KSA Snacks Bar Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 12.00 % |

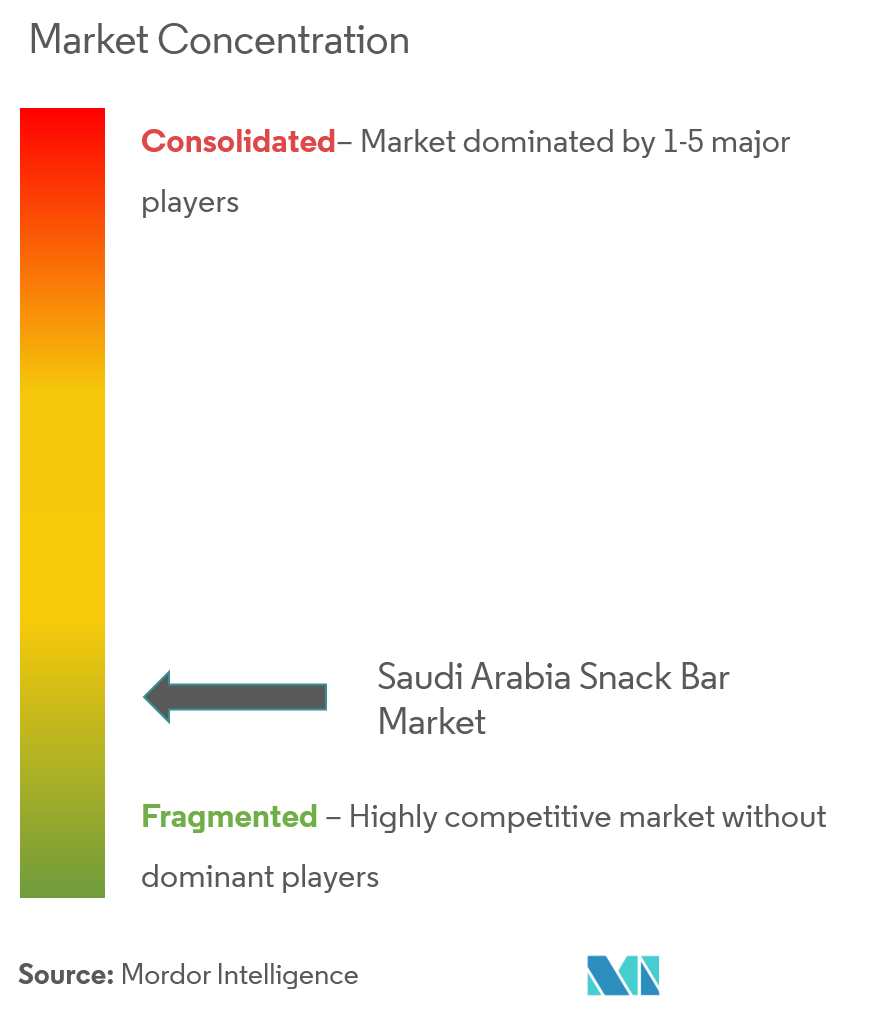

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

KSA Snacks Bar Market Analysis

The Saudi Arabian snack bar market is projected to grow ata CAGR of 12% during the forecast period (2020- 2025).

- The increased consumption of sweet baked goods, a sizeable young population, and changing lifestyles, demanding health andwellness products, are the primary drivers for the market.

- European and American companies hold major sharesinthe Saudi Arabian snack bar market.

- Convenience stores and supermarkets are the largest distribution channels for the retail sales of snack bars. They areexpected to dominate the market, during the forecast period.

KSA Snacks Bar Market Trends

This section covers the major market trends shaping the Saudi Arabia Snack Bar Market according to our research experts:

Saudi Demands for Healthy Snacks

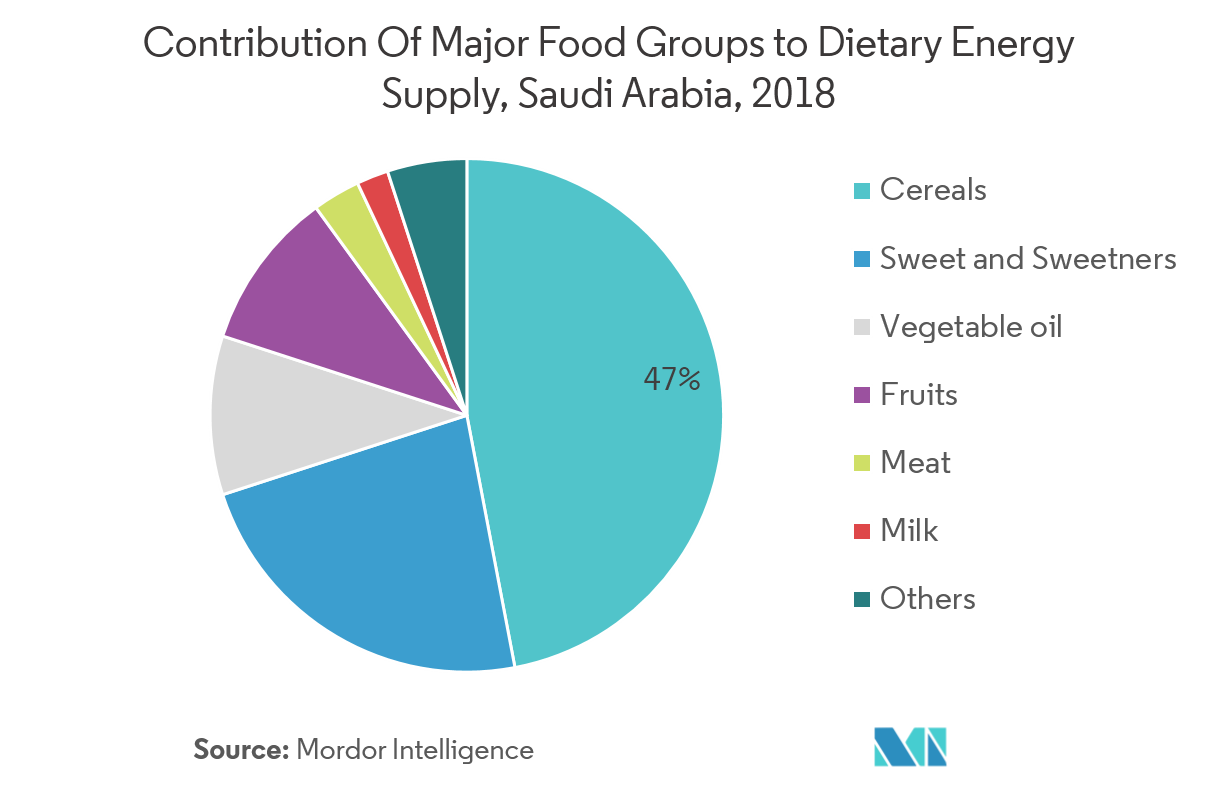

The snack consumption pattern in Saudi Arabia is different from that of the other Middle Eastern countries. The consumers prefer sweet baked and cereal-based products, on multiple occasions. Snack bar is considered to be a high-end, premium baked product, which is less popular among the average Saudi consumers, due to its high price. The economic slowdown in the country has affected the growth of the cereal bar market. The consumers' taste for sweet bakery products is the primary factor driving the cereal/granola bar market. High fiber, low sugar, gluten-free, and mix of grains, in the snack bar, are in high demand. The increased snacking habits among the Saudi consumers offer potential market opportunities for the manufacturers, to innovate products. Companies, by introducing healthier products within the comparative price range of baked goods and confectionery, attract consumers.

