Market Trends of Packaging Industry in Saudi Arabia

This section covers the major market trends shaping the Saudi Arabia Packaging Market according to our research experts:

Rigid Packaging Materials, like Paper and Paperboard, are Expected to Hold a Significant Market Share

- With the introduction of government initiatives in Saudi Arabia proposing a plan to limit the usage of plastic, paper and paperboard are considered as the best alternatives due to its recyclable properties. The harm that these materials cause the environment is less, as compared to the plastic packaging, and it have been established and backed by multiple research reports.

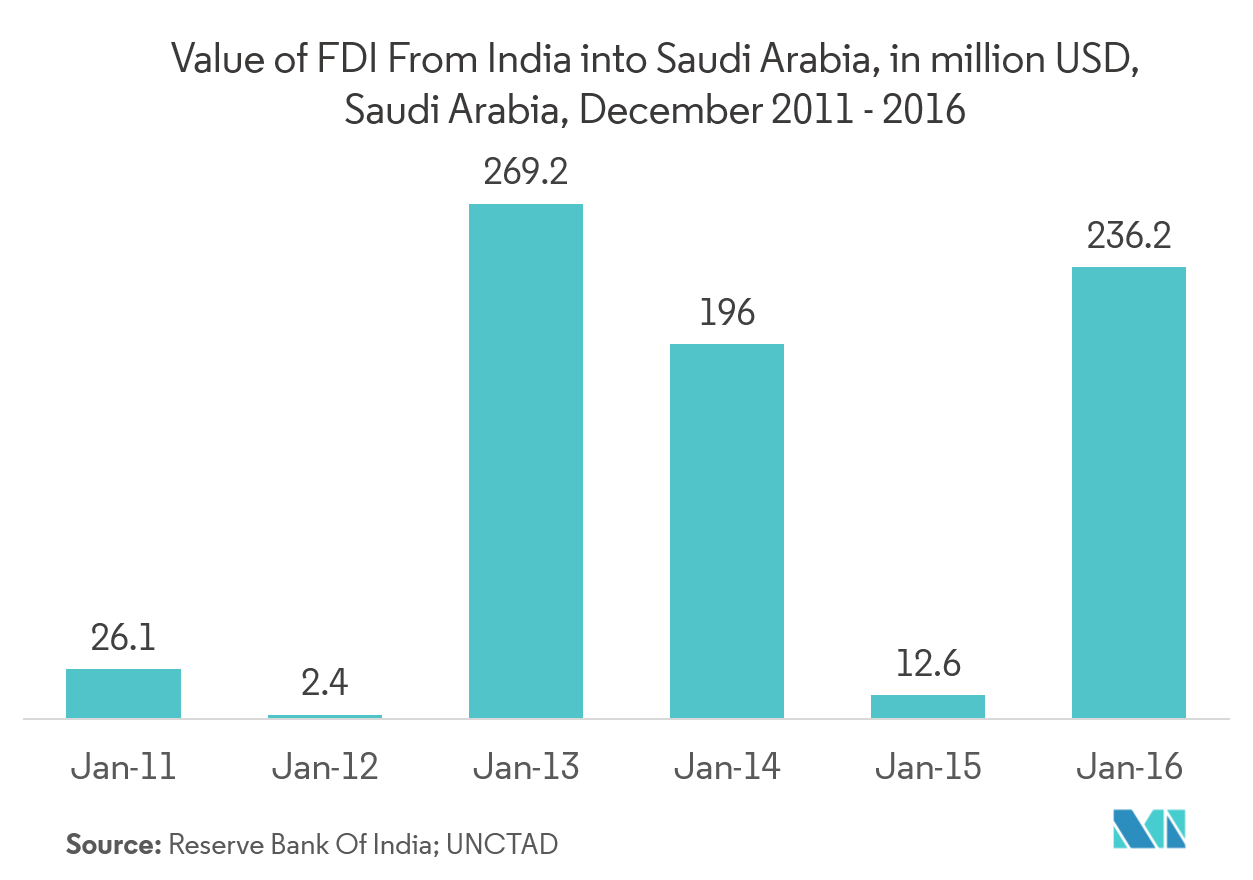

- Economy diversification policies have also expedited the foreign investment. One window solution for business setup has also been a positive impact on the market. Furthermore, with the already existing food and beverage products using paper and paperboard for different levels of packaging, it has become easier to gain acceptance from the current set of consumers. Thus, the paper and paperboard packaging is expected to replace plastic packaging in the future.

- Plastic packaging solutions are currently being used across various industries, such as manufacturing, retail, and healthcare. It has gained a significant traction in the healthcare industry due to its high barrier properties, long shelf-life, and durability. The demand for plastic packaging solutions is expected to grow during the forecast period.

