PAC Programming Software Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 15.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

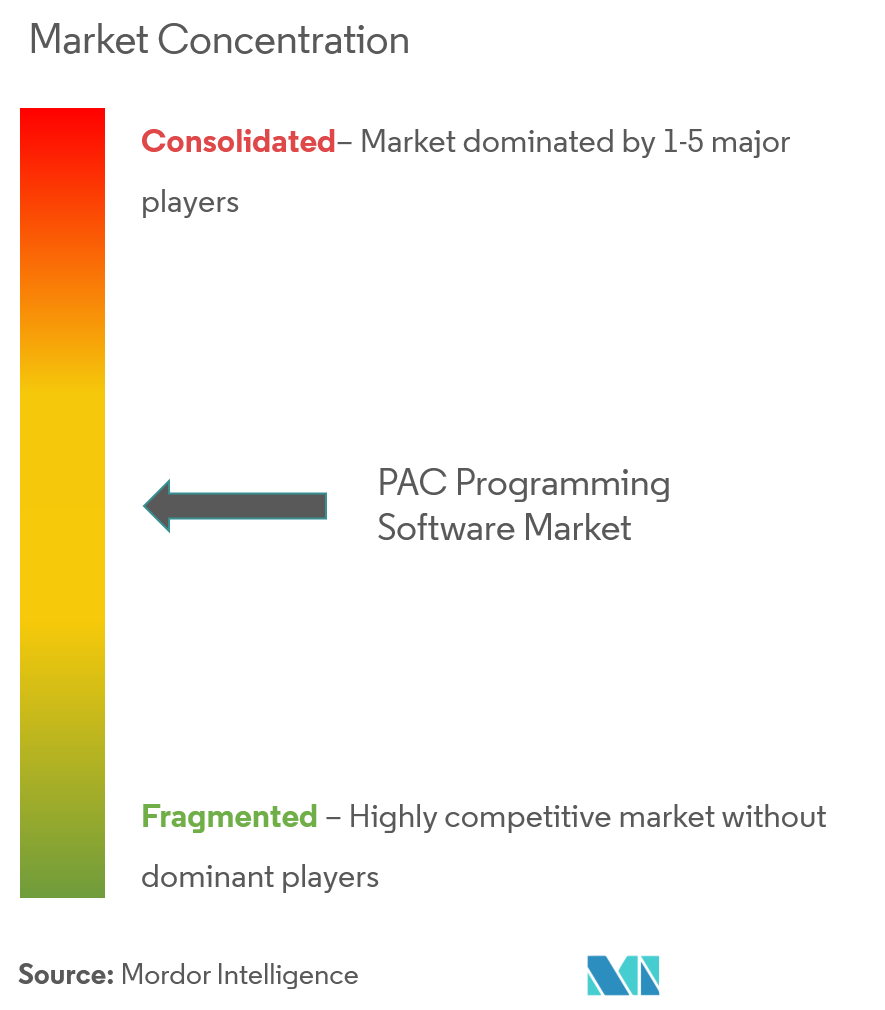

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

PAC Programming Software Market Analysis

The Programmable Automation Controller (PAC) programming software market is expected to register a CAGR of 15% during the forecast period (2021 - 2026). With the rapid increase in demand for the automated manufacturing process in various verticals, such as manufacturing, automotive, and chemical, the market is expected to witness high growth.

- PACs are the combined features of traditional automation technologies, such as distributed control systems (DCSs), programmable logic controllers (PLCs), personal computers (PCs), and remote terminal units (RTUs).

- The rapidly rising need for automation and with the increasing technological advancements in the field of sensors, machine size (emergence of smaller automated machines), software, the market is witnessing high growth.

- The usage of PAC's will shift firms' focus on open communication standards and software integration with less focus on the hardware. As users focus more on the total system performance rather than just the hardware selection, PAC's will become more demanding by customers who are not satisfied by traditional PLC's.

- Moreover, the rise in industrialization and increase in the number of manufacturing units across several developed as well as developing regions including North America, Europe, and Asia-Pacific will further boost the market studied.

PAC Programming Software Market Trends

This section covers the major market trends shaping the PAC Programming Software Market according to our research experts:

Rise in Automation to Augment Market Growth

- The advent of automation in various industries has facilitated the control over various operational aspects of industries, without any significant intervention from operators, using various control devices and software.

