Residential Induction Cooktops Market Size

| Study Period | 2020 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.00 % |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Europe |

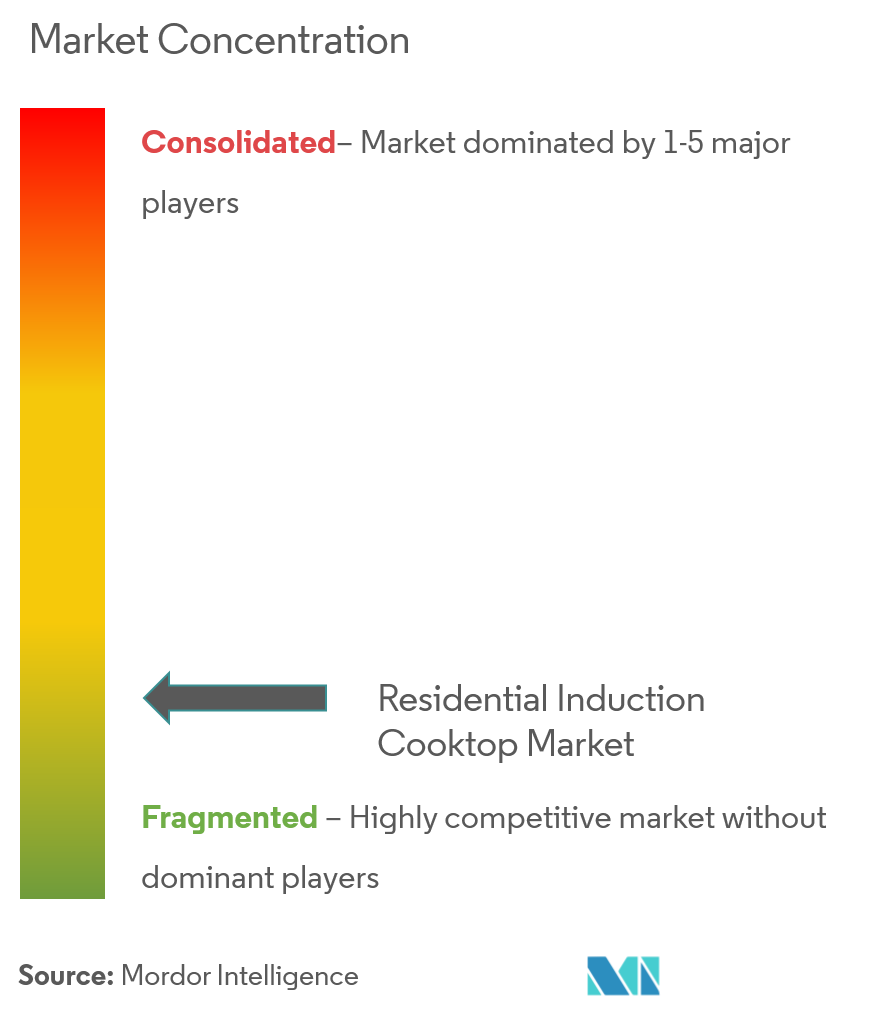

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Residential Induction Cooktops Market Analysis

The residential Induction Cooktops Market is expected to achieve a CAGR of 6% during the forecast period. The demand for household induction cooktops is high among the urban population, especially in developing nations, due to factors such as high purchasing power, better infrastructural facilities, and an increase in the working population. The rise in fuel prices for conventional gas cooktops and the growth in the trend for modular kitchens, along with the comfort and safety benefits to users, are the major factors that drive the household induction cooktops market.

The persisting COVID-19 pandemic had an impact on the global household induction cooktop market. Consumer electronics demand has been affected by the closure of firms and the cessation of economic activities. Furthermore, China, as one of the biggest manufacturers of electronic components and the hub of the viral spread, caused supply chain and international trade disruptions, limiting market development. However, the normalization of key players' day-to-day operations and the relaxation of rules and regulations imposed by governments in various countries were expected to boost the market during the forecast period.

Household induction cooktops have become more prominent in developing countries due to the rise in the working population and their purchasing power. The use of modular kitchens and the inflation of fuel prices have triggered people to choose an alternative to traditional cookware. An increase in safety and security measures to safeguard people from any fire accidents also hikes up the demand for induction cooktops. The focus on high-tech products and easy-to-use cookware has gained prominence over the years. Various residential construction projects have been on the rise, and people prefer installing induction cooktops more than any other traditional cooking equipment. All these factors are looked at as key drivers for household induction cooktop market growth.

Residential Induction Cooktops Market Trends

Sustainability and Energy Efficiency is Driving the Market Growth

The energy efficiency of induction cooktops is one of the most attractive characteristics of this cooking method. Induction cooktops are one of the most energy-efficient appliances, with the energy consumed transferred to the food, compared to electric and gas cooktops.

Buyers will appreciate that these cooktops use less energy, which is better for the climate and could even lower electric bills. And more potential buyers are putting energy efficiency at the top of their wish lists when it comes to homes, with buyers considering it a key desirable feature.

As a result, converting LPG stoves to induction stoves can be one of the policy alternatives used by the government of Indonesia to achieve energy sustainability and minimize carbon emissions.

Increasing Demand of Induction Cooktops for Home Cooking is Anticipated to Drive the Market

According to the Brazilian Journal of Nutrition, more than half of the participants in a study of 1,005 people said they cooked more frequently after the pandemic than before.

In addition, the rising need for energy efficiency and low operating costs is also fostering the market growth of induction cooktops. For instance, according to the IOP Conference Series on Materials Science and Engineering, electrical energy now dominates household energy demand, which is expected to increase by 50 percent by 2050.

