Safety Laser Scanner Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.25 % |

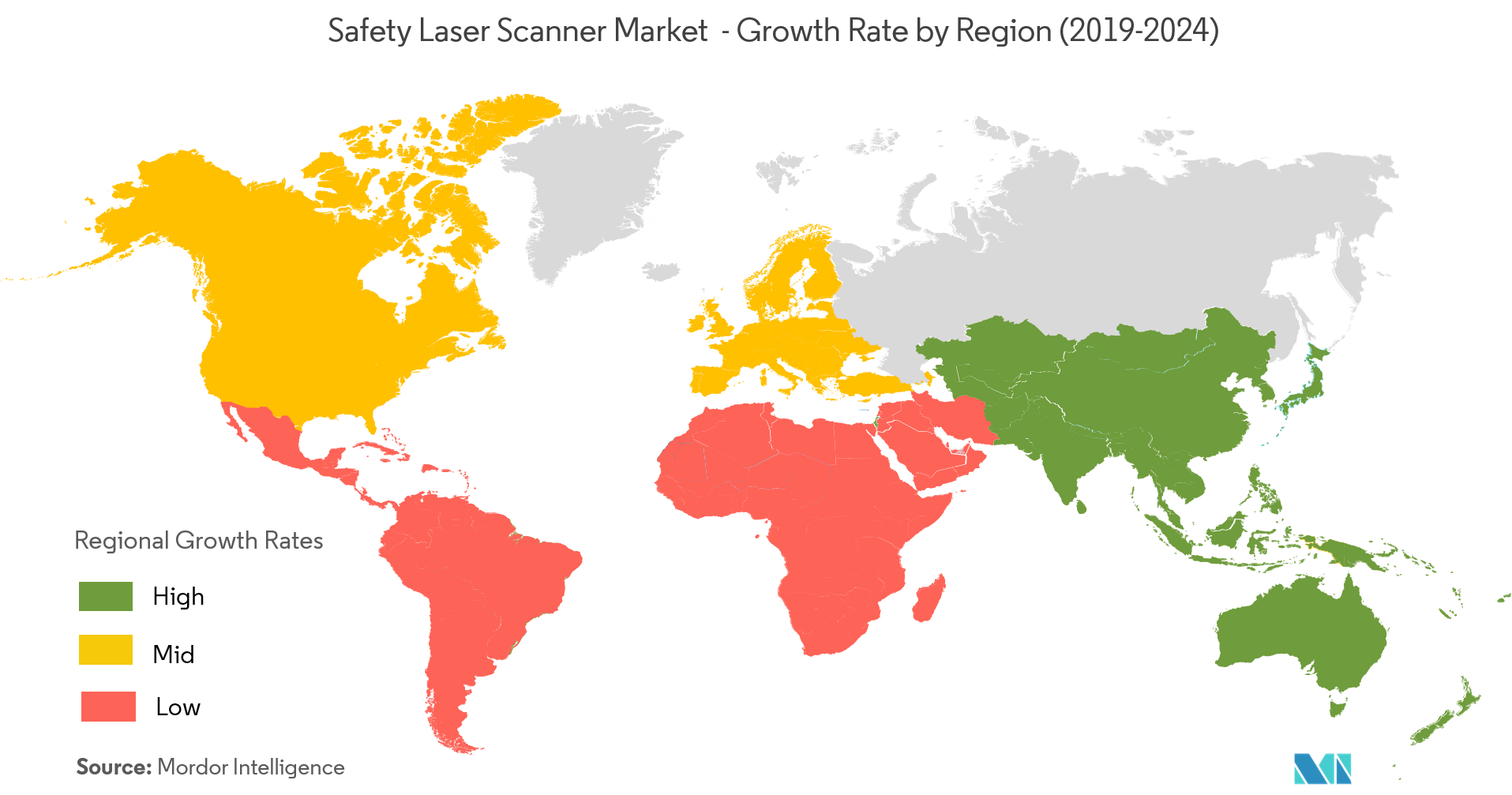

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

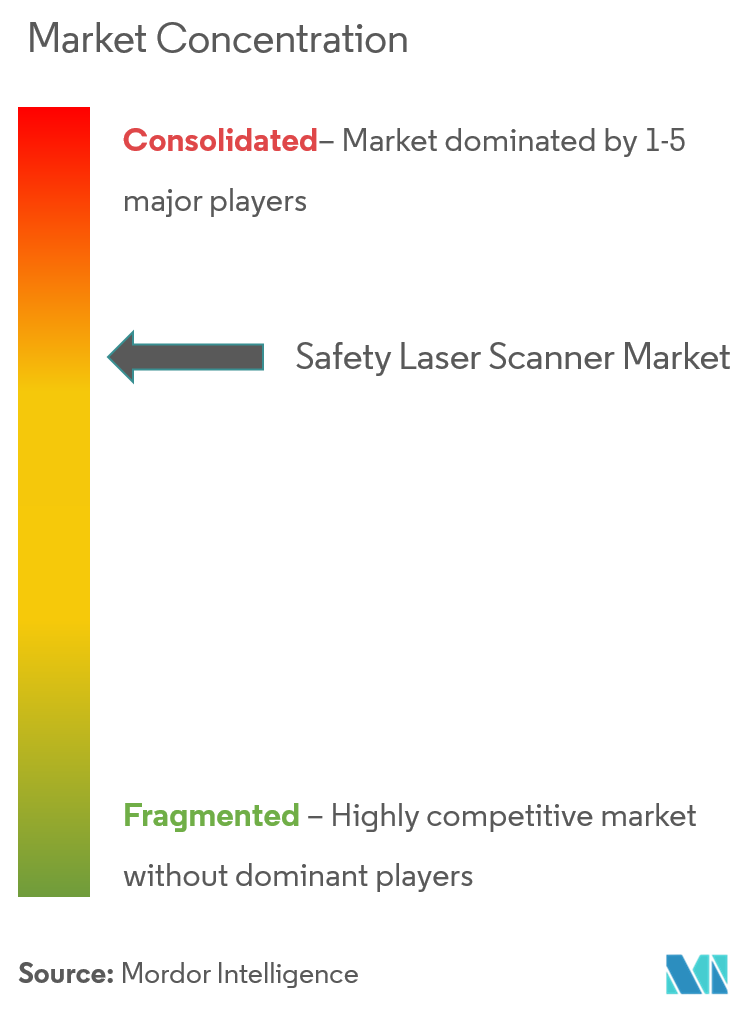

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Safety Laser Scanner Market Analysis

The safety laser scanners market is expected to witness a CAGR of 6.25% over the forecast period (2021 - 2026). The safety laser scanner works on the principle of 'time of flight' to measure the time taken by the light to reflect back from the object. Also, an integrated rotating mirror allows the protection areas defined by the user to be monitored in two dimensions. These scanners are being extensively used for both indoor and outdoor applications.

- Over the years, due to increasing fatalities at the workplaces especially in the industrial sector, the companies have been emphasizing on the safety measures and making the machine surrounding more safe for the operators. As the safety laser scanners allow installations on new as well as retro fitted machineries allowing companies to meet the safety complainces, it has gained more popularity in the market and hence driving the market growth.

- Moreover, the safety laser scanner pioneered by SICK AG is an effective, compact, and flexible for installation on various machines including staionary and moving machines. Also, these can be applied vertically as the access guarding systems. This is another factor fueling the adoption rate of safety laser scanners across the industries.

- However, due to the existing substitute products like safety mats and light curtains offering limited but similar solutions is hindering growth of the security laser scanners market to an extent.

Safety Laser Scanner Market Trends

This section covers the major market trends shaping the Safety Laser Scanner Market according to our research experts:

Automotive Applications are Expected to Grow Significantly

- The safety laser scanners are extensively being adopted by the automotive industry due to the increasing use of automatic guided vehicles (AGVs). Usually, there are two kinds of lasers used on the AGVs, one for navigation and other for detecting obstacles in the path by safety laser scanners; and is used to move trolleys through the workshop and warehouse especially when combined with lean system trolleys and gravity-fed flow rack.

- In manufacturing facilities such as semi-automatic painting, the machine requires the frequent entry of operators to move out of the painted parts. In such cases, an advanced safety laser scanner enables two-way protection to the machine allowing entry to the operator for replacing the finished part and simultaneously protecting the area where it is working on another part.

