Market Trends of Robotic Waste Sorting System Industry

This section covers the major market trends shaping the Robotic Waste Sorting System Market according to our research experts:

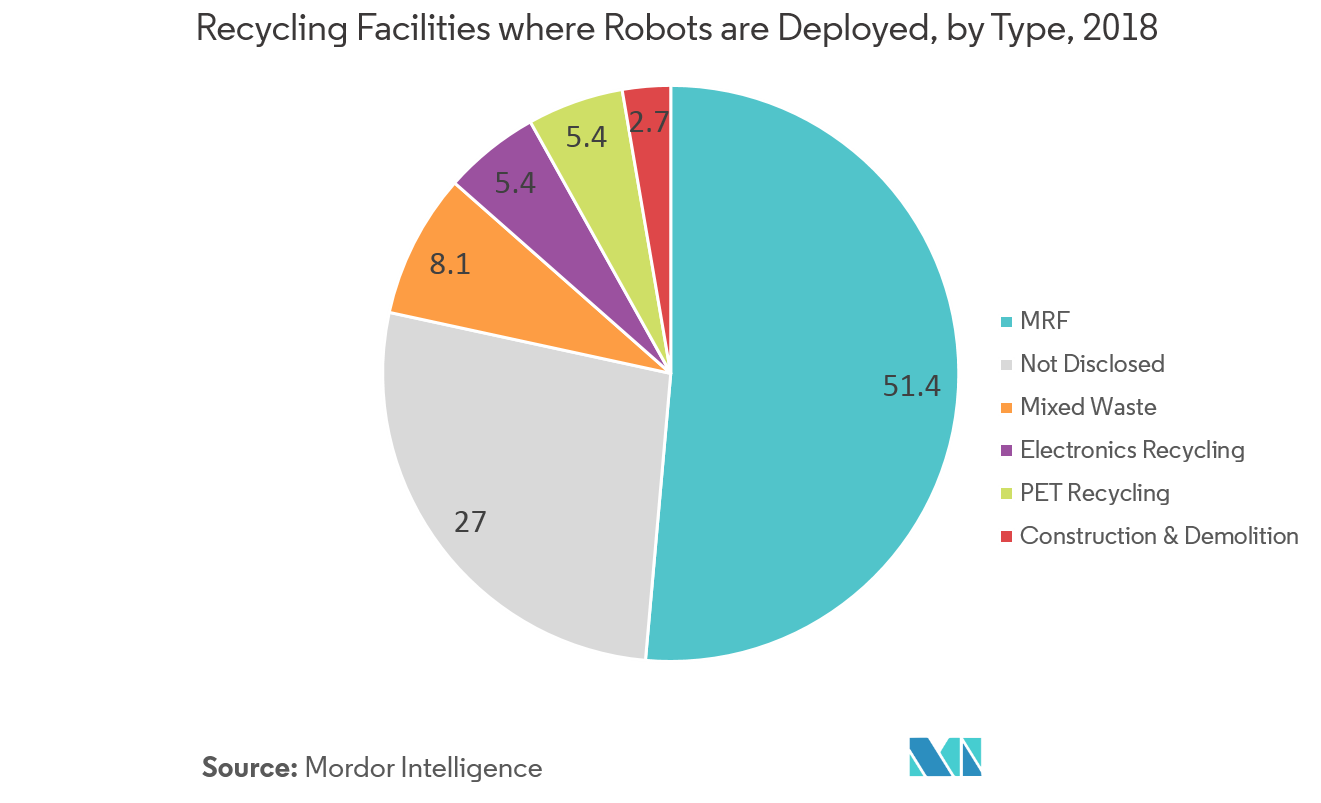

Materials Recovery Facility (MRF) to Witness the Highest Growth

- Recent policies pertaining to scrap imports into China are making exporting some post-consumer recyclables increasingly difficult. Material recovery facility (MRF) operators are trying to find new technologies or processes to help them meet China’s stricter quality requirements.

- Operators of material recovery facilities (MRFs) and other recycling plants also face the risk of being bombarded with technical terms as they go through proposals from technology and machinery vendors. This drives the MRFs to deploy robots for waste sorting system.

- As per Resource Recycling, or the most part, robots are working in single-stream MRFs.

- In May 2018, Machinex revealed its new sorting robot, SamurAI. At a materials recycling facility (MRF), SamurAI is designed to reduce reliance on manual sorting, therefore reducing ongoing operating costs while improving overall system performance.

- In June 2018, Lakeshore Recycling Systems announced the installation of this robot at its Heartland Recycling Center.It reduced LRS’ reliance on manual labor in the single-stream recycling facility, which in turn decreased the operation costs while improving productivity.

- In April 2017, Bulk Handling Systems announced the installation of Max-AI Technology, an artificial intelligence system which identifies recyclables and other items for recovery, at a materials recycling facility in Sun Valley, California.

