Postal Automation System Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| CAGR | 7.00 % |

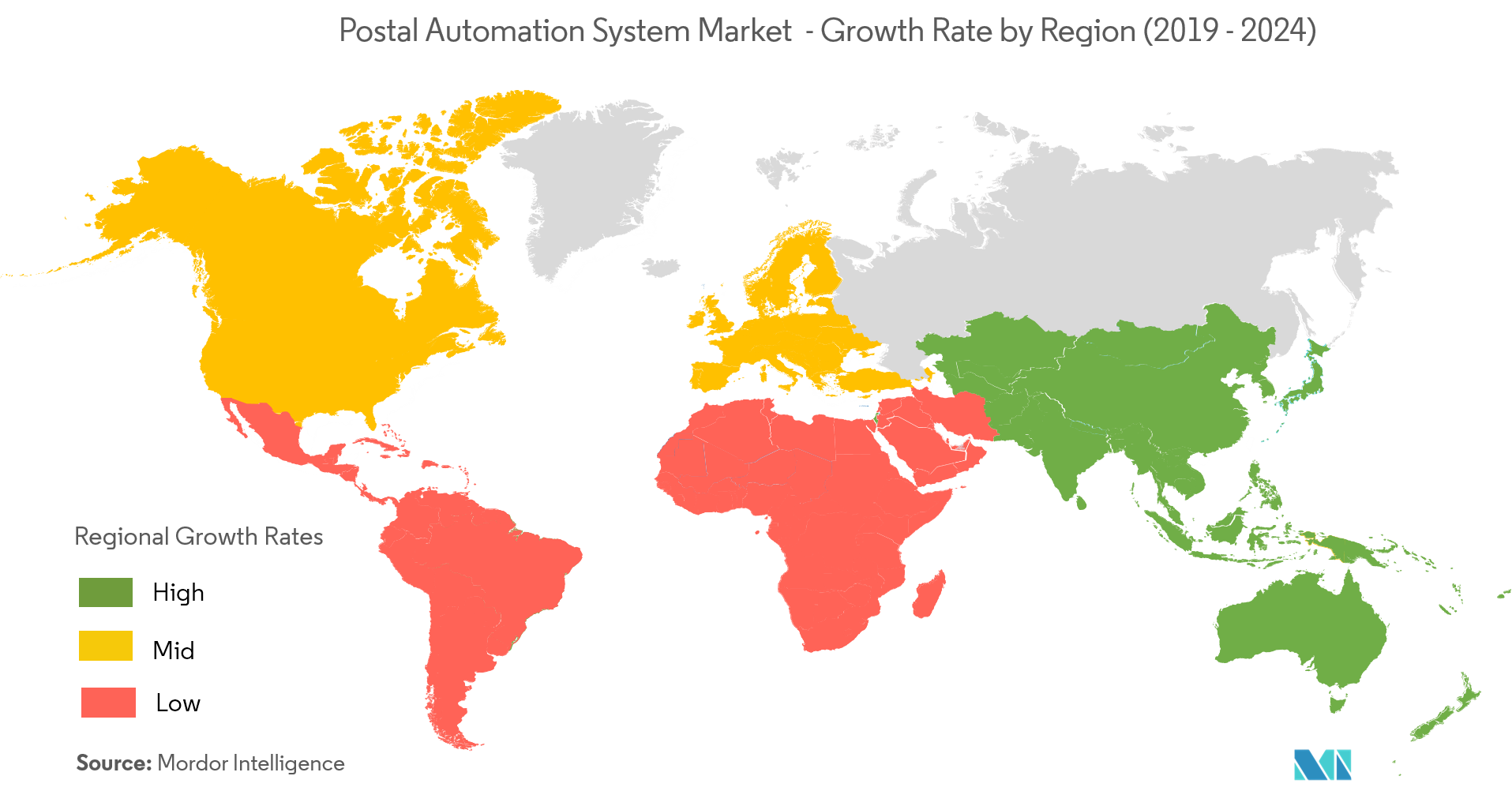

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Postal Automation System Market Analysis

The Postal Automation Market is expected to register a CAGR of approximately 7% during the forecast period (2021 - 2026). The increasing adoption of automated solutions across various end-user industries and major technological advancements like industry 4.0 and digitization has necessitated the need for automation in the sorting and delivery processes in the postal industry. Further, rising labor costs due to labor shortages are expected to further drive the postal automation market.

