Rigid Bulk Packaging Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 4.90 % |

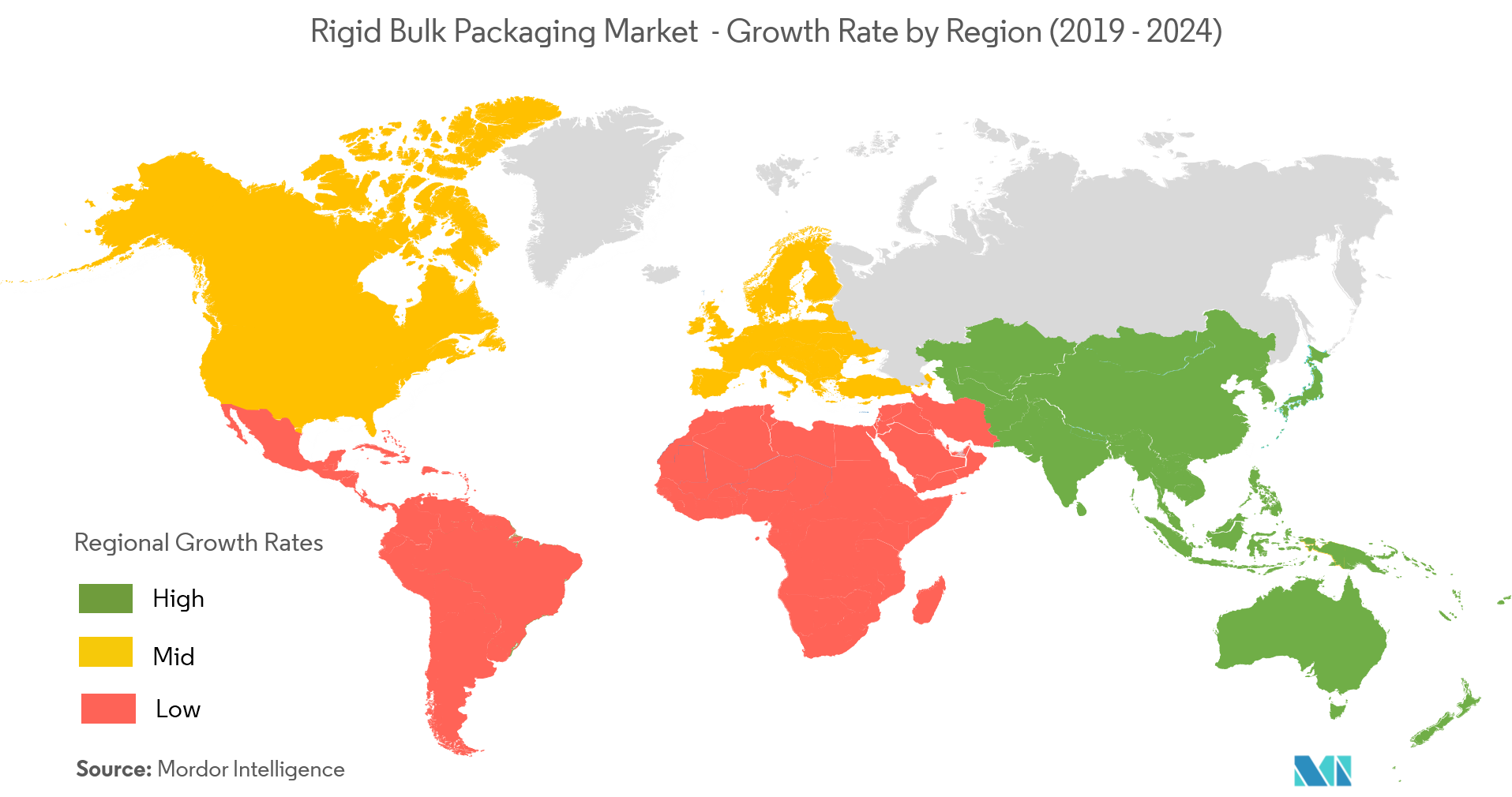

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

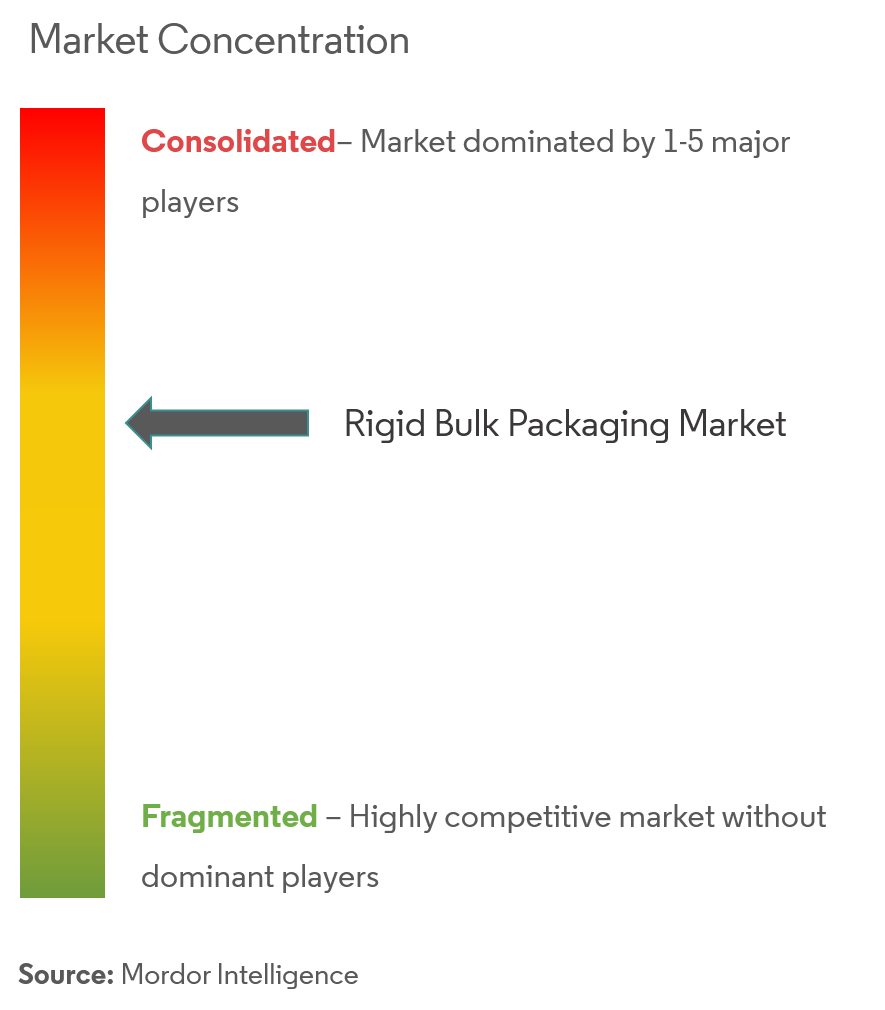

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Rigid Bulk Packaging Market Analysis

The rigid bulk packaging market is expected to register a CAGR of 4.9% during the forecast period 2021-2026. Over the last few decades, global bulk packaging has received very scant attention compared to consumer packaging. However, recently, governments and organizations across the world have come to realize the importance of safe and sustainable industrial packaging.

- Some of the major drivers contributing to the growth of this market include the emergence of sustainable and recycling packaging materials, steady growth in construction activity and increased demand for food and packaging transport materials across the globe.

- Further, the greater need to improve logistics costs, bill of materials, and enhance overall efficiency across the supply chain, is expected to drive investments in innovation among the industrial packaging manufacturers over the forecast period.

- On the other hand, the market has been buoyed by companies and governments focused on claiming the necessary measures to reduce packaging wastage.

Rigid Bulk Packaging Market Trends

This section covers the major market trends shaping the Rigid Bulk Packaging Market according to our research experts:

Intermediate Bulk Containers to Witness the Fastest Growth

- IBCs are mainly used for the storage and handling of materials in the oil and gas, chemical, and petrochemical sectors. Furthermore, IBCs ensure product safety and cost-effective packaging solutions, as well as helps in downgauging the overall packaging cost owing to its features, like multiple usages, large storage capacity, and usability with different industrial products.

- The need for suitable corrosion resistant containers for the storage and handling of both hazardous and non-hazardous liquid applications has driven the usage of intermediate bulk containers in the chemicals, pharmaceutical, food and beverage, and oil and lubricants sectors.

- The export from the United Kingdom was dominated by fuel commodities in the year 2018. According to UK trade info, total exports of goods for April 2019 were EUR 29.9 billion. This was a decrease of EUR 3.8 billion (11%) compared with the previous month, and an increase of EUR 1.8 billion (6.5%) compared with April 2018.

- Furthermore, the increased demand for reusability and sustainable packaging has driven the adoption of returnable bulk containers, particularly for exports.

in 2018.png)

North America to Hold a Major Share

- The rigid bulk packaging market in the United States is bolstered by the presence of significant market players and strong manufacturing industries, such as chemicals, pharmaceutical, food & beverages, and automotive.

- The country is also the third largest exporter, after China and the European Union, as well as the second largest importer of goods in the world. These good mainly constitute of industrial machinery, medical equipment, petroleum products, and automotive parts and supplies. According to the World Bank, the exports of goods in 2016 accounted for 11.82% of the GDP and increased to 12.06% in 2017.

- The country’s focus on strengthening its trade relations during the forecast period is expected to aid market growth. This trend has been buoyed by the reserves of crude oil in the United States increased 19.5% (6.4 billion barrels) to 39.2 billion barrels at year-end 2017, setting a new US record for crude oil proved reserves, stated by EIA.

Rigid Bulk Packaging Industry Overview

The rigid bulk packaging market concentration is moderately consolidated with the presence of the fewer major player in the market. Additionally, the other major players in the packaging market are adopting acquisitionand partnership strategies to enter the market to grow their market offerings.

- Mar 2019 - Amcor Limited acquired its rival Bemis Company, Inc. andaims tocreate a stronger value proposition for shareholders, customers, employees, and the environment.

- Mar 2019 -IFCO SYSTEMS, the leading global provider of reusable packaging solutions for fresh foods, announced the acquisition by Triton and Abu Dhabi Investment Authority (ADIA).This makes IFCO a fully independent companycapable of acting agile and flexible, offering the industry’s most efficient and sustainable fresh foods packaging solutions.

Rigid Bulk Packaging Market Leaders

-

Amcor PLC

-

Mondi Group PLC

-

Greif Inc.

-

Nefab Packaging AB

-

SCHÜTZ GmbH & Co.

*Disclaimer: Major Players sorted in no particular order

Rigid Bulk Packaging Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Emergence of Sustainable and Recyclable Packaging Materials

-

4.4 Market Restraints

- 4.4.1 Environmental Legislations Challenge the Market Growth

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Material

- 5.1.1 Pastic

- 5.1.2 Metal

- 5.1.3 Wood

- 5.1.4 Other Materials

-

5.2 By Product

- 5.2.1 Industrial Bulk Containers

- 5.2.2 Drums

- 5.2.3 Pails

- 5.2.4 Boxes

- 5.2.5 Other Products

-

5.3 By End-user Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Industrial

- 5.3.4 Pharmaceutical and Chemical

- 5.3.5 Other End-user Industries

-

5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 Japan

- 5.4.3.2 India

- 5.4.3.3 China

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Saudi Arabia

- 5.4.5.4 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Mondi PLC

- 6.1.3 Greif Inc.

- 6.1.4 Nefab Packaging AB

- 6.1.5 SCHÜTZ GmbH & Co. KGaA

- 6.1.6 Sonoco Products Company

- 6.1.7 The Cary Company

- 6.1.8 Taihua Group

- 6.1.9 Hoover Container Solutions

- 6.1.10 Cleveland Steel Container

- 6.1.11 Bulk-Pack Inc.

- 6.1.12 BWAY Corporation

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityRigid Bulk Packaging Industry Segmentation

The scope of the rigid bulk packaging market is limited to the forms of bulk packaging products offered by various vendors made of different materials for a wide range of end-user verticals, including the food, beverage, industrial, chemicals, and pharmaceutical sectors, globally.

| By Material | Pastic | |

| Metal | ||

| Wood | ||

| Other Materials | ||

| By Product | Industrial Bulk Containers | |

| Drums | ||

| Pails | ||

| Boxes | ||

| Other Products | ||

| By End-user Industry | Food | |

| Beverage | ||

| Industrial | ||

| Pharmaceutical and Chemical | ||

| Other End-user Industries | ||

| Geography | North America | United States |

| Canada | ||

| Geography | Europe | Germany |

| France | ||

| United Kingdom | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | Japan |

| India | ||

| China | ||

| Rest of Asia-Pacific | ||

| Geography | Latin America | Brazil |

| Mexico | ||

| Rest of Latin America | ||

| Geography | Middle East & Africa | United Arab Emirates |

| South Africa | ||

| Saudi Arabia | ||

| Rest of Middle East & Africa |

Rigid Bulk Packaging Market Research FAQs

What is the current Rigid Bulk Packaging Market size?

The Rigid Bulk Packaging Market is projected to register a CAGR of 4.90% during the forecast period (2024-2029)

Who are the key players in Rigid Bulk Packaging Market?

Amcor PLC, Mondi Group PLC, Greif Inc., Nefab Packaging AB and SCHÜTZ GmbH & Co. are the major companies operating in the Rigid Bulk Packaging Market.

Which is the fastest growing region in Rigid Bulk Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Rigid Bulk Packaging Market?

In 2024, the Asia Pacific accounts for the largest market share in Rigid Bulk Packaging Market.

What years does this Rigid Bulk Packaging Market cover?

The report covers the Rigid Bulk Packaging Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Rigid Bulk Packaging Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Rigid Bulk Packaging Industry Report

Statistics for the 2024 Rigid Bulk Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Rigid Bulk Packaging analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.