Oxygen Therapy Equipment Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 11.20 % |

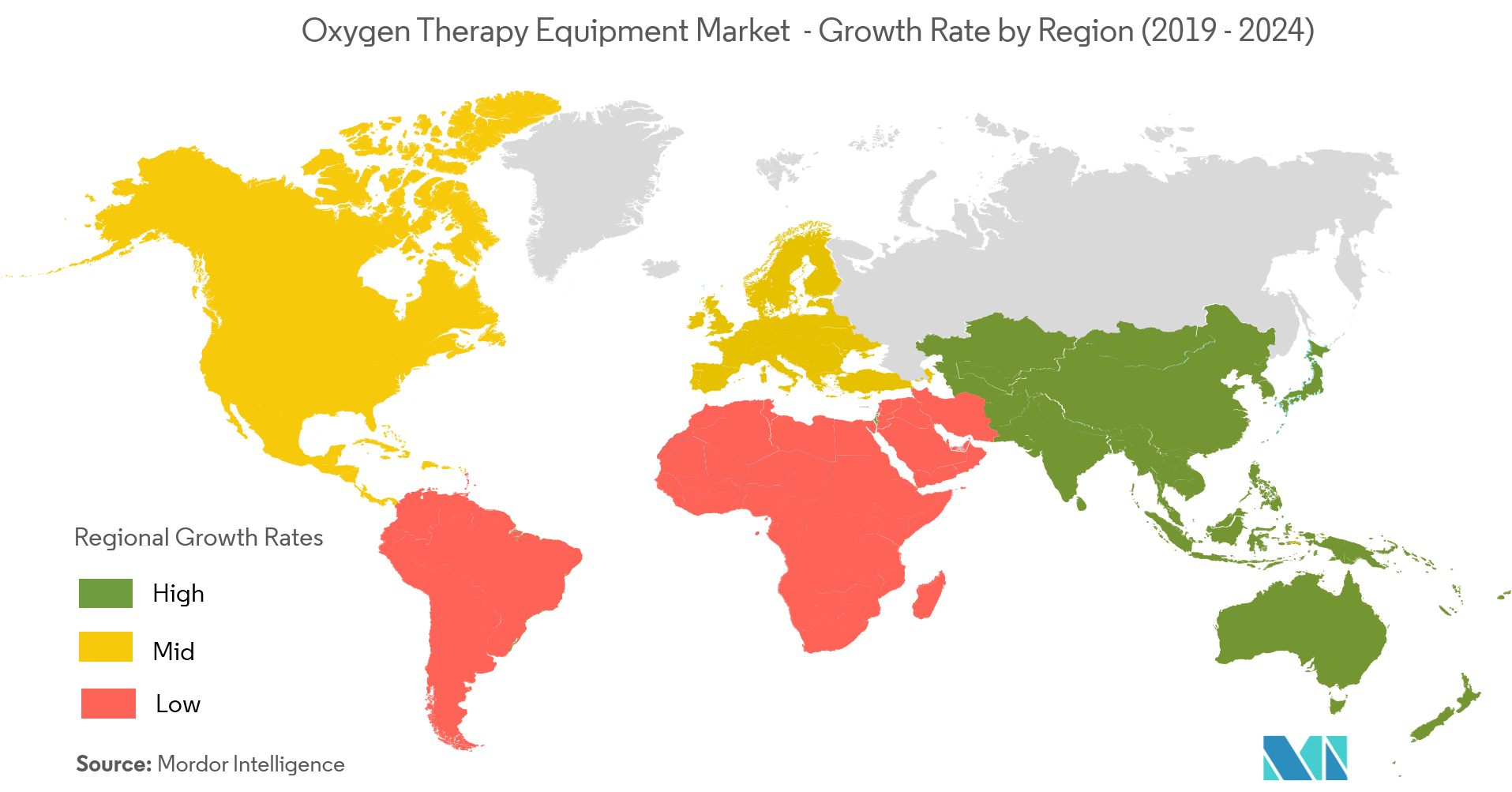

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

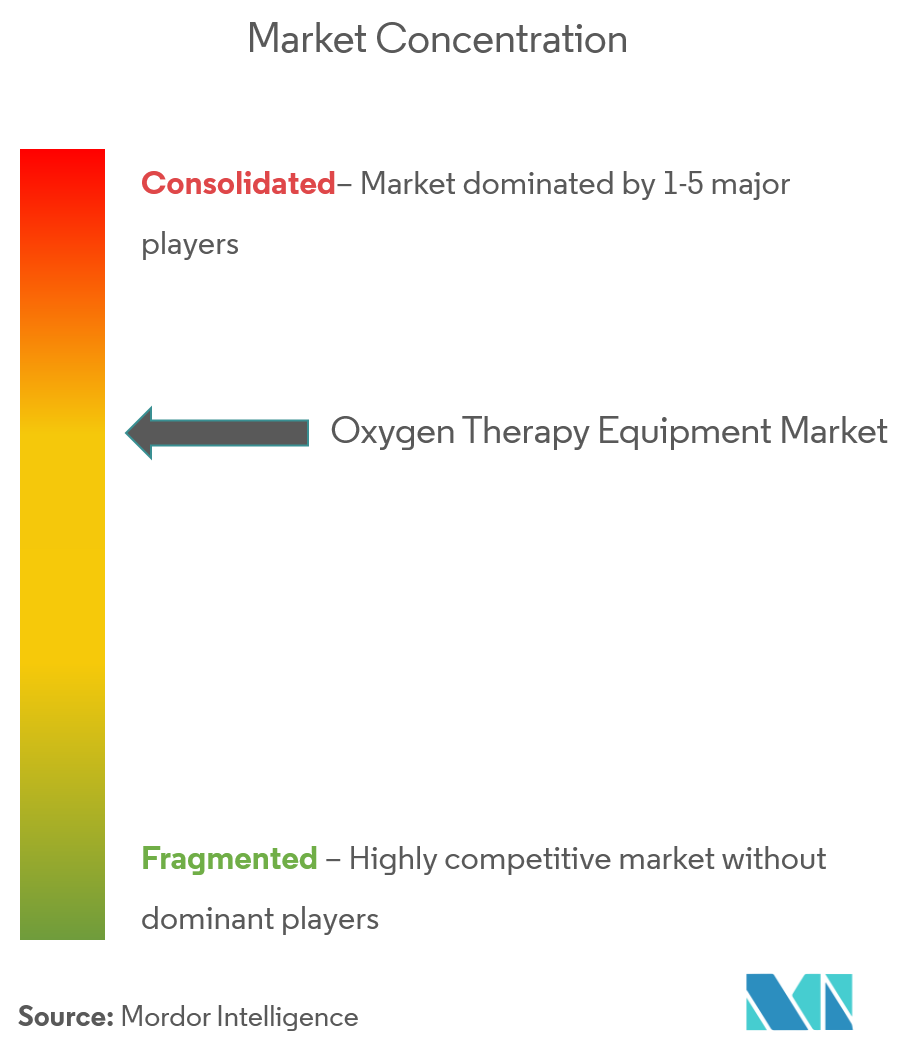

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Oxygen Therapy Equipment Market Analysis

The major factors for the growth of the oxygen therapy equipment market include the increase in tobacco smoking and the rising prevalence of respiratory diseases and technological advancement in oxygen therapy.

The increasing prevalence of respiratory diseases is the major factor expected to drive the overall growth of the market over the forecast period. As per the data published by the World Health Organization (WHO), the Global Burden of Disease Study reports a prevalence of 251 million cases of Chronic Obstructive Pulmonary Disease (COPD) globally in 2016. The cases of COPD is likely to increase globally owing to the higher smoking prevalence and aging populations in many countries.

Furthermore, as per the estimates of the American Academy of Allergy, Asthma & Immunology, in 2016, around 8.3% of children in the United States had asthma. It is the most common chronic disease in children. The major risk factor for most of the respiratory diseases is smoking. In 2016, more than 15 of every 100 US adults aged 18 years or older smoked cigarettes as per the estimates of Centre for Disease Control and Prevention (CDC). Thus, owing to the rising prevalence of respiratory diseases the market is expected to witness huge demand over the forecast period.

Oxygen Therapy Equipment Market Trends

This section covers the major market trends shaping the Oxygen Therapy Equipment Market according to our research experts:

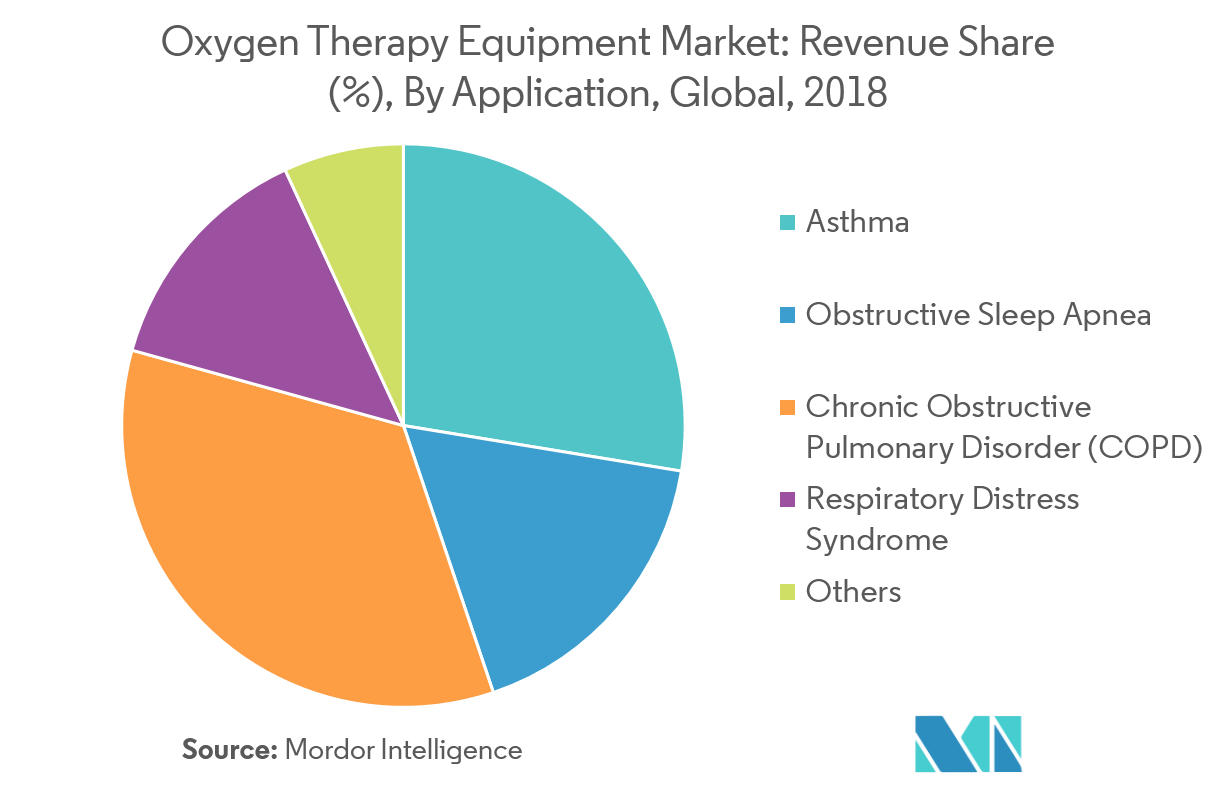

Chronic Obstructive Pulmonary Disorder (COPD) is the Segment by Application expected to hold Largest Market Share over the Forecast Period

Chronic respiratory diseases affect the airways and other parts of the lungs for a long duration of the period. Respiratory symptoms are among the major causes of consultation with doctors and physicians in primary health care centers. Chronic respiratory diseases affect more than 1 billion people, globally, as per the Global Asthma report, 2018. COPD, with tobacco smoking as its root cause, has affected a significant part of the world population, as per the WHO. Furthermore, according to a 2017 publication in The Lancet Respiratory Medicine, in 2015, an estimated 3.2 people died from COPD, globally. If the patient has low levels of oxygen owing to COPD in blood then long-term oxygen therapy is used. Thus, the rising prevalence of COPD is expected to create huge demand for oxygen therapy equipments resulting in high growth of the Oxygen Therapy Equipment market.

North America is Expected to Hold Largest Market Share over the Forecast Period

The United States is expected to be the largest oxygen therapy equipment market owing to the rising prevalence of respiratory diseases and the presence of better healthcare infrastructure. Also, there is a rise in per capita health expenditure in the country which is expected to increase over the forecast period owing to the decrease in the unemployment rate. The major risk factor for most of the respiratory diseases is smoking. In 2016, more than 15 of every 100 US adults aged 18 years or older smoked cigarettes as per the estimates of the Centre for Disease Control and Prevention (CDC). The cases of COPD is likely to increase in the United States owing to the higher smoking prevalence and aging populations in the country. Over the last decades, there have been significant advances in oxygen concentrator design and functionality. The newer generation of portable oxygen concentrators is designed to be lightweight, quiet, and energy-efficient. Owing to associated advantages of compact size, lower cost, and convenience to carry, the use of portable oxygen contractors have been growing rapidly. Thus, owing to the all above mentioned factors the market is expected to witness high growth.