- Also, the evolution of smart, connected, and efficient automated postal operations through the integration of Industry 4.0 practices with various technologies like RFID, Barcode Readers, Scanners, etc. is expected to grow the market significantly.

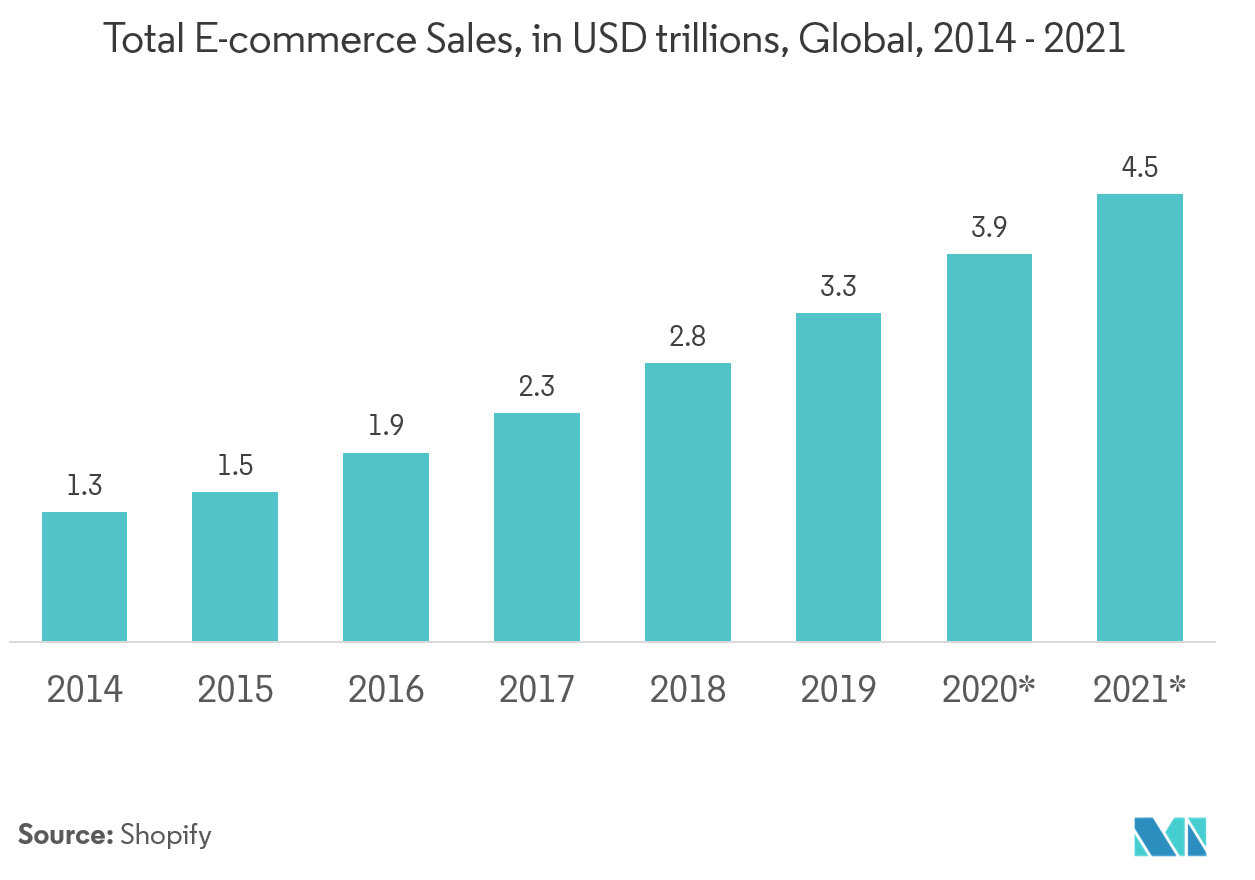

- The massive growth in e-commerce has resulted in massive growth in the volume of parcels and packages. For instance, according to Shopify, it is estimated that there will be 1.92 billion global digital buyers in 2019, with e-commerce sales expected to account for 13.7% of retail sales worldwide. Thus, a need for automated solutions in the postal industry is expected to further enhance the e-commerce logistics industry. Hence, automation in the postal industry is expected to grow significantly in the forecast period.

- However, the declining volume of traditional mails like letters and mails, owing to internet penetration and the use of smart devices, is one of the major factors hindering the market growth. Also, high initial investments and maintenance costs are further restricting the growth of the market.

