Outdoor Wi-Fi Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 7.12 Billion |

| Market Size (2029) | USD 11.20 Billion |

| CAGR (2024 - 2029) | 9.49 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Outdoor Wi-Fi Market Analysis

The Outdoor Wi-Fi Market size is estimated at USD 7.12 billion in 2024, and is expected to reach USD 11.20 billion by 2029, growing at a CAGR of 9.49% during the forecast period (2024-2029).

Numerous venues, including metro stations, hotels, railroad stations, cafes, markets, airports, parks, institutions of higher learning, and other public spaces, now feature outdoor Wi-Fi hotspots. It encourages the internet's tremendous accessibility. The grounds for the market's expansion include rising social media usage, increasing internet penetration, and rising demand for smart devices in several nations.

- Governments are prioritizing outdoor Wi-Fi penetration across the globe to speed the broadband services uptake. According to Ericsson, the global number of fixed broadband connections is estimated to reach 1.5 billion by the end of 2026. It also predicted that by the end of 2026, North America would have 340 million 5G subscriptions. As a result, such expansion will likely influence the future outdoor Wi-Fi market's growth.

- Moreover, the government initiatives towards deploying Wi-Fi hotspots will significantly drive the studied market. For instance, in May last year, a senior telecom department of India official stated that state-owned Bharat Sanchar Nigam would transition 30,000 of its Wi-Fi hotspots to the PM-WANI framework in June last year. Railways include an ambitious plan for all its future hotspots to be under the framework. To promote broadband internet proliferation throughout the nation, the government approved the establishment of outdoor Wi-Fi networks and access points by local Kirana and neighborhood shops in December 2020. The PM-WANI, or outdoor Wi-Fi Access Network Interface, includes the potential to start a vast Wi-Fi revolution in the nation.

- Further, last year, the International Telecommunication Union (ITU) estimated that 5.3 billion people, or 66% of the world's population, would use the internet. It marks a 24% growth from 2019, with an expected 1.1 billion people joining the internet throughout that time. Such a rise in internet penetration will create opportunities for local and international outdoor Wi-Fi vendors to introduce new products and increase the bandwidth to capture a significant market share.

- Throughout the pandemic, working from home became the new norm. Due to consumer pressure to work entirely from home, industries and the residential market have increased outdoor Wi-Fi use to meet this demand. Wi-Fi services rose to a greater extent, boosting social media use. For instance, The New York Times reports that group calls in Italy climbed tenfold while voice calls on Facebook's WhatsApp, Messenger, and Instagram platforms increased by 100% and 50%, respectively. Similarly, Google notes rising videoconferencing product usage and new YouTube usage trends but says peak traffic levels are still well within their capabilities. Many application providers, including Netflix, Akamai, and YouTube, have agreed to lower video streaming quality during peak hours in Europe due to increased demand. Some have also changed default global settings from high-definition to standard-definition.

- On the flip side, without VPNs, outdoor Wi-Fi is exposed to attacks like Man-in-the-Middle (MITM) attacks, evil Twin attacks, malware injection, Wi-Fi snooping and sniffing, etc. Using VPN on free public hotspots will reduce all of these mentioned attacks risks. The encryption process will effectively shield all the user's data from snooping. While the hacker can see that the user is connected to the internet with the help of outdoor Wi-Fi, they cannot read the transmitted data details.

Outdoor Wi-Fi Market Trends

This section covers the major market trends shaping the Outdoor Wi-Fi Market according to our research experts:

Growing Investments in Smart City Projects Globally

- A smart city is an urban area using advanced technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), cloud storage, big data, and data analytics. They gather and analyze utilization data and use the insights gained from them to manage resources, services, and assets effectively. Growing government measures to address urbanization and overpopulation and the growing need for resource management for sustainable development are driving growth in the smart cities industry.

- The United States is one of the top regions for developing platforms for smart cities. With IoT Smart Communities technology, cities can use resources more effectively and enhance everything from air and water quality to transportation, energy, and communication infrastructure. According to Smart America, during the next 20 years, American city governments may spend up to USD 41 trillion upgrading their infrastructure to take advantage of the Internet of Things.

- In November last year, the Smart Cities Council, a smart cities organization, began operations in the United Kingdom. The Smart Cities Council and its associated global impact program, "Everyone," bring together government, business, academia, philanthropy, and charity to take action and impact the key challenges and possibilities that cities and communities face today. People, safety, beauty, sustainability, resilience, and equity will be included in the expansion of "smart" from place and infrastructure in the United Kingdom.

