Patient Engagement Solution Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 24.00 Billion |

| Market Size (2029) | USD 46.96 Billion |

| CAGR (2024 - 2029) | 14.38 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Patient Engagement Solution Market Analysis

The Global Patient Engagement Solution Market size is estimated at USD 24 billion in 2024, and is expected to reach USD 46.96 billion by 2029, growing at a CAGR of 14.38% during the forecast period (2024-2029).

During COVID, digital solutions in healthcare have played a major role as the countries went into lockdown with strict measures that led to a decline in many other healthcare services but telehealthcare emerged as one of the foremost tools during this pandemic which facilitates many healthcare services during the lockdown and is still growing. Also, many countries are incorporating digital health services into conventional healthcare systems owing to COVID-19 which is expected to have an impact on the studied market. For instance, according to the article "The European Digital Health Revolution in the wake of COVID-19," published in April 2021, the European Commission proposed the EU4Health program as part of a COVID-19 recovery response program. The initiative aims to raise EUR 5.1 billion for the digital transformation of the European health sector and ensure preparedness for future cross-border health threats. Thus, increasing investments by European governments toward the digital transformation of healthcare will drive market growth over the study period. According to the report "Digital Health and the Global Pandemic" published in 2020, in France, during the pre-coronavirus times, the national insurance fund recorded and reimbursed about 40,000 teleconsultations per month, which increased to more than 10 times in one week during the pandemic. Thus, the high surge in reimbursements for teleconsultations indicates the surge in teleconsultations during the pandemic, thus positively impacting the market in the region. Hence, supporting government initiatives, increasing product launches, and raising awareness about the use of digital solutions in healthcare during COVID has majorly impacted the market.

The rising trend of using mobile applications has boosted the growth of this market. Moreover, the increased prevalence of chronic diseases and efforts by the government to create awareness about the engagement solutions have further helped this market to grow in the forest period. Due to these factors, the market has been attracting investors, which is further helping this market to grow. Initiatives by the government are one of the key factors for the growth of the market. For instance, in March 2020, France's new healthcare act 2019, which is based on the government's plan 'My Health 2022' includes electronic health records (EHR) to be rolled out nationwide and will become essential to several e-Health platforms, artificial intelligence (AI) is a priority domain and telemedicine which will include the full coverage by the public health system. For instance, Dossier Medical Partagé (DMP) will become an integral part of the 'Espace Numerique de Santé,' a digital health platform for patients planned for 2022. The DMP will be further developed with patient summaries and vaccination information. Due to this integration, the ease of access to the information will prevent delays during the consultation as all the data will be available.

Patient engagement solutions are a novel field in healthcare. Thus, there is a lack of awareness of solutions among the people and IT professionals in this industry, which is a major restraint of the market. Moreover, security concerns are also hampering the growth of the market. These factors are hence restraining this market's growth.

Patient Engagement Solution Market Trends

This section covers the major market trends shaping the Patient Engagement Solution Market according to our research experts:

Web-based and Cloud-based Services Segment is Expected to Witness Growth Over the Forecast Period

Web-based and Cloud-based services refer to web-based software that stores data via web-based servers, allowing providers to quickly access their data from virtually anywhere with an internet connection. The factors such as increasing initiatives taken by the government for the adoption of services, coupled with advancements in technology and developments in healthcare organizations, are driving the growth of the market.

The government in various countries is taking initiatives to support the growth of information technology in healthcare. For instance, in February 2021, as a part of the United Kingdom government launched an initiative to adopt a fully connected cloud-driven health service, over two million National Health Services (NHS) mail mailboxes were moved to Exchange Online, which is a part of Microsoft's Azure Cloud. This will enable smoother and more efficient communication between staff across NHS organizations and departments and provide improved access to information. This will increase the usage of (Health Information technology) HCIT Change Management services in the United Kingdom and boosts the growth of the market. Such initiatives would increase the overall adoption of web-based services, which will increase market growth.

Additionally, the joint initiatives taken by the government bodies and market players in the region are also driving the growth of the market. For instance, in September 2021, Deutsche Telekom's T-Systems partnered with Google Cloud to build and deliver sovereign cloud services to German enterprises, healthcare firms, and the public. The companies will jointly innovate to develop a large spectrum of next-generation sovereign cloud solutions and infrastructure. The company is considering building a similar sovereign cloud for Austria and Switzerland. This would help in the expansion of services into new geographies, which would increase market growth in the coming future.

Moreover, several companies are offering web-based solutions. For instance, in January 2021, WRS Health expanded its footprint with the availability of Neurology-Cloud. Derived from WRS Health's 20 years of experience, Neurology-Cloud is an electronic health record (EHR) that meets the needs of medical practices specializing in Neurology.

Thus, owing to the above-mentioned factors, the market segment is expected to project growth over the forecast period.

