Rotary Pumps Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.40 % |

| Fastest Growing Market | Asia-Pacific |

| Largest Market | Asia-Pacific |

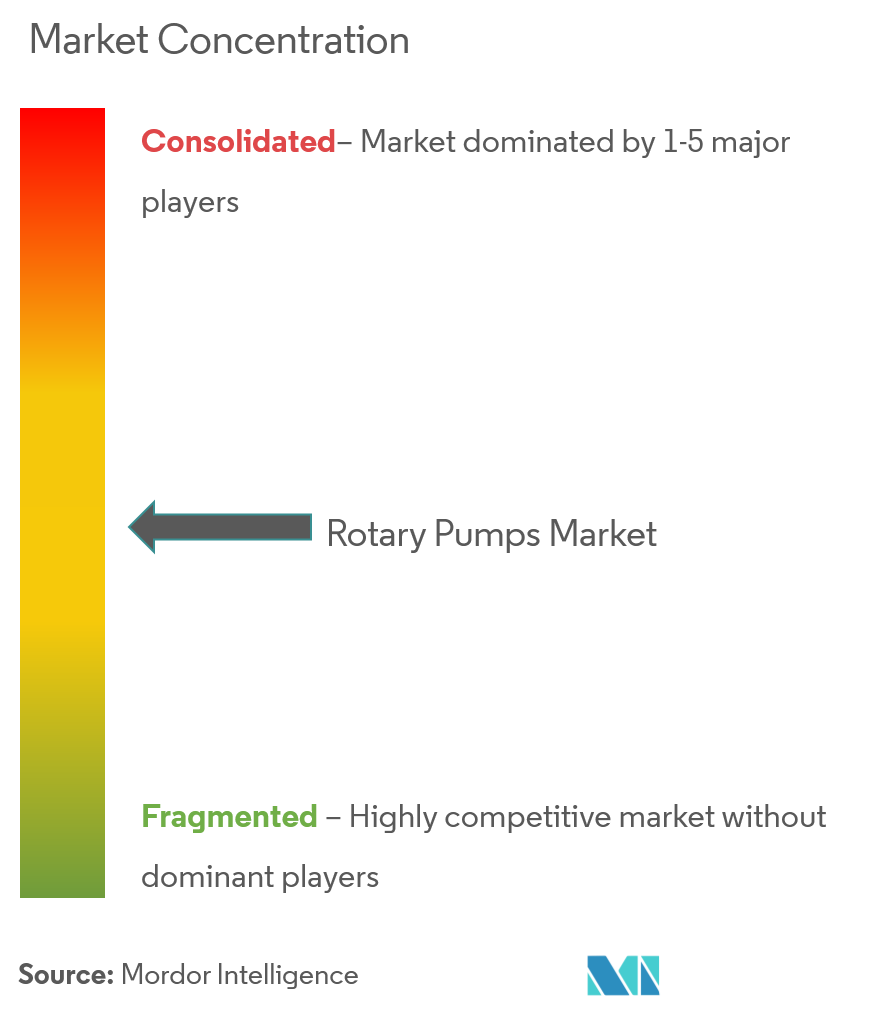

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Rotary Pumps Market Analysis

The Global Rotary Pump market is expected to grow at a CAGR of 5.4% over the forecast period. According to the International Journal of Innovative Research in Science, Engineering, and Technology, pumps consume nearly 20% of the global energy demand. The increasing need for energy systems that are easy to operate and fuse with other newer technologies across industries is driving the rotary pump market.

- Due to their capacity to pump gases and liquids without experiencing head loss, rotary pumps have long been in great demand. This makes them the preferred option for industries searching for long-lasting pumps with minimal costs. The need for a pump that can operate effectively under high differential pressure and pump high-viscosity fluids through compact designs has been growing as industrial processes progress.

- The COVID-19 pandemic affected nearly every international industry, and the pump industry was particularly hit hard. The government implemented lockdowns in numerous nations around the world. Lockdown prompted the pump industry to cease operations. In the post-pandemic period, the situation is deteriorating, and the pandemic's effects are being felt increasingly in several end-user industries, including waste management, paper and pulp, and others.

