Print Equipment Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 2.20 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Print Equipment Market Analysis

The print equipment market was valued at USD 22.4 Billion in 2020, at a CAGR of 2.2% during the forecast period (2021 - 2026). The process that has seen the biggest number of improvements in recent years is sheetfed offset litho. Innovations by the leading Western and Japanese manufacturers have transformed the technology, to a great extent. Sheetfed offset litho printers are increasingly carrying out simultaneous printing of groups of jobs by setting them up side-by-side across a large-format press. This printing process trend is expected to drive the market in future period.

- Introduction of 3D printing is driving the market.The demand for reduced weight in product packaging and use of thinner and smaller labelling is increasing by the day. This is likely to assist well for print equipment market. Furthermore, emphasis laid on recycling ability of the printing labels is expected to contribute positively to the print equipment market. Governments across the world have already started investing in R&D on 3D printing, which has had a positive impact on technology propagation and adoption. For instance, the Dutch government invested an additional USD 150 million in 3D printing-related research and innovation.

- The increasing investment in the packaging printing machinery is driving the market. In today's era, an attractive and effective packaging holds the key not only to successfully market a product but to positively change its perception in people's minds as well. According to Packaging of the World, yearly approx 30% businesses report that their revenues increase when they improve their product packaging and this percent will show a exponential rise in coming future.

- However, the high cost incurred on the implementation of printing structure may restrict growth in the market. Besides high cost structure and sensitive pricing environment, the shifting preference from traditional media to digital media in printing technique might as well hinder the global market in the coming years.

Print Equipment Market Trends

This section covers the major market trends shaping the Print Equipment Market according to our research experts:

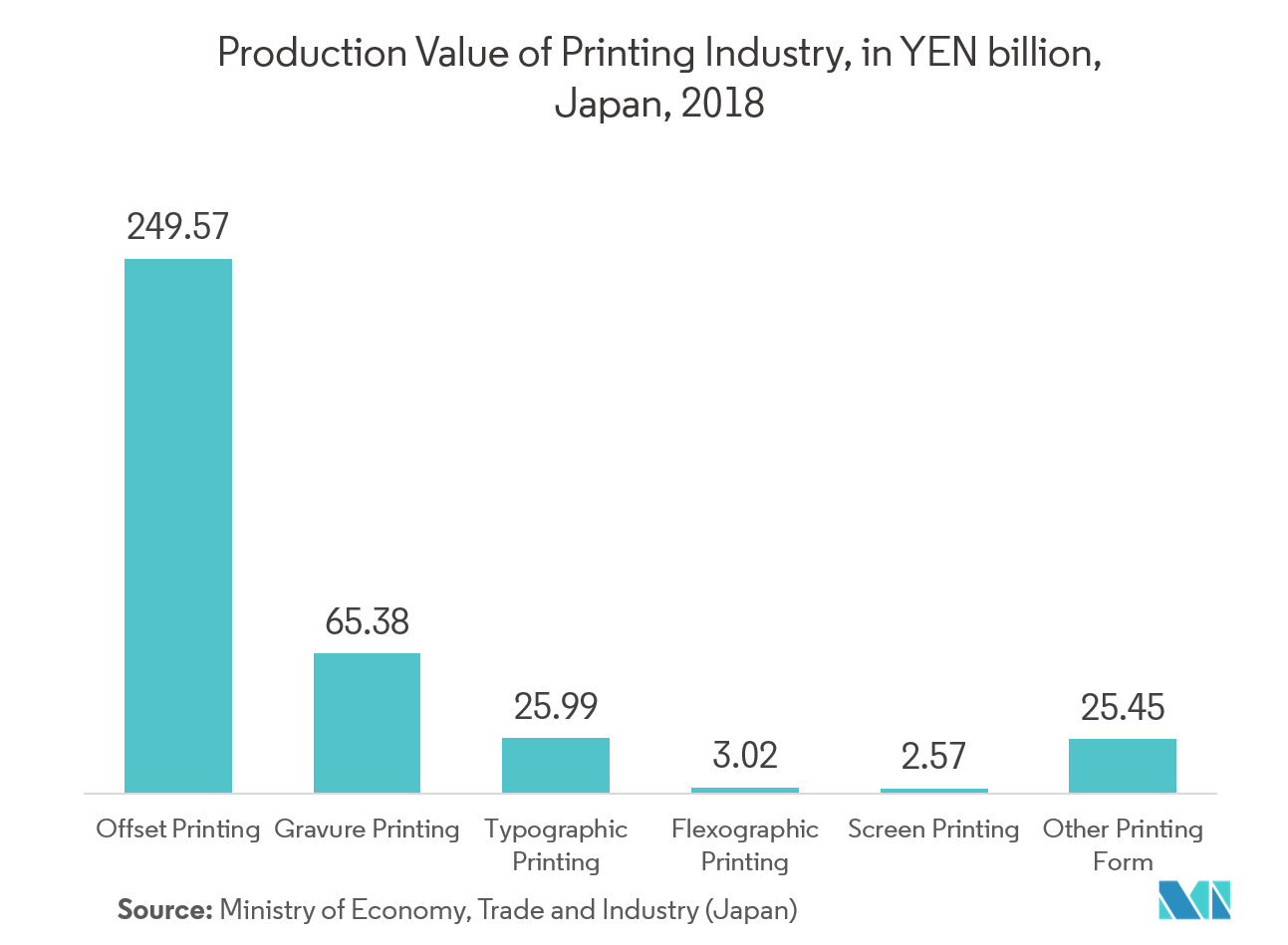

Offset Printing Holds the Significant Share in The Market

- The offset printing press process is used in all kinds of printing from the high, medium and low range for the varied range of applications. For many small and medium-sized printing companies, the 50 x 70 cm format is the ideal fit for their product range, especially for commercial and packaging print.

- Many packaging printers in the pharmaceutical and cosmetics segment in particular use the 50 x 70 format, which offers benefits for small folding carton sizes and a high level of embellishments, as well as short runs. However, some companies are upgrading the new design to enhance its user-friendliness. For instance, in Aug 2019, Heidelberg launches a new ergonomic design for its Speedmaster XL 75 and CX 75 offset presses to modernized the new concept design.

- Moreover, one of the most approachable trends for 2018 for offset printers is the hybrid press, which is at the intersection of the digital and offset print process. Offset printers can digitize much of the print process through the use of computers.

- For instance, in Nov 2019, New Heidelberg Versafire and Prinect Digital Frontend Version 2020 introduced flexible application options, particularly in conjunction with offset printing, where the sheets can be pre-printed in offset and then at the desired position added to the digital prints. This makes a fully flexible hybrid production of digital and offset possible and the advantages of both printing processes can be optimally exploited.

- In Japan, the production value of offset printing shows high growth year to year. Japan Printing and Graphics provides high quality, offset printing with many different styles and finishes to meet its business needs. Moreover, various firms of Japan are expanding their business by enhancing network distribution for product to improve the technology. For instance, in Jan 2019, on the eve of the PrintPack India 2019 exhibition, Provin, a distributor of equipment for offset press, held a press conference where they gave a demo of Miyakoshi (printing machinery firm of Japan) Intermittent narrow web offset press MLP-13C 5 color with two flexo units.

