People Counting System Market Size

| Study Period | 2019 - 2029 |

| Market Size (2024) | USD 1.28 Billion |

| Market Size (2029) | USD 2.35 Billion |

| CAGR (2024 - 2029) | 13.04 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

People Counting System Market Analysis

The People Counting System Market size is estimated at USD 1.28 billion in 2024, and is expected to reach USD 2.35 billion by 2029, growing at a CAGR of 13.04% during the forecast period (2024-2029).

With the integration of IoT and cloud services for stimulating the building security is likely to augment the demand for people counting systems. The deployment of such devices has increased in recent years due to the government rules and mandates owing to the increase in acts of terrorism and violence in malls, events, and clubs.

- This system has gained market traction in almost all sectors; however, retail and commercial spaces tend to dominate the market. The rising number of supermarkets, shopping malls, and retail stores are boosting the adoption of people counting technologies worldwide.

- In retail stores, these systems are deployed to calculate the conversion rates, staff planning, and hence enhance marketing effectiveness. It is also used for crowd management in crowded places such as shopping malls and concerts, where other than crowd management it is also used for monitoring high-traffic areas.

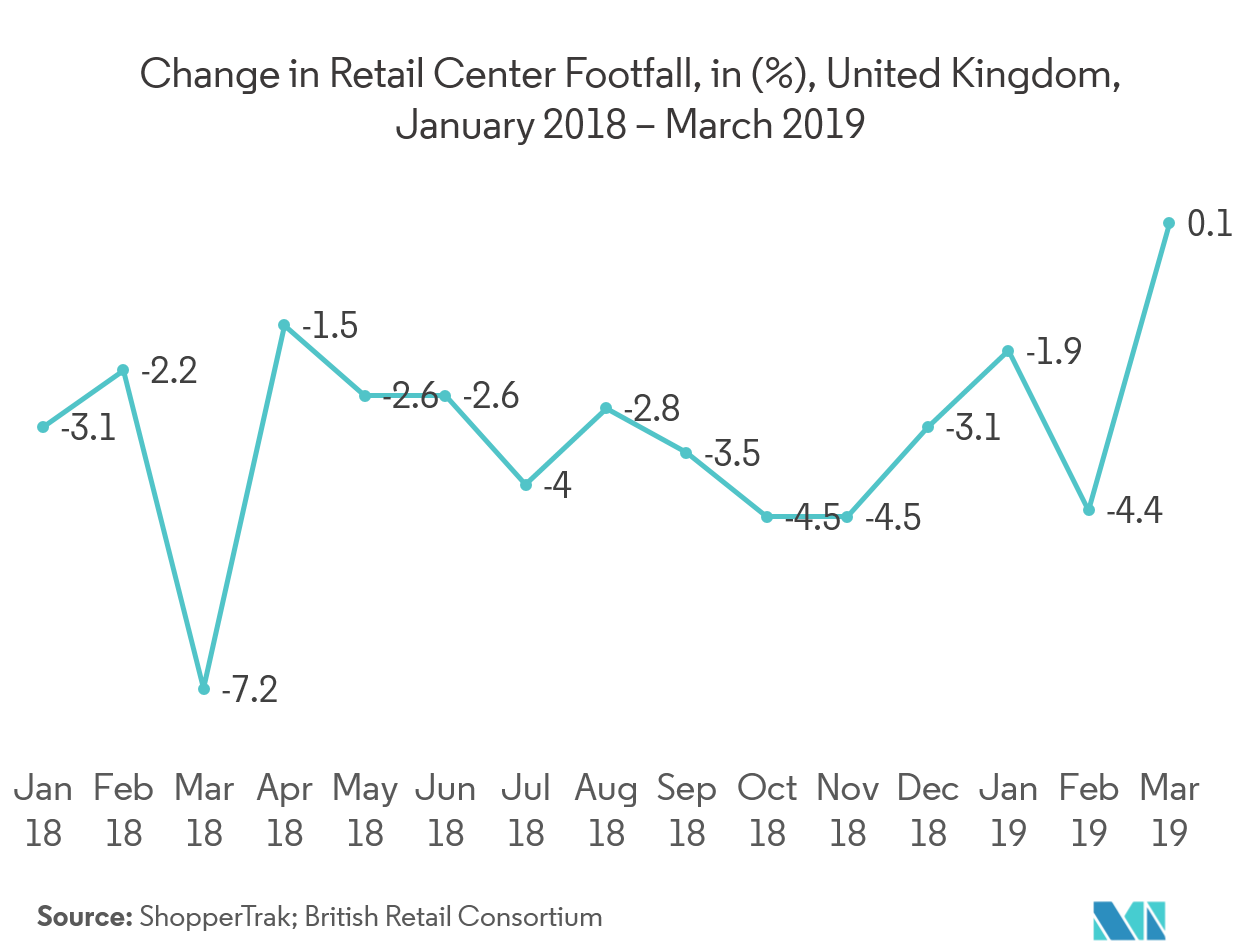

- On the other hand, the massive growth in the e-commerce industry and the expanding online sales channel pose a significant threat to the brick and mortar stores, which in turn is adversely affecting the growth of the market.

