Packaged Vegan Foods Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 9.74 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

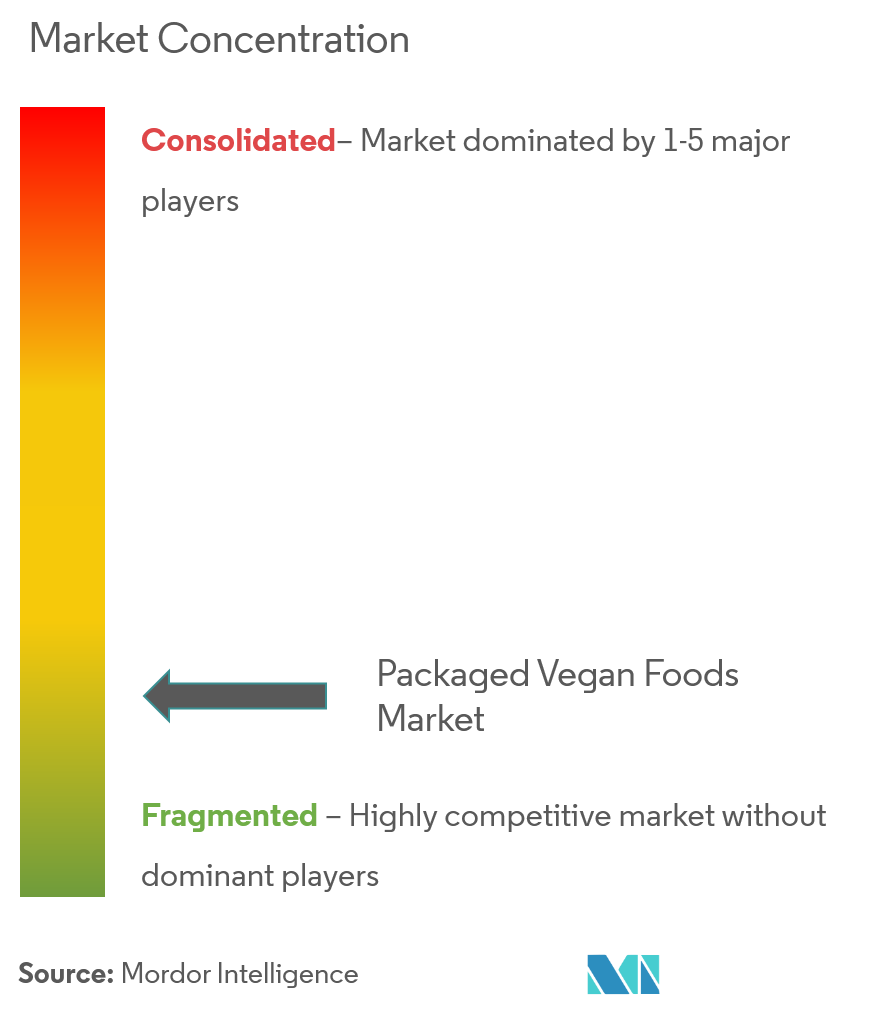

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Packaged Vegan Foods Market Analysis

The global packaged vegan foods market is projected to grow at a CAGR of 9.74% during the forecast period.

- With the introduction of the vegan concept and its continuous rising demand, owing to the associated health benefits,the processed foodmarket is witnessing an instream flow of numerous plant-based products across all the segments.

- Theretained freshness over aprolonged consumption period backed by the nutritional and health benefits makepackaged vegan food, a consumer preference.

- However, the packaged vegan food market faces a major challenge due tothe lack of definitive regulations associated with vegan food labelling.

Packaged Vegan Foods Market Trends

This section covers the major market trends shaping the Packaged Vegan Foods Market according to our research experts:

Plant-based Meat Substitutes are Gaining Significance

The cautiousness regarding the ill-effects of meat-based products on health is leading consumers in making a shift towards a safer diet. Considering the potential of the meat substitute market, tycoons like Kellogg’s, Conagra Brands Inc., and The Campbell Soup Company have invaded the market by acquiring small meat substitute companies. For instance, Campbell Soup Company acquired the Pacific Foods of Oregon LLC for USD 700 million in 2017, with expectations of strengthening Campbell’s health and well-being portfolio in the growing natural and organic category, thus promoting market growth.