- Further, Toyota is constructing a 175-acre smart city at the foot of Japan's Mount Fuji, approximately 62 miles from Tokyo. The "future city" will serve as a trial ground for technology such as robotics, smart homes, and artificial intelligence. It will initially house 2,000 Toyota employees and their families, retired couples, retailers, and scientists to test and develop these technologies. Toyota's "Woven City" residents would live in smart homes with in-home robotics systems to help with daily life and sensor-based artificial intelligence to monitor health and other necessities.

- According to International Institute for Management Development, Singapore was the top smart city in 2021. Compared to the other cities on the list, it has many benefits, such as good cleanliness, medical services, and security CCTV cameras. Such developments are expected to drive the studied market.

Asia-Pacific to Witness the Significant Growth

- The Asia-Pacific outdoor Wi-Fi market is expected to grow faster because of the presence of the two largest economies of the world, i.e., China and India. The strong economic growth in the region, coupled with the information that the internet brings, interprets that the internet is poised for dynamic change in the Asia-Pacific region. Due to this, the outdoor Wi-Fi market includes a massive opportunity in this region.

- Companies are competitive in the technological Wi-Fi landscape in the region, leading to various products launch related to the latest technology. For instance, in March last year, ZTE, a Chinese technology company, showcased the world's first Wi-Fi 7 consumer-ready product named the ZTE MC888 Flagship. The ZTE MC888 Flagship is a Wi-Fi 7 5G CPE (Customer Premises Equipment) that takes cellular data from 4G LTE and 5G networks and converts it to Wi-Fi signals so users can connect. If all three bands were fully utilized, the ZTE MC888 Flagship would support the 2.4G Hz/5G Hz/6 Hz frequency bands and up to 19 Gbps speeds. Features like 320 MHz bandwidth, multi-link operation (MLO), and 4K QAM are included.

- In October last year, a campus-wide Wi-SUN network was established by the IIIT Hyderabad Smart City Living Lab in collaboration with Silicon Labs to facilitate research and solutions for the Internet of Things (IoT) and smart cities. To connect millions of IoT nodes, Wi-SUN enables utilities, cities, and businesses to construct long-range, low-power wireless mesh networks. To create a robust network across the campus and use these lights as router nodes to transfer sensor data, this project involves converting campus streetlights to Wi-SUN smart streetlights.

- South Korea plans to lead Wi-Fi 6E commercialization, the following Wi-Fi generation that extends the connectivity to the 6 GHz band, thus enabling more bandwidth and faster speeds at lower latency. For instance, in January last year, Wi-Fi 6E was tested in various ways on the southern resort island of Jeju at an event conducted by the Ministry of Science and ICT. An 8K VR real-time streaming service was tested in a virtual reality theme park during the demonstration. Also, participants at a high school gymnasium watched a game simultaneously through about 100 terminals using a relay camera and a Wi-Fi 6E router. Moreover, the Wi-Fi 6E roaming service was tested at an airport in the country.

- In August 2022, D-Link launched DSL X1852E Wi-Fi Router. This router offers speeds up to 1200 Mbps on its 5 GHz band and 574 Mbps on its 2.4 GHz band with the latest WPA3 128-bit encryption. This router also incorporates Wi-Fi 6's cutting-edge Orthogonal Frequency Division Multiple Access (OFDMA) technologies. It also provides two-way MU-MIMO technology, which helps distribute data flow to multiple devices simultaneously.

