Printed Sensor Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.62 % |

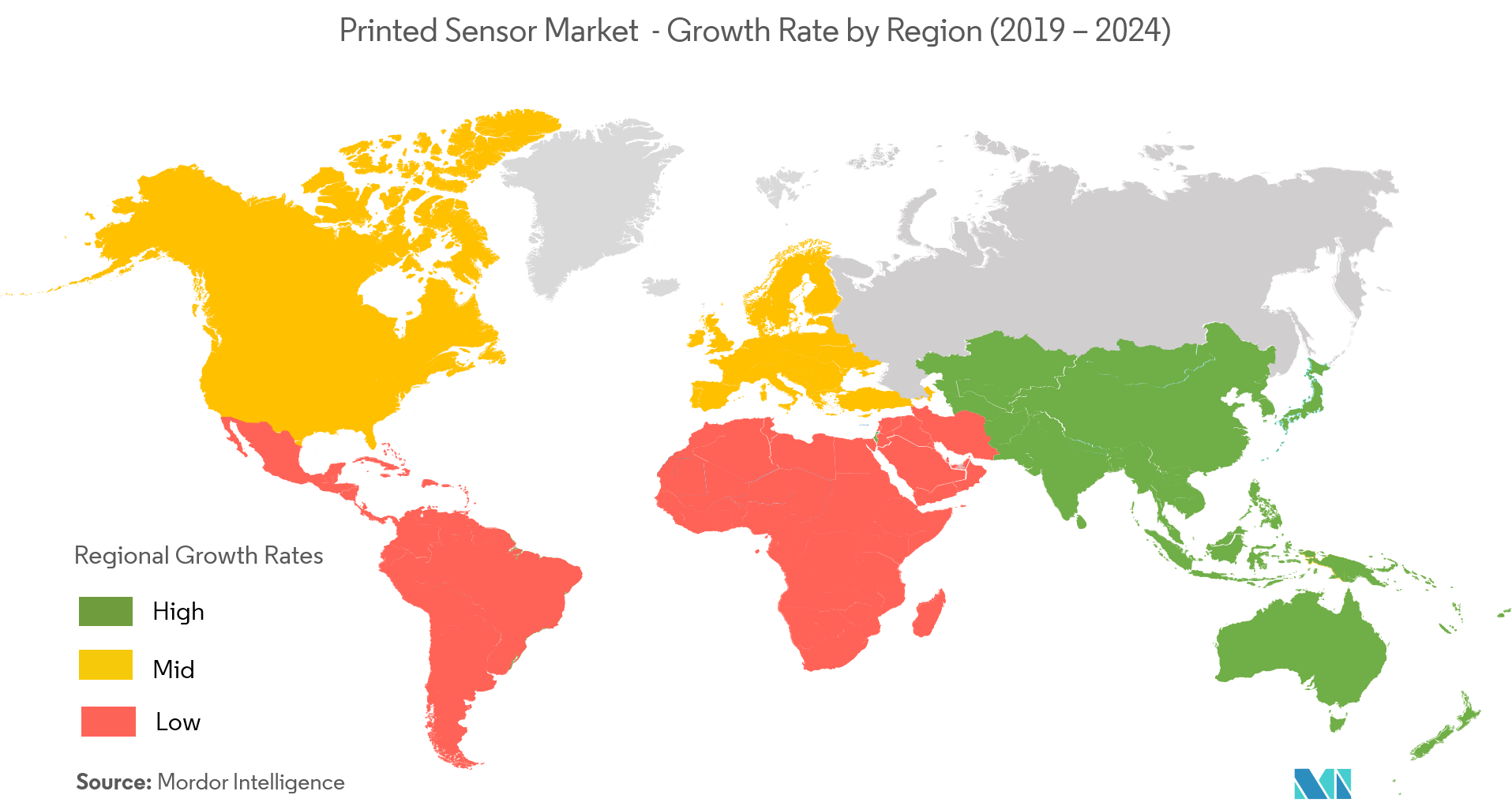

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

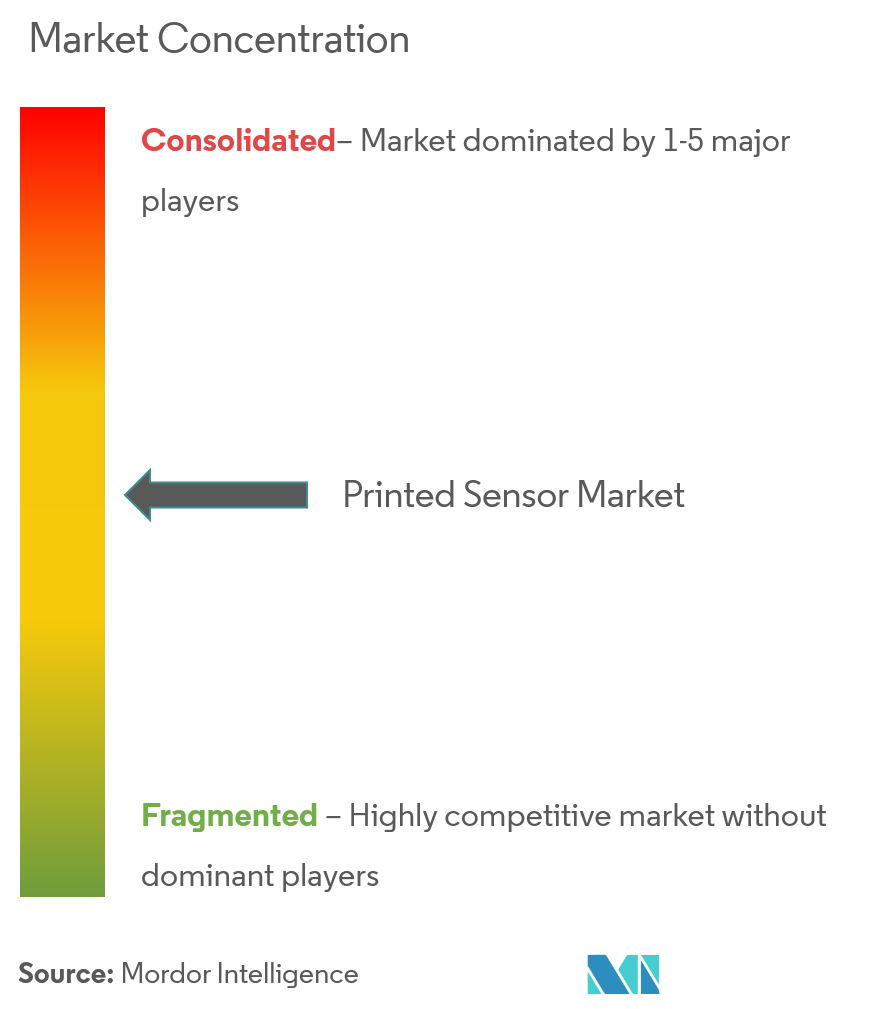

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Printed Sensor Market Analysis

The printed sensor market was valued at USD 8.63 billion in 2020, at a CAGR of 6.62% during the forecast period of 2021 - 2026. The printed sensors technology costs less and can be manufactured on a large scale, providing high economies of scale to manufacturers. High demand from smart packaging is another factor driving the growth of the market. Smart packaging helps easier tracking and reduced packaging costs.

- The manufacturers of the printed sensor will have low input costs due to the achievement of economies of trade. Due to the constant design, the manufacturers can achieve economies of trade and thus reducing the cost and maximizing the profit margin.

- Since printed electronics are thin, lightweight, flexible and yet robust, they can be integrated very well into packaging, either during production or as an affixed e-label. This drives the adoption rate of the printed sensor in the smart packaging industry.

- The initial setup of the manufacturing of printed sensors need substantial investment due to the high equipment technology. This acts as a restraint as the high investment costs acts as a barrier for small manufacturers.

