Palm Vein Biometrics Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 22.30 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Palm Vein Biometrics Market Analysis

The Palm Vein Biometrics Market valued USD 0.58 billion in 2020 is expected to reach USD 1.86 billion by 2026 at a CAGR of over 22.3% during the forecast period (2021 - 2026). As palm vein biometrics relies on scanning the vein pattern under the skin, it is considered to be a reliable and extremely secure biometric modality. Unlike fingerprint biometric technology which depends on the integrity of the skin on the fingertip for precise identification and can be negatively impacted by cuts, bruises, and dirt, the integrity of the skin is not a problem with palm vein biometrics.

- Over the years, the requirement to control access to premises, and systems has grown. Currently, many organizations rely on passwords, or cards to confirm people's identity for access. However, this traditional approach poses severe challenges. For instance, loss, or theft of cards causes security risks. With the correct combination of PIN and card, anyone could be granted access to restricted areas or data. Thus, increasing application of biometrics for security purpose is expected to positively impact the market growth.

- For instance, Bharat Petroleum Corporation Limited in India is using palm vein recognition technology to keep track of employees and provide authorized access to them. Companies such as Fujitsu, in 2018, announced that it will deploy its palm vein authentication technology to its employees in Japan. The palm vein authentication will replace password-based measures, and allow the employees to gain access to buildings and log in to their desktops with only their hand.

- With multiple options available for biometric identification, companies could choose to adopt multifactor authentication to reduce the probability of fraud even further. Such trends are also expected to influence market growth. For instance, Fujitsu has plans to combine its palm vein scanning technology with facial recognition in a new authentication concept for access control.

Palm Vein Biometrics Market Trends

This section covers the major market trends shaping the Palm Vein Biometrics Market according to our research experts:

BFSI Expected to Hold the Largest Market Share

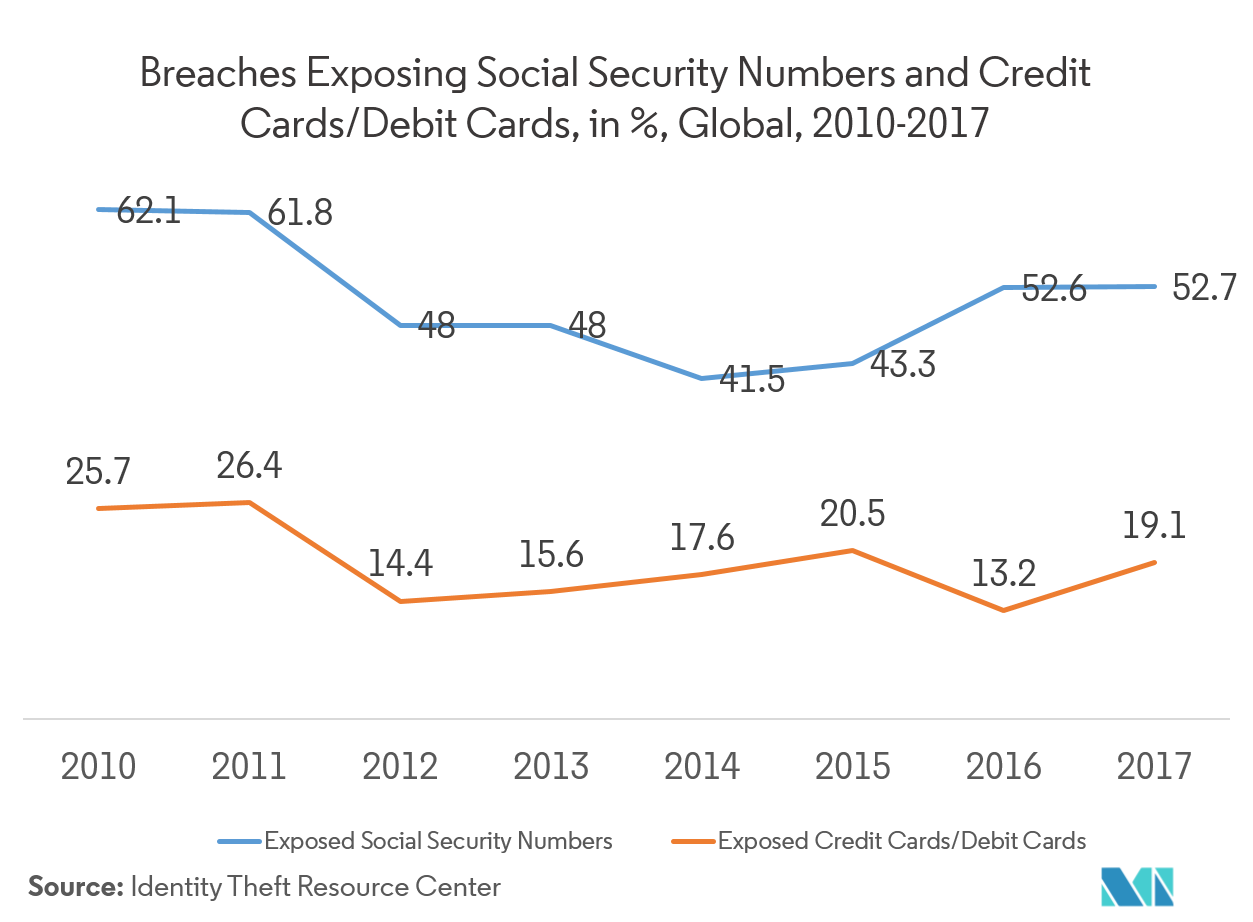

- With the increasing level of security breaches, need for highly secure verification and identification systems have increased in the BFSI sector. Various banks and financial institutions integrated biometrics technologies such as palm vein recognition technology with access control systems to provide customers with secure access. For instance, Bank of Tokyo-Mitsubishi, a commercial bank in Japan, implemented a palm vein biometric system to provide a secure and cost-effective solution to its customers.

- Apart from physical access control, palm vein biometrics is expected to gain traction for contactless payment authentication. For instance, in 2018, Japan’s AEON Credit Service and Fujitsu will begin a trial of a cardless retail payment system using biometric palm vein authentication technology at some convenience stores.

- Many BFSI organizations are adopting palm vein biometrics, which is fueling the market’s growth. For instance, Gesa Credit Union, a financial services institution is leveraging palm recognition technology in association with financial technology company Fiserv. Fiserv is a financial services technology solutions provider, that offers a DNA account processing platform and integrated services, including Verifast: Palm Authentication for biometric authentication.

- Many startups are also investing in product innovations. For instance, in June 2019, Redrock Biometrics, a vendor of palm-based biometrics for authentication and identification, announced the launch of its identification solution, PalmID-X at the exclusive invitation-only Finovate Spring 2019.

North America Expected to Hold Significant Market Share

- According to the Federal Trade Commission, identity thefts related to payment and banking sector are prominent in North America, which in turn, is set to boost the adoption of advanced authentication services such as biometrics. According to the Federal Trade Commission, in 2018, California experienced the maximum number of identity theft complaints. Around 73,668 cases of identity thefts were reported.

- The region is also witnessing a growing interest among organizations in adopting systems that use biometric characteristics to identify people. For instance, a New Jersey-based healthcare company, Atlantic Health System uses Patient Secure’s biometric palm vein scanning solution to speed up the patient intake and improve record accuracy. This technology helps in preventing individuals from using someone else's medical data to receive treatment.

- Many BFSI organizations are adopting palm vein biometrics, which is fueling the market’s growth in the region. For instance, Gesa Credit Union, a financial services institution, headquartered in the United States, is leveraging palm recognition technology in association with financial technology company Fiserv. Fiserv is a financial services technology solutions provider, that offers a DNA account processing platform and integrated services, including Verifast: Palm Authentication for biometric authentication.

- Many startups are also investing in product innovations in the region. For instance, in June 2019, Redrock Biometrics (San Francisco), a vendor of palm-based biometrics for authentication and identification, announced the launch of their identification solution, PalmID-X at the exclusive invitation-only Finovate Spring 2019. The solution expands the application of biometric identification to a large group of people, creating a basis for seamless services and transactions without the physical tokens. Using a standard RGB camera and infrared camera, PalmID-X captures palm prints or subdermal veins to produce a highly unique palm signature.

