Plastic Furniture Market Size

| Study Period | 2020 - 2029 |

| Market Size (2024) | USD 15.22 Billion |

| Market Size (2029) | USD 18.74 Billion |

| CAGR (2024 - 2029) | 4.25 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Plastic Furniture Market Analysis

The Plastic Furniture Market size is estimated at USD 15.22 billion in 2024, and is expected to reach USD 18.74 billion by 2029, growing at a CAGR of 4.25% during the forecast period (2024-2029).

With the onset of the pandemic, the booming sector of plastic furniture was heavily impacted due to the restriction and lockdown in the initial period. The manufacturing index also showed a drastically declined number for the month of March, April, and May of 2020. The furniture industry bounced back with the rise in work or study from furniture in the latter half of 2020. The pandemic also resulted in the need for privacy and personalized space within the house that was required for the work-from-home or study-from-home, which resulted in an increase in demand for WFH furniture.

Due to the increased demand for inexpensive, lightweight, and durable plastic furniture in a range of end-use industries, consumers are selecting plastic furniture over traditional, wooden, or metal furniture.

The study concludes that the development of the plastic furniture business will be greatly influenced by ongoing improvements in engineered plastics and an increasing focus on recyclable plastics. The industry gained momentum with the development of high-performance plastic polymers ideal for making durable plastic furniture. The makers of plastic furniture will keep producing new types of plastic and furniture designs to capitalize on possible sales prospects. Small businesses are entering the plastic furniture market with innovative designs of recycled plastic furniture to take advantage of the growing consumer demand for eco-friendly products.

Plastic Furniture Market Trends

This section covers the major market trends shaping the Plastic Furniture Market according to our research experts:

Demand for Expensive, Fun, and Durable Plastic Furniture is Driving the Market

People all across the world favor plastic furniture because it is more opulent, durable, and affordable than furniture made of metal and wood. Wooden chairs are rather stiff and more prone to fracture and distortion, and consumers prefer plastic furniture to metal furniture.

On the other side, plastic furniture is more pressure-resistant because of greater flexibility. Furniture made of plastic is also less expensive than furniture made of metal and wood. Plastic furniture benefits from this on the global market. Plastic furniture is additionally adaptable and portable. Additionally, one of the main factors fueling industry expansion is increased plastic furniture's resistance to disintegration.

Asia-Pacific is Anticipated to Grow at the Highest Rate

Due to increased disposable incomes, rising public awareness of plastic furniture, and India and China's dominance in the region, Asia-Pacific is predicted to develop at a large rate in the global plastic furniture industry. The plastic furniture market in Africa is anticipated to expand at a healthy rate. The market in Middle-East and Africa is drawing investment from businesses looking for greater opportunities there, and it is anticipated that it will experience a robust increase over the next years.

Plastic Furniture Industry Overview

Included in the report are significant international businesses involved in the plastic furniture sector. In terms of market share, only a few of the top rivals currently dominate the market. Demand, however, is determined by consumer spending. Large enterprises compete by making massive purchases, providing a wide selection of goods, and utilizing clever marketing and merchandising techniques. Small enterprises target a specific market niche and compete with larger product portfolios and superior customer service. Companies including Keter Group, Ashley Furniture Industries, Inc., IKEA, Nilkamal Limited, and Berkshire Hathaway Inc., among others have been profiled in the report.

Plastic Furniture Market Leaders

-

Keter Group

-

Ashley Furniture Industries, Inc.

-

IKEA

-

Nilkamal Limited

-

Berkshire Hathaway Inc.

*Disclaimer: Major Players sorted in no particular order

Plastic Furniture Market News

- June 2022: After a two-year pandemic delay, Italy's furniture and design industries welcomed the Milan Furniture Fair with unapologetically outrageous statement pieces, multifunctional furniture that fits in small spaces, and sustainable creations by emerging designers that are guiding the industry in the direction of going greener.

- June 2022: Together with Voice of the Oceans, Tramontina USA embarked on a journey to a better future to bring attention to the problem of plastics in the oceans and identify fresh approaches to resolve it.

Plastic Furniture Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Market Opportunities

- 4.5 Supply Chain / Value Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.7 Insights into the Trends Influencing the Plastic Furniture Market