People Counting System Market Trends

This section covers the major market trends shaping the People Counting System Market according to our research experts:

Retail Sector to Dominate the Market

- As the retail sector is booming with the advent of advanced technologies, the retail stores are leveraging technological solutions to optimize operations, improve customer satisfaction, and boost profitability, hence driving the need for people counting systems.

- People counting devices helps retailers record the number of footfalls, conversion rates, lost sales opportunities. The managers can then compare these numbers and hence determine the pattern in consumer behavior. These features help them devise a new marketing campaign or plan a new product launch effectively.

- These devices also help the store managers to improve in-store operations like staffing, customer service, and product restocking. Apart from calculating footfall, the store managers are also able to manage the crowd effectively. These factors are the major factors expected to stimulate market growth in the retail sector in the forecast period.

- However, the massive growth in the e-commerce sector and the rise of various online shopping websites is expected to hinder the market growth as it is expected to slow down the adoption of the people counting devices.

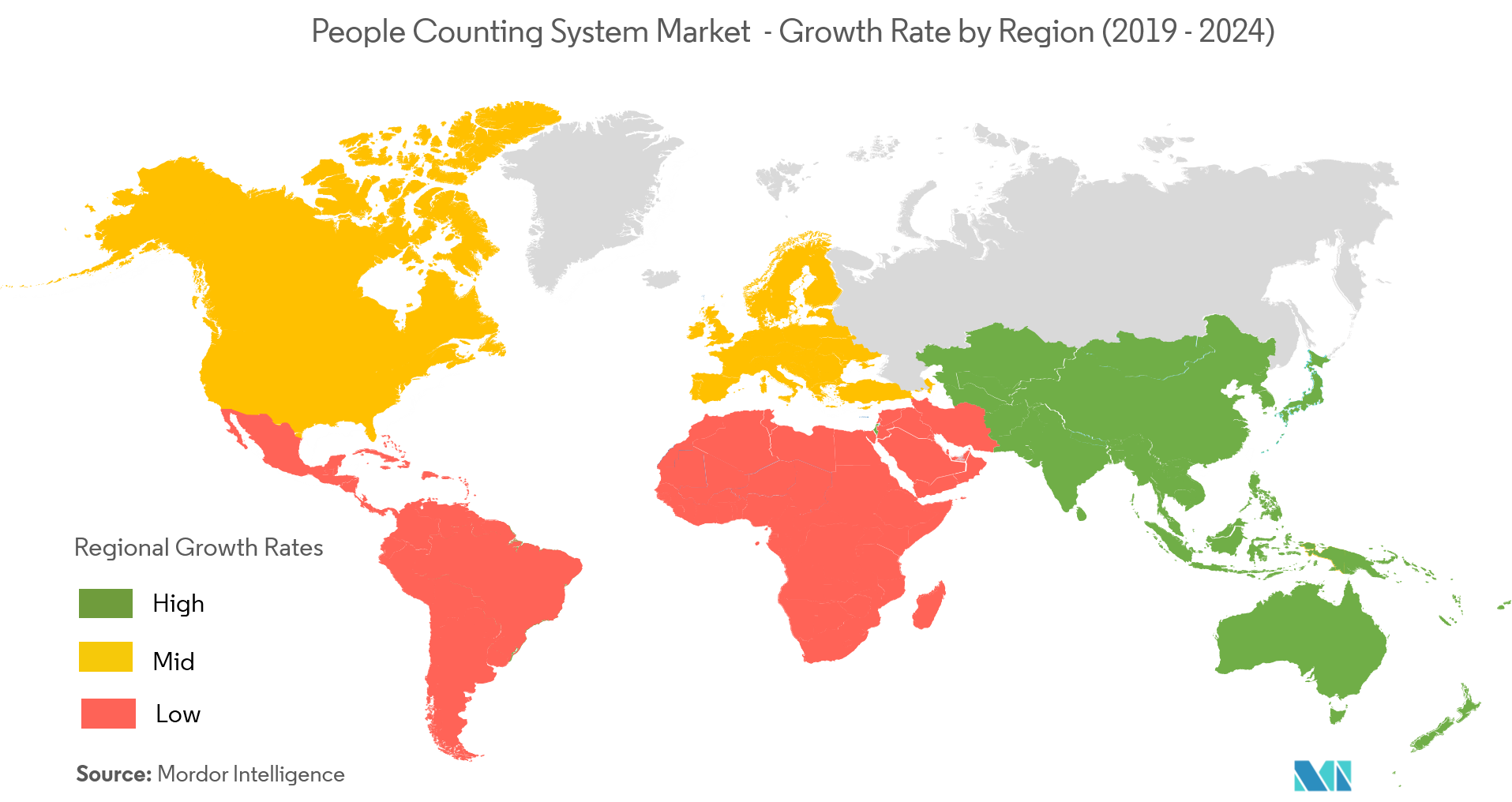

Asia-Pacific Expected to Grow Significantly

- The Asia-Pacific region is expected to register the highest growth rate in terms of adoption of the people counting systems primarily due to the increasing number of retail stores, supermarkets, shopping malls, etc. Furthermore, government initiatives in favor of foreign retailers in India are also leading to the rising number of retail stores in the Asia-Pacific.