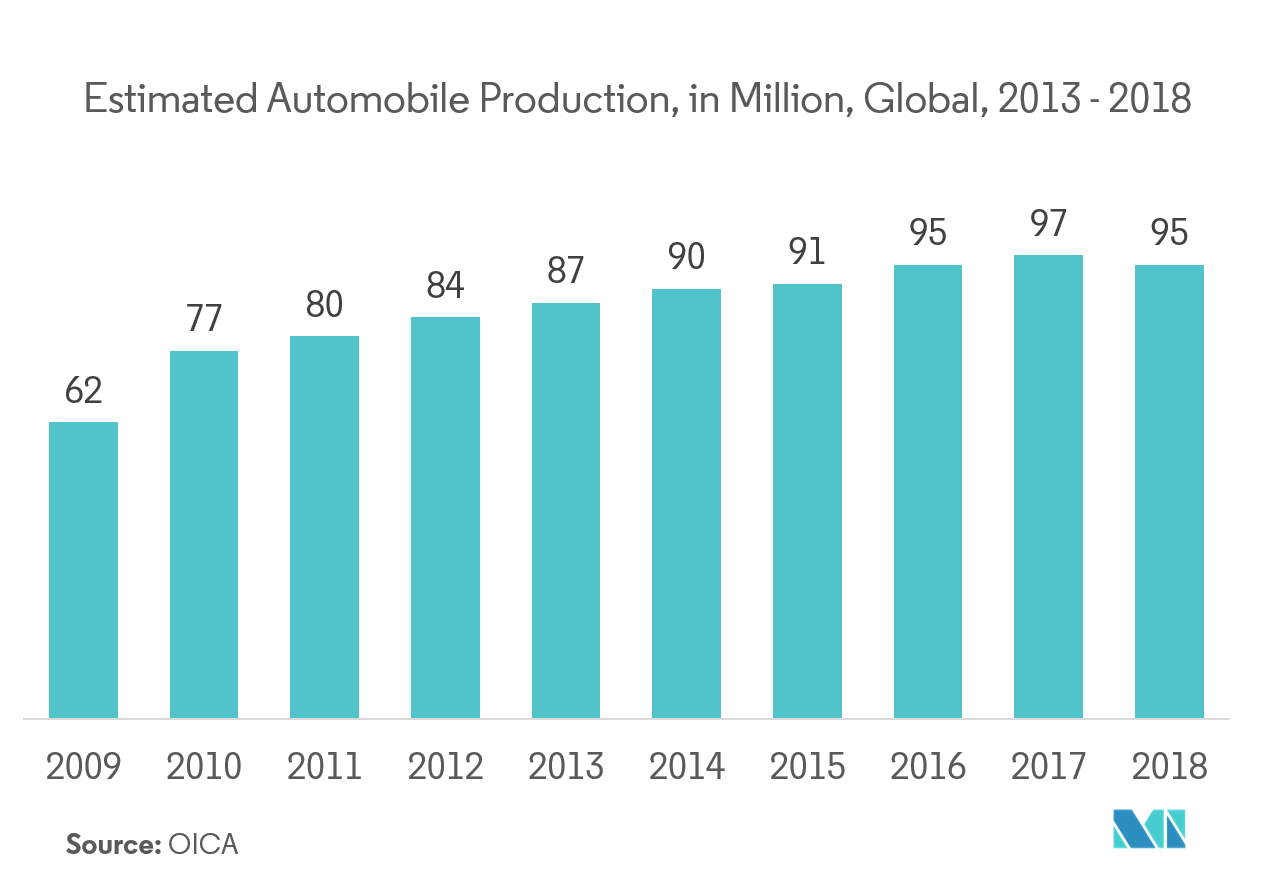

- Over the years, the automotive manufacturers across the world have been making expansions in their production capacities. For instance, BMW announced its expansion in its South Carolina plant for manufacturing 1400 X3 through X7 models each day. In another example, Toyota is also having expansion in Sao Paulo, Brazil by spending over USD 230 million to produce existing Etios and Yaris models with some new vehicle models.

Asia Pacific Region to Grow Significantly

- Recently, China have been facing a rise in labor wages and tighter regulations resulting in higher operating cost for the manufacturing companies. Hence these companies are seeking opportunities in Southern East Asia for the lower-value production network which would be largely integrated into global manufacturing value chain. Moreover, mega trade policies like RCEP (Regional Comprehensive Economic Partnership) is helping free cross border trades in the region for automotive and consumer goods & electronics.