- 4.8 Insights into Technological Innovations in the Market

- 4.9 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Kitchen Furniture

- 5.1.2 Living and Dining Room Furniture

- 5.1.3 Bathroom Furniture

- 5.1.4 Outdoor Furniture

- 5.1.5 Other Types

-

5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

-

5.3 By Distribution Channel

- 5.3.1 Supermarkets and Hypermarkets

- 5.3.2 Specialty Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

-

5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6. COMPETITIVE LANDSCAPE

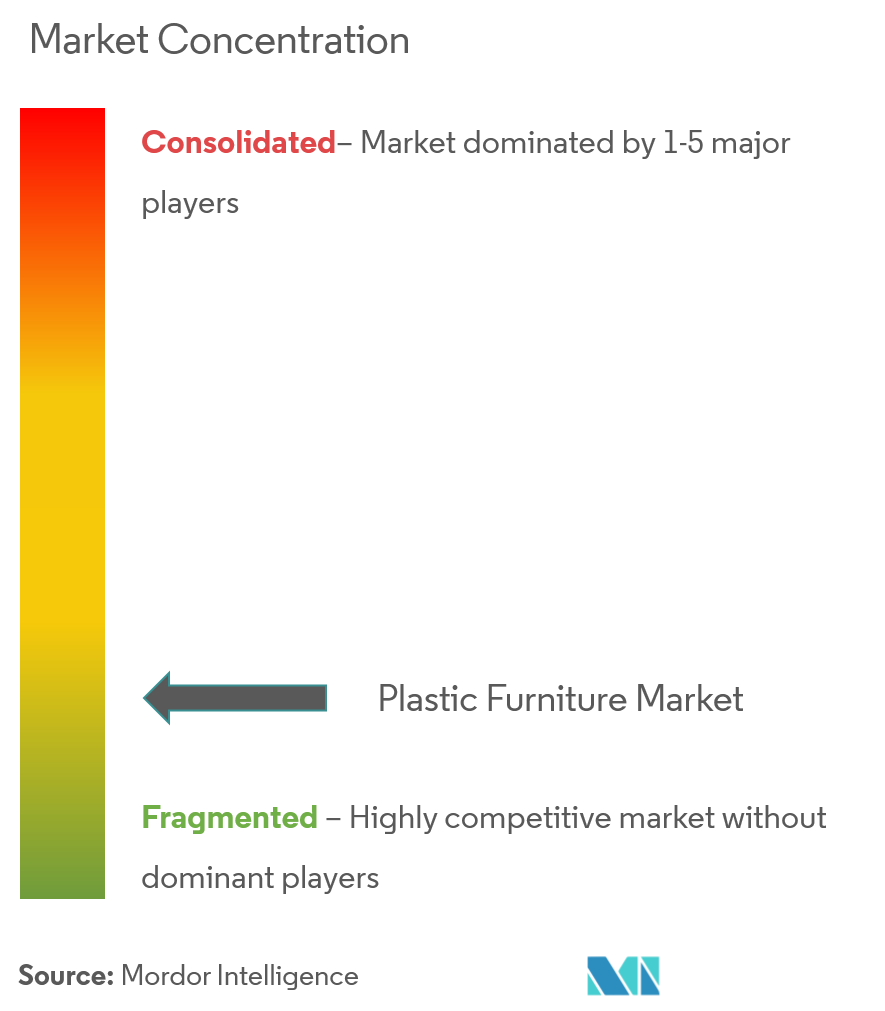

- 6.1 Market Concentration Overview

-

6.2 Company Profiles

- 6.2.1 Ashley Furniture Industries Inc.

- 6.2.2 IKEA

- 6.2.3 Keter Group

- 6.2.4 Vitra International AG

- 6.2.5 Cosmoplast Industrial Company LLC

- 6.2.6 Berkshire Hathaway Inc.

- 6.2.7 Rooms To Go

- 6.2.8 Foliot Furniture

- 6.2.9 Nilkamal Limited

- 6.2.10 La-z-boy

- 6.2.11 Sleep Number

- 6.2.12 Telos Furniture*

- *List Not Exhaustive

7. FUTURE OF THE MARKET

8. DISCLAIMER AND ABOUT US

** Subject To AvailablityPlastic Furniture Industry Segmentation

A complete background analysis of the Plastic Furniture Market includes an assessment of the parental market, emerging trends by segments and regional markets, significant changes in market dynamics, and a market overview covered in the report.

The Plastic Furniture Market is Segmented by Type (Kitchen Furniture, Living and Dining Room Furniture, Bathroom Furniture, Outdoor Furniture, and Other Types), End User (Residential and Commercial), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online, and Other Distribution Channels), and Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa). The report offers market size and values in (USD million) for all the above segments.

| By Type | Kitchen Furniture |

| Living and Dining Room Furniture | |

| Bathroom Furniture | |

| Outdoor Furniture | |

| Other Types | |

| By End User | Residential |

| Commercial | |

| By Distribution Channel | Supermarkets and Hypermarkets |

| Specialty Stores | |

| Online | |

| Other Distribution Channels | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| South America | |

| Middle-East and Africa |

Plastic Furniture Market Research FAQs

How big is the Plastic Furniture Market?

The Plastic Furniture Market size is expected to reach USD 15.22 billion in 2024 and grow at a CAGR of 4.25% to reach USD 18.74 billion by 2029.

What is the current Plastic Furniture Market size?

In 2024, the Plastic Furniture Market size is expected to reach USD 15.22 billion.

Who are the key players in Plastic Furniture Market?

Keter Group, Ashley Furniture Industries, Inc., IKEA, Nilkamal Limited and Berkshire Hathaway Inc. are the major companies operating in the Plastic Furniture Market.

Which is the fastest growing region in Plastic Furniture Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Plastic Furniture Market?

In 2024, the North America accounts for the largest market share in Plastic Furniture Market.

What years does this Plastic Furniture Market cover, and what was the market size in 2023?

In 2023, the Plastic Furniture Market size was estimated at USD 14.60 billion. The report covers the Plastic Furniture Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Plastic Furniture Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Plastic Furniture Industry Report

Statistics for the 2024 Plastic Furniture market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Plastic Furniture analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.