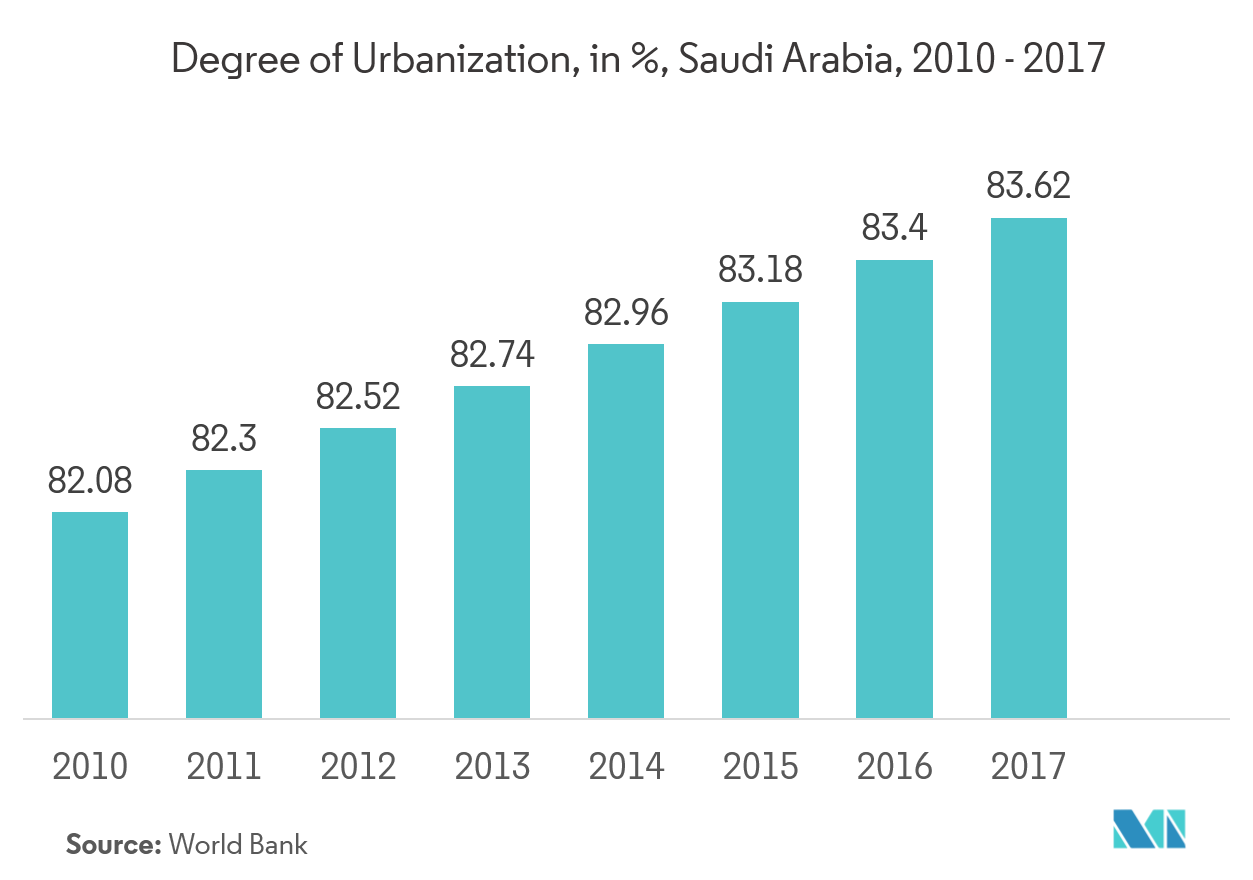

Rapid Urbanization and Augmenting Policies Prompt the Retailers to Experience a Significant Market Growth

- To reduce the dependence on the revenues from the oil and gas sector, the government is focusing on developments of other industries. Thus, this will help cater to development and generate a substantial amount of revenues from other sectors, in order to safeguard themselves from the risk that pertains due to the non-renewable nature of fossil fuels.

- The Government of Saudi Arabia aimed toward having a more inclusive role for the Saudi nationals through Saudization reforms. In favor of this initiative, the Saudi Arabian government announced that it would nationalize 12 economic activities, including retailing. Over 40 retail professions (including apparel and footwear specialist retailers, homewares and home furnishing stores, electronics and appliance specialist retailers, and jewelry and watch specialist retailers) were restricted to Saudi nationals for employment. These restrictions were effective in three phases, i.e., from September 2018 to January 2019.

- The immediate effect of economic restructuring would have resulted in an economic slowdown. Therefore, the recent initiatives are being taken by the government as a part of Saudi Vision 2030, which offers a higher long-term outlook. With FDIs increasing in Saudi Arabia, the retail sector is expected to register a substantial growth in the market.