Power Amplifier Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 8.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Power Amplifier Market Analysis

The Power Amplifier Market was valued at USD 23.219 billion in 2020 and is expected to reach USD 37.881 billion by 2026, at a CAGR of 8.5% over the forecast period 2021 - 2026. Wireless communications have been exploding in the last few years, and their growth is expected to follow similar in the near future. While the market demand is for higher throughput and lower power consumption, the designers of wireless transmitters have to cope with even more stringent demands on system bandwidth, linearity, and versatility. The power amplifier (PA) is a crucial element of the transmitter since it greatly affects both power efficiency and linearity. These amplifiers draw power from the source of supply and control the output signal with a larger amplitude. Power amplifiers are an update to the traditional amplifiers and are used in consumer electronic devices, such as smartphones and tablets. In addition, to meet the demand of harsh industrial environments, these amplifiers are designed to be extremely robust, often capable of strengthening the low-power signal.

- The expanding adoption of power semiconductors in smartphones and usage of 5G is one of the primary factor improving the demand. With the increment in the need for greater data rates and larger spectral efficiency, the requirement for high-speed mobile broadband internet is growing. This has driven to the implementation of LTE, which is further anticipated to boost the expansion of the Power Amplifier market. With the introduction of the Internet and its consequent migration to mobile platforms, the need for high data rates over increasingly crowded radio bands has prompted linearity standards to limits or extremes that are well beyond the abilities of any known PA technology.

- The class A amplifiers held the most extensive share in the global power amplifier industry in 2018, while the class D power amplifiers are supposed to be the fastest-growing during the forecast period. In terms of vertical, the consumer electronics vertical is forecasted to account for the bulk of the power amplifier industry during the forecast period. The growing trend of digitalization and progress in smart city projects in many countries across the world is also generating potential possibilities for the growth of the power amplifier semiconductor market. Moreover, progress in the usage of RF power devices in several lighting applications is also encouraging growth in the global power amplifier market.

Power Amplifier Market Trends

This section covers the major market trends shaping the Power Amplifier Market according to our research experts:

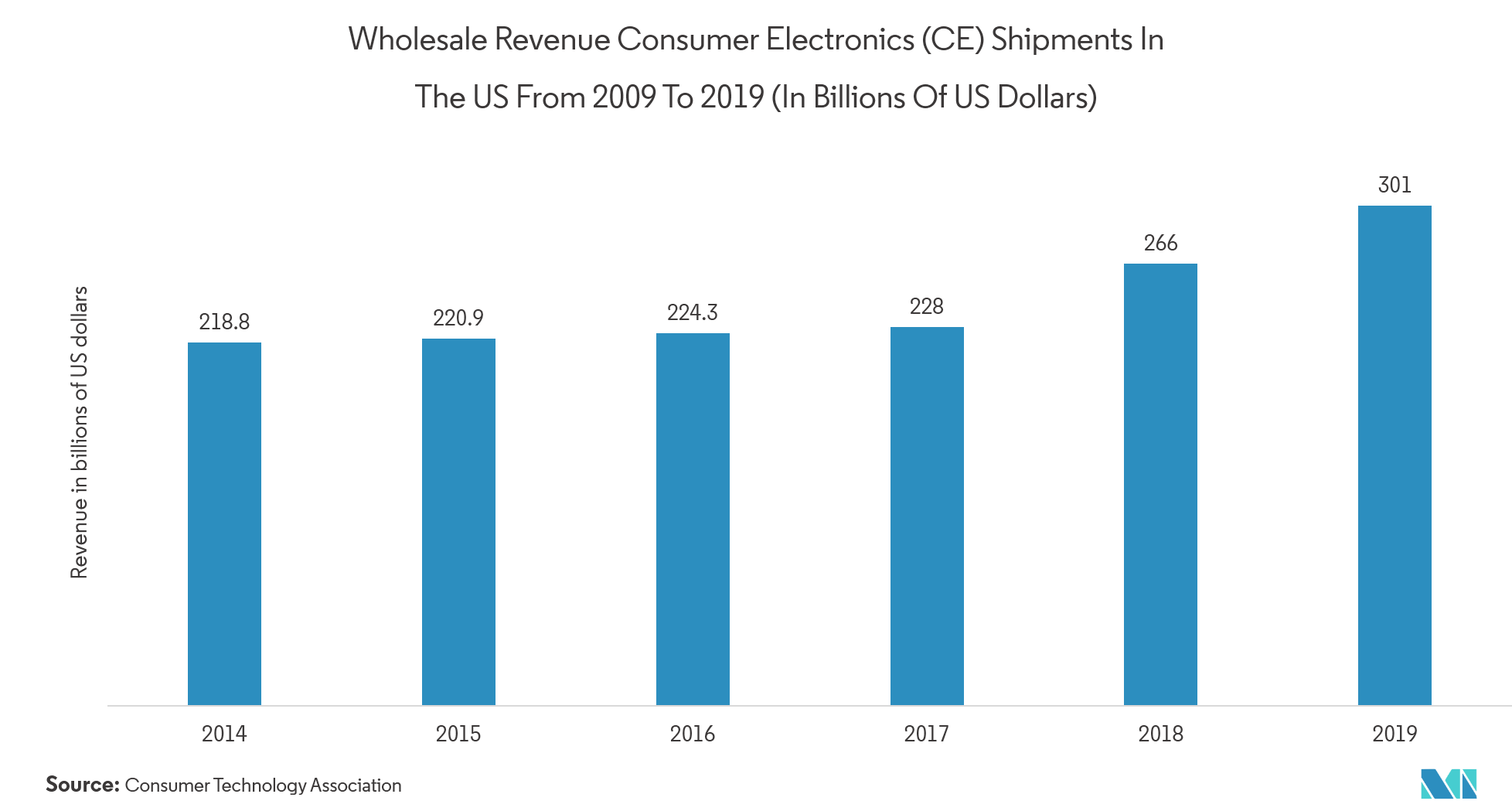

Consumer Electronics Sector to Offer Potential Growth Opportunities

- Increasing adoption of consumer electronics is witnessed globally, especially in smartphones, tablets, smartwatch, smart television, and smart homes devices is anticipated to drive the market over the forecast period. For instance, According to IBEF, 2019, Indian appliance and consumer electronics (ACE) market reached Rs 2.05 trillion (USD 31.48 billion) in 2017, India is one of the largest growing electronics markets in the world and is expected to grow at 41% CAGR between 2017-20 to reach USD 400 billion.

- Consumer Electronics being a major application industry of power amplifiers, would, henceforth, drive the global Power Amplifiers market. Additionally, proliferating penetration of 4G technology and the development of the next-generation wireless network, such as 5G, would also drive the demand and growth of power amplifiers market. Moreover, as 4G trends and new smartphones become more common, users will demand more features with faster service. Features like a large touchscreen, a powerful processor, a high powered operating system, live TV feeds, GPS navigation and dual-mode 4G/5G service may be standard in the near future.

- Technological evolution in the field of wireless communication and developments in materials used for manufacturing RF components, such as Gallium Arsenide (GaAs) and Silicon Germanium (SiGe), is also expected to augment market growth. Moreover, the development of innovative RF technologies offer products with a dynamic power range, higher frequencies, and lower noise parameters, enabling the design of next-generation electronic components.