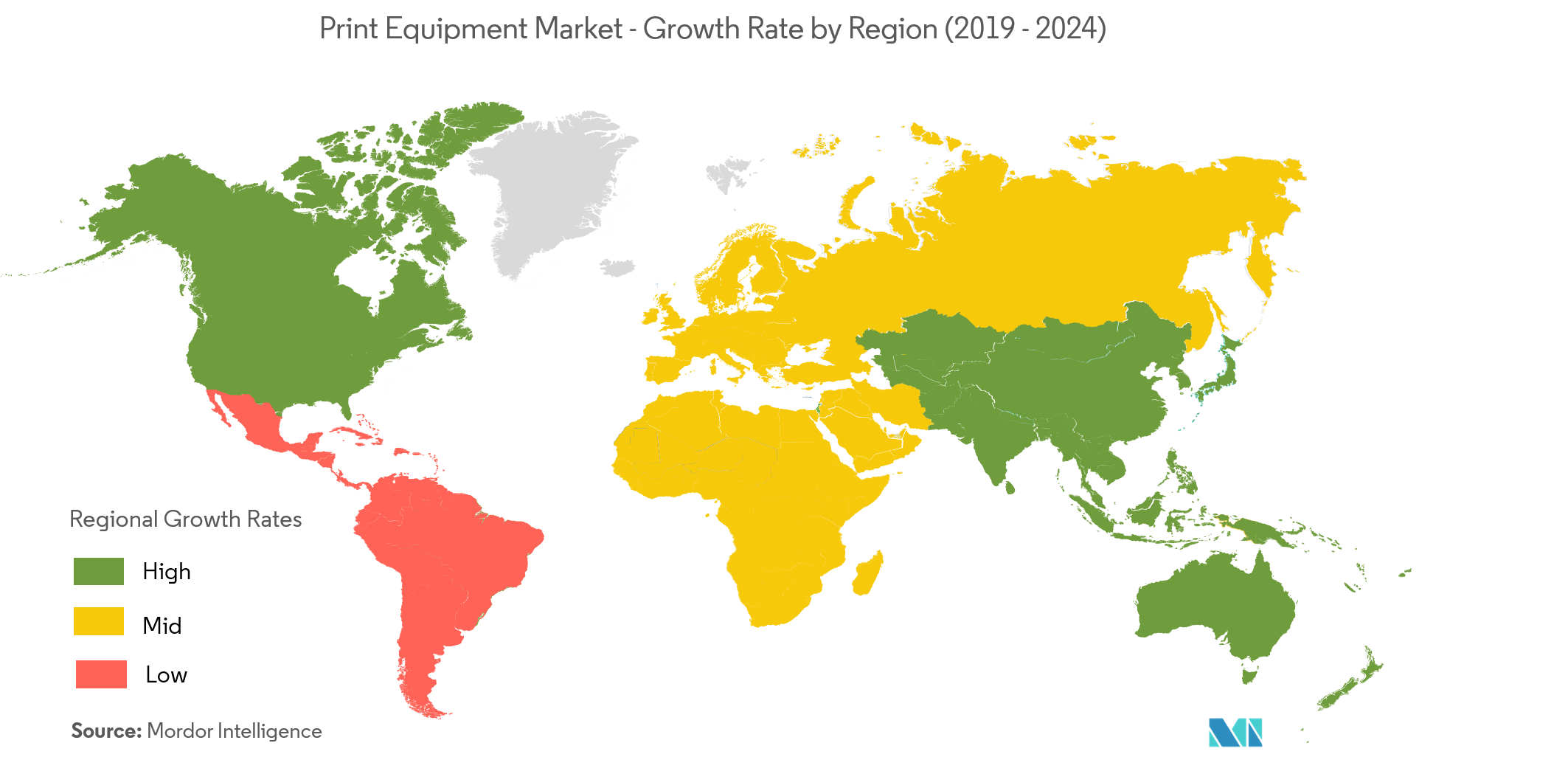

Asia-Pacific Expected to be the Fastest Growing Region

- Asia-Pacific is expected for the major growth in the market as various firms are investing in these regions due to high end-user demand along with more development opportunities in packaging printing.

- For instance, Bobst to show the latest solutions and services at Labelexpo Asia 2019, China. The company will illustrate its new Master DM5 hybrid press, the digitally automated machine for the label market. This will illustrate new technologies and opportunities for converters, driven by the digital revolution and drive the growth of hybrid press in this region.

- Moreover, Xeikon, a leading global innovator of digital printing technology, will also present its latest innovations at Labelexpo Asia 2019. After a highly successful Labelexpo Europe in September of this year and equally successful attendance at Printing United in Dallas in the US in October, Xeikon is committed to reaching out to the printers and converters in Asia Pacific. The reason behind attending Labelexpo Asia is to help and guide the region’s potential customers who are looking to enter new markets such as food labels or labels for wines, spirits, health & beauty, and pharmaceuticals.

- Also, Asian companies are expanding their business in other Asian countries. For instance, in March 2019, MPS Systems located in Malaysia expanded their business in China with company name Arisen Printing Equipment for establishing MPS flexo, offset, and digital-hybrid printing presses. In China, the company will service both flexo and gravure printing industries. Moreover in Malaysia, the company shifted to a new location in Bukit Jelutongto where they planned to open a technology center to feature live demonstrations of the EF flexo press with full automation. This will enhance the market growth in these countries.

Print Equipment Industry Overview

The print equipment market is fragmented in nature and the rivalry in the market is increasing from both local and global players due to the technology advancement in the printing segment. Key players are Mark Andy Inc., BOBST, etc. Recent developments in the market are -

- April 2019 -HP announced the new HP Stitch S series, a portfolio of digital textile printers which can deliver fast, precise color-matching, alongside efficient, simplified processes. It is HP’s latest innovation is designed to accelerate commercial digital print adoption.

- Nov 2019 - CEAD, a Netherlands-based provider of large-scale, composite 3D printing, and Siemensare expanding on existing collaboration and will be jointly presenting their latest development of AM Flexbot.The new AM Flexbot is controlled by Siemens’ technology. It integrates Sinumerik CNC with Run MyRobot/Direct Control as well as a Comau robot arm and CEAD’s single screw extruder unit. The hybrid machine, with both additive and CNC components, can build parts up and achieve higher precision by milling the print down to its final dimensions.

