Poultry Packaging Industry Overview

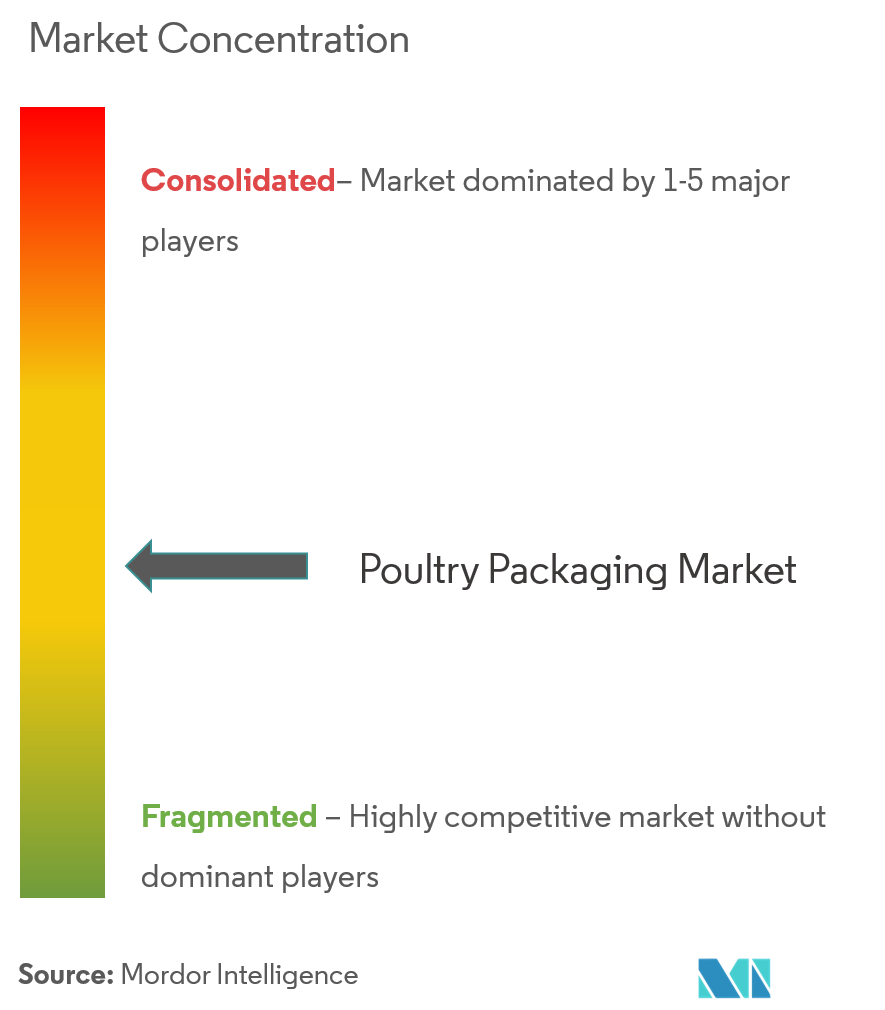

The poultry packaging market is competitive in nature, owing to the presence of many global players in the market. Few global payers are... However, with the increasing population and increasing awareness about the nutrition value associated with the poultry meats are increasing the demand for thehygiene packaging. Moreover, the presence of local players in the market, are increasing the competitiveness among the players. Product launch, high cost on research and development are the prime growth strategies adopted by the players to sustain the intense competition. Few recent developments are:

- October 2019 -LDCGroup announced that they have bought the poultry production facility from the CasinoGroup. This acquisition would provide the opportunity for the Casino Group and LDC to combine their resources and thereby strengthen the high-quality French poultry chain.

- March 2019 -Moy Park launched a new packaging strategy to reduce the use of the plastics and by 2020, they aim to eliminate thesingle-use plastics from their offices and restaurants. The company is planning to reduce its single-use plastic by collaborating with its supply chain partners to develop more sustainable packaging solutions.

Poultry Packaging Market Leaders

-

Amcor plc

-

Berry Global, Inc

-

Mondi Group

-

Sealed Air Corporation

-

ProAmpac LLC

- *Disclaimer: Major Players sorted in no particular order