- These automation devices combine the advantages of a PLC-style traditional machinery or process control system, with the flexible type configuration and integration advantages of PC-based system, using a PAC (programmable automation controller), due to the various advantages of PAC programming software, the market is expected to grow further.

- Developing economies, such as China, India, etc., are primarily driving the growth of the automation industry. Emerging economies are also investing heavily in the development of several industries and the adoption of automation.

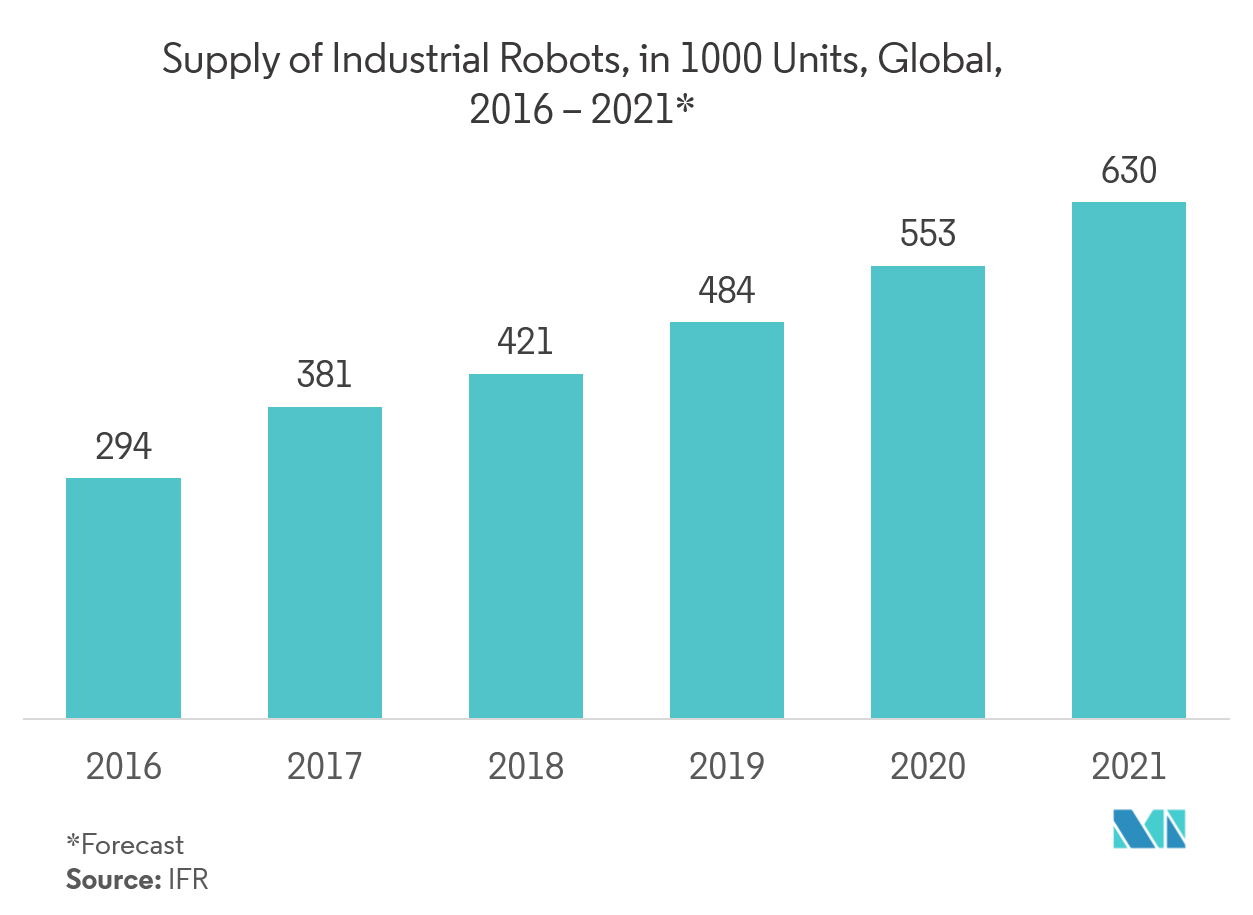

- With the increasing supply of industrial robots across the world, it is evident that automation is rapidly increasing in various manufacturing sectors, which is boosting demand in the market studied.

