Rice Transplanter Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.80 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

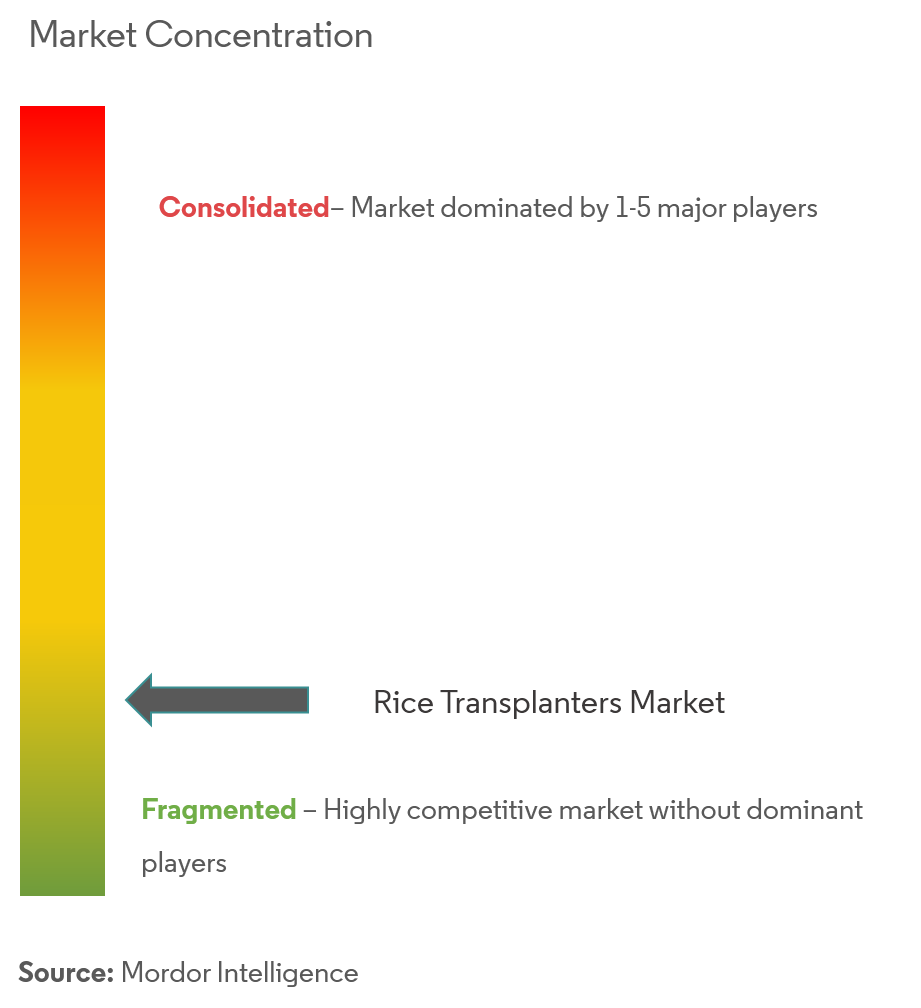

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Rice Transplanter Market Analysis

The Global Rice Transplanter Market size is estimated at USD 1.48 billion in 2023, and is expected to reach USD 1.96 billion by 2028, growing at a CAGR of 5.80% during the forecast period (2023-2028).

- The rise in population across the globe is inducing a high demand for food, which in turn is driving the demand for farming machinery such as rice transplanters, especially in regions like Asia. Therefore, agricultural laborers are shifting to urban areas. The global decline in farm labor is the major reason that farm owners opt for agricultural machinery like rice transplanters. According to data from the International Labor Organization (ILO), worldwide, the percentage of people who work in agriculture dropped to 26% in 2022.

- Reducing manpower availability for agricultural work has increased mechanical transplanters' availability because using a self-propelled transplanter gives economic benefits to the farmers over manual transplanting methods. Mechanical transplanting has significantly increased grain yield and decreased drudgery and time compared to manual operations. According to the Indian Council of Food and Agriculture (ICFA), the percentage of agriculture workers in India is estimated to decline by 25.7% in 2050.

- Asia-Pacific is the largest geographical segment of the market studied and accounts for more than half of the total share. Some of the driving factors, like increasing labor shortage work in the paddy fields and continuous technological innovations, have helped increase the efficiency of rice machinery in major rice-producing countries like India and China.

Rice Transplanter Market Trends

Decline in Farm Labor is Driving the Market

- Developing economies have larger percentages of the population dependent on agriculture, decreasing over time as many people have migrated to the urban area every year. According to Food and Agriculture Organization (FAO), employment in the agriculture sector declined drastically in countries like China in 2021 by 23.9% compared to the previous year, with 24.4%. This is primarily due to agricultural machinery ruling under the name of modern agriculture in developed countries. While more than two-thirds of the population in poor countries work in agriculture, less than 5% of the population does in rich countries. This is making opportunity for the players to produce new products in the market, hence boosting the market's growth in future years.

- According to data from the International Labor Organization, worldwide, the percentage of people who work in agriculture will have dropped to 26% in 2022. In many developed countries, including the United States, the average age of a farmer is 60. Still, the average age is rising as the rural youth has branched out from their countries to seek a life in the city. This pushes the machinery market to grow in developed countries during the forecast period.

- According to the Indian Council of Food and Agriculture, the percentage of agriculture workers in India is estimated to decline by 25.7% in 2050, which has led to increasing demand for agricultural equipment in the country. Hence, the rice transplanter market demand will increase during the forecast period.

Asia-Pacific Dominates the Market

- Rice is the staple crop for many Asian countries like China and India, with almost 90% of the world's rice grown in the Asia Pacific. The growing population in Asian countries is raising the demand for food, especially in countries like India which is the most populated country in the region.

- According to the World Population Review (WPR), India's population was 1.41 billion in 2022. This increase in population has increased the demand for food in the region. Rice is the main staple food in more than 100 countries, and enhancement in rice production is crucial to ending hunger, especially in Asia.

- Small farmers in India usually perform rice transplanting manually. Manual paddy transplanting required about 238 man hours per hectare. The performance of different rice establishment methods was evaluated, and the maximum grain productivity was found under the system of rice intensification method followed by mechanical transplanter. Reducing manpower availability for agricultural work has increased the availability of mechanical transplanters in India.

- China is the world's largest producer of rice, making up 30% of global rice production, which deploys various methods like manual or mechanical. Manual transplanting is declining in rural areas due to a lack of skilled labor. It is common in these areas with smaller land due to high populations and higher rates of available labor. China dominates the market in this region with a major market share as it exports paddy to other Asian countries. Nearly every province in China plants rice and produces more than one-fourth of the world's rice annually. Farmers in India prefer manually operated machines, while China and countries in Asia witness a higher demand for riding type of rice transplanter machines.

Rice Transplanter Industry Overview

The rice transplanter market is fragmented, with various small and medium-sized companies resulting in stiff competition. The development of regional markets and local players in different parts of the world is the major factor for the fragmented nature of the market. Major Player like Kubota Inc, with their R&D team and technology, is able to provide a smart solution. Every player is working smartly and in an innovative way to compete in the market. Kubota, Iseki, Mitsubishi, CLASS, and CNH Industrial are the five major players competing in the market.

Rice Transplanter Market Leaders

-

Kubota

-

Iseki

-

Mitsubishi

-

CLASS

-

CNH Industrial

*Disclaimer: Major Players sorted in no particular order

Rice Transplanter Market News

- October 2022: Kubota launched its Agri-Robo Rice transplanter with the help of its R&D team and young innovators. This Agri-robo rice transplanter made transplanting a beautiful process and provided 'expert full-field planting' that saves farmers both effort and labor.

- February 2022: Kubota invested in US-based Ag startup ''Farm X," which is the company's second investment in the startup. This investment enabled FarmX's business expansion, enabled Kubota to cement ties with FarmX, and accelerated the development of platforms for implementing precision farming for specialty crops.

Rice Transplanter Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Product Type

- 5.1.1 Ride-on Rice Transplanter

- 5.1.2 Walking Rice Transplanter

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market Share Analysis

-

6.4 Company Profiles

- 6.4.1 Kubota Carporation

- 6.4.2 CNH Industrial

- 6.4.3 CLAAS KGaA mbH

- 6.4.4 Iseki & Co., Ltd.

- 6.4.5 Mitsubishi

- 6.4.6 Yanmar Co., Ltd

- 6.4.7 Mahindra & Mahindra Limited

- 6.4.8 TYM Corporation

- 6.4.9 Jiangsu World Agriculture Machinery Co., Ltd

- 6.4.10 LEMKEN GmbH & Co. KG

- 6.4.11 Shandong Fuerwo Agricultural Equipment Co., Ltd

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityRice Transplanter Industry Segmentation

A rice transplanter is a specialized transplanter fitted to transplant rice seedlings onto paddy fields.

The global rice transplanter market is segmented by product type (ride-on rice transplanters and walking rice transplanter) and geography (North America, Europe, Asia Pacific, South America, and Africa).

The report offers market estimation and forecasts in value (USD) for the above-mentioned segments.

.

| Product Type | Ride-on Rice Transplanter | |

| Walking Rice Transplanter | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Spain | ||

| Russia | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Africa | South Africa |

| Rest of Middle East & Africa |

Rice Transplanter Market Research FAQs

What is the current Global Rice Transplanter Market size?

The Global Rice Transplanter Market is projected to register a CAGR of 5.80% during the forecast period (2024-2029)

Who are the key players in Global Rice Transplanter Market?

Kubota, Iseki, Mitsubishi, CLASS and CNH Industrial are the major companies operating in the Global Rice Transplanter Market.

Which is the fastest growing region in Global Rice Transplanter Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Global Rice Transplanter Market?

In 2024, the Asia Pacific accounts for the largest market share in Global Rice Transplanter Market.

What years does this Global Rice Transplanter Market cover?

The report covers the Global Rice Transplanter Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Global Rice Transplanter Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Rice Transplanter Industry Report

Statistics for the 2024 Rice Transplanter market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Rice Transplanter analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.