Proactive Security Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 14.00 % |

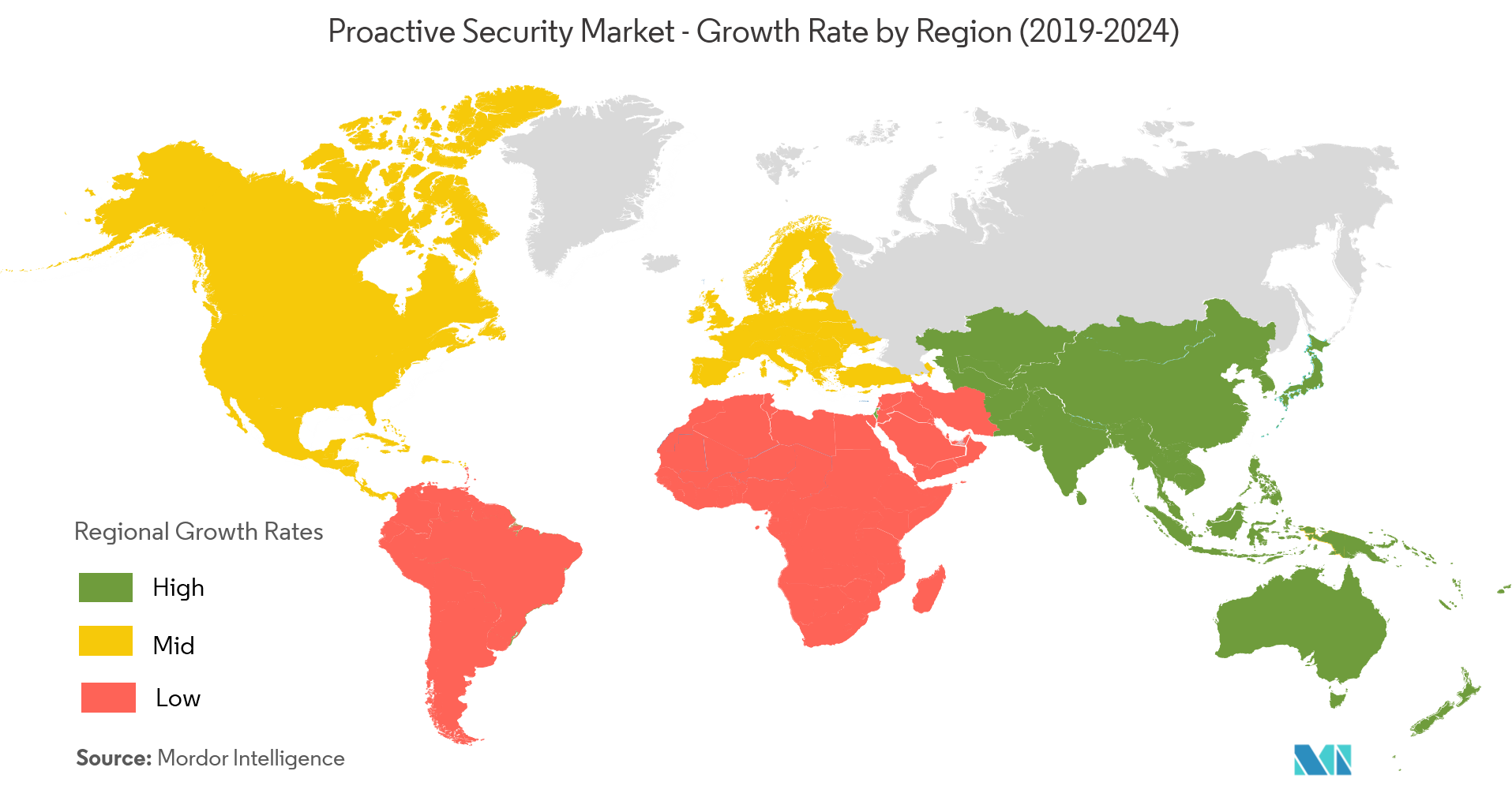

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Proactive Security Market Analysis

The proactive security market was valued at USD 20.81 million in 2020 and is expected to reach USD 45.67 million by 2026, at a CAGR of 14% over the forecast period 2021 - 2026. Businesses are integrating proactive approach, in which they act to prevent any dangers before they occur. A large number of enterprises are thus opting for proactive security solutions over reactive security solutions.

- Evolving data breaches leading to high costs of recovery and increasing number of connected devices across enterprises, owing to BYOD trend and IoT implementation, have encouraged enterprises to shift from reactive to proactive security solutions.

- With enterprises undergoing a digital transformation, stringent regulations, like GDPR, PCI DSS, and others, are being imposed to safeguard IT systems from data breaches. Regulations and compliances mandate enterprises to adopt effective security solutions, and thereby support the growth of proactive security solutions.

- The need for proactive security is, furthermore, expected to be complemented by the increasing number of security breaches, cyber-attacks. In addition to this, increasing penetration of cloud technology will boost the demand for proactive security.