- Moreover, the presence of infrastructures such as bus stations, airports, and train stations, coupled with many upcoming projects, are triggering the deployment of people counting systems. Also, the expansion of the hospitality industry is facilitating the growth of the market in the region.

- Increasing urbanization, growing middle-class population, and changes in the spending habits of consumers have propelled the growth of the retail sector in APAC. This has led many players in the people counting system market to invest in this region as the retail sector is one of the major end-users of people counting systems.

People Counting System Industry Overview

The people counting system market is moderately consolidated due to the presence of a limited number of players concentrated in a few countries. These players have adopted various growth strategies such as mergers & acquisitions, new product launches, expansions, joint ventures, and partnerships, to strengthen their market share. Product innovation and technological advancements are most to stay relevant in the market. The market players are focusing on portfolio diversification through partnerships and mergers to strengthen their position in the market.

- June 2019 - FLIR Systems, Inc. recently announced the FLIR TrafiData intelligent thermal traffic sensor solution for improved data collection capabilities to offer transportation management with critical insights for smarter, safer cities.

- April 2019 - Axis Communications is launching an affordable mini dome with full HD and built-in IR for both indoor and outdoor use. AXIS Companion Dome mini LE is the latest member of AXIS Companion, which is a complete end-to-end solution that simplifies professional-level video surveillance for small businesses.

People Counting System Market Leaders

-

FLIR Systems, Inc.

-

IEE SA

-

Axis Communications AB

-

RetailNext Inc.

-

Traf-Sys Inc.

*Disclaimer: Major Players sorted in no particular order

People Counting System Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Security, Terrorism and Threats Risks Stimulating Building Security

- 4.2.2 Integration of IoT and Cloud Services

-

4.3 Market Restraints

- 4.3.1 Growth of E-commerce has Negatively Impacted the Market

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

-

4.6 Technology Snapshot

- 4.6.1 Wired

- 4.6.2 Wireless

- 4.6.3 Thermal Imaging

- 4.6.4 Other Technology

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Hardware

- 5.1.2 Software & Services

-

5.2 By End-user Application

- 5.2.1 Hospitality

- 5.2.2 Retail

- 5.2.3 Transportation

- 5.2.4 BFSI

- 5.2.5 Sports & Entertainment

- 5.2.6 Other End-user Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 FLIR Systems, Inc.

- 6.1.2 IEE SA

- 6.1.3 Axis Communications AB

- 6.1.4 RetailNext Inc.

- 6.1.5 Traf-Sys Inc.

- 6.1.6 HELLA Aglaia Mobile Vision GmbH

- 6.1.7 Iris GmbH

- 6.1.8 ShopperTrak

- 6.1.9 InfraRed Integrated Systems Ltd.

- 6.1.10 Eurotech SPA

- 6.1.11 SensMax

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityPeople Counting System Industry Segmentation

The people counting system consists of the counter device integrated with a surveillance camera and facial recognition technology that measures the number of people and the direction in which they travel. The people counting system is widely used in the entrance and exist of shopping malls, retail stores, government buildings, and many other public places, where there is a chance of high crowd.

| By Type | Hardware | |

| Software & Services | ||

| By End-user Application | Hospitality | |

| Retail | ||

| Transportation | ||

| BFSI | ||

| Sports & Entertainment | ||

| Other End-user Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Italy | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle-East & Africa |

People Counting System Market Research FAQs

How big is the People Counting System Market?

The People Counting System Market size is expected to reach USD 1.28 billion in 2024 and grow at a CAGR of 13.04% to reach USD 2.35 billion by 2029.

What is the current People Counting System Market size?

In 2024, the People Counting System Market size is expected to reach USD 1.28 billion.

Who are the key players in People Counting System Market?

FLIR Systems, Inc., IEE SA, Axis Communications AB, RetailNext Inc. and Traf-Sys Inc. are the major companies operating in the People Counting System Market.

Which is the fastest growing region in People Counting System Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in People Counting System Market?

In 2024, the North America accounts for the largest market share in People Counting System Market.

What years does this People Counting System Market cover, and what was the market size in 2023?

In 2023, the People Counting System Market size was estimated at USD 1.13 billion. The report covers the People Counting System Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the People Counting System Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

People Counting System Industry Report

Statistics for the 2024 People Counting System market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. People Counting System analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.