Postal Automation System Market Trends

This section covers the major market trends shaping the Postal Automation System Market according to our research experts:

Hardware Component Expected to Grow Significantly

- The hardware component is expected to hold a majority share in the postal automation system market. Automation in any end-user industry is essentially a collection of connected hardware components and data solutions. Hence, the need for a hardware component in the postal and parcel industry is increasing with the increase in the need for automation in the industry.

- Also, the increase in the number of new system installations as part of capacity expansion and upgrades in the existing system as part of automation in the postal industry is expected to be the major factor driving the market.

- Furthermore, the massive growth in the e-commerce industry has led to a surge in the number of parcel deliveries across the globe. Also, crossborder retail has further stimulated the growth in parcel deliveries. Hence, an automated and connected hardware system is essential in a postal automation system to enhance the supply chain in the postal industry.

- However, these hardware systems require regular maintenance, along with hardware and software upgrades. Also, high-value contracts are signed between automation equipment manufacturers and postal operators for after-sales services. Owing to this, the market for services is expected to grow at the highest rate during the forecast period.

North America Expected to Dominate the Market

- The North America region is expected to account for the largest share of the postal automation system market in the forecast period. Major factors like the presence of major postal and CEP companies in the region are driving the market growth in the region.

- Also, renovation and upgradation of existing postal automation systems in North America has resulted in the installation or capacity expansion of these systems, thereby contributing to the growth of the market in the region.

- Further, the massive growth of e-commerce in the region has led to an increase in the need for automated solutions in the postal and parcel industry. For instance, according to the US Department of Commerce, in the first quarter of 2019, the share of e-commerce in total U.S. retail sales was 10.7%, which increased as compared to 9.8% in the first quarter in 2018. As of that quarter, retail e-commerce sales in the United States amounted to almost USD 146.2 billion.