- The Internet of Things (IoT) and Industry 4.0 are two examples of cutting-edge technologies that are quickly taking over the field of industrial automation. Pump producers are looking for ways to profit from the growing dominance of cutting-edge technologies in industrial sectors by introducing highly efficient and affordable pumps.

- Increased smart manufacturing facilities with pumps networked to the cloud are anticipated to supply vital information like the machine status. Thus, introducing novel designs of smart rotary pumps and strengthening one's position as a one-stop solution provider in the rotary pumps market is projected to emerge as a prominent market trend in the following years.

- For instance, Sensata Technologies announced the release of a new asset monitoring solution in May 2022. This solution enables predictive maintenance for rotating assets and provides plant managers with useful data. The sensors are made to be simple to retrofit into a variety of rotary pumps that are already in use. Data from the sensor is examined at the edge for anomalies using powerful AI-driven algorithms for rotary assets by Nanoprecise and then sent to the Sensata IQ cloud-based platform for additional analysis.

- Additionally, the market for rotary pumps is expected to be driven by the use of modern technologies in agriculture to increase total factor productivity in order to meet the growing demand for agricultural products. Furthermore, the market for rotary pumps is anticipated to be driven by rising disposable incomes and an increase in the demand for process manufacturing due to rising standards.

- However, the market expansion may be hampered by the growing cost of raw materials, which is anticipated to raise the price of rotary pumps. As the oil and gas business continues to decline, manufacturers in the rotary pump market will likely shift their attention to seizing sales opportunities in other application areas.

Rotary Pumps Market Trends

This section covers the major market trends shaping the Rotary Pumps Market according to our research experts:

Water and Wastewater Management to Account for a Significant Share

- According to United Nations estimates, the global water problem is expected to worsen by 50% by 2050. This is driving up investments and activities by governments and organizations in water utilities worldwide. The market for rotary pumps in the water and wastewater management sector is expected to be driven by these expenditures.

- Numerous chances are opening up for rotary pump market players due to the importance of sanitation and the expanding access to water supply in most developing countries. The rotary pumps offer affordable options for wastewater treatment programs for primary, secondary, and tertiary water treatment programs.

- The lobe rotary pump is the most popular and economical pump for treating water and wastewater with sludge levels of 3% and above. The pandemic also caused numerous projects to be postponed and the wastewater treatment sector to stand at a complete standstill. The COVID-19 outbreak pushed back the opening of the Buzzards Bay wastewater treatment facility to November 2020. The delays influenced the demand for these pumps in various projects.

- The specialty chemical industry is being driven by rising industrialization, manufacturing, and electronics demand. Additionally, during the past six years, the global market for aerosol propellants-commonly used in goods like spray paints, air fresheners, and deodorants-has significantly increased.

- For example, NETZSCH Pumps USA introduced its wide portfolio of cutting-edge, field-proven equipment for demanding wastewater applications in September 2022. For wastewater treatment applications requiring high flow at low to medium pressures in a tiny, compact package in just about any orientation and installation, the TORNADO T1 Rotary Lobe Pump is an incredibly versatile option. The TORNADO T1 pump can operate in various viscosities, solids, temperatures, abrasion, corrosive/acidic process fluids, and environmental conditions.

Asia Pacific to Execute the Fastest CAGR During the Forecast Period

- Due to rising product demand in wastewater, mining, power, and chemicals sectors, Asia-Pacific is anticipated to dominate the global rotary pump market. To capitalize on the cost-effective qualities of rotary pumps and increase lucrative sales in India, China, and other high-potential markets, market players are moving their production operations to Asian nations where labor costs are cheaper.

- Furthermore, compared to 2017 levels, the Asia-Pacific region's electricity consumption is expected to increase by 66.6% by 2040. According to the IEA, the growth of electricity is anticipated to soar by 98%. The popularity of progressive capacity pumps, the most common in the power production industry because of their efficiency advantages, is expected to increase. East Asia has many power generation companies; thus, its nations are expected to see an increased demand for rotary pumps.