Outdoor Wi-Fi Industry Overview

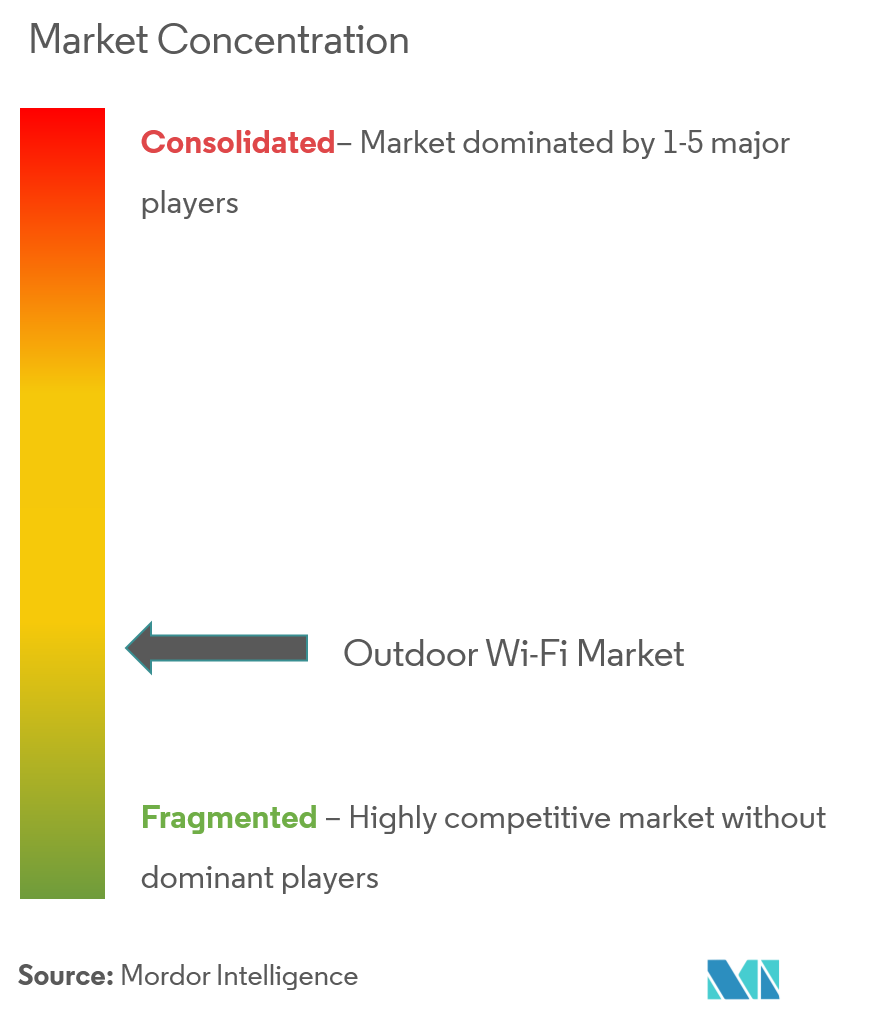

The outdoor Wi-Fi market is fragmented, and the competitive rivalry among existing competitors is high. Also, moving forward, acquisitions and collaboration of large companies with startups are expected, focusing on innovation. Some key players in the market are Cisco Systems Inc. and Hewlett-Packard Enterprise Company, among others.

- May 2022: Cisco announced the release of its first outdoor Wi-Fi 6E-ready access point and improvements for remote industrial operations. The new Catalyst IW9167 Series adds greater versatility to our industrial wireless portfolio than ever. With a single hardware solution and two wireless alternatives, we give businesses more excellent options for deploying the best wireless technologies for their applications - and for future-proofing deployments by quickly switching between the two technologies as business needs change.

- May 2022: Qualcomm Technologies, Inc. announced the availability of its Wi-Fi 7-enabled Qualcomm Networking Pro Series Gen 3 platform family. The Qualcomm Networking Pro Series, Gen3, is a high-performance Wi-Fi 7 network infrastructure platform portfolio that is now sampling and accessible to global development partners. The products combine Wi-Fi 7 features with Qualcomm Technologies' intelligent multi-channel management technologies to improve speeds, lower latency, and network utilization for Wi-Fi 6/6E devices. It offers game-changing throughput and incredibly low latency for the next generation of Wi-Fi 7 client devices.

Outdoor Wi-Fi Market Leaders

-

Aerohive Networks

-

Airspan Networks

-

Alvarion Technologies (SuperCom)

-

Cisco Systems Inc.

-

Fortinet Inc.

*Disclaimer: Major Players sorted in no particular order

Outdoor Wi-Fi Market News

- August 2022: Extreme Networks unveiled the Extreme AP5050, which the company claims are the industry's first outdoor Wi-Fi 6E outdoor access point (AP) for deployment in various outdoor environments. The outdoor AP is versatile and straightforward to install, and it integrates Wi-Fi 6E, sophisticated security, and AI/ML capabilities in a single package. It includes three 44:4 radios that deliver high efficiency, high-performance 802.11ax aggregate data speeds of up to 10 Gpbs.

- January 2022: The OpenWiFi initiative of the Telecom Infra Project (TIP) intends to disassemble the Wi-Fi network software stack and bring open-source Wi-Fi networking to the world. Candela Technologies, a long-time member of the TIP OpenWiFi community, is constantly striving to provide the finest available test solutions to help and empower the community to produce high-quality Wi-Fi products. Edgecore, for example, is one of the vendors in the community that creates and manufactures such high-quality Wi-Fi equipment. Edgecore includes a wide range of high-end access points preloaded with TIP's OpenWiFi AP software, providing users with an open platform for additional customization.

