RF Power Semiconductor Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 13.25 % |

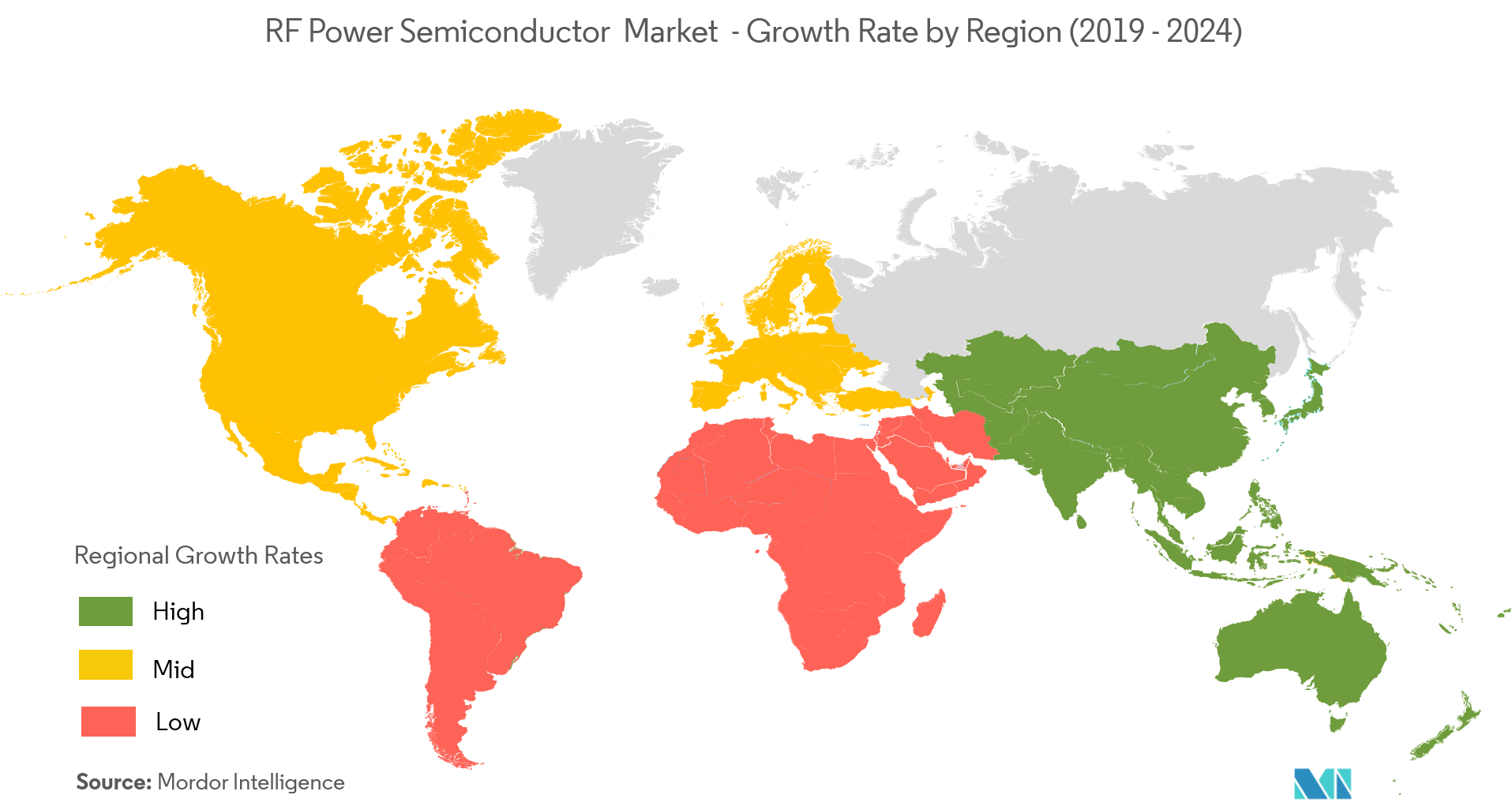

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

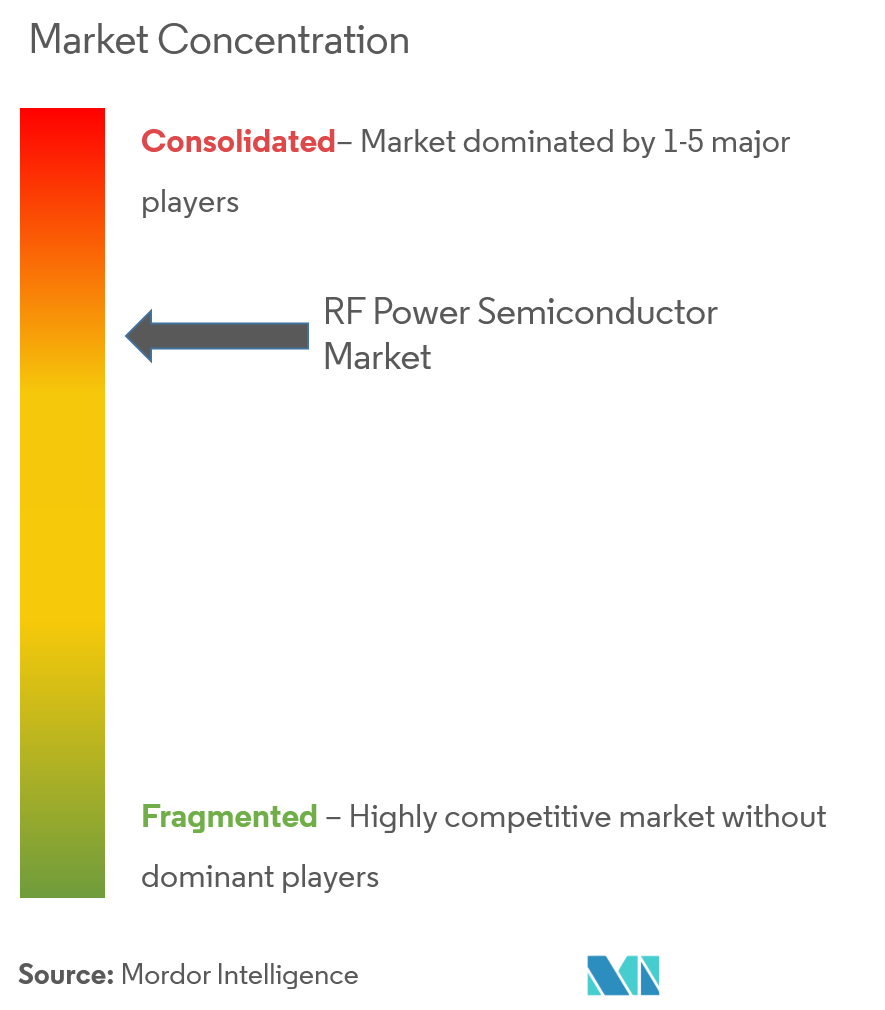

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

RF Power Semiconductor Market Analysis

The RF power semiconductor market is expected to register a CAGR of 13.25%, during the forecast period (2021 - 2026). The growing adoption of RF power semiconductors in smartphones and usage of 5G is one of the major factor growing the demand. With the increase in the need for higher data rates and greater spectral efficiency, the demand for high-speed mobile broadband internet is increasing. This has led to the implementation of LTE, which is further expected to boost the expansion of the RF power market.

- The growing adoption of effective management solutions in the power industry is also attracting many vendors to innovate sector oriented products. This is further expanding the scope for RF power semiconductor devices. For instance, Cadence Design Systems, Inc. announced that it had enhanced the Cadence Voltus IC Power Integrity Solution with an extensively parallel (XP) algorithm option employing distributed processing technology for power grid signoff at advanced-node process technologies.

- The rising trend of digitalization and increase in smart city projects in various countries across the world is also creating potential opportunities for the growth of the RF power semiconductor market. Increase in usage of RF power devices in various lighting applications is also driving growth in the global RF power market.

- However, issues related to the high cost of RF power due to improved performance are estimated to challenge the growth of the market. For instance, in October 2018, Cree, Inc announced that it has signed a strategic long-term agreement to produce and supply its Wolfspeed silicon carbide wafers to one of the world's leading power device companies.

RF Power Semiconductor Market Trends

This section covers the major market trends shaping the RF Power Semiconductor Market according to our research experts:

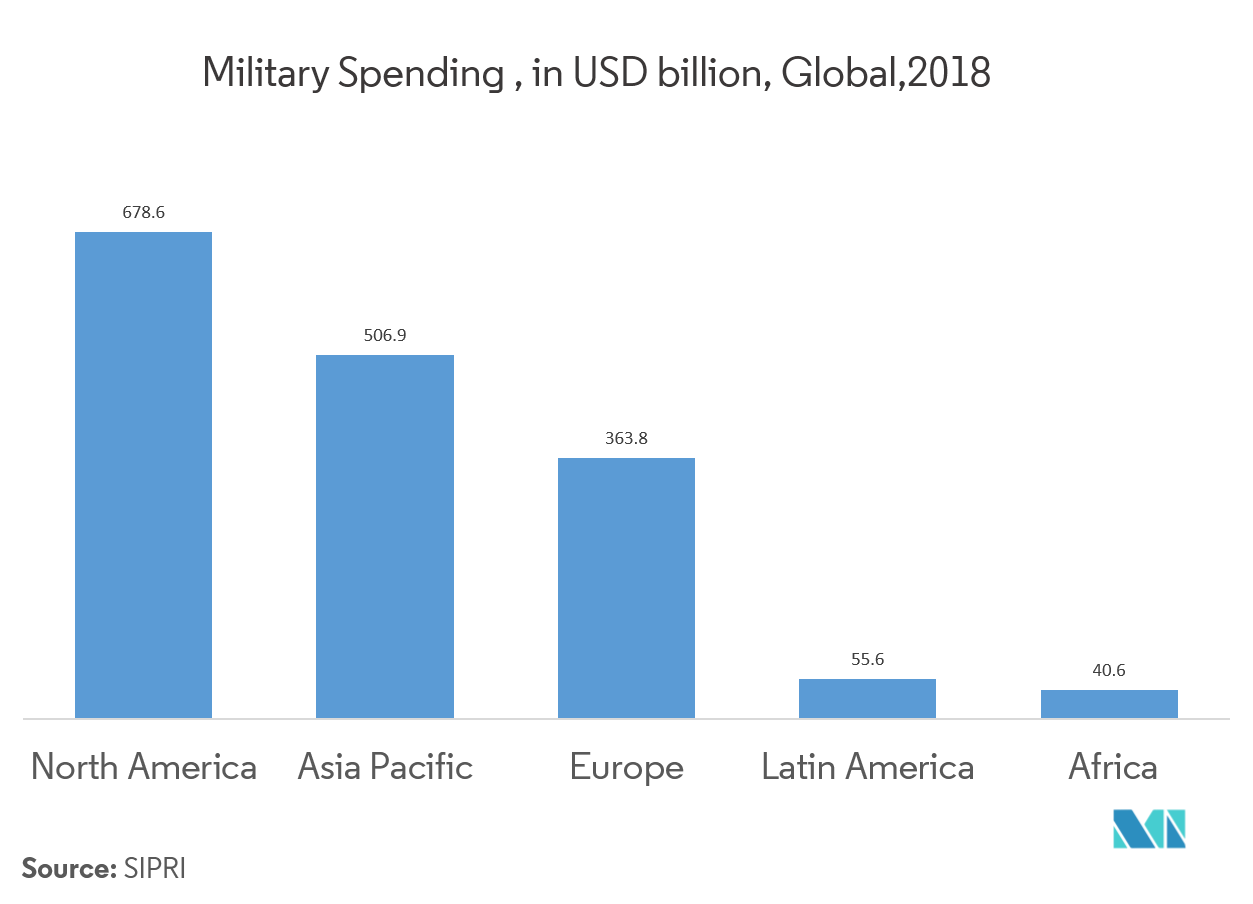

Aerospace and Defense Sector to Offer Potential Growth Opportunities

- The modernization of defense equipment has led to the requirement for high-power semiconductor devices, such as GaN RF and LDMOS devices. ICs used in radar boards incorporate GaN that enables efficient navigation, facilitate collision avoidance, and enable real-time air traffic control.

- RF power amplifiers used in the radar systems are low on power and performance. The bandwidth performance and efficiency of RF power devices are substantially higher and thus, are used in the radars deliver higher performance in terms of power and radar range. This reduces the number of radar systems required to monitor the same perimeter, thereby cutting cost. Thus, the demand for RF power devices is set to grow in the defense sector during the forecast period.

- Moreover, rising focus of the Europe Space Agency (ESA) on the increased usage of GaN across space projects and the use of GaN-based transistors in the military and defense sectors will help the RF power market to gain traction over the forecast period.

Asia-Pacific is Expected to Occupy a Significant Share in RF Power Semiconductor Market

- Asia-Pacific’s established electronics industry and the adoption of innovative technologies have provided organizations in the region a competitive edge in the market.

- Increasing production of electric vehicles in Asia-Pacific is expected to drive the demand for RF GaN, which in turn, may boost the market for RF power in the region. China is the largest maker of electric vehicles. In 2018, it sold 28,081,000, including buses and commercial vehicles, according to the China Association of Automobile Manufacturers.

- Increase in demand for better cellular networks from China, India, South Korea, Taiwan, and Malaysia and the increasing production of semiconductor devices will drive the market’s growth prospects in this region.

- According to Ericsson, the estimated number of smartphone subscription is maximum in Asia-Pacific (excluding China and India) with USD 1575 million in Q1 2018. This adoption rate will drive RF device manufacturers to develop high-performance RF filters that can cater to the needs of smartphone and tablet OEMs, thus further stimulating the market growth in this region.

RF Power Semiconductor Industry Overview

The RF power semiconductor market is consolidated. Major market share is occupied by top players in the market. Moreover, the manufacturing cost of making RF power semiconductors is high which makes the new player difficult toenter the market. Some of the key players includeAnalog DevicesInc.,Aethercomm Inc., CreeInc.,Mitsubishi Electric Corporation,NXP Semiconductors NV,Qorvo Inc.,STMicroelectronics NV, among others.

- June 2019 -NXP Semiconductors N.V.unveiled one of the industry’s most integrated portfolio of RF solutions for 5G cellular infrastructure, industrial and commercial markets. Building on its strong legacy, disruptive R&D, world-class manufacturing and global presence, NXP’s comprehensive suite of solutions exceed today’s 5G RF power amplification demands for base stations--from MIMO to massive MIMO based active antenna systems for cellular and Millimeter Wave (mmWave) spectrum bands.

- May 2019 -As part of its long-term growth strategy, Cree, Inc.announcedit will invest up to USD 1 billion in the expansion of its silicon carbide capacity with the development of a state-of-the-art, automated 200mm silicon carbide fabrication facility and a materials mega factory at its U.S. campus headquarters in Durham, N.C. It markedthe company’s largest investment to date in fueling its Wolfspeed silicon carbide and GaN on silicon carbide business. Upon completion in 2024, the facilities will substantially increase the company’s silicon carbide materials capability and wafer fabrication capacity, allowing wide bandgap semiconductor solutions that enable the dramatic technology shifts underway within the automotive, communications infrastructure and industrial markets.

RF Power Semiconductor Market Leaders

-

Cree Inc.

-

Mitsubishi Electric Corporation

-

NXP Semiconductors NV

-

Qualcomm Inc.

-

Analog Devices Inc.

*Disclaimer: Major Players sorted in no particular order

RF Power Semiconductor Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increasing Usage of Smartphones

- 4.2.2 Growing Transition toward 5G and Long-term Evolution (LTE) Implementation

-

4.3 Market Restraints

- 4.3.1 High Cost of RF Power

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Technology

- 5.1.1 LDMOS

- 5.1.2 GaAs

- 5.1.3 GaN

-

5.2 By Application

- 5.2.1 Telecom Infrastructure

- 5.2.2 Aerospace and Defense

- 5.2.3 Wired Broadband

- 5.2.4 Satellite Communication

- 5.2.5 RF Energy (Automotive)

- 5.2.6 Other Applications

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 South Korea

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle-East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Aethercomm Inc.

- 6.1.2 Analog Devices Inc.

- 6.1.3 Cree Inc.

- 6.1.4 M/A-COM Technology Solutions Holdings Inc.

- 6.1.5 Mitsubishi Electric Corporation

- 6.1.6 NXP Semiconductors NV

- 6.1.7 Qorvo Inc.

- 6.1.8 Qualcomm Inc.

- 6.1.9 Murata Manufacturing Co. Ltd

- 6.1.10 STMicroelectronics NV

- 6.1.11 Toshiba Corporation

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityRF Power Semiconductor Industry Segmentation

A radio frequency power semiconductor is a device that can be utilized as a switch or rectifier in power electronics. The RF power semiconductor is designed to work in the radio frequency spectrum, which is about 3KHz up to 300GHz.Depending upon the various application, RF power semiconductor can be used in different technologies.

| By Technology | LDMOS | |

| GaAs | ||

| GaN | ||

| By Application | Telecom Infrastructure | |

| Aerospace and Defense | ||

| Wired Broadband | ||

| Satellite Communication | ||

| RF Energy (Automotive) | ||

| Other Applications | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| India | ||

| South Korea | ||

| Japan | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle-East & Africa |

RF Power Semiconductor Market Research FAQs

What is the current RF Power Semiconductor Market size?

The RF Power Semiconductor Market is projected to register a CAGR of 13.25% during the forecast period (2024-2029)

Who are the key players in RF Power Semiconductor Market?

Cree Inc., Mitsubishi Electric Corporation, NXP Semiconductors NV, Qualcomm Inc. and Analog Devices Inc. are the major companies operating in the RF Power Semiconductor Market.

Which is the fastest growing region in RF Power Semiconductor Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in RF Power Semiconductor Market?

In 2024, the Asia Pacific accounts for the largest market share in RF Power Semiconductor Market.

What years does this RF Power Semiconductor Market cover?

The report covers the RF Power Semiconductor Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the RF Power Semiconductor Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

RF Power Semiconductor Industry Report

Statistics for the 2024 RF Power Semiconductor market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. RF Power Semiconductor analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.