- China is one of the leading rotary lobe pump makers in Asia-Pacific, and its products are used in all applications. Another important commercial application is pharmaceuticals. China is putting a lot of effort into domestic drug production. As a result, the pharma industry has a greater need for the installation of rotary lobe pumps.

- The utilization of rotary pumps is being further complemented by recent expansion in infrastructural improvements and continuous industrialization in emerging markets like India and China. As a result, there will likely be more competition in developing nations' rotary pump markets, which will continue to be highly consolidated among the top rotary pump producers.

- Market participants are using an optimal price strategy for rotary pumps to gain a competitive edge in the fiercely competitive local marketplaces of the above-growing economies. As a result, China and India are the most profitable markets for rotary pumps and are predicted to continue to rule the area.

- China issued its 14th Five-Year Plan in June 2022. According to the IEA, it has an ambitious goal of having 33% of electricity generated by renewable sources by 2025, including an 18% target for wind and solar technology. China has put in place more than 33 policy efforts to boost renewable electricity, especially in fields like solar and wind energy, to achieve this. These variables are anticipated to have a significant impact on market growth in the area throughout the projection period.

Rotary Pumps Industry Overview

The rotary pump market is moderately fragmented due to product differentiation, which provides companies with innovation potential. Some key players in the market are Dover Corporation, Xylem Inc., and Colfax Corporation. Some recent developments in the market are:

- September 2022 - At WEFTEC 2022, NETZSCH unveiled its newest product line, PERIPRO Peristaltic Pumps. These NETZSCH hose pumps have a robust design for use in demanding applications and large rollers for increased durability and reduced energy use. The TORNADO T1 Rotary Lobe Pump is a part of the launch of the new product line. It is a very adaptable option for wastewater treatment applications that need high flow at low to medium pressures in a small, compact package in just about any orientation and installation.

- May 2022 - ITT Inc introduced a new technology generation for the i-ALERT whole machine health monitoring ecosystem. The i-ALERT3 sensor is made to more rapidly, precisely, and affordably monitor and log the temperature and vibration of any spinning machine. Employing a wider vibration frequency range detects and diagnoses mechanical and electrical faults in rotary pumps, motors, and other industrial machinery before they happen.

Rotary Pumps Market Leaders

-

Atlas Copco AB

-

Dover Corporation

-

Xylem Inc.

-

Colfax Corporation

-

IDEX Corporation

*Disclaimer: Major Players sorted in no particular order

Rotary Pumps Market News

- August 2022 - Pfeiffer Vacuum, a leading supplier of vacuum technology, offers the first hermetically sealed rotary vane pump for mass spectrometry. For mass spectrometers (ICP-MS, LC/MS) used in pharmaceutical and clinical analytics, food and environmental analytics, and other related fields, the SmartVane serves as a backing pump. By ensuring that there are no oil leaks, this vacuum pump helps to avoid contamination.

- March 2022 - Ingersoll Rand Inc., a leading global provider of industrial solutions for mission-critical flow creation, was pleased to introduce the new SVT Series of high-efficiency, high-capacity oil-lubricated rotary screw vacuum pumps through its specialized vacuum brand Elmo Rietschle. By dynamically adjusting the pump speed to fit the actual demand, the SVT series is created to function intelligently and maintain optimal vacuum levels and flow rates, maximizing energy savings that can be as much as 30-50% when in contrast to competing fixed speed technologies.