Oxygen Therapy Equipment Industry Overview

The market studied is a consolidated market owing to the presence of few major market players. Some of the market players are Allied Healthcare Products, Inc., CAIRE Inc., DeVilbiss Healthcare, Fisher & Paykel Healthcare Limited, Hersill, Invacare Corporation, Koninklijke Philips N.V., Smiths Medical, TECNO-GAZ SpA, and Teleflex Incorporated

Oxygen Therapy Equipment Market Leaders

-

DeVilbiss Healthcare

-

Hersill

-

Invacare Corporation

-

Koninklijke Philips N.V.,

-

TECNO-GAZ SpA

*Disclaimer: Major Players sorted in no particular order

Oxygen Therapy Equipment Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increase in Tobacco Smoking and Rising Prevalence of Respiratory Diseases

- 4.2.2 Technological Advancement in Oxygen Therapy

-

4.3 Market Restraints

- 4.3.1 Stringent Regulatory Guidelines

-

4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product

- 5.1.1 Oxygen Source Equipment

- 5.1.1.1 Oxygen Cylinders

- 5.1.1.2 Oxygen Concentrators

- 5.1.1.3 Liquid Oxygen Devices

- 5.1.1.4 Others

- 5.1.2 Oxygen Delivery Devices

- 5.1.2.1 Oxygen Masks

- 5.1.2.2 Nasal Cannula

- 5.1.2.3 Venturi Masks

- 5.1.2.4 Non-rebreather Masks

- 5.1.2.5 Others

-

5.2 By Application

- 5.2.1 Asthma

- 5.2.2 Obstructive Sleep Apnea

- 5.2.3 Chronic Obstructive Pulmonary Disorder (COPD)

- 5.2.4 Respiratory Distress Syndrome

- 5.2.5 Others

-

5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Home Healthcare

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Others

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Allied Healthcare Products, Inc.

- 6.1.2 CAIRE Inc.

- 6.1.3 DeVilbiss Healthcare

- 6.1.4 Fisher & Paykel Healthcare Limited

- 6.1.5 Hersill

- 6.1.6 Invacare Corporation

- 6.1.7 Koninklijke Philips N.V.,

- 6.1.8 Smiths Medical

- 6.1.9 TECNO-GAZ SpA

- 6.1.10 Teleflex Incorporated

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityOxygen Therapy Equipment Industry Segmentation

As per the scope of this report, oxygen therapy equipment includes oxygen source equipment and oxygen delivery devices. These devices are used in the treatment of various respiratory diseases. The market is segmented by product, application, end user, and geography

| By Product | Oxygen Source Equipment | Oxygen Cylinders |

| Oxygen Concentrators | ||

| Liquid Oxygen Devices | ||

| Others | ||

| By Product | Oxygen Delivery Devices | Oxygen Masks |

| Nasal Cannula | ||

| Venturi Masks | ||

| Non-rebreather Masks | ||

| Others | ||

| By Application | Asthma | |

| Obstructive Sleep Apnea | ||

| Chronic Obstructive Pulmonary Disorder (COPD) | ||

| Respiratory Distress Syndrome | ||

| Others | ||

| By End User | Hospitals | |

| Home Healthcare | ||

| Ambulatory Surgical Centers | ||

| Others | ||

| Geography | North America | US |

| Canada | ||

| Mexico | ||

| Geography | Europe | Germany |

| UK | ||

| France | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Middle East and Africa | GCC |

| South Africa | ||

| Rest of Middle East and Africa | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America |

Oxygen Therapy Equipment Market Research FAQs

What is the current Oxygen Therapy Equipment Market size?

The Oxygen Therapy Equipment Market is projected to register a CAGR of 11.20% during the forecast period (2024-2029)

Who are the key players in Oxygen Therapy Equipment Market?

DeVilbiss Healthcare, Hersill, Invacare Corporation, Koninklijke Philips N.V., and TECNO-GAZ SpA are the major companies operating in the Oxygen Therapy Equipment Market.

Which is the fastest growing region in Oxygen Therapy Equipment Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Oxygen Therapy Equipment Market?

In 2024, the North America accounts for the largest market share in Oxygen Therapy Equipment Market.

What years does this Oxygen Therapy Equipment Market cover?

The report covers the Oxygen Therapy Equipment Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Oxygen Therapy Equipment Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Oxygen Therapy Equipment Industry Report

Statistics for the 2024 Oxygen Therapy Equipment market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Oxygen Therapy Equipment analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.