Market Trends of Rigid Bulk Packaging Industry

This section covers the major market trends shaping the Rigid Bulk Packaging Market according to our research experts:

Intermediate Bulk Containers to Witness the Fastest Growth

- IBCs are mainly used for the storage and handling of materials in the oil and gas, chemical, and petrochemical sectors. Furthermore, IBCs ensure product safety and cost-effective packaging solutions, as well as helps in downgauging the overall packaging cost owing to its features, like multiple usages, large storage capacity, and usability with different industrial products.

- The need for suitable corrosion resistant containers for the storage and handling of both hazardous and non-hazardous liquid applications has driven the usage of intermediate bulk containers in the chemicals, pharmaceutical, food and beverage, and oil and lubricants sectors.

- The export from the United Kingdom was dominated by fuel commodities in the year 2018. According to UK trade info, total exports of goods for April 2019 were EUR 29.9 billion. This was a decrease of EUR 3.8 billion (11%) compared with the previous month, and an increase of EUR 1.8 billion (6.5%) compared with April 2018.

- Furthermore, the increased demand for reusability and sustainable packaging has driven the adoption of returnable bulk containers, particularly for exports.

in 2018.png)

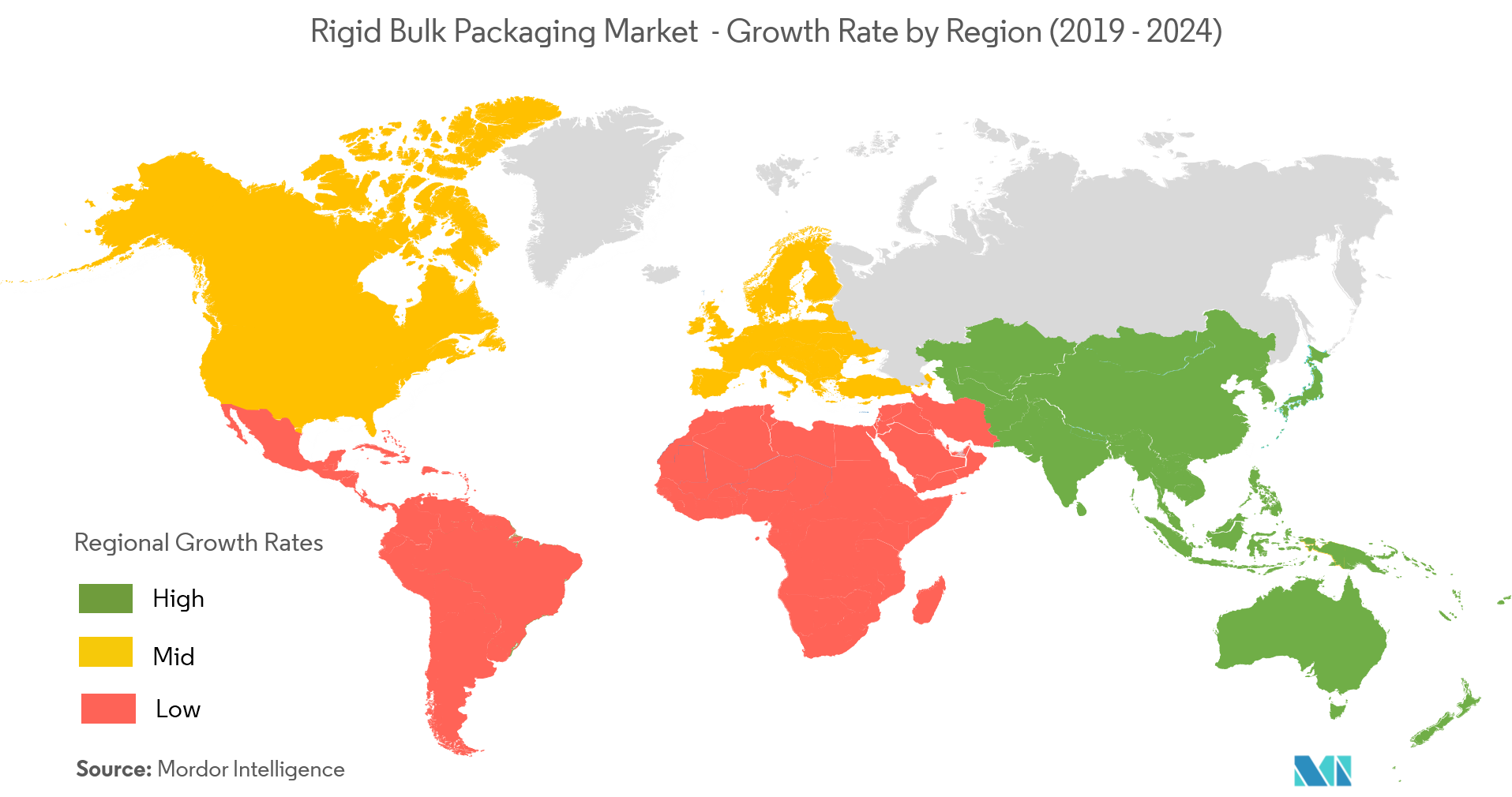

North America to Hold a Major Share

- The rigid bulk packaging market in the United States is bolstered by the presence of significant market players and strong manufacturing industries, such as chemicals, pharmaceutical, food & beverages, and automotive.

- The country is also the third largest exporter, after China and the European Union, as well as the second largest importer of goods in the world. These good mainly constitute of industrial machinery, medical equipment, petroleum products, and automotive parts and supplies. According to the World Bank, the exports of goods in 2016 accounted for 11.82% of the GDP and increased to 12.06% in 2017.

- The country’s focus on strengthening its trade relations during the forecast period is expected to aid market growth. This trend has been buoyed by the reserves of crude oil in the United States increased 19.5% (6.4 billion barrels) to 39.2 billion barrels at year-end 2017, setting a new US record for crude oil proved reserves, stated by EIA.