Rotary Pumps Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Focus on Waste-Water Management Systems in most Developing Countries

- 4.2.2 Focus on Retrofitting of Existing Energy-Efficient Pumps

- 4.3 Industry Value Chain Analysis

-

4.4 Industry Attractiveness Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 North America

- 5.1.1 By Type

- 5.1.1.1 Vane

- 5.1.1.2 Screw

- 5.1.1.3 Progressive Cavity (PC)

- 5.1.1.4 Lobe

- 5.1.1.5 Gear

- 5.1.2 By End-user Vertical

- 5.1.2.1 Oil and Gas

- 5.1.2.2 Power Generation

- 5.1.2.3 Chemical and Petrochemical

- 5.1.2.4 Food and Beverage

- 5.1.2.5 Water and Wastewater

- 5.1.2.6 Pharmaceutical

- 5.1.2.7 Other End-user Verticals

- 5.1.3 By Country

- 5.1.3.1 United States

- 5.1.3.2 Canada

-

5.2 Europe

- 5.2.1 By Type

- 5.2.1.1 Vane

- 5.2.1.2 Screw

- 5.2.1.3 Progressive Cavity (PC)

- 5.2.1.4 Lobe

- 5.2.1.5 Gear

- 5.2.2 By End-user Vertical

- 5.2.2.1 Oil and Gas

- 5.2.2.2 Power Generation

- 5.2.2.3 Chemical and Petrochemical

- 5.2.2.4 Food and Beverage

- 5.2.2.5 Water and Wastewater

- 5.2.2.6 Pharmaceutical

- 5.2.2.7 Other End-user Verticals

- 5.2.3 By Country

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Rest of Europe

-

5.3 Asia-Pacific

- 5.3.1 By Type

- 5.3.1.1 Vane

- 5.3.1.2 Screw

- 5.3.1.3 Progressive Cavity (PC)

- 5.3.1.4 Lobe

- 5.3.1.5 Gear

- 5.3.2 By End-user Vertical

- 5.3.2.1 Oil and Gas

- 5.3.2.2 Power Generation

- 5.3.2.3 Chemical and Petrochemical

- 5.3.2.4 Food and Beverage

- 5.3.2.5 Water and Wastewater

- 5.3.2.6 Pharmaceutical

- 5.3.2.7 Others End-user Verticals

- 5.3.3 By Country

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

-

5.4 Latin America

- 5.4.1 By Type

- 5.4.1.1 Vane

- 5.4.1.2 Screw

- 5.4.1.3 Progressive Cavity (PC)

- 5.4.1.4 Lobe

- 5.4.1.5 Gear

- 5.4.2 By End-user Vertical

- 5.4.2.1 Oil and Gas

- 5.4.2.2 Power Generation

- 5.4.2.3 Chemical and Petrochemical

- 5.4.2.4 Food and Beverage

- 5.4.2.5 Water and Wastewater

- 5.4.2.6 Pharmaceutical

- 5.4.2.7 Other End-user Verticals

- 5.4.3 By Country

- 5.4.3.1 Brazil

- 5.4.3.2 Mexico

- 5.4.3.3 Argentina

- 5.4.3.4 Rest of Latin America

-

5.5 Middle East and Africa

- 5.5.1 By Type

- 5.5.1.1 Vane

- 5.5.1.2 Screw

- 5.5.1.3 Progressive Cavity (PC)

- 5.5.1.4 Lobe

- 5.5.1.5 Gear

- 5.5.2 By End-user Vertical

- 5.5.2.1 Oil and Gas

- 5.5.2.2 Power Generation

- 5.5.2.3 Chemical and Petrochemical

- 5.5.2.4 Food and Beverage

- 5.5.2.5 Water and Wastewater

- 5.5.2.6 Pharmaceutical

- 5.5.2.7 Other End-user Verticals

- 5.5.3 By Country

- 5.5.3.1 United Arab Emirates

- 5.5.3.2 Saudi Arabia

- 5.5.3.3 South Africa

- 5.5.3.4 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Dover Corporation

- 6.1.2 Colfax Corporation

- 6.1.3 SPX Flow Inc.

- 6.1.4 Xylem Inc.

- 6.1.5 IDEX Corporation

- 6.1.6 Atlas Copco AB

- 6.1.7 Pfeiffer Vacuum Technology AG.

- 6.1.8 ULVAC Inc.