Proactive Security Market Trends

This section covers the major market trends shaping the Proactive Security Market according to our research experts:

BFSI Sector Expected to Grow at a Significant Rate

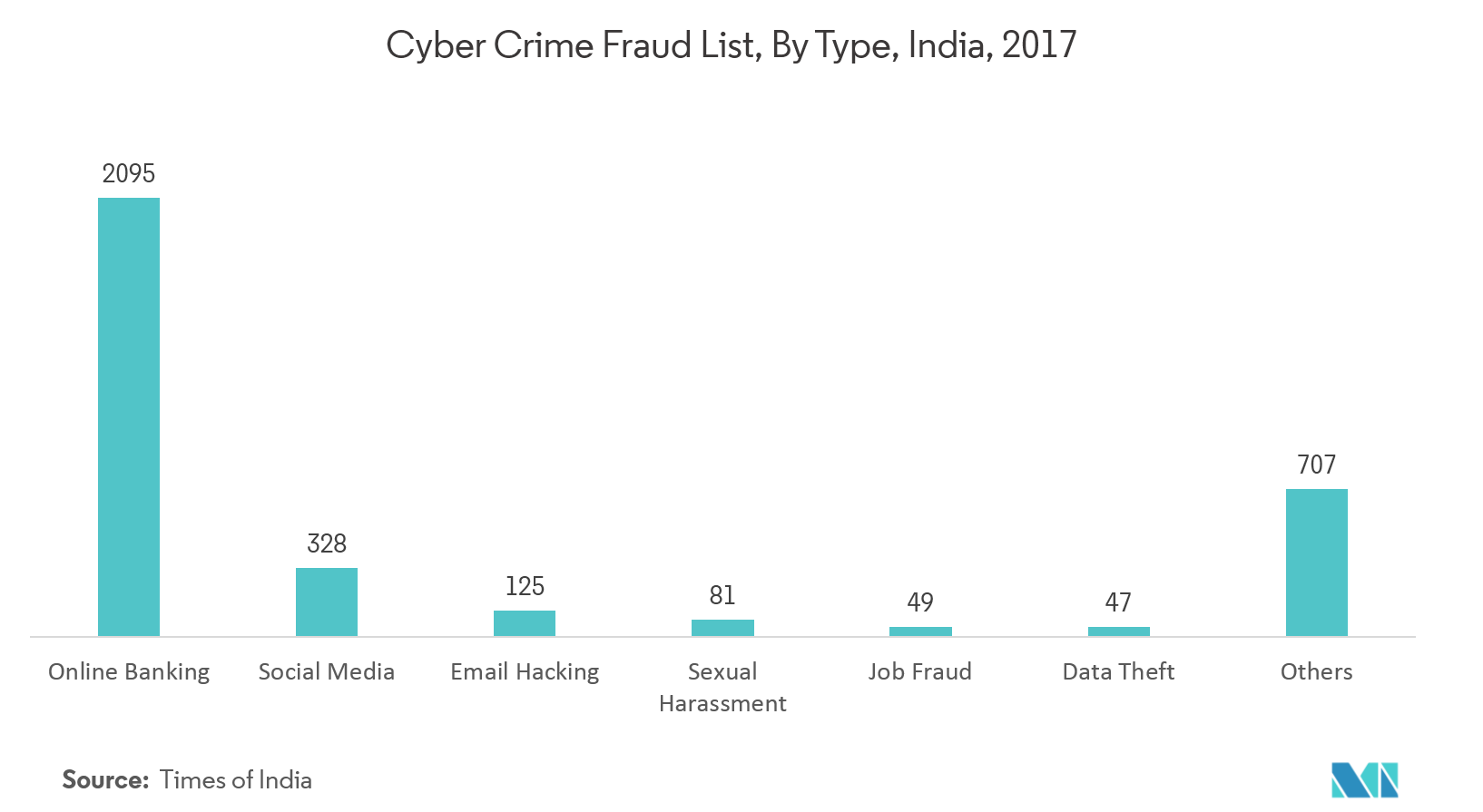

- The BFSI is the fastest-growing vertical in the proactive security market, as BFSI companies have stringent legal and regulatory compliances associated with information security. Small and Medium-sized Enterprises (SMEs) continue to deploy proactive security solutions, as SMEs are increasingly facing malware-based and DNS-based cyber-attacks.

- The number of cyber-attacks against financial services companies, according to data from the Financial Conduct Authority (FCA), increased by more than 80%, in 2018. Considering that cyber-attacks have a direct impact on the churn rate, the financial service providers are expected to strengthen their security solutions.

- Banks and other financial service providers are actively adopting proactive security solutions, to defend their IT assets and data from malware and ransomware. Apart from the regular initiatives like encryption, solutions, such as advanced malware protection, security analytics, vulnerability management, among others, the security providers are well equipped to deal with the advanced vulnerability system in order to safeguard the BFSI industry.

North America Expected to Account for the Largest Market Share

- The increasing need for organizations to protect their data from advanced cyber-attacks and addressing the stringent government regulations are expected to drive the proactive security market across the region.