North America is Expected to Dominate the Market Over the Forecast Period

The North American market is rapidly growing due to the supporting initiatives taken by public and private organizations. For instance, according to the Congressional Research Service report published in July 2021, the United States had an estimated population of 326 million individuals in 2020. Most of those individuals had private health insurance or received health care services under a federal program (such as Medicare or Medicaid). About 8.6% of the United States population was uninsured. Individuals (including those who were uninsured), health insurers, and federal and state governments spent approximately USD 3.9 trillion on various types of health consumption expenditures (HCE) in 2020, which accounted for 18.8% of the nation's gross domestic product.

While considering hospitals as a major component of the health industry, their development is done with the help of novel technologies and services, such as patient engagement solutions, which help in the management of operations related to patient health in these developed countries. Various initiatives by key market players are another factor for the growth of the market. For instance, in June 2020, IBM and Wipro collaborated to assist Wipro customers in embarking on a seamless and secure hybrid cloud journey. Through this alliance, Wipro will develop hybrid cloud offerings to help businesses migrate, manage, and transform mission-critical workloads and applications, with security across public or private cloud and on-premises IT environments. Similarly, in February 2021, Humana (US) collaborated with IBM (US) to deploy IBM Watson Assistant for Health Benefits; it is an AI-enabled virtual agent built in the IBM Watson Health Cloud. This agent helps provide a better member experience while providing greater clarity and transparency on benefits and other related matters for Humana Employer Group members. Such initiatives would increase the market during the forecast period.

Due to the higher adaptability of innovative technologies and raising awareness among the general population about health, this region is expected to dominate the patient engagement solutions market.

Patient Engagement Solution Industry Overview

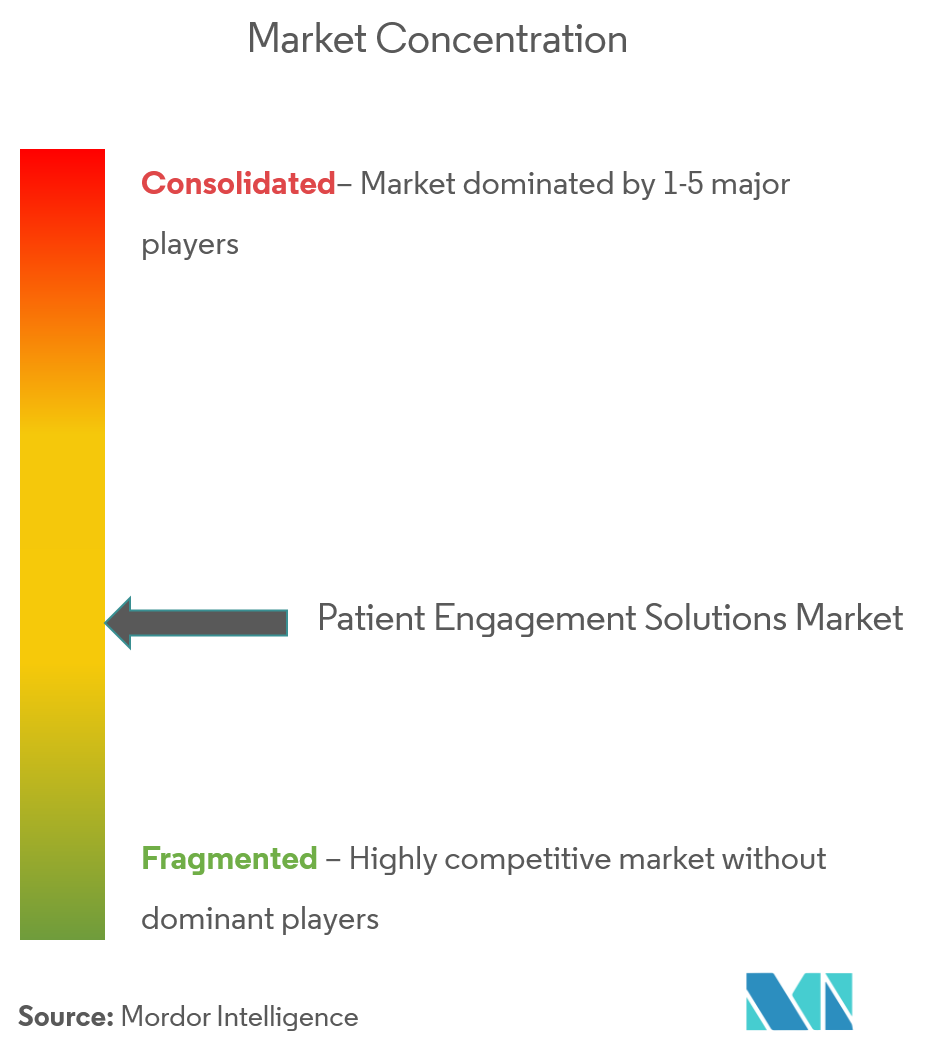

As this is a relatively new market, this market is experiencing some new players. Most players are based in developing counties due to more technological advancements. However, due to the ease of connectivity in modern times, these players have also penetrated developing countries and are trying to establish a market in these countries. Some new players are emerging from developing counties as well. Moreover, many new startups, including My Haven Health, Ask Rose, and Advancing Synergy, have been emerging to compete with the established companies in the sector. The key market players are Allscripts Healthcare Solutions, Inc., Athenahealth Inc., Cerner Corporation, GetWellNetwork Inc., IBM, Lincor Solutions, Mckesson Corporation, Medecision Inc., MEDHOST, Orion Health Ltd, Welvu, and Yourcareuniverse Inc.