Residential Induction Cooktops Industry Overview

The report covers major international players operating in the residential induction cooktop market. In terms of market share, a few of the major players currently dominate the market. The residential induction cooktop market is intensely competitive and characterized by the presence of numerous regional and global vendors. The rising number of new vendors will strengthen the competitive environment of the market. These vendors are increasingly competing against each other based on factors such as product quality, technology, product pricing, and product portfolio. Large companies compete through volume purchasing, breadth of products, and effective merchandising and marketing. Small companies focus on a market segment and compete through the depth of their products and superior customer service. Companies including LG Electronics, Inc., Whirlpool Corporation, Panasonic Corporation, Koninklijke Philips N.V., and Robert Bosch GmbH, among others, have a strong presence in the market.

Residential Induction Cooktops Market Leaders

-

LG Electronics, Inc.

-

Whirlpool Corporation

-

Panasonic Corporation

-

Koninklijke Philips N.V.

-

Robert Bosch GmbH,

*Disclaimer: Major Players sorted in no particular order

Residential Induction Cooktops Market News

- In January 2023: Preethi lanced a new product Prestige Iris 2.0 Induction Cooktop 2023. This product by Prestige Iris comes under the best overall category for satisfactory performance across features like auto-off settings, multiple preset menus, ease of use, safety, looks, and variable time settings

- In August 2022: Kent RO Systems Ltd., headquartered in India, launched the Kent Jewel induction cooktop with a power consumption capacity of 2000 watts. In addition, it features eight pre-set menus, including fry, curry, keep warm, roti, water, soup, rice, and milk boiling

Residential Induction Cooktops Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Drivers

- 4.3 Restraints

- 4.4 Market Opportunities

- 4.5 Value Chain Analysis of the Residential Induction Cooktop Market

-

4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Built-In Induction Cooktops

- 5.1.2 Free-Standing and Portable Induction Cooktops

-

5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Specialty Stores

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Mexico

- 5.3.2.3 Other South American Countries

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Other European Countries

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 Japan

- 5.3.4.3 India

- 5.3.4.4 Other Asia-Pacific Countries

- 5.3.5 Middle East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Other Middle Eastern and African Countries

6. COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

-

6.2 COMPANY PROFILES

- 6.2.1 LG Electronics, Inc.

- 6.2.2 Whirlpool Corporation

- 6.2.3 Panasonic Corporation

- 6.2.4 Koninklijke Philips N.V.

- 6.2.5 TTK Prestige Ltd

- 6.2.6 Sub-Zero Group, Inc.

- 6.2.7 Electrolux Group

- 6.2.8 Robert Bosch GmbH

- 6.2.9 Miele Group

- 6.2.10 SMEG S.p.A.

- 6.2.11 Other Companies (Daewoo Electronics Corporation, Fisher & Paykel Appliances Holdings Ltd., Glen Dimplex Home Appliances Ltd.,, Videocon Industries Limited, Bajaj Electricals Ltd, Haier Group, Morphy Richards, Inalsa Appliances, Kenwood Limited, and Butterfly Gandhimathi Appliances Limited)*

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. DISCLAIMER AND ABOUT US

** Subject To AvailablityResidential Induction Cooktops Industry Segmentation

Automation and automatic operations of household kitchen appliances are high in demand among customers in developing nations, busy lifestyles and sophistication in daily lifestyle activities are the two key factors leading to the adoption of automated induction cooktops. A complete background analysis of the residential induction cooktop market, which includes an assessment of the parental market, emerging trends by segments and regional markets, significant changes in market dynamics, and a market overview, is covered in the report. The residential induction cooktop market is segmented by type (built-in induction cooktops, free-standing induction cooktops, and portable induction cooktops), by end-user (residential and commercial), and by geography (North America, Europe, Asia-Pacific, South America, and the Middle East and Africa). The report offers market size and forecast values for the Residential Induction Cooktops Market in USD billion for the above segments.

| By Type | Built-In Induction Cooktops | |

| Free-Standing and Portable Induction Cooktops | ||

| By Distribution Channel | Supermarkets/Hypermarkets | |

| Specialty Stores | ||

| Online | ||

| Other Distribution Channels | ||

| Geography | North America | United States |

| Canada | ||

| Geography | South America | Brazil |

| Mexico | ||

| Other South American Countries | ||

| Geography | Europe | Germany |

| France | ||

| United Kingdom | ||

| Other European Countries | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Other Asia-Pacific Countries | ||

| Geography | Middle East & Africa | United Arab Emirates |

| Saudi Arabia | ||

| South Africa | ||

| Other Middle Eastern and African Countries |

Residential Induction Cooktops Market Research FAQs

What is the current Residential Induction Cooktops Market size?

The Residential Induction Cooktops Market is projected to register a CAGR of 6% during the forecast period (2024-2029)

Who are the key players in Residential Induction Cooktops Market?

LG Electronics, Inc., Whirlpool Corporation, Panasonic Corporation, Koninklijke Philips N.V. and Robert Bosch GmbH, are the major companies operating in the Residential Induction Cooktops Market.

Which is the fastest growing region in Residential Induction Cooktops Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Residential Induction Cooktops Market?

In 2024, the Europe accounts for the largest market share in Residential Induction Cooktops Market.

What years does this Residential Induction Cooktops Market cover?

The report covers the Residential Induction Cooktops Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Residential Induction Cooktops Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Residential Induction Cooktops Industry Report

Statistics for the 2023 Residential Induction Cooktops market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Residential Induction Cooktops analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.