Outdoor Wi-Fi Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHT

- 4.1 Market Overview

-

4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Technology Snapshot

5. MARKET DYNAMICS

- 5.1 Introduction to Market Dynamics

-

5.2 Market Drivers

- 5.2.1 Increasing Demand for Internet of Things and Penetration of Internet Enabled Gadgets

- 5.2.2 Growing Investments in Smart City Projects Globally

-

5.3 Market Restraints

- 5.3.1 Rising Privacy and Security Concerns

6. MARKET SEGMENTATION

-

6.1 By Product

- 6.1.1 WLAN Controllers

- 6.1.2 Access Points

- 6.1.3 Wireless Hospot Gateways

-

6.2 By Service

- 6.2.1 Network Planning and Design

- 6.2.2 Installation and Support

-

6.3 By Implementation Model

- 6.3.1 Outdoor Hotspots

- 6.3.2 Private Networks

-

6.4 By End-user Industry

- 6.4.1 Healthcare

- 6.4.2 Education

- 6.4.3 Logistics and Transportation

- 6.4.4 Travel and Hospitality

- 6.4.5 Public Utilities

- 6.4.6 Other End-user Industries

-

6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East & Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Key Vendor Profiles

- 7.1.1 Aerohive Networks

- 7.1.2 Airspan Networks

- 7.1.3 Alvarion Technologies (SuperCom)

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Fortinet Inc.

- 7.1.6 Hewlett-Packard Company

- 7.1.7 Huawei Technologies Co. Ltd

- 7.1.8 Juniper Networks

- 7.1.9 Netgear Inc.

- 7.1.10 Nokia Siemens Networks

- 7.1.11 Ubiquiti Networks Inc.

- 7.1.12 Zebra Technologies

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityOutdoor Wi-Fi Industry Segmentation

Wi-Fi technology is crucial for various systems, such as Machine to Machine (M2M) and Hot Spots. Outdoor Wi-Fi technology is emerging across multiple verticals, such as healthcare, education, shopping malls, the public sector, railway stations, and airports. The scope also comprises Products and Services.

The Global Outdoor Wi-Fi Market is segmented by product (WLAN controllers, access points, and wireless hotspot gateways), service (network planning and design and installation and support), implementation model (outdoor hotspots and private networks), end-user industry (healthcare, education, logistics and transportation, travel and hospitality, public utilities, and other end-user industries), and geography(North America, Europe, Asia Pacific, Latin America, Middle East, and Africa).

The market sizes and forecasts are in value (USD million) for all the above segments.

| By Product | WLAN Controllers |

| Access Points | |

| Wireless Hospot Gateways | |

| By Service | Network Planning and Design |

| Installation and Support | |

| By Implementation Model | Outdoor Hotspots |

| Private Networks | |

| By End-user Industry | Healthcare |

| Education | |

| Logistics and Transportation | |

| Travel and Hospitality | |

| Public Utilities | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Outdoor Wi-Fi Market Research FAQs

How big is the Outdoor Wi-Fi Market?

The Outdoor Wi-Fi Market size is expected to reach USD 7.12 billion in 2024 and grow at a CAGR of 9.49% to reach USD 11.20 billion by 2029.

What is the current Outdoor Wi-Fi Market size?

In 2024, the Outdoor Wi-Fi Market size is expected to reach USD 7.12 billion.

Who are the key players in Outdoor Wi-Fi Market?

Aerohive Networks, Airspan Networks, Alvarion Technologies (SuperCom), Cisco Systems Inc. and Fortinet Inc. are the major companies operating in the Outdoor Wi-Fi Market.

Which is the fastest growing region in Outdoor Wi-Fi Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Outdoor Wi-Fi Market?

In 2024, the North America accounts for the largest market share in Outdoor Wi-Fi Market.

What years does this Outdoor Wi-Fi Market cover, and what was the market size in 2023?

In 2023, the Outdoor Wi-Fi Market size was estimated at USD 6.5 billion. The report covers the Outdoor Wi-Fi Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Outdoor Wi-Fi Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Outdoor WiFi Solutions Industry Report

Statistics for the 2024 Outdoor WiFi Solutions market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Outdoor WiFi Solutions analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.