expenditure on Advanced Materials and Technologies

-

4.4 Market Restraints

- 4.4.1 High Cost of Optical Ceramics

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Polycrystalline

- 5.1.2 Monocrystalline

-

5.2 By End-user Industry

- 5.2.1 Aerospace & Defense

- 5.2.2 Energy

- 5.2.3 Healthcare

- 5.2.4 Consumer Goods

- 5.2.5 Other End-user Industries

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 India

- 5.3.3.5 Japan

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle-East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 CeraNova Corporation

- 6.1.2 Ceramtec GmbH

- 6.1.3 Surmet Corporation

- 6.1.4 Schott AG

- 6.1.5 Coorstek Corporation

- 6.1.6 Murata Manufacturing Co. Ltd.

- 6.1.7 Konoshima Chemicals Co. Ltd.

- 6.1.8 Kyocera Corporation

- 6.1.9 Saint-Gobain S.A.

- 6.1.10 Ceradyne Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE OUTLOOK

** Subject To AvailablityOptical Ceramics Industry Segmentation

Optical ceramics are advanced industrial materials that are developed for use in various optical applications. The advantage of optical ceramics is the possibility of production of reasonably priced and large-sized materials for large area detection. They derive their utility from their response to infrared, optical, and ultraviolet light. These ceramics are made of several types of materials. Each of this type is meant for a specific and a unique purpose.

| By Type | Polycrystalline | |

| Monocrystalline | ||

| By End-user Industry | Aerospace & Defense | |

| Energy | ||

| Healthcare | ||

| Consumer Goods | ||

| Other End-user Industries | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| France | ||

| United Kingdom | ||

| Spain | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| South Korea | ||

| India | ||

| Japan | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Argentina | ||

| Rest of Latin America | ||

| Geography | Middle-East & Africa | Saudi Arabia |

| South Africa | ||

| Rest of Middle-East & Africa |

Optical Ceramics Market Research FAQs

What is the current Optical Ceramics Market size?

The Optical Ceramics Market is projected to register a CAGR of 15% during the forecast period (2024-2029)

Who are the key players in Optical Ceramics Market?

CeraNova Corporation, Ceramtec GmbH, Surmet Corporation, CoorsTek Corporation and Murata Manufacturing Co. Ltd. are the major companies operating in the Optical Ceramics Market.

Which is the fastest growing region in Optical Ceramics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Optical Ceramics Market?

In 2024, the North America accounts for the largest market share in Optical Ceramics Market.

What years does this Optical Ceramics Market cover?

The report covers the Optical Ceramics Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Optical Ceramics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Optical Ceramics Industry Report

Statistics for the 2024 Optical Ceramics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Optical Ceramics analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.