- Security vendors across North America Region are offering proactive security solutions via security analytics, AMP, security monitoring, attack simulation, security orchestration, and risk & vulnerability management. As the frequency of security breaches has increased tremendously over the past 5 years, organizations have increased their IT security investments to protect against advanced threats.

- Further, the growing adoption of cloud-based solutions & services among enterprises is expected to provide significant growth opportunities thereby fueling the demand of proactive security solution during the forecast period across the North America.

Proactive Security Industry Overview

The proactive security market is highly competitive and consists of prominent players. In terms of market share, some of the major players currently dominate the market. However, with the advancement in the security services, new players are increasing their market presence thereby expanding their business footprint across the emerging economies.

- May 2019 -Cygilantannounced that it has joined the AT&T Cybersecurity Partner Program to help AlienVault USM Anywhere customers with managed security services.As a part of AT&T Cybersecurity’s program, Cygilant assigns dedicated Cybersecurity Advisors who become familiar with a customer’s systems, processes, compliance requirements, and security goals.

- March 2019 - RSAunveiled the newest version of its market-leading SIEM, RSA NetWitnessPlatform, which features machine learning models based on deep endpoint observations to rapidly detect anomalies in user's behavior to uncover evolving threats. This announcement furthers RSA's strategy to help customers take a unified, phased approach to manage digital risk, an ever-increasing challenge faced by organizations with ambitious digital transformation initiatives.

Proactive Security Market Leaders

-

Oracle Corp.

-

FireEye Inc.

-

IBM Corp.

-

RSA Security LLC (Dell Technologies)

-

Rapid7 Inc.

*Disclaimer: Major Players sorted in no particular order

Proactive Security Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Rising Trend of BYOD and IoT Adoption across Enterprises

- 4.3.2 Stringent Government Regulations to Safeguard the Enterprise Data

-

4.4 Market Restraints

- 4.4.1 Lack of Skilled Cybersecurity Professionals

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

5. MARKET SEGMENTATION

-

5.1 By Size of the Organization

- 5.1.1 Large Enterprise

- 5.1.2 Small and Medium Enterprise

-

5.2 By Solution

- 5.2.1 Advanced Malware Protection (AMP)

- 5.2.2 Security Monitoring and Analytics

- 5.2.3 Vulnerability Assessment

- 5.2.4 Other Solutions

-

5.3 By End-user Industry

- 5.3.1 IT & Telecommunication

- 5.3.2 BFSI

- 5.3.3 Retail

- 5.3.4 Industrial

- 5.3.5 Government & Defence

- 5.3.6 Other End-user Industries

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Australia

- 5.4.3.4 Japan

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Oracle Corp.

- 6.1.2 FireEye Inc.

- 6.1.3 IBM Corp.

- 6.1.4 RSA Security LLC (Dell Technologies)

- 6.1.5 Rapid7 Inc.

- 6.1.6 Cygilant Inc.

- 6.1.7 Qualys Inc.

- 6.1.8 Trustwave Holdings Inc.

- 6.1.9 AlienVault Inc. (AT&T Cybersecurity)

- 6.1.10 ThreatConnect Inc.

- 6.1.11 FireMon LLC.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityProactive Security Industry Segmentation

A proactive security approach is used for prevention against major cybersecurity incidents before they actually happen. With the adoption of proactive security solutions, organizations can effectively maintain and secure their critical information from data breaches. Proactive security solutions help organizations optimize their security infrastructure, easily manage security vulnerabilities, and control all their security products from a single platform. The proactive security program that encompasses prudent practices, such as content monitoring and filtering of electronic communications among others, will help ensure the security, confidentiality, and compliance with regulations that mandate the protection of sensitive information.

| By Size of the Organization | Large Enterprise | |

| Small and Medium Enterprise | ||

| By Solution | Advanced Malware Protection (AMP) | |

| Security Monitoring and Analytics | ||

| Vulnerability Assessment | ||

| Other Solutions | ||

| By End-user Industry | IT & Telecommunication | |

| BFSI | ||

| Retail | ||

| Industrial | ||

| Government & Defence | ||

| Other End-user Industries | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| Australia | ||

| Japan | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Mexico |

| Brazil | ||

| Rest of Latin America | ||

| Geography | Middle-East & Africa |

Proactive Security Market Research FAQs

What is the current Proactive Security Market size?

The Proactive Security Market is projected to register a CAGR of 14% during the forecast period (2024-2029)

Who are the key players in Proactive Security Market?

Oracle Corp., FireEye Inc., IBM Corp., RSA Security LLC (Dell Technologies) and Rapid7 Inc. are the major companies operating in the Proactive Security Market.

Which is the fastest growing region in Proactive Security Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Proactive Security Market?

In 2024, the North America accounts for the largest market share in Proactive Security Market.

What years does this Proactive Security Market cover?

The report covers the Proactive Security Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Proactive Security Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Proactive Security Industry Report

Statistics for the 2024 Proactive Security market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Proactive Security analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.