Patient Engagement Solution Market Leaders

-

Allscripts Healthcare Solutions Inc

-

Athenahealth Inc

-

Cerner Corporation

-

Mckesson Corporation

-

IBM

*Disclaimer: Major Players sorted in no particular order

Patient Engagement Solution Market News

- In March 2022, DeliverHealth launched its partner program. DeliverHealth program supports strategic partners within the eco-system, growing sales domestically and internationally while enabling healthcare organizations to simplify the daily complexities of healthcare, improve patient outcomes and reduce overall costs.

- In March 2022, the EHR vendor Epic launched its first-ever customer relationship management technology for health systems called Cheers. The EHR vendor developed Cheers after several Epic customers requested capabilities to better connect with patients, especially as COVID-19 strained health systems.

Patient Engagement Solution Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Rising Trend of Mobile Health Applications

- 4.2.2 Growing Popularity of Patient Engagement Solutions Among the Aging Population

- 4.2.3 Rising Investments and Technological advancements

-

4.3 Market Restraints

- 4.3.1 Protection of Patient Information

- 4.3.2 Lack of Skilled IT Professionals in the Healthcare Industry

-

4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION (Market Size by Value - USD million)

-

5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Service

-

5.2 By Delivery Mode

- 5.2.1 Web-based and Cloud-based

- 5.2.2 On-Premise

-

5.3 By Application

- 5.3.1 Social Management

- 5.3.2 Fitness and Health Management

- 5.3.3 Home Healthcare Management

- 5.3.4 Financial Management

-

5.4 By End User

- 5.4.1 Provider

- 5.4.2 Payer

- 5.4.3 Patient

- 5.4.4 Other End Users

-

5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle-East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Allscripts Healthcare Solutions Inc.

- 6.1.2 Athenahealth Inc.

- 6.1.3 Cerner Corporation

- 6.1.4 GetWellNetwork Inc.

- 6.1.5 IBM

- 6.1.6 Lincor Solutions

- 6.1.7 Mckesson Corporation

- 6.1.8 Medecision Inc.

- 6.1.9 MEDHOST

- 6.1.10 Orion Health Ltd

- 6.1.11 Welvu

- 6.1.12 Yourcareuniverse Inc.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityPatient Engagement Solution Industry Segmentation

Patient engagement is a broad term that encompasses patient activation along with interventions designed for promoting positive patient behavior. Patient engagement has a two-fold benefit for the healthcare industry. It results in a proactive patient who is more compliant with the ongoing treatment and preventive measures being undertaken. The Patient Engagement Solution Market is segmented by Component (Hardware, Software, and Service), Delivery Mode (Web-based and Cloud-based, and On-Premise), Application (Social Management, Fitness and Health Management, Home Healthcare Management, and Financial Management), End User (Provider Payer, Patient, and Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East, and Africa, and South America). The market report also covers the estimated market sizes and trends for 17 countries across major global regions. The report offers the value (USD million) for the above-mentioned segments.

| By Component | Hardware | |

| Software | ||

| Service | ||

| By Delivery Mode | Web-based and Cloud-based | |

| On-Premise | ||

| By Application | Social Management | |

| Fitness and Health Management | ||

| Home Healthcare Management | ||

| Financial Management | ||

| By End User | Provider | |

| Payer | ||

| Patient | ||

| Other End Users | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Middle-East and Africa | GCC |

| South Africa | ||

| Rest of Middle-East and Africa | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America |

Patient Engagement Solution Market Research FAQs

How big is the Global Patient Engagement Solution Market?

The Global Patient Engagement Solution Market size is expected to reach USD 24.00 billion in 2024 and grow at a CAGR of 14.38% to reach USD 46.96 billion by 2029.

What is the current Global Patient Engagement Solution Market size?

In 2024, the Global Patient Engagement Solution Market size is expected to reach USD 24.00 billion.

Who are the key players in Global Patient Engagement Solution Market?

Allscripts Healthcare Solutions Inc, Athenahealth Inc, Cerner Corporation, Mckesson Corporation and IBM are the major companies operating in the Global Patient Engagement Solution Market.

Which is the fastest growing region in Global Patient Engagement Solution Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Global Patient Engagement Solution Market?

In 2024, the North America accounts for the largest market share in Global Patient Engagement Solution Market.

What years does this Global Patient Engagement Solution Market cover, and what was the market size in 2023?

In 2023, the Global Patient Engagement Solution Market size was estimated at USD 20.98 billion. The report covers the Global Patient Engagement Solution Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Global Patient Engagement Solution Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Patient Engagement Solution Industry Report

Statistics for the 2024 Patient Engagement Solution market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Patient Engagement Solution analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.