- 6.1.9 Busch Systems

- 6.1.10 Gardner Denver Holdings Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityRotary Pumps Industry Segmentation

A rotary pump is a positive displacement pump and a common vacuum pump available in various types, such as vanes, screws, lobes, and gears. Rotary pumps can handle high pressure and viscosity and facilitate flow despite the differential pressure and compact design. They have many applications across industries for lubrication, such as processing equipment, wind turbines, and hydraulic fracturing trucks.

The Rotary Pumps Market is Segmented By Type (Vane, Gear, Screw, Lobe, Progressive Cavity), End-user Vertical (Oil and Gas, Power Generation, Chemical and Petrochemical, Food and Beverage, Water and Wastewater Management, Pharmaceutical, Other End-User Verticals), and Geography. The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| North America | By Type | Vane |

| Screw | ||

| Progressive Cavity (PC) | ||

| Lobe | ||

| Gear | ||

| North America | By End-user Vertical | Oil and Gas |

| Power Generation | ||

| Chemical and Petrochemical | ||

| Food and Beverage | ||

| Water and Wastewater | ||

| Pharmaceutical | ||

| Other End-user Verticals | ||

| North America | By Country | United States |

| Canada | ||

| Europe | By Type | Vane |

| Screw | ||

| Progressive Cavity (PC) | ||

| Lobe | ||

| Gear | ||

| Europe | By End-user Vertical | Oil and Gas |

| Power Generation | ||

| Chemical and Petrochemical | ||

| Food and Beverage | ||

| Water and Wastewater | ||

| Pharmaceutical | ||

| Other End-user Verticals | ||

| Europe | By Country | Germany |

| United Kingdom | ||

| France | ||

| Rest of Europe | ||

| Asia-Pacific | By Type | Vane |

| Screw | ||

| Progressive Cavity (PC) | ||

| Lobe | ||

| Gear | ||

| Asia-Pacific | By End-user Vertical | Oil and Gas |

| Power Generation | ||

| Chemical and Petrochemical | ||

| Food and Beverage | ||

| Water and Wastewater | ||

| Pharmaceutical | ||

| Others End-user Verticals | ||

| Asia-Pacific | By Country | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Latin America | By Type | Vane |

| Screw | ||

| Progressive Cavity (PC) | ||

| Lobe | ||

| Gear | ||

| Latin America | By End-user Vertical | Oil and Gas |

| Power Generation | ||

| Chemical and Petrochemical | ||

| Food and Beverage | ||

| Water and Wastewater | ||

| Pharmaceutical | ||

| Other End-user Verticals | ||

| Latin America | By Country | Brazil |

| Mexico | ||

| Argentina | ||

| Rest of Latin America | ||

| Middle East and Africa | By Type | Vane |

| Screw | ||

| Progressive Cavity (PC) | ||

| Lobe | ||

| Gear | ||

| Middle East and Africa | By End-user Vertical | Oil and Gas |

| Power Generation | ||

| Chemical and Petrochemical | ||

| Food and Beverage | ||

| Water and Wastewater | ||

| Pharmaceutical | ||

| Other End-user Verticals | ||

| Middle East and Africa | By Country | United Arab Emirates |

| Saudi Arabia | ||

| South Africa | ||

| Rest of Middle East & Africa |

Rotary Pumps Market Research FAQs

What is the current Rotary Pumps Market size?

The Rotary Pumps Market is projected to register a CAGR of 5.40% during the forecast period (2024-2029)

Who are the key players in Rotary Pumps Market?

Atlas Copco AB, Dover Corporation, Xylem Inc., Colfax Corporation and IDEX Corporation are the major companies operating in the Rotary Pumps Market.

Which is the fastest growing region in Rotary Pumps Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Rotary Pumps Market?

In 2024, the Asia-Pacific accounts for the largest market share in Rotary Pumps Market.

What years does this Rotary Pumps Market cover?

The report covers the Rotary Pumps Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Rotary Pumps Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Rotary Pumps Industry Report

Statistics for the 2024 Rotary Pumps market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Rotary Pumps analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.