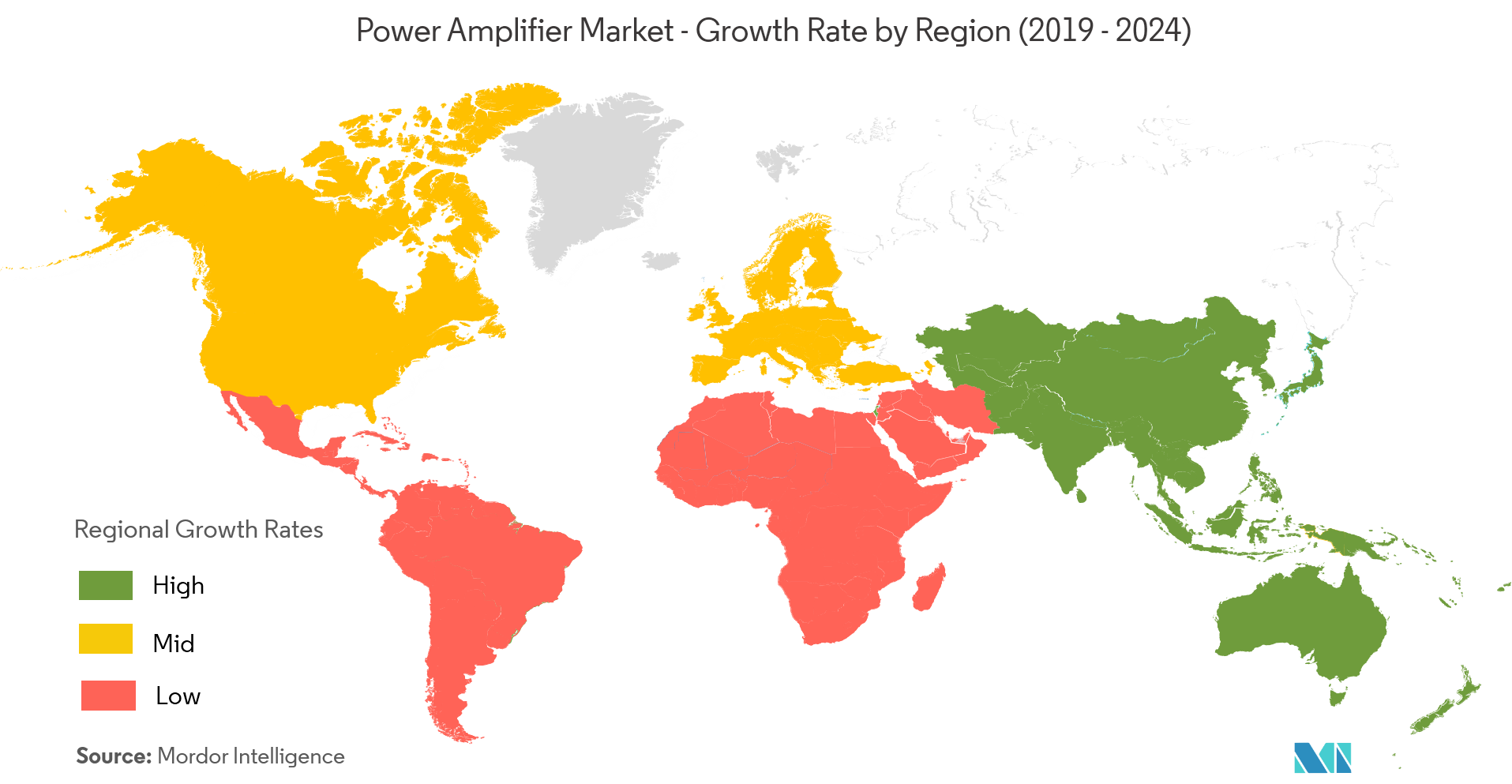

Asia-Pacific is Expected to Occupy a Significant Share in Power Amplifier Market

- Increasing penetration of smartphones and related devices coupled with the expansion of 5G cellular networks is anticipated to promote the growth of the power amplifier market in the Asia Pacific region. Incessant rise of consumers of the electronic sector in developing countries has further attributed to the growth of this market.

- The power amplifier market in the Asia Pacific is catalyzed by advancements in semiconductor industry coupled with rising demand for energy-efficient products. With IoT and next-gen wireless network taking over the technological world, the power amplifier market is expected to witness a rampant growth in the near future.

- Presence of prominent semiconductor industry in emerging economies of the Asia Pacific such as China, Japan, and India is likely to bode well with the growth of power amplifier market. Further, increasing investment into the development of technologically advanced RF power amplifier has been envisaged to create lucrative dimensions for manufacturers across the Asia Pacific.

- Increasing production of electric vehicles in Asia-Pacific is expected to drive the demand for GaN, which in turn, may boost the market for RF power in the region. China is the largest maker of electric vehicles. In 2018, it sold 28,081,000, including buses and commercial vehicles, according to the China Association of Automobile Manufacturers.

- China remains at the forefront of the market, exhibiting a relatively high CAGR over the period of assessment from 2018-2028. India and ASEAN countries are further likely to contribute to the growth of Asia Pacific power amplifier market.

