Proactive Security Industry Overview

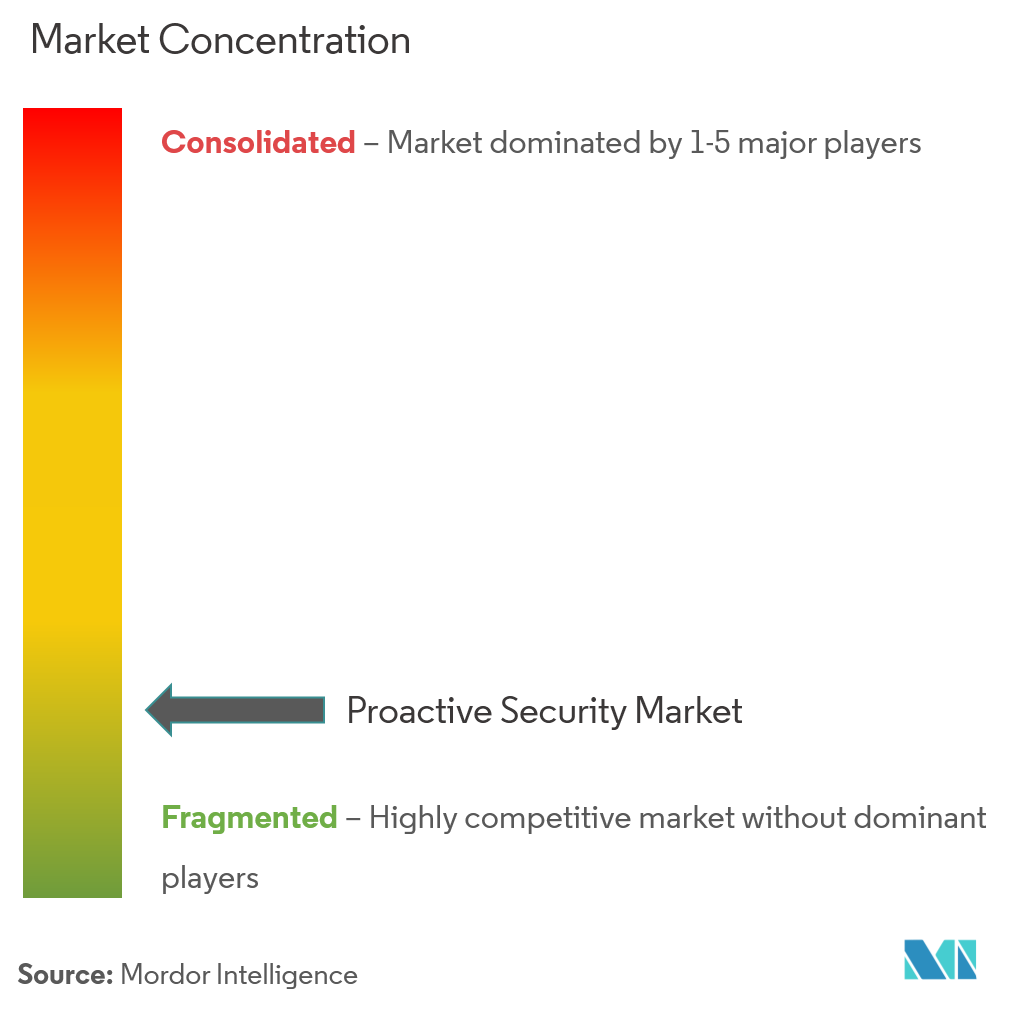

The proactive security market is highly competitive and consists of prominent players. In terms of market share, some of the major players currently dominate the market. However, with the advancement in the security services, new players are increasing their market presence thereby expanding their business footprint across the emerging economies.

- May 2019 -Cygilantannounced that it has joined the AT&T Cybersecurity Partner Program to help AlienVault USM Anywhere customers with managed security services.As a part of AT&T Cybersecurity’s program, Cygilant assigns dedicated Cybersecurity Advisors who become familiar with a customer’s systems, processes, compliance requirements, and security goals.

- March 2019 - RSAunveiled the newest version of its market-leading SIEM, RSA NetWitnessPlatform, which features machine learning models based on deep endpoint observations to rapidly detect anomalies in user's behavior to uncover evolving threats. This announcement furthers RSA's strategy to help customers take a unified, phased approach to manage digital risk, an ever-increasing challenge faced by organizations with ambitious digital transformation initiatives.

Proactive Security Market Leaders

-

Oracle Corp.

-

FireEye Inc.

-

IBM Corp.

-

RSA Security LLC (Dell Technologies)

-

Rapid7 Inc.

- *Disclaimer: Major Players sorted in no particular order