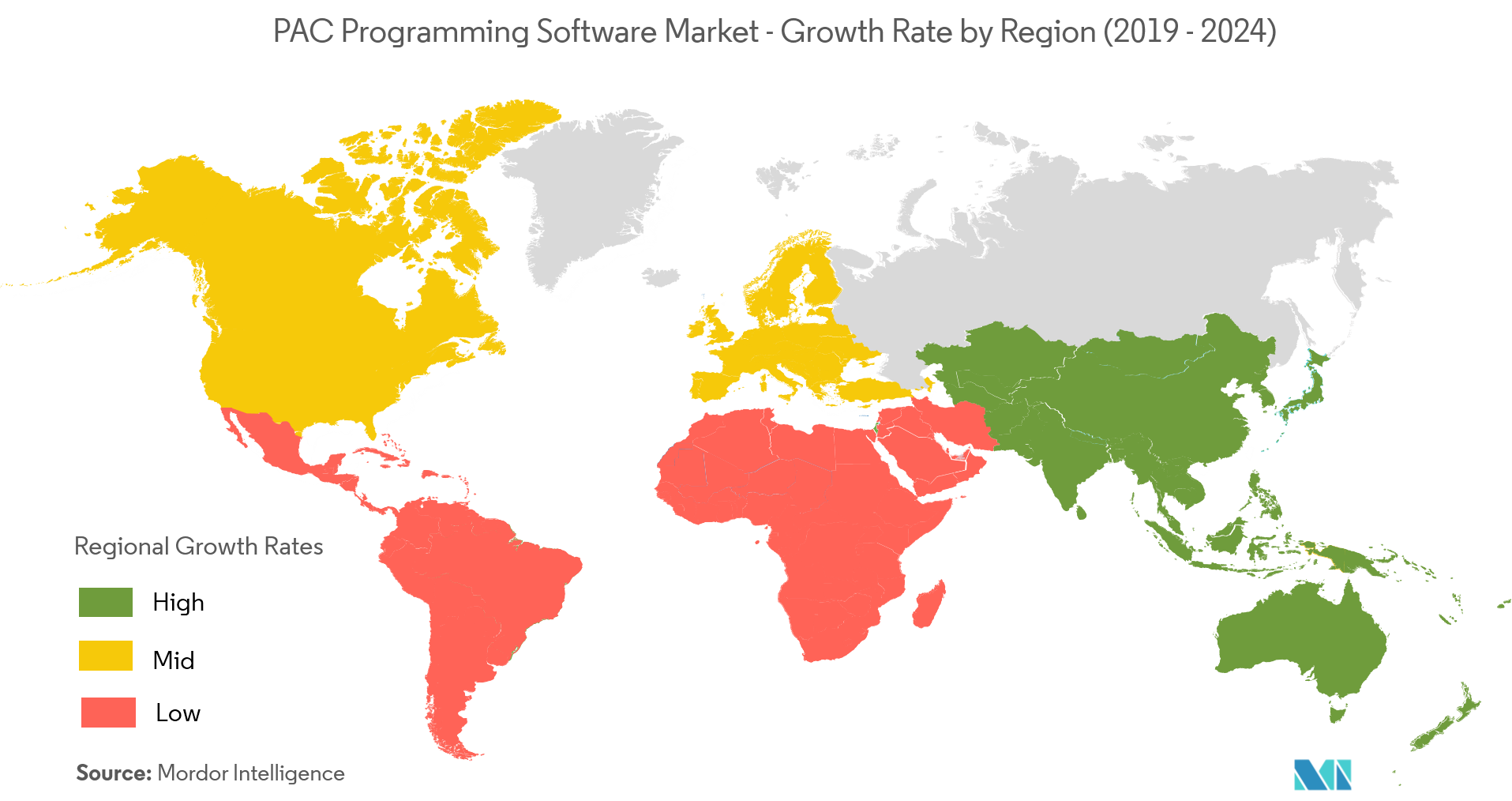

Asia-Pacific to Witness High Growth

- Asia-Pacific region is witnessing high growth, benefiting from recent policy changes, investments in automation, and availability of commodities at lower prices.