Printed Sensor Market Trends

This section covers the major market trends shaping the Printed Sensor Market according to our research experts:

Consumer Electronics is Expected to Hold Major Market Share

- Printed sensors and arrays offer capabilities in the Consumer Electronics that are unavailable in traditional silicon sensor systems. Printed devices tend to allow for more flexible form factors due to their low profiles and bendable substrates. The material cost can also be reduced by combining the sensors with the measurement system on a single substrate.

- Due to the miniaturizations of devices, the compact form factor is preferred in consumer electronics. Printed sensors can solve these issues with their slim design profile and bendable form factor, as well as their extremely fast responses to stimuli.

- New form factors such as flexible displays, batteries and solar allow consumer electronics companies to differentiate their products compared to the usual rigid box design of electronics.

Asia-Pacific is Expected to Hold Largest Market Share

Printed Sensor Industry Overview

The printed sensor market consists of several players. In terms of market share, none of the players currently dominate the market. The market is being viewed as a lucrative investment opportunity due to the attractive earnings that can be generated from it.

- November 2019- FlexEnable has acquired Merck’s portfolio of best-in-class, high-performance Organic Thin-Film Transistor (OTFT) materials, including revolutionary and highly-patented organic semiconductors and dielectrics. The acquisition of Merck’s OTFT materials includes over 300 patents covering materials, processes, and devices. This brings FlexEnable's total number of organic electronics patents to over 1,000.

- July 2019 -Isorgand Sumitomo Chemical, a global leader in OPD materials production and other fields,had made anagreement to develop new OPD products for use as smartphone fingerprint sensors and hybrid organic-CMOS image sensors.

Printed Sensor Market Leaders

-

FlexEnable Limited

-

Renesas Electronics Corporation

-

Canatu Oy

-

Butler Technologies

-

ISORG

*Disclaimer: Major Players sorted in no particular order

Printed Sensor Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

-

4.5 Technology Snapshot

- 4.5.1 Inkjet Printing

- 4.5.2 Screen Printing

- 4.5.3 Flexographic Printing

- 4.5.4 Other Printing Technologies

5. MARKET SEGMENTATION

-

5.1 By End-User Industry

- 5.1.1 Consumer Electronics

- 5.1.2 Healthcare

- 5.1.3 Industrial

- 5.1.4 Automotive and Transportation

- 5.1.5 Other End-user Industries

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 FlexEnable Limited

- 6.1.2 ISORG SA

- 6.1.3 Plastic Logic HK Ltd.

- 6.1.4 Renesas Electronics Corporation

- 6.1.5 Butler Technologies Inc.

- 6.1.6 Canatu Oy

- 6.1.7 KWJ Engineering inc. (SPEC Sensors LLC)

- 6.1.8 Peratech Holdco Limited

- 6.1.9 Pressure Profile Systems Inc.

- 6.1.10 T+Ink Inc. (IDTechEx Ltd.)

- 6.1.11 Tekscan Inc.

- 6.1.12 Thin Film Electronics ASA.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityPrinted Sensor Industry Segmentation

The printed sensor works with the development of printed sensors, investigation of the physical properties of ink and substrate interaction as well as RFID technology and system integration. The main manufacturing method is ink-jet printing, but flexo and screen printing are also used . The inks used are mostly nano-particle inks.

| By End-User Industry | Consumer Electronics |

| Healthcare | |

| Industrial | |

| Automotive and Transportation | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Printed Sensor Market Research FAQs

What is the current Printed Sensor Market size?

The Printed Sensor Market is projected to register a CAGR of 6.62% during the forecast period (2024-2029)

Who are the key players in Printed Sensor Market?

FlexEnable Limited, Renesas Electronics Corporation, Canatu Oy, Butler Technologies and ISORG are the major companies operating in the Printed Sensor Market.

Which is the fastest growing region in Printed Sensor Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Printed Sensor Market?

In 2024, the North America accounts for the largest market share in Printed Sensor Market.

What years does this Printed Sensor Market cover?

The report covers the Printed Sensor Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Printed Sensor Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Printed Sensor Industry Report

Statistics for the 2024 Printed Sensor market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Printed Sensor analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.