Print Equipment Market Leaders

-

Mark Andy Inc.

-

BOBST

-

KOMORI Corporation

-

Windmoller & Holscher

-

Barry-Wehmiller

*Disclaimer: Major Players sorted in no particular order

Print Equipment Market News

January 2021 - Epson, a prominent player in digital imaging and printing solutions announced the launch of its first-ever industrial level Direct-to-Garment printer, the Epson SureColor SCF3030. The product is a robust direct-to-garment (DTG) printer that was primarily designed for higher productivity. The company also stated that this printer was targeted toward garment screen printers, e-commerce customers, drop-shipment jobbers, and new start-ups that are engaged in the personalized T-shirt printing business as it offers a lower total cost of ownership for the medium/large garments and T-shirt manufacturers.

February 2021 - Japanese giant Canon announced the launch of seven new ink tank printers at a starting price of INR 11,048, to expand its PIXMA G Series line-up in India. These new PIXMA G Series printers include the drip-free, hands-free ink refilling mechanism, and a user-replaceable maintenance cartridge that was designed to ensure minimum downtime and maximum productivity for homes and businesses. The company also stated that all the printers may be made available across prominent e-commerce platforms and authorized retailers starting from mid-February.

Print Equipment Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Introduction of 3D Printing

- 4.3.2 Increasing Investment in the Packaging Printing Machinery

-

4.4 Market Restraints

- 4.4.1 High Cost Incurred on the Implementation of Printing Structure

- 4.5 Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Types

- 5.1.1 Digital

- 5.1.2 Offset

- 5.1.3 Flexo

- 5.1.4 Other Types

-

5.2 By Application

- 5.2.1 Packaging

- 5.2.2 Publication

- 5.2.3 Commercial

- 5.2.4 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Mark Andy Inc.

- 6.1.2 BOBST

- 6.1.3 KOMORI Corporation

- 6.1.4 Windmoller & Holscher

- 6.1.5 Barry-Wehmiller

- 6.1.6 Landa Corporation

- 6.1.7 SPG Prints

- 6.1.8 Rotatek Printing Machinery

- 6.1.9 Comexi Group

- 6.1.10 Heidelberger Druckmaschinen AG

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityPrint Equipment Industry Segmentation

The global printing market is gaining momentum due to technological advancements such as digital enhancements of equipment, evolving software tools and automation in printing. Rising demand for packaged goods means that packaging and label printing are two of the few growth sectors in print demand and other end users supporting the growth are the publication and other commercial segments.

| By Types | Digital |

| Offset | |

| Flexo | |

| Other Types | |

| By Application | Packaging |

| Publication | |

| Commercial | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Print Equipment Market Research FAQs

What is the current Print Equipment Market size?

The Print Equipment Market is projected to register a CAGR of 2.20% during the forecast period (2024-2029)

Who are the key players in Print Equipment Market?

Mark Andy Inc., BOBST, KOMORI Corporation, Windmoller & Holscher and Barry-Wehmiller are the major companies operating in the Print Equipment Market.

Which is the fastest growing region in Print Equipment Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Print Equipment Market?

In 2024, the North America accounts for the largest market share in Print Equipment Market.

What years does this Print Equipment Market cover?

The report covers the Print Equipment Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Print Equipment Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Print Equipment Industry Report

The global printing equipment market is categorized by types such as digital, offset, and flexo, with applications spanning packaging, publication, and other commercial uses. The market is segmented geographically into North America, Asia-Pacific, Europe, the Middle East and Africa, and South America. The market analysis provides insights into market trends and market growth, offering a comprehensive market overview and market outlook. The market forecast includes an industry overview and industry outlook, detailing market predictions and market segmentation.

Industry analysis and industry research highlight the market leaders and their market share, while industry statistics and industry size give a clear picture of the market value. The report example and report PDF provide an in-depth market review and market data, supported by industry reports and industry information.

The industry trends and market growth rate are crucial for understanding the market dynamics. The industry sales and market value are also discussed, providing a complete market analysis. Research companies contribute to the industry research, ensuring the accuracy of the market forecast.

This comprehensive report includes a sample of this industry analysis as a free report PDF download, offering valuable insights into the market segmentation and market predictions. The industry outlook and market data are essential for stakeholders to make informed decisions.