Palm Vein Biometrics Industry Overview

The palm vein biometrics market is competitive and consists of several major players. Many companies are increasing their market presence by introducing new products, by expanding their operations or by entering into strategic mergers and acquisitions.

- November 2019 - Fujitsu launched sales of the FUJITSU Security Solution AuthConductor V2 which uses various authentication methods, including palm vein authentication, to deliver comprehensive biometric authentication support for customers. In addition to providing a unified palm vein authentication office environment, this product features facial authentication, fingerprint authentication and IC card authentication for PC logons, and is fully scalable to support use by anywhere from several people to organizations with tens of thousands of users. With the launch of this upgraded solution, Fujitsu enables customers to enjoy convenience with secure and flexible solutions for a diverse range of use cases and authentication scenarios.

- June 2019 - Redrock Biometrics launched its identification solution, PalmID-X. It expands the applicability of biometric identification to multiple people, creating a basis for seamless services and transactions without physical tokens. It captures palm prints and/or subdermal veins to create a unique palm signatures.

Palm Vein Biometrics Market Leaders

-

Fujitsu Limited

-

BioEnable Technologies Pvt Ltd

-

M2SYS Technology - KernellÓ Inc.

-

Mantra Softech Pvt Ltd

-

BioSec Group Ltd

*Disclaimer: Major Players sorted in no particular order

Palm Vein Biometrics Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increasing Data Privacy Protection Concerns

- 4.2.2 Increasing Need to Secure Financial Transactions

-

4.3 Market Restraints

- 4.3.1 Technical Limitations of Palm Vein Biometrics

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porters Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

- 4.7 Impact of Covid-19 on the Market

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Hardware

- 5.1.2 Software and Solution

-

5.2 Application

- 5.2.1 Healthcare

- 5.2.2 BFSI

- 5.2.3 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 M2SYS Technology - KernellO Inc.

- 6.1.2 BioSec Group Ltd

- 6.1.3 BioEnable Technologies Pvt. Ltd

- 6.1.4 Fujitsu Limited

- 6.1.5 Mantra Softech (India) Private Limited

- 6.1.6 IdentyTech Solutions America Inc.

- 6.1.7 Matrix Comsec Pvt. Ltd

- 6.1.8 Imprivata Inc.

- 6.1.9 Hitachi Ltd

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityPalm Vein Biometrics Industry Segmentation

Palm vein patterns are unique for an individual. Palm vein biometric technology captures an image of the vein pattern beneath the skin and uses that image as the basis for identifying an individual. Palm vein biometric uses near-infrared light to capture a palm vein pattern, thus, it does not require high-quality skin integrity for precise identification. The market includes both hardware and software and solutions provided by companies. Companies such as M2SYS Technology offer scanners for palm vein biometrics whereas companies such as Fujitsu offers palm vein authentication technology.

| Type | Hardware |

| Software and Solution | |

| Application | Healthcare |

| BFSI | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Palm Vein Biometrics Market Research FAQs

What is the current Palm Vein Biometrics Market size?

The Palm Vein Biometrics Market is projected to register a CAGR of 22.30% during the forecast period (2024-2029)

Who are the key players in Palm Vein Biometrics Market?

Fujitsu Limited, BioEnable Technologies Pvt Ltd, M2SYS Technology - KernellÓ Inc., Mantra Softech Pvt Ltd and BioSec Group Ltd are the major companies operating in the Palm Vein Biometrics Market.

Which is the fastest growing region in Palm Vein Biometrics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Palm Vein Biometrics Market?

In 2024, the North America accounts for the largest market share in Palm Vein Biometrics Market.

What years does this Palm Vein Biometrics Market cover?

The report covers the Palm Vein Biometrics Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Palm Vein Biometrics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Palm Vein Biometrics Industry Report

Statistics for the 2024 Palm Vein Biometrics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Palm Vein Biometrics analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.