North America is the Market Leader for Packaged Vegan Foods

As per World Health Organization, people consuming an average of ¼-pound of red meat per day raise their risk of developing colon cancer by 17% during their lifetime, and unfortunately, this is just one of the ailments associated with consumption of meat. With the help of extensive awareness campaigns and publicity, the North American population has upgraded its knowledge regarding the cons of meat consumption. Also, the working-profile people have no time to spare on instant cooking and simultaneous consumption, be it vegetarian or meat. Packaged vegan foods emerged as a complete remedy. The convenience of easy handling and healthy food simultaneously was well appreciated. U.S. Department of Agriculture's statistics concludes that the U.S. cattle commercial slaughter and inventories in 2015 were 28.7 million head, which is the lowest rate it has been in more than a decade.

Packaged Vegan Foods Industry Overview

Increasing awareness against animal cruelty has led to a rise in the number of people following vegan habits in the North American region. Owing to this, the demand for Vegan products has gone up ranging throughout the application segments. Rivalry among leading market players like Amy's Kitchen Inc., Beyond Meat, Tofutti Brands, Annie's Homegrown, Inc. and Danone S.A. to capture the market is continuous and therefore, they are focusing on gaining significant market shares in specific realms of the packaged vegan foods market.

Packaged Vegan Foods Market Leaders

-

Amy's Kitchen, Inc.

-

Tofutti Brands, Inc.

-

Annie's Homegrown, Inc.

-

Beyond Meat

-

Danone S.A.

*Disclaimer: Major Players sorted in no particular order

Packaged Vegan Foods Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Dairy alternatives

- 5.1.2 Meat alternatives & packaged vegan meals

- 5.1.3 Vegan bakery & confectionery products

- 5.1.4 Others

-

5.2 By Distribution Channel

- 5.2.1 Supermarket/ Hypermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Online Stores

- 5.2.4 Others

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Amy's Kitchen, Inc.

- 6.4.2 Beyond Meat

- 6.4.3 Tofutti Brands, Inc.

- 6.4.4 Annie's Homegrown, Inc.

- 6.4.5 Danone S.A.

- 6.4.6 Barbara's

- 6.4.7 Follow Your Heart

- 6.4.8 Louisville Vegan Jerky Co.

- 6.4.9 Edward & Sons Trading Co.

- 6.4.10 Dr. McDougall's Right Foods

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityPackaged Vegan Foods Industry Segmentation

The global packaged vegan foods market is segregated by product type into dairy alternatives,meat alternatives & packaged vegan meals, vegan bakery & confectionery products, and others.Based on theDistribution Channel, the market is segmented bysupermarket/ hypermarkets, convenience stores, online stores, and others. Also, the market hasbeen diversely classified bygeography.

| By Product Type | Dairy alternatives | |

| Meat alternatives & packaged vegan meals | ||

| Vegan bakery & confectionery products | ||

| Others | ||

| By Distribution Channel | Supermarket/ Hypermarkets | |

| Convenience Stores | ||

| Online Stores | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Spain |

| United Kingdom | ||

| Germany | ||

| France | ||

| Italy | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East and Africa | South Africa |

| Saudi Arabia | ||

| Rest of Middle East and Africa |

Packaged Vegan Foods Market Research FAQs

What is the current Packed Vegan Foods Market size?

The Packed Vegan Foods Market is projected to register a CAGR of 9.74% during the forecast period (2024-2029)

Who are the key players in Packed Vegan Foods Market?

Amy's Kitchen, Inc., Tofutti Brands, Inc., Annie's Homegrown, Inc., Beyond Meat and Danone S.A. are the major companies operating in the Packed Vegan Foods Market.

Which is the fastest growing region in Packed Vegan Foods Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Packed Vegan Foods Market?

In 2024, the North America accounts for the largest market share in Packed Vegan Foods Market.

What years does this Packed Vegan Foods Market cover?

The report covers the Packed Vegan Foods Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Packed Vegan Foods Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Packaged Vegan Foods Industry Report

Statistics for the 2024 Packaged Vegan Foods market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Packaged Vegan Foods analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.