Postal Automation System Industry Overview

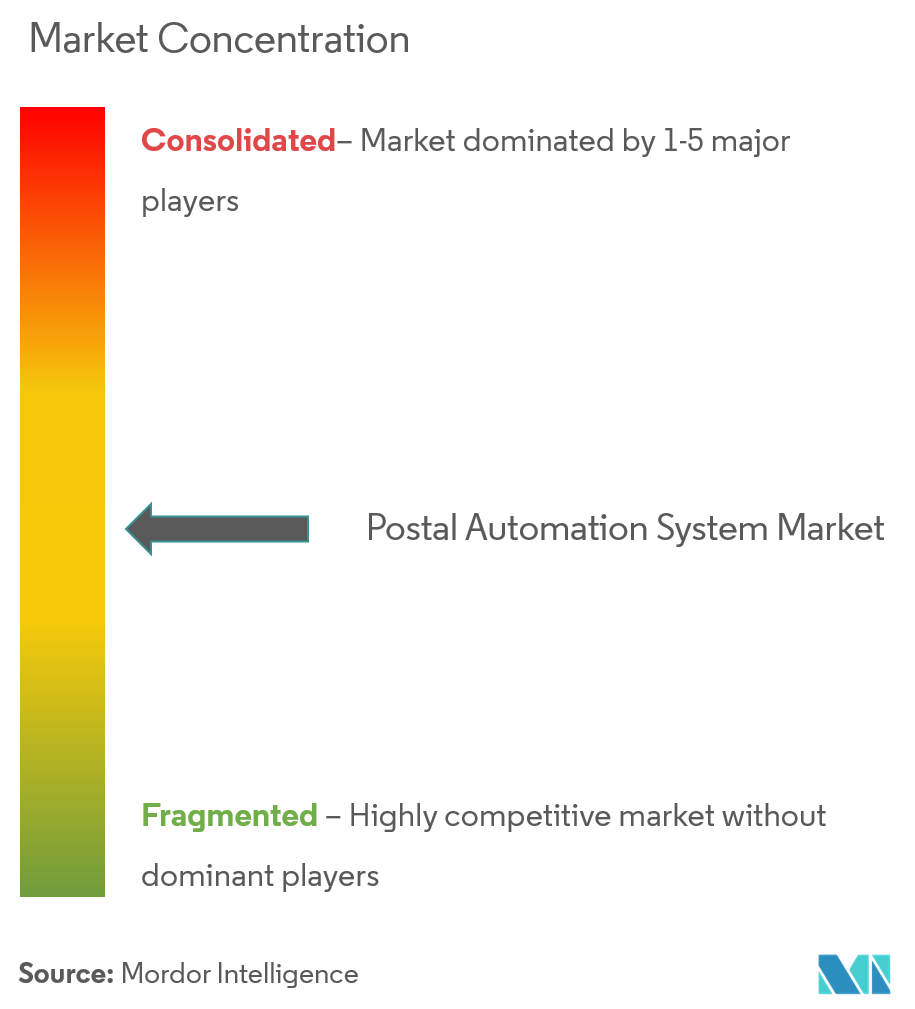

The global postal automation system market is moving towards fragmentation owing to the various technological advancements taking place in the postal industry. Since the market is continuously evolving, the market players are developing various solutions to gain maximum market share and are viewing innovation and expansion as a lucrative path to stay ahead of the competitors.

- October 2019 - Siemens Logistics offers airports and airlines a comprehensive portfolio of innovative software solutions to optimize processes. This includes Service 4.0 for the predictive maintenance of baggage handling systems. The forecasts are generated from collected data, and preventive measures are taken to improve system reliability and avoid unscheduled downtimes.

- September 2019 -Vanderlande will launch the next installment of its scalable solutions (evolutions) – DIRECTSORT – at the Parcel and Post Expo 2019, to be held in The Netherlands. DIRECTSORT is a modular, future-proof and straightforward solution that sorts parcels from the moment they are unloaded from trailers, vans or load carriers – with the aim of optimizing the total cost of ownership (TCO).

Postal Automation System Market Leaders

-

Toshiba Corporation

-

Beumer Group

-

Siemens AG

-

NEC Philippines, Inc.

-

Solystic SAS

*Disclaimer: Major Players sorted in no particular order

Postal Automation System Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Growth in E-commerce Industry

- 4.2.2 Increasing Labor Costs

- 4.2.3 Increasing Adoption of Automated Solutions in the Logistics Sector

-

4.3 Market Restraints

- 4.3.1 Declining Volume of Traditional Mails

- 4.3.2 High Adoption Costs

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

-

4.6 Technology Snapshot

- 4.6.1 Culler Facer Canceller

- 4.6.2 Letter Sorter

- 4.6.3 Flat Sorter

- 4.6.4 Mail Sorter

- 4.6.5 Parcel Sorter

- 4.6.6 Cross Belt Sorter

5. MARKET SEGMENTATION

-

5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

-

5.2 By Application

- 5.2.1 Express Parcel and Courier

- 5.2.2 Government Postal

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 South Korea

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Toshiba Corporation

- 6.1.2 BEUMER Group

- 6.1.3 Siemens AG

- 6.1.4 NEC Philippines, Inc.

- 6.1.5 SOLYSTIC SAS

- 6.1.6 Vanderlande Industries

- 6.1.7 Pitney Bowes Inc.

- 6.1.8 Zebra Technologies Corp.

- 6.1.9 Fives Group

- 6.1.10 Ammeraal Beltech Holding BV

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityPostal Automation System Industry Segmentation

With the advent of technological advancements across various end-user industries, the postal and parcel industry is also evolving rapidly. Globalization has boosted the world economy by the massive international flow of data, and new innovations in technology and data are reinventing the mail and parcel industry. For instance, when mail or parcels are scanned upon entering a facility, internet-based technology provides customers with real-time tracking information. Hence, automation in the postal and parcel industry is evolving rapidly owing to the various growth drivers.

| By Component | Hardware | |

| Software | ||

| Services | ||

| By Application | Express Parcel and Courier | |

| Government Postal | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| South Korea | ||

| Japan | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle-East & Africa |

Postal Automation System Market Research FAQs

What is the current Postal Automation System Market size?

The Postal Automation System Market is projected to register a CAGR of 7% during the forecast period (2024-2029)

Who are the key players in Postal Automation System Market?

Toshiba Corporation, Beumer Group, Siemens AG, NEC Philippines, Inc. and Solystic SAS are the major companies operating in the Postal Automation System Market.

Which is the fastest growing region in Postal Automation System Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Postal Automation System Market?

In 2024, the North America accounts for the largest market share in Postal Automation System Market.

What years does this Postal Automation System Market cover?

The report covers the Postal Automation System Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Postal Automation System Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Postal Automation System Industry Report

Statistics for the 2024 Postal Automation System market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Postal Automation System analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.