Power Amplifier Industry Overview

The Power Amplifiermarket is moderately competitive and consists of various major players. In terms of market share, few of the major players currently dominate the market. The presence of dominant players has further strengthened its capability to develop highly established products, with the ability to transform the industrial application of technology.With the increasing importance on performance and rising levels of competition inthe industry, the market is poised to witness strong growth over and beyond the forecast period.

- August 2019 -Murata Manufacturing Co., Ltd., expandedits production capabilities at its existing location in Ohda-shi, Shimane Prefecture. The installation of additional assembly equipment and construction of the new manufacturing building will boost production capacity of multilayer ceramic capacitors, enabling Murata to meet growing demand in the medium and long term spurred by the increasing functionality of electronic devices and expanded use of electronics in automobiles.

- June 2019 -NXP Semiconductors NVunveiled one of the industry’s most integrated portfolio of RF solutions for 5G cellular infrastructure, industrial and commercial markets. Building on its strong legacy, disruptive R&D, world-class manufacturing and global presence, NXP’s comprehensive suite of solutions exceed today’s 5G RF power amplification demands for base stations from MIMO to massive MIMO based active antenna systems for cellular and Millimeter Wave (mmWave) spectrum bands.

Power Amplifier Market Leaders

-

Toshiba Corporation

-

Stmicroelectronics NV

-

Analog Devices

-

Murata Manufacturing Co. Ltd

-

NXP Semiconductor

*Disclaimer: Major Players sorted in no particular order

Power Amplifier Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Augmented Demand for Consumer Electronics

- 4.3.2 Growing Transition toward 5G and Long-term Evolution (LTE) Implementation

-

4.4 Market Restraints

- 4.4.1 Deminished Price Margin

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

-

4.6 Technology Snapshot

- 4.6.1 Silicon

- 4.6.2 Silicon Germanium

- 4.6.3 Gallium Arsenide

- 4.6.4 Complementary Metal-Oxide Semiconductor

- 4.6.5 Other Technologies

5. MARKET SEGMENTATION

-

5.1 By Industry Vertical

- 5.1.1 Consumer Electronics

- 5.1.2 Industrial

- 5.1.3 Telecommunication

- 5.1.4 Automotive

- 5.1.5 Other Industry Vertical

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 South Korea

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Toshiba Corporation

- 6.1.2 Stmicroelectronics NV

- 6.1.3 NXP Semiconductor

- 6.1.4 Analog Devices Inc.

- 6.1.5 Broadcom Limited

- 6.1.6 Texas Instruments Incorporated

- 6.1.7 Mitsubishi Electric Corporation

- 6.1.8 Maxim Integrated

- 6.1.9 Fuji Electric Co. Ltd.

- 6.1.10 Infineon Technologies AG

- 6.1.11 Qorvo Inc.

- 6.1.12 Murata Manufacturing Co. Ltd

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityPower Amplifier Industry Segmentation

The power amplifier (PA) is a pivotal element in transmitter systems, whose principal task is to enhance the power level of signals at its input up to a predefined level. PA’s features are largely associated with the absolute output power levels obtainable, followed to the greatest efficiency and linearity performances.

| By Industry Vertical | Consumer Electronics | |

| Industrial | ||

| Telecommunication | ||

| Automotive | ||

| Other Industry Vertical | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| South Korea | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World |

Power Amplifier Market Research FAQs

What is the current Power Amplifier Market size?

The Power Amplifier Market is projected to register a CAGR of 8.5% during the forecast period (2024-2029)

Who are the key players in Power Amplifier Market?

Toshiba Corporation, Stmicroelectronics NV, Analog Devices, Murata Manufacturing Co. Ltd and NXP Semiconductor are the major companies operating in the Power Amplifier Market.

Which is the fastest growing region in Power Amplifier Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Power Amplifier Market?

In 2024, the Asia Pacific accounts for the largest market share in Power Amplifier Market.

What years does this Power Amplifier Market cover?

The report covers the Power Amplifier Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Power Amplifier Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Power Amplifier Industry Report

Statistics for the 2024 Power Amplifier market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Power Amplifier analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.