APAC RFID Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Market Size (2024) | USD 5.11 Billion |

| Market Size (2029) | USD 7.06 Billion |

| CAGR (2024 - 2029) | 6.68 % |

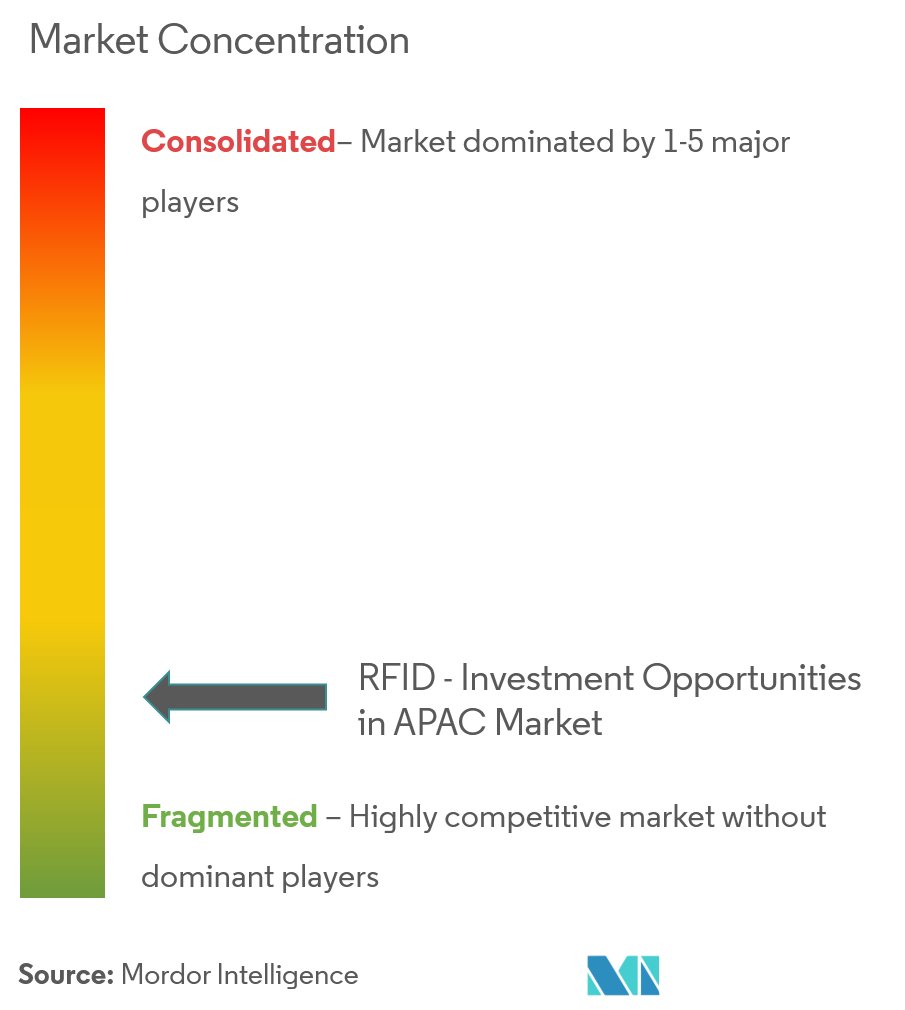

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

APAC RFID Market Analysis

The RFID Investment Opportunities in APAC Market size is estimated at USD 5.11 billion in 2024, and is expected to reach USD 7.06 billion by 2029, growing at a CAGR of 6.68% during the forecast period (2024-2029).

Technological advancements have led to new approaches within the RFID technology like microprocessors with 5.8 GHz tags for smart cards and chipless IDs that enable contactless communication even in the absence of a silicon chip.

- The RFID technology has emerged as a low-cost alternative for RFID system and has the potential to penetrate mass markets for low-cost item tagging, considering the high cost of silicon RFID transponders compared to optical barcodes.

- The APAC region is forecasted to be the greatest user of RFID technology and will witness strong growth in RFID revenues owing to increasing opportunities of RFID applications in countries such as India, China, Japan, South Korea and Taiwan.

- For instance, The Institute of Electrical and Electronics Engineers (IEEE) estimated that by 2020, more than 50 billion objects would be networked, of which many will use chipless RFID.

- The government support and initiatives for the use of Radio Frequency Identification (RFID) technology across various industrial verticals such as national ID cards and transportation, in addition increasing acceptance of RFID technology by private players has also added strong potential to RFID market.

- Many alternate labelling methods are being developed like linear barcoding and 2D data matrix barcoding, which hamper the growth of RFID. GS1 logistics label is the latest example which is used in the serial shipping container.

APAC RFID Market Trends

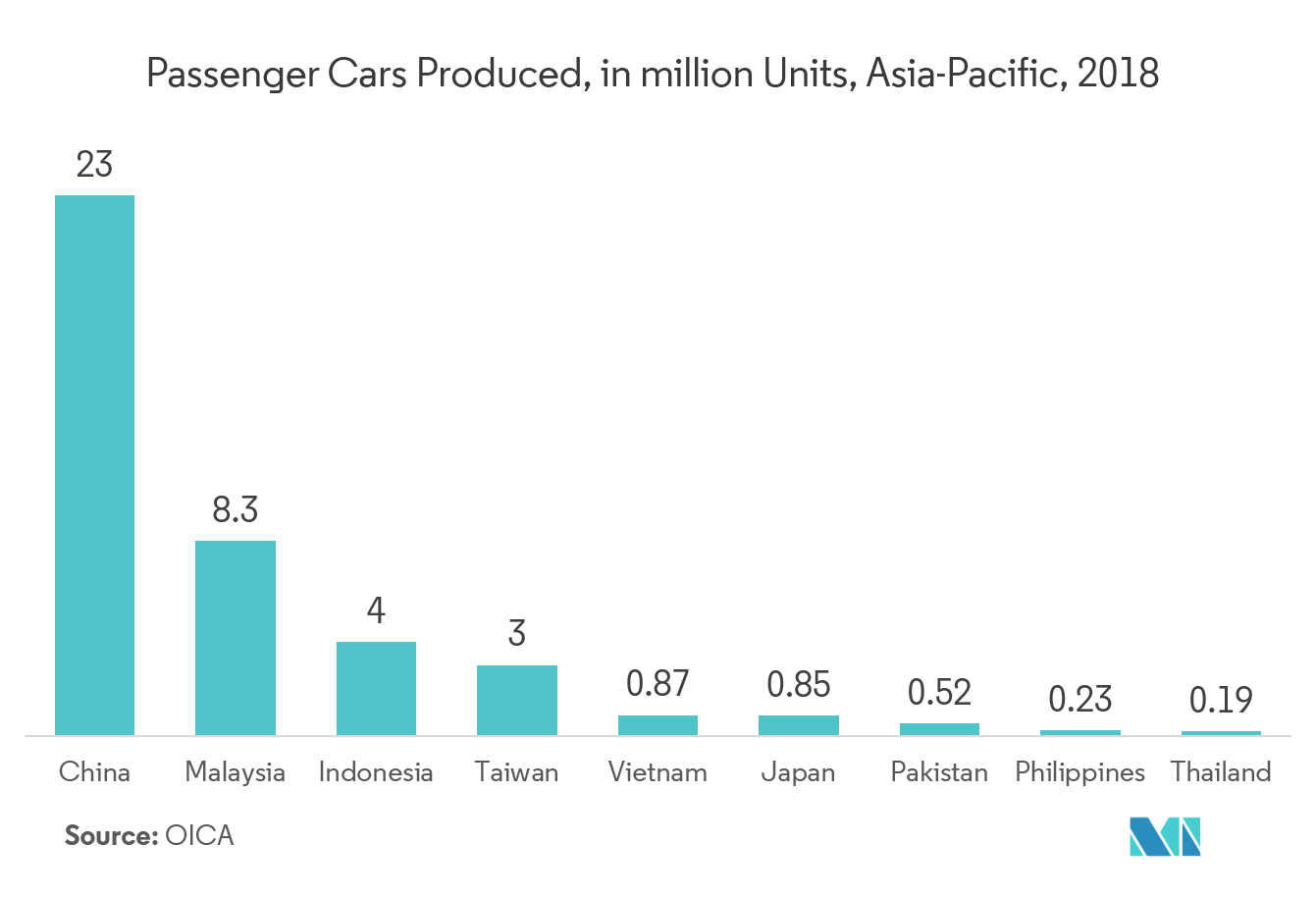

Application in Automotive to Account for a Significant Share in APAC

- The innovative things are happening regularly in the automotive industry during the closing decade. Also, we are witnessing the products that are being developed have already been blended on by new smart new digital and engineering technology.

- The RFID tag provides a building or parking lot an intensified level of security. These systems are programmed accordingly when in parking, it keeps the counting of all vehicles that have entered and tell if there is space available in the parking or not. Furthermore, for the new entrants in the house, it already shows if the vehicles are authorised or not, then they give access to homes.

- Smartrac industry transponders are designed to accommodate the specific requirements of the automotive industry. These RFID sensors can measure moisture, liquid or temperature in their environment and pass the information to a reader.

- The government support and initiatives for the use of Radio Frequency Identification (RFID) technology across various industrial verticals such as automation, besides the increase in passenger cars in the APAC, will in increase the demand of RFID technology by private players, has also added strong potential to RFID market.

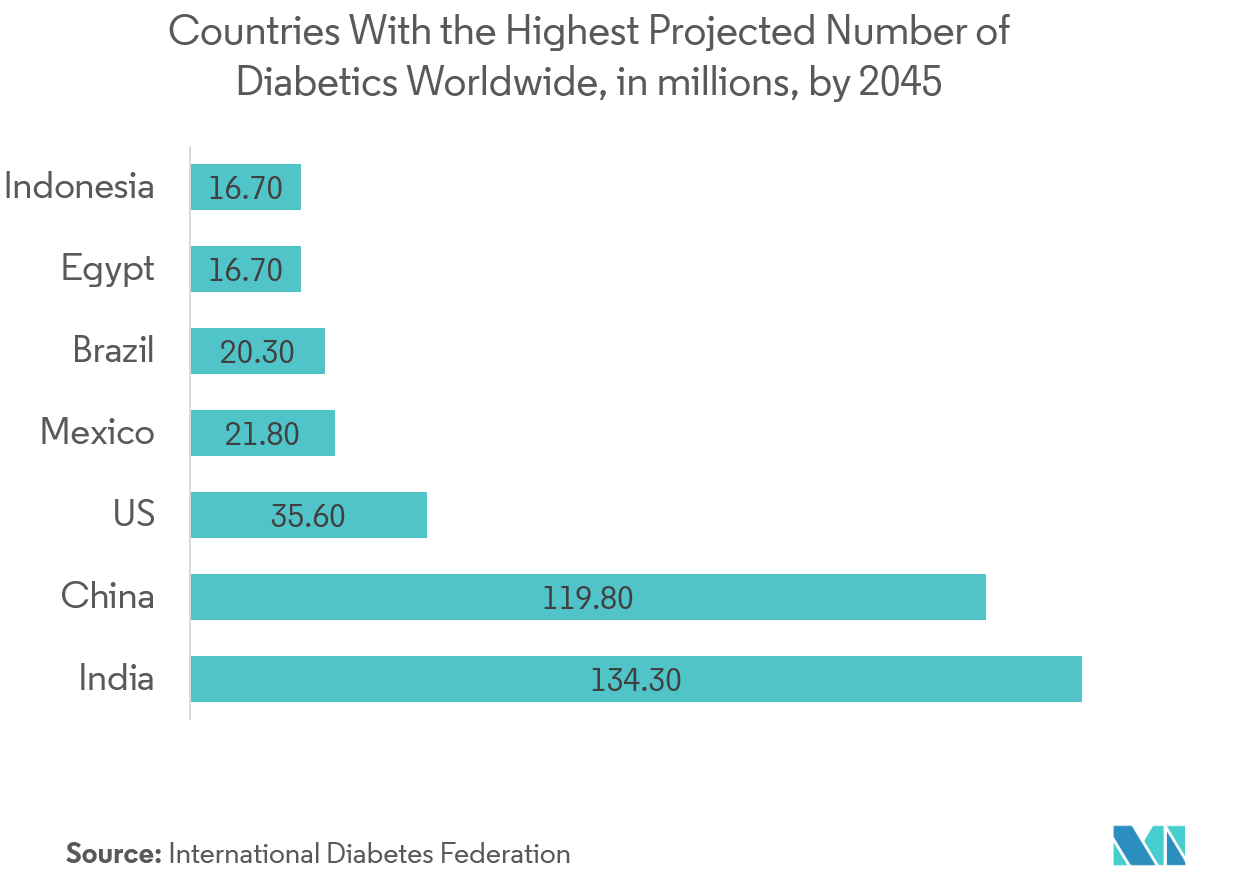

Application in Healthcare & Medical Share to Drive the Market Growth

- Asia-Pacific is expected to witness a significant growth rate over the forecast period owing to the investments in improving patient care. Owing to these initiatives, India’s healthcare industry is one of the fastest growing sectors and it is expected to reach USD 280 billion by 2020. The country has also become one of the leading destinations for high-end diagnostic solutions with tremendous capital investment for advanced diagnostic facilities, thus catering to a greater proportion of the population.

- Moreover, the prevalence of hypertension (HTN) continues to increase in developing countries particularly in India and China. According to the Indian Council of Medical Research, hypertension is attributable to 10.8% of all deaths in India. This has resulted in increased investments in RFID to monitor heart rate and blood pressure.

- Besides, India and China are expected to be the countries with the most number of diabetics in the future, reported the International Diabetes Federation which has bolstered the demand for clinically validated tracking devices in the region.

APAC RFID Industry Overview

The major players in APAC include Yodobashi Camera Co. Ltd., Tsinghua Tongflag Co. Ltd., Chilitag Technology, Lynstan Engineering, Ceylon Technology, ThingMagic, EMW Co. Ltd., Ripro Corporation, Perfect Corporation, Perfect RFID, Rasilant Technologies, among others. The market is fragmented since there's is competition among major players. Therefore, the market concentration will be low.

- April 2019 -Alien Technology,announced the Higgs-9 IC, the first release of its next-generation of Higgs RFID semiconductor integrated circuits.Higgs-9 enables enterprise-critical applications to run faster, smarter and with quicker ROI in RFID deployments.

- April 2019 -Avery Dennison, in a partnership with Kit Checkaimed for implementation ofRFID technology for Big Pharma. This collaborationwillhelppharmaceutical companies to build into their medication labels, thereby enabling the tracking of each product from the point of manufacture until after it arrives at a hospital.

APAC RFID Market Leaders

-

Rasilant Technologies

-

Perfect RFID

-

Yodobashi Camera Co.,Ltd.

-

Ripro Corporation

-

Jadak Tech

*Disclaimer: Major Players sorted in no particular order

APAC RFID Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Rapid Adoption Of The Technology In Various Sectors

- 4.3.2 High Return On Investment

-

4.4 Market Restraints

- 4.4.1 Inadequate Infrastructure

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product

- 5.1.1 RFID Tags

- 5.1.2 Readers

- 5.1.3 Readers

- 5.1.4 Antennas

- 5.1.5 RFID Software and Middleware Services

-

5.2 By Application

- 5.2.1 Retail & Consumer Goods

- 5.2.2 Asset Tracking

- 5.2.3 Banking and Finance

- 5.2.4 Automotive

- 5.2.5 Manufacturing

- 5.2.6 Healthcare & Medical

- 5.2.7 Other Applications

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Yodobashi Camera Co.,Ltd.

- 6.1.2 Tsinghua Tongfang Co.,Ltd.

- 6.1.3 CHILITAG Technology

- 6.1.4 Ceyon Technology

- 6.1.5 Jadaktech

- 6.1.6 EMW Co Ltd.

- 6.1.7 Ripro Corporation

- 6.1.8 Perfect RFID

- 6.1.9 Rasilant Technologies

- *List Not Exhaustive

7. INVESTMENT ANALAYIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityAPAC RFID Industry Segmentation

RFID (Radio Frequency Identification) is an emerging disruptive wireless technology for identification, tracking, and sensing. A chipless RFID tag does not contain an application specific integrated circuit (ASIC), hence the reader does all signal processing to read the tag. RFID tags are low-cost passive microwave/millimeter wave circuits where the information is stored in printable resonators and delay lines and typically implemented in flexible substrates such as polymers and papers, like optical barcodes.

The Asia-Pacific RFID Market is segmented by Product (RFID Tags, Readers, Printers, Antennas, RFID Software, and Middleware Services), Application (Retail & Consumer Goods, Asset Tracking, Banking and Finance, Automotive, Manufacturing, Healthcare & Medical, Other Applications). The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| By Product | RFID Tags |

| Readers | |

| Readers | |

| Antennas | |

| RFID Software and Middleware Services | |

| By Application | Retail & Consumer Goods |

| Asset Tracking | |

| Banking and Finance | |

| Automotive | |

| Manufacturing | |

| Healthcare & Medical | |

| Other Applications |

APAC RFID Market Research FAQs

How big is the APAC RFID Investment Market?

The APAC RFID Investment Market size is expected to reach USD 5.11 billion in 2024 and grow at a CAGR of 6.68% to reach USD 7.06 billion by 2029.

What is the current APAC RFID Investment Market size?

In 2024, the APAC RFID Investment Market size is expected to reach USD 5.11 billion.

Who are the key players in APAC RFID Investment Market?

Rasilant Technologies, Perfect RFID, Yodobashi Camera Co.,Ltd., Ripro Corporation and Jadak Tech are the major companies operating in the APAC RFID Investment Market.

What years does this APAC RFID Investment Market cover, and what was the market size in 2023?

In 2023, the APAC RFID Investment Market size was estimated at USD 4.79 billion. The report covers the APAC RFID Investment Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the APAC RFID Investment Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

RFID Investment Opportunities in APAC Industry Report

Statistics for the 2024 RFID - Investment Opportunities in APAC market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. RFID - Investment Opportunities in APAC analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.