- The inception of many power generation projects after the global recession and the initiation of large-scale Greenfield projects in the region have driven the demand for PAC programming software market.

- China is considered as the manufacturing hub of the world, with manufacturing facilities of domestic as well as international players set up in the country. As the labor cost is rising in the country, China is rapidly transforming from a medium to a high-tech manufacturing hub, which is expected to further propel the market growth

- India is launching initiatives like ‘Make in India’ to place the country on the world map as a manufacturing hub and to gain global recognition. The Indian Brand Equity Foundation has reported that India is expected to become the fifth-largest manufacturing country in the world by the end of 2020.

PAC Programming Software Industry Overview

The PAC programming software market is highly competitive with the presence of many big and small players. The market appears to be moderately concentrated and the key strategies adopted by the major players are product innovation and mergers and acquisition. Some of the key players in the market areSchneider Electric,Rockwell Automation,Siemens AG, among others.

- February 2018:Honeywell international collaborated with Equate Petrochemical Company, a global producer of petrochemicals. Both thecompanies signed an MoU, for the development of technologies that will support operations at Equate Petrochemical.

PAC Programming Software Market Leaders

-

Schneider Electric SE

-

Rockwell Automation, Inc.

-

National Instruments Corporation

-

Opto22

-

Eaton Corporation

*Disclaimer: Major Players sorted in no particular order

PAC Programming Software Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Rising Adoption of Automation

-

4.4 Market Restraints

- 4.4.1 High Initial Investment in Automation

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 HMI (Human Machine Interface)

- 5.1.2 Advanced Process Control (APC)

- 5.1.3 Asset Management

- 5.1.4 Database Connectivity

- 5.1.5 Other Types

-

5.2 By Solution Type

- 5.2.1 Open PAC System

- 5.2.2 Compact PAC System

- 5.2.3 Distributed PAC System

-

5.3 By End User

- 5.3.1 Oil and Gas

- 5.3.2 Electric Power

- 5.3.3 Construction

- 5.3.4 Food & Beverages

- 5.3.5 Water and Wastewater

- 5.3.6 Other End Users

-

5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Opto22

- 6.1.2 General Electric

- 6.1.3 National Instruments Corporation

- 6.1.4 Schneider Electric SE

- 6.1.5 Rockwell Automation Inc.

- 6.1.6 Delta Electronics, Inc.

- 6.1.7 Eaton Corporation

- 6.1.8 Texas Instruments Inc.

- 6.1.9 MKS Instruments Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityPAC Programming Software Industry Segmentation

A programmable automation controller (PAC) is a two or more processor-based device like a personal computer and is basically a PC integrated with a PLC with multitasking capabilities to automate control of more than one equipment. Although the PAC includes PLC capabilities, its hardware architecture and software are designed to be more user-friendly to the computer programmer.

| By Type | HMI (Human Machine Interface) |

| Advanced Process Control (APC) | |

| Asset Management | |

| Database Connectivity | |

| Other Types | |

| By Solution Type | Open PAC System |

| Compact PAC System | |

| Distributed PAC System | |

| By End User | Oil and Gas |

| Electric Power | |

| Construction | |

| Food & Beverages | |

| Water and Wastewater | |

| Other End Users | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

PAC Programming Software Market Research FAQs

What is the current Programmable Automation Controller (PAC) Programming Software Market size?

The Programmable Automation Controller (PAC) Programming Software Market is projected to register a CAGR of 15% during the forecast period (2024-2029)

Who are the key players in Programmable Automation Controller (PAC) Programming Software Market?

Schneider Electric SE, Rockwell Automation, Inc., National Instruments Corporation, Opto22 and Eaton Corporation are the major companies operating in the Programmable Automation Controller (PAC) Programming Software Market.

Which is the fastest growing region in Programmable Automation Controller (PAC) Programming Software Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Programmable Automation Controller (PAC) Programming Software Market?

In 2024, the North America accounts for the largest market share in Programmable Automation Controller (PAC) Programming Software Market.

What years does this Programmable Automation Controller (PAC) Programming Software Market cover?

The report covers the Programmable Automation Controller (PAC) Programming Software Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Programmable Automation Controller (PAC) Programming Software Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Programmable Automation Controller Industry Report

Statistics for the 2024 Programmable Automation Controller market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Programmable Automation Controller analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.