- The robotics sector in the region has been witnessing a significant growth over the years. In a latest report by IFR, it is estimated that China, Japan, and South Korea cummulatively account for over 64% of industrial robots shipment in 2018 globally. Additionally, the government initiatives like Make in India, are encouraging the industrial sector in the region, wchih is estimated to drive the demand for safety laser scanners in the forecast period.

- Moreover in late 2018, South Korean governemtn approved a bill, OSHA (occupational Safety and Health Act) to govern safety at the workplace and have pushed a fine of over USD 9,000 on violation. Such a move by the governments is expected to drive the adoption of safety laser scanners to meet the safety compliance by the companies.

Safety Laser Scanner Industry Overview

The market for safety laser scanner is moderately consolidated with the presence of a few major companies dominating the market. These companies are continuously investing in making strategic partnerships and product developments to gain more market share.

- May 2019 - The pioneer of developing safety laser scanner SICK AG, launched its latest model of safety laser scanner outdoorScan3 for outdoor applications in AGVs. With this development, the company has opened huge opportunities for automating and increasing the efficiency of intralogistics production processes with a vision of a self-managed value chain in the spirit of industry 4.0.

Safety Laser Scanner Market Leaders

-

Leuze Electronics GmbH

-

OMRON Corporation

-

Panasonic Corporation

-

Rockwell Automation Inc.

-

SICK AG

*Disclaimer: Major Players sorted in no particular order

Safety Laser Scanner Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Increasing Automation in Different Industries Using AGVs

- 4.2.2 Growing Emphasis on Workplace Safety

-

4.3 Market Restraints

- 4.3.1 Safety Mats and Light Curtains Offering Similar Protective Solutions

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By End-user Industries

- 5.1.1 Automotive

- 5.1.2 Healthcare & Pharmaceuticals

- 5.1.3 Consumer Goods & Electronics

- 5.1.4 Other End-user Industries

-

5.2 Geography

- 5.2.1 North America

- 5.2.1.1 US

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 UK

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 Latin America

- 5.2.4.2 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Leuze Electronics GmbH

- 6.1.2 OMRON Corporation

- 6.1.3 Panasonic Corporation

- 6.1.4 Rockwell Automation Inc.

- 6.1.5 SICK AG

- 6.1.6 Banner Engineering

- 6.1.7 Hans Turck

- 6.1.8 Hokuyo Automatic Co., Ltd.

- 6.1.9 IDEC Corporation

- 6.1.10 Keyence Corporation

- 6.1.11 Pilz GmbH & Co. KG

- 6.1.12 Datalogic SpA

- 6.1.13 Arcus Automation Private Limited

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablitySafety Laser Scanner Industry Segmentation

The scope of the study for the security laser scanners market has considered the vendors offering products for both stationary and vertical application with various coverage angle and response rate for a wide range of applications across the geographical regions.

| By End-user Industries | Automotive | |

| Healthcare & Pharmaceuticals | ||

| Consumer Goods & Electronics | ||

| Other End-user Industries | ||

| Geography | North America | US |

| Canada | ||

| Rest of North America | ||

| Geography | Europe | Germany |

| UK | ||

| France | ||

| Rest of Europe | ||

| Geography | Asia-Pacific | China |

| Japan | ||

| India | ||

| Rest of Asia-Pacific | ||

| Geography | Rest of the World | Latin America |

| Middle East and Africa |

Safety Laser Scanner Market Research FAQs

What is the current Safety Laser Scanner Market size?

The Safety Laser Scanner Market is projected to register a CAGR of 6.25% during the forecast period (2024-2029)

Who are the key players in Safety Laser Scanner Market?

Leuze Electronics GmbH, OMRON Corporation, Panasonic Corporation, Rockwell Automation Inc. and SICK AG are the major companies operating in the Safety Laser Scanner Market.

Which is the fastest growing region in Safety Laser Scanner Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Safety Laser Scanner Market?

In 2024, the North America accounts for the largest market share in Safety Laser Scanner Market.

What years does this Safety Laser Scanner Market cover?

The report covers the Safety Laser Scanner Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Safety Laser Scanner Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Safety Laser Scanner Industry Report

Statistics for the 2024 Safety Laser Scanner market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Safety Laser Scanner analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.