Residential Washing Machine Market Size

| Study Period | 2020-2029 |

| Base Year For Estimation | 2023 |

| Market Size (2024) | USD 49.01 Billion |

| Market Size (2029) | USD 70.53 Billion |

| CAGR (2024 - 2029) | 7.55 % |

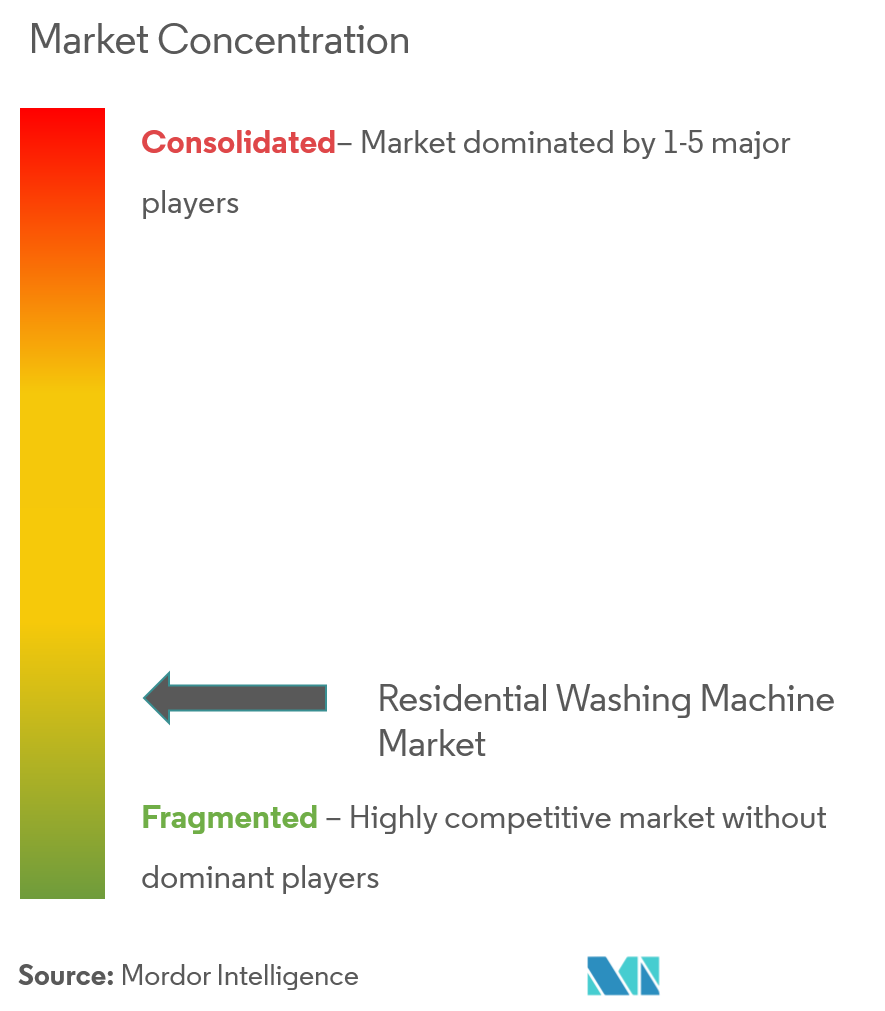

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Residential Washing Machine Market Analysis

The Residential Washing Machine Market size is estimated at USD 49.01 billion in 2024, and is expected to reach USD 70.53 billion by 2029, growing at a CAGR of 7.55% during the forecast period (2024-2029).

The residential washing machine market encompasses a wide range of products designed for home use, including top-load and front-load washers and washer-dryer combinations. This market is driven by increasing disposable income, urbanization, and changing lifestyles, leading to higher demand for convenient and efficient laundry solutions.

There has been a growing trend toward energy-efficient and water-saving washing machines as consumers become more environmentally conscious. Manufacturers also focus on developing smart washing machines that offer features such as remote monitoring and control via smartphone apps, further enhancing user convenience.

The residential washing machine market is competitive, led by several significant market players vying for market share. Innovation in technology and design and competitive pricing strategies drive competition in this market. Additionally, after-sales service and brand reputation significantly influence consumer purchasing decisions.

Residential Washing Machine Market Trends

Significant Consumer Demand for Fully Automatic Machine

The demand for fully automatic washing machines has surged in the residential market due to their convenience and user-friendly nature, requiring less manual effort than semi-automatic models. These machines are offered in top-load and front-load designs, appealing to a broad spectrum of consumer preferences.

The demand for fully automatic washing machines can be due to various factors, such as increasing disposable incomes, which have led consumers to be more willing to invest in appliances that offer convenience and time savings. The growing trend toward nuclear families and dual-income households has increased the demand for appliances that can help reduce the time and effort required for household chores. Technological advancements have led to the development of more efficient and feature-rich fully automatic washing machines, further driving their popularity among consumers.

Asia-Pacific Region is Dominating the Market

The Asia-Pacific region is a dominating market for washing machines, driven by rapid urbanization, increasing disposable incomes, and changing lifestyles. Countries like China, India, Japan, and South Korea are significant contributors to the growth of the washing machine market in this region.

The Asia-Pacific region has recently shifted toward energy-efficient and smart washing machines. Consumers are increasingly looking for appliances that offer convenience, efficiency, and advanced features. Manufacturers are introducing innovative products that meet these demands.

Asia-Pacific is also witnessing a rise in online sales of washing machines, driven by the growing popularity of e-commerce platforms. Online sales offer consumers a more comprehensive range of products to choose from, as well as the convenience of shopping from home.

Residential Washing Machine Industry Overview

The residential washing market is highly fragmented, with a large number of manufacturers existing in the market. Technological advancement and product innovations help companies differentiate among their products and compete to occupy a significant market share. Provide seasonal discounts and referral rewards and collaborate with complementary local businesses. Some existing players are LG Electronics Inc., Whirlpool Corporation, Electrolux AB, and Panasonic Corporation.

Residential Washing Machine Market Leaders

-

LG Electronics Inc.

-

Whirlpool Corporation

-

Haier Group Corporation

-

Electrolux AB

-

Panasonic Corporation

*Disclaimer: Major Players sorted in no particular order

Residential Washing Machine Market News

- May 2023: Super Plastronics Pvt. Ltd invested USD 240 million in a washing machine plant in Noida, India. The company is the brand licensee for several international electronics companies and invested in the washing machine segment of Thompson, which entered the Indian washing machine market in 2020.

- March 2023: Haier introduced new washing machines that are manufactured in India, expanding its range of home appliances. Priced at INR 43,000 (USD 518.63), the washing machines offer smart laundry solutions and come in capacities ranging from 8 kg to 9 kg. They include features such as anti-scaling technology, a bionic magic filter, and a 3D rolling wash, with a lineup of 60 models.

Residential Washing Machine Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increasing Urbanization Raising Sales of Residential Washing Machines

- 4.2.2 Increasing Demand for Convenience

-

4.3 Market Restraints

- 4.3.1 Supply Chain Disruptions with Rising Geopolitical Tensions

- 4.3.2 Environmental Concern and High Power Consumption

-

4.4 Market Opportunities

- 4.4.1 Increasing Demand for Smart Features in Residential Washing Machines

-

4.5 Industry Attractiveness - Porters' Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in Residential Washing Machine Market

- 4.7 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Front Load

- 5.1.2 Top Load

-

5.2 By Technology

- 5.2.1 Fully-automatic

- 5.2.2 Semi-automatic

-

5.3 By Distribution Channel

- 5.3.1 Multibrand Stores

- 5.3.2 Exclusive Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

-

5.5 North America

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

-

5.6 Europe

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Russia

- 5.6.5 Italy

- 5.6.6 Spain

- 5.6.7 Rest of Europe

-

5.7 Asia-Pacific

- 5.7.1 India

- 5.7.2 China

- 5.7.3 Japan

- 5.7.4 Australia

- 5.7.5 Rest of Asia-Pacific

-

5.8 South America

- 5.8.1 Brazil

- 5.8.2 Argentina

- 5.8.3 Rest of South America

-

5.9 Middle East and Africa

- 5.9.1 United Arab Emirates

- 5.9.2 South Africa

- 5.9.3 Rest of Middle East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

-

6.2 Company Profiles

- 6.2.1 LG Electronics Inc.

- 6.2.2 Whirlpool Corporation

- 6.2.3 Haier Group Corporation

- 6.2.4 Electrolux

- 6.2.5 Panasonic

- 6.2.6 BSH Home Appliances Group

- 6.2.7 IFB Industries Ltd

- 6.2.8 Samsung

- 6.2.9 Hitachi

- 6.2.10 Toshiba*

- *List Not Exhaustive

7. MARKET FUTURE TREND

8. DISCLAIMER AND ABOUT US

** Subject To AvailablityResidential Washing Machine Industry Segmentation

A residential washing machine is an appliance used for washing laundry in homes and other residential units. They provide domestic units with an easy and convenient way of washing laundry. Rising innovations are making these machines automatic and energy-efficient for households to use. The residential washing machine market is segmented by type, technology, distribution channel, and geography. By type, the market is segmented into front load and top load. By technology, the market is segmented into fully automatic and semi-automatic. By distribution channel, the market is segmented into multi-brand stores, exclusive stores, online, and other distribution channels (local dealers). By geography, the market is segmented into North America, Europe, Asia-Pacific, Latin America, the Middle East and Africa, and the Rest of the world. The report also covers the market sizes and forecasts for the residential washing machine market in value (USD) for all the above segments.

| By Type | Front Load |

| Top Load | |

| By Technology | Fully-automatic |

| Semi-automatic | |

| By Distribution Channel | Multibrand Stores |

| Exclusive Stores | |

| Online | |

| Other Distribution Channels | |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America | |

| Europe | United Kingdom |

| Germany | |

| France | |

| Russia | |

| Italy | |

| Spain | |

| Rest of Europe | |

| Asia-Pacific | India |

| China | |

| Japan | |

| Australia | |

| Rest of Asia-Pacific | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Middle East and Africa | United Arab Emirates |

| South Africa | |

| Rest of Middle East and Africa |

Residential Washing Machine Market Research Faqs

How big is the Residential Washing Machine Market?

The Residential Washing Machine Market size is expected to reach USD 49.01 billion in 2024 and grow at a CAGR of 7.55% to reach USD 70.53 billion by 2029.

What is the current Residential Washing Machine Market size?

In 2024, the Residential Washing Machine Market size is expected to reach USD 49.01 billion.

Who are the key players in Residential Washing Machine Market?

LG Electronics Inc., Whirlpool Corporation, Haier Group Corporation, Electrolux AB and Panasonic Corporation are the major companies operating in the Residential Washing Machine Market.

What years does this Residential Washing Machine Market cover, and what was the market size in 2023?

In 2023, the Residential Washing Machine Market size was estimated at USD 45.31 billion. The report covers the Residential Washing Machine Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Residential Washing Machine Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Residential Washing Machine Industry Report

Statistics for the 2024 Residential Washing Machine market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Residential Washing Machine analysis includes a market forecast outlook for 2024 to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.