Pet Care Market Size

| Study Period | 2019-2029 |

| Market Size (2024) | USD 20.02 Billion |

| Market Size (2029) | USD 24.59 Billion |

| CAGR (2024 - 2029) | 4.20 % |

| Fastest Growing Market | North America |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Pet Care Market Analysis

The Pet Care Market size is estimated at USD 20.02 billion in 2024, and is expected to reach USD 24.59 billion by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

- The pet care industry has been experiencing positive growth due to a surge in the adoption of pets worldwide. According to Industrieverband Heimtierbedarf (IVH) e.V, the cat population in Germany has increased by 1 million to reach 16.7 million in 2021. This has stimulated the demand for pet services and products and encouraged significant growth in the pet care market.

- Many other major countries, such as the United States, Brazil, and the United Kingdom, have experienced a similar surge in pet populations, increasing the demand for pet care products worldwide. In recent years, many people have invested in pet care products such as accessories, pet health, and pet fashion, as pets are seen as family members. This is even higher in the millennial generation of developing and developed countries worldwide.

- Along with this, the rise in disposable incomes has increased the willingness of pet owners to spend on high-quality products. Therefore, the growing interest in pet humanization, coupled with a rise in demand for premiumization in pet care products, is driving the market growth for pet care products.

Pet Care Market Trends

Pet Humanization Trend

- According to Pets International, the pet humanization trend positively influences market growth, with more than 90% of people considering pets to be part of their family. The pandemic further fuels this, as more owners have brought pets to their homes due to isolation and pandemic restrictions worldwide.

- Along with pet food and pet grooming products, demand for other pet care products, such as activity tracking collars, has risen recently, especially from the millennial or Gen Y generation, to measure their pet's agility and to play sports. For example, around 100,000 dogs in the United Kingdom have now been fitted with activity monitoring devices, according to PitPat, a leading manufacturer of dog activity monitors.

- Furthermore, the popularity of pet fashion among pet owners has a positive impact on the market and is expected to contribute to significant growth during the forecast period. Some pet owners are very particular about representing their lifestyles by spending on comfortable and luxurious pet products, encouraging many market competitors to launch new and customized products in the pet grooming service segment.

- Due to all these factors, pet care products have become a dominant segment in the pet industry. For instance, According to the American Pet Products Association, the pet care market accounts for over 50% of American pet industry sales, with over USD 64 billion in 2021. Therefore, the pet humanization trend and rising investments in R&D are anticipated to drive market growth in the coming years.

North America is Leading the Pet Care Market

- The pet care market in North America is well-matured in terms of consumers and available products. For example, millennials now account for a third of all pet owners in the United States and are well aware of the type of pet products they use for their pets. Premiumization is pivotal in driving the sales of pet care products in North America.

- A growing demand for natural pet food is gaining traction among pet owners, owing to obesity risks in pets such as dogs and cats. According to the Association for Pet Obesity Prevention, 55% of dogs and cats in the United States are obese. This presents a more significant opportunity for manufacturers to add quality ingredients and diets and launch added-value products to cater to the growing consumer interest in premium products.

- With more product launches with value-added quality ingredients, the demand for pet care products is expected to grow further during the forecast period.

