Organic Acids Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 4.50 % |

| Fastest Growing Market | Europe |

| Largest Market | Asia Pacific |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Organic Acids Market Analysis

The globalorganic acidmarket is growing at a CAGR of 4.5% during the forecast period (2020 - 2025).

-

Theglobalmarketfororganic acidis mainly driven byitsrisingapplication in packaged food due to its antioxidant properties, preservation, acidity regulation, flavor enhancement, and many others.High growth in the pharmaceutical industry is alsofuellingdemand for organic acids, due to its functional properties such as lactic acid is commonly used in the pharmaceutical industry. Further, the use of organic acid in the textile, feed and personal care industry is also remarkable.

-

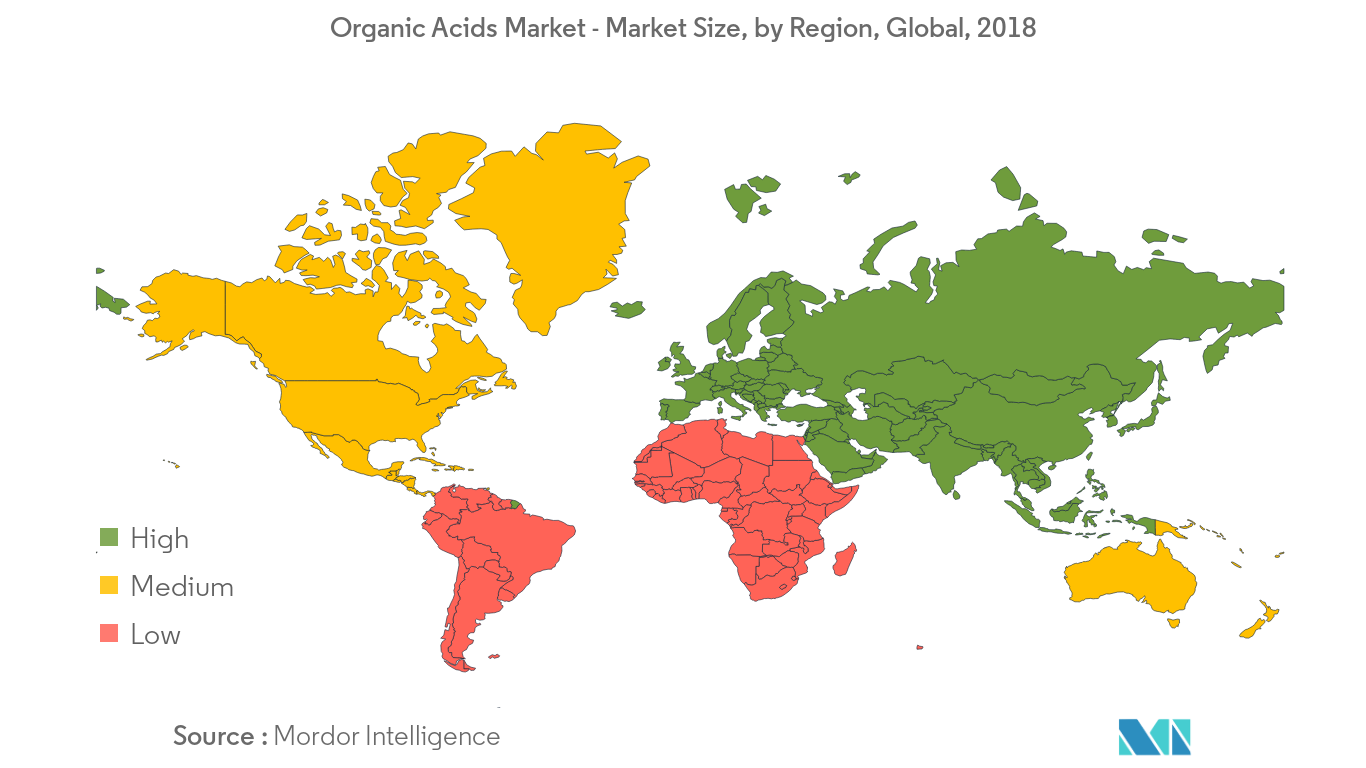

Asia-Pacific accounts for the largest share in the global market, followed by Europe, which is one of the regions that have a high potential for the growth of the organic acids market. North America is expected to witness comparatively slower growth as compared to other regions.

Organic Acids Market Trends

This section covers the major market trends shaping the Organic Acids Market according to our research experts:

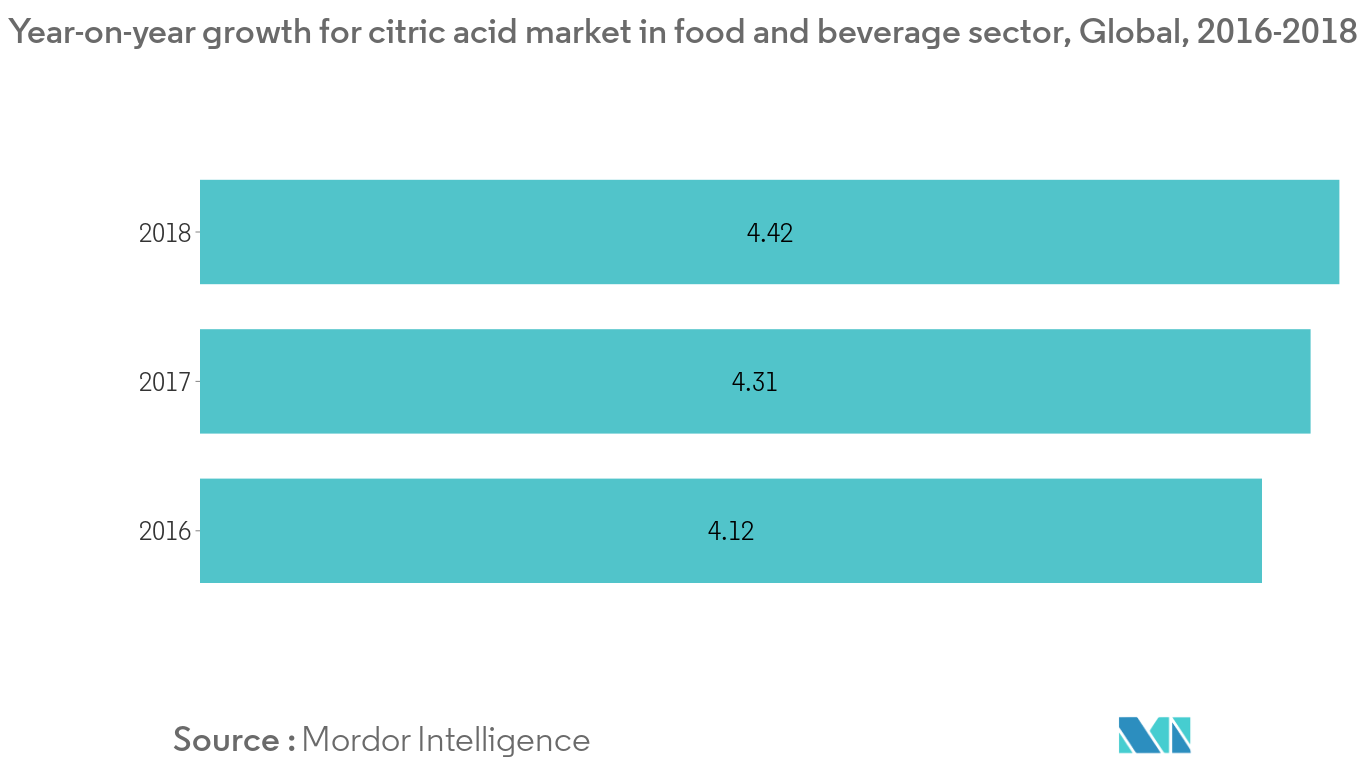

Rising Demand of Citric Acid in Food and Beverage Industries

Citric acid is one of the most widely used additives in the food and beverage industry, both as an acidulate and preservative to enhance the shelf life of convenience foods, due to its low toxicity, when compared with other acidulates. It is found in non-alcoholic beverages and in jams, gelatin-based desserts, and tinned vegetables and fruit. It also plays a huge role in enhancing flavors, particularly in the drinks industry, as it provides a sour and refreshing flavor, which offsets the sweetness of many drinks. Also, regulatory bodies, such as the US Food and Drug Administration considers citric acid a safe natural acid in the diet, thus favoring the market growth. The FDA reports that consuming 500 milligrams of citric acid per day has no harmful effects. In addition, the use of citric acid in processed frozen foods and as an additive in some fats and oils enhances the action of antioxidants, which effectively reduces the deterioration rate of these products.Also,regulationof the European Union specifies that citric acids are permitted additives for beer and malt beverages. Thus, an increase in demand for malt beverages will further fuel the market growth.

Asia Pacific to Drive the Organic Acid Market

Asia-Pacific accounts for the largest market share in the global market of organic acids owing to the increasing consumption of processed food and growing disposable income in the region. Also, according to a survey conducted by Associated Chambers of Commerce and Industry of India (ASSOCHAM), due to the steep rise in the prices of vegetables, people are turning to other alternatives by purchasing processed ginger-garlic pastes, tomato purees, and ketchup. Therefore, the rise in 20-225% sales of these products in November 2015 has resulted in fueling the food organic acids market in the region.

Organic Acids Industry Overview

The global market for organic acid is fragmented, owing to the presence of large regional and domestic players in different countries. Emphasis is given on the merger, expansion, acquisition, and partnership of the companies along with new product development as strategic approaches adopted by the leading companies to boost their brand presence among consumers. Major global players in the market are Cargill, Incorporated, Eastman Chemical Company, BASF SE, Archer Daniels Midland Company, Tate & Lyle PLC, DSM, andDow Inc.among others.

Organic Acids Market Leaders

-

Cargill, Incorporated

-

Eastman Chemical Company

-

BASF SE

-

Archer Daniels Midland Company

-

Tate & Lyle PLC

*Disclaimer: Major Players sorted in no particular order

Organic Acids Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Acetic acid

- 5.1.2 Citric acid

- 5.1.3 Lactic acid

- 5.1.4 Others

-

5.2 By Application

- 5.2.1 Food & Beverage

- 5.2.2 Animal Feed

- 5.2.3 Pharmaceuticals

- 5.2.4 Others

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Cargill, Incorporated

- 6.4.2 Eastman Chemical Company

- 6.4.3 BASF SE

- 6.4.4 Archer Daniels Midland Company

- 6.4.5 Tate & Lyle PLC

- 6.4.6 Koninklijke DSM N.V.

- 6.4.7 DuPont

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityOrganic Acids Industry Segmentation

Theglobalorganic acidmarkethasbeen segmentedbytypeintoacetic acid, citric acid, lactic acid, and others; and by application into food & beverage, animal feed, pharmaceuticals, and others.Also, the study provides an analysis of theorganic acid market in the emerging and established markets across the globe, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

| By Type | Acetic acid | |

| Citric acid | ||

| Lactic acid | ||

| Others | ||

| By Application | Food & Beverage | |

| Animal Feed | ||

| Pharmaceuticals | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Russia | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | India |

| China | ||

| Japan | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East & Africa | South Africa |

| Saudi Arabia | ||

| Rest of Middle East & Africa |

Organic Acids Market Research FAQs

What is the current Organic Acids Market size?

The Organic Acids Market is projected to register a CAGR of 4.5% during the forecast period (2024-2029)

Who are the key players in Organic Acids Market?

Cargill, Incorporated, Eastman Chemical Company, BASF SE, Archer Daniels Midland Company and Tate & Lyle PLC are the major companies operating in the Organic Acids Market.

Which is the fastest growing region in Organic Acids Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Organic Acids Market?

In 2024, the Asia Pacific accounts for the largest market share in Organic Acids Market.

What years does this Organic Acids Market cover?

The report covers the Organic Acids Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Organic Acids Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Organic Acids Industry Report

Statistics for the 2024 Organic Acids market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Organic Acids analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.