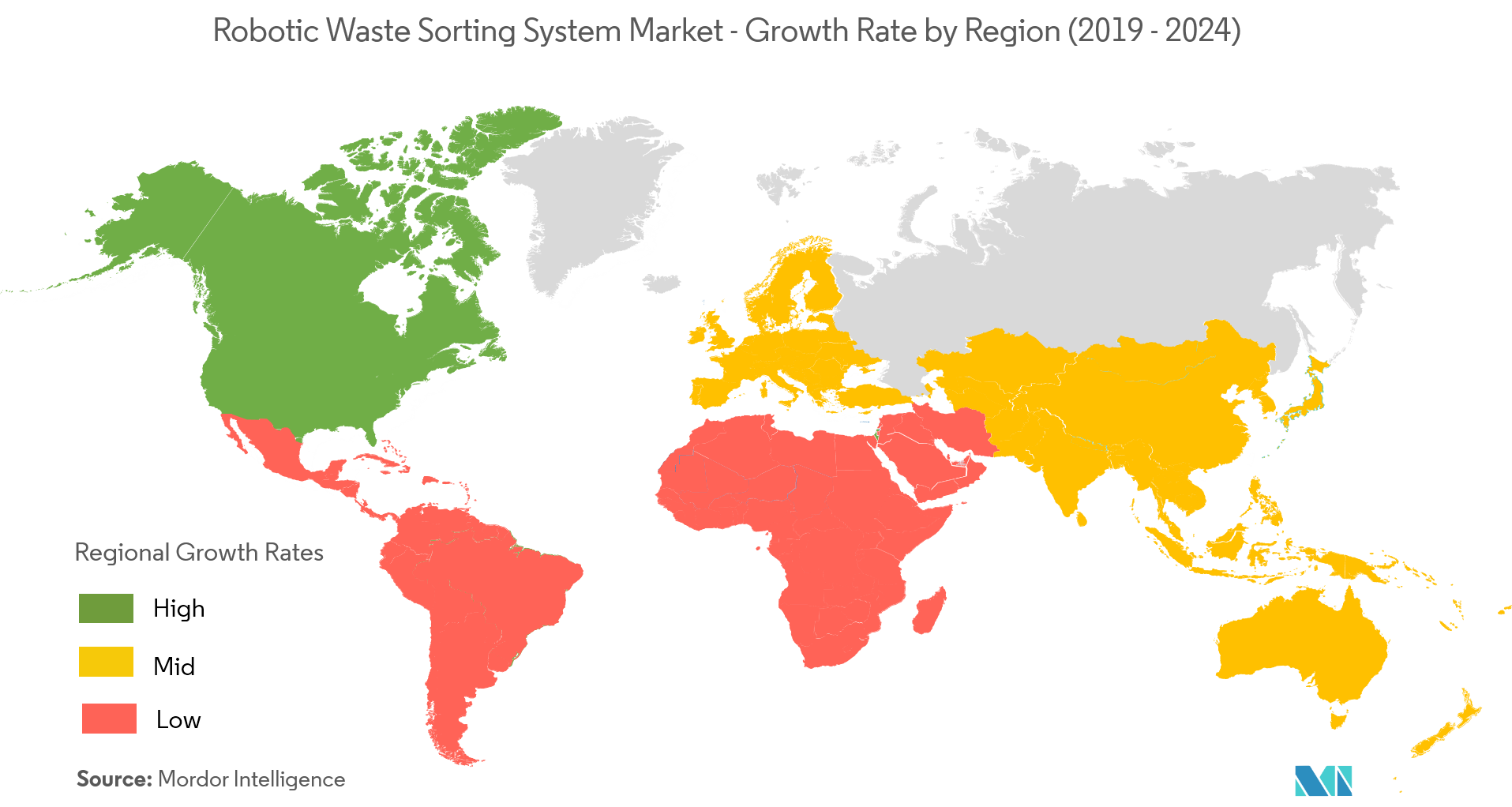

North America to Dominate the Market

- North America is the largest and the fastest-growing market due to its increasing consumption of products that are toxic to the environment.

- Also after compiling data from major robot providers, Resource Recycling estimates over 80 robots are either working or have been purchased in the U.S. and Canada.They’re sorting residential and commercial recyclables, mixed-waste, plastics, shredded electronics, and construction and demolition debris.

- Canadian government has announced that announced in March 2019 that Sustainable Development Technology Canada (SDTC) is investing USD 1.4 million in Waste Robotics, a company that makes intelligent recycling robots. The investment will help Quebec-based Waste Robotics develop a high-capacity, multi-arm robot waste sorting system that uses artificial intelligence (AI) to better sort commercial waste.

- Plessisville, Quebec-based recycling equipment provider Machinex announced in March 2019 that its SamurAI technology has been deployed in partnership with AMP at a Quebec MRF.

- Denver-based AMP Robotics has developed software — a AMP Neuron platform that uses computer vision and machine learning, so robots can recognize different colors, textures, shapes, sizes and patterns to identify material characteristics so they can sort waste.