Pet Care Industry Overview

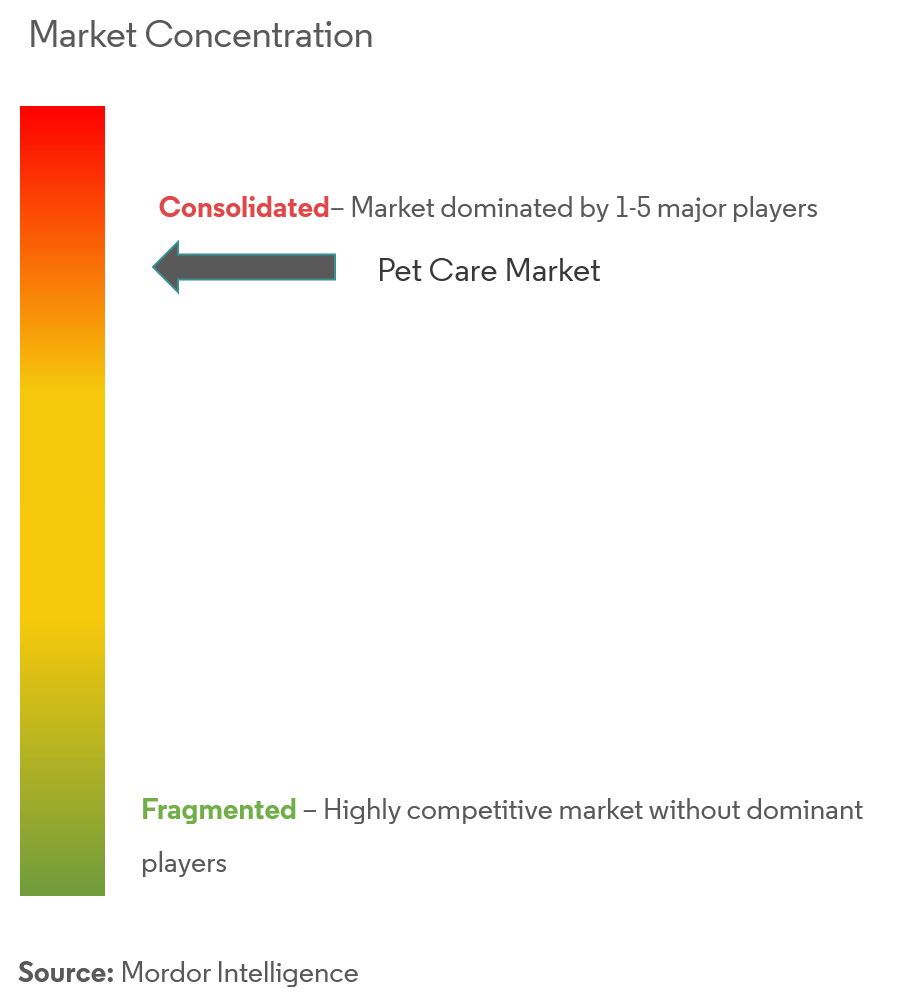

The pet care market is concentrated with the presence of multinational companies such as Mars Pet Care, Colgate-Palmolive (Hills Pet Nutrition), Nestle SA - Purina, J.M.Smucker, and General Mills Inc. (Blue Buffalo). These companies are involved in various strategic activities, such as acquisitions and the launching of new pet care products, to consolidate their market shares and strengthen their positions in the market.

Pet Care Market Leaders

-

General Mills Inc (Bluebuffalo)

-

The J.M. Smucker Company

-

Mars Pet Care

-

Colgate-Palmolive (Hills Pet Nutrition)

-

Nestle SA - Purina

*Disclaimer: Major Players sorted in no particular order

Pet Care Market News

- November 2022: Mars Pet Care finalized an acquisition deal with Champion Pet Foods, a prominent global manufacturer specializing in premium pet food. This strategic move significantly bolsters Mars Pet Care's product range and amplifies its global market presence in the pet care industry.

- August 2022: Wiggles, an Indian pet care brand, expanded its offerings with the introduction of a new product line named Every Dawg. This line features gluten and sugar-free pet food tailored for dogs of all breeds, further diversifying Wiggles' pet food portfolio.

- December 2021: Unilever, a renowned global consumer goods company, marked its entry into the pet care market in Brazil with the launch of Cafune. This inaugural pet care brand encompasses a variety of products, such as pet shampoos, conditioners, wipes, kitty litter, training pads for dogs, and home disinfectants, aiming to meet diverse pet care needs in the Brazilian market.

Pet Care Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study and Market Definition

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Pet Type

- 5.1.1 Dog

- 5.1.2 Cat

- 5.1.3 Fish

- 5.1.4 Other Pet Types

-

5.2 Product Type

- 5.2.1 Pet Food

- 5.2.1.1 Dry

- 5.2.1.2 Wet

- 5.2.2 Pet Care

- 5.2.2.1 Oral Care

- 5.2.2.2 Dietary Supplements

- 5.2.2.3 Veterinary Diets

- 5.2.3 Grooming Products

- 5.2.3.1 Shampoos and Conditioners

- 5.2.3.2 Combs and Brushes

- 5.2.3.3 Clippers and Scissors

- 5.2.3.4 Other Grooming Products

-

5.3 Distribution Channel

- 5.3.1 Offline Retail Stores

- 5.3.2 Online Retail Sores

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Mars Incorporated

- 6.3.2 Colgate-Palmolive

- 6.3.3 Nestle SA (Purina)

- 6.3.4 General Mills Inc. (Blue Buffalo)

- 6.3.5 The J.M. Smucker Company

- 6.3.6 heristo aktiengesellschaft

- 6.3.7 Champion Petfoods LP

- 6.3.8 The Hartz Mountain Corporation

- 6.3.9 Petmate

- 6.3.10 Tail Blazers

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityPet Care Industry Segmentation

The pet care market involves products used in pet food and safety, nourishment, exercise, and medical attention. It also includes oral care, veterinary care, dietary supplements, pet grooming, pet fashion products, etc.

The pet care market is segmented by pet type (dog, cat, fish, and other pet types), product type (pet food, pet care, and grooming products), distribution channel (offline retail stores and online stores), and geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

The report offers the market size and forecasts in value (USD) for all the above segments.

| Pet Type | Dog | |

| Cat | ||

| Fish | ||

| Other Pet Types | ||

| Product Type | Pet Food | Dry |

| Wet | ||

| Product Type | Pet Care | Oral Care |

| Dietary Supplements | ||

| Veterinary Diets | ||

| Product Type | Grooming Products | Shampoos and Conditioners |

| Combs and Brushes | ||

| Clippers and Scissors | ||

| Other Grooming Products | ||

| Distribution Channel | Offline Retail Stores | |

| Online Retail Sores | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Spain | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle-East and Africa | South Africa |

| Saudi Arabia | ||

| Rest of Middle-East and Africa |

Pet Care Market Research Faqs

How big is the Pet Care Market?

The Pet Care Market size is expected to reach USD 20.02 billion in 2024 and grow at a CAGR of 4.20% to reach USD 24.59 billion by 2029.

What is the current Pet Care Market size?

In 2024, the Pet Care Market size is expected to reach USD 20.02 billion.

Who are the key players in Pet Care Market?

General Mills Inc (Bluebuffalo), The J.M. Smucker Company, Mars Pet Care, Colgate-Palmolive (Hills Pet Nutrition) and Nestle SA - Purina are the major companies operating in the Pet Care Market.

Which is the fastest growing region in Pet Care Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Pet Care Market?

In 2024, the North America accounts for the largest market share in Pet Care Market.

What years does this Pet Care Market cover, and what was the market size in 2023?

In 2023, the Pet Care Market size was estimated at USD 19.18 billion. The report covers the Pet Care Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Pet Care Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What are the key sustainability challenges in the Pet Care Industry?

The key sustainability challenges in the Pet Care Industry are a) Environmental impact of pet food production & waste b)Production of animal-derived ingredients can contribute to greenhouse gas emissions, deforestation, and water pollution

Pet Care Industry Report

The global pet care market is witnessing significant growth, driven by increased pet ownership, consumer spending on pet care products, and the trend of pet humanization where pets are treated as family members. This has led to a surge in demand for various pet care products such as food, healthcare, pet insurance, grooming services, and more. The market is also evolving with a shift towards dietary food items for pets to prevent health issues like obesity and the introduction of innovative pet care products like location tracker devices and smart toys due to technological advancements. However, the high cost of quality pet care products may restrict their demand among lower-income populations. The pet care market is further influenced by the rising popularity of online shopping and subscription-based services for pet products. The North American market dominates with the largest share due to high spending on pet care products and services. According to Mordor Intelligence™ Industry Reports, the Pet Care market share, size, and revenue growth rate statistics are available, including a market forecast outlook and a historical overview. A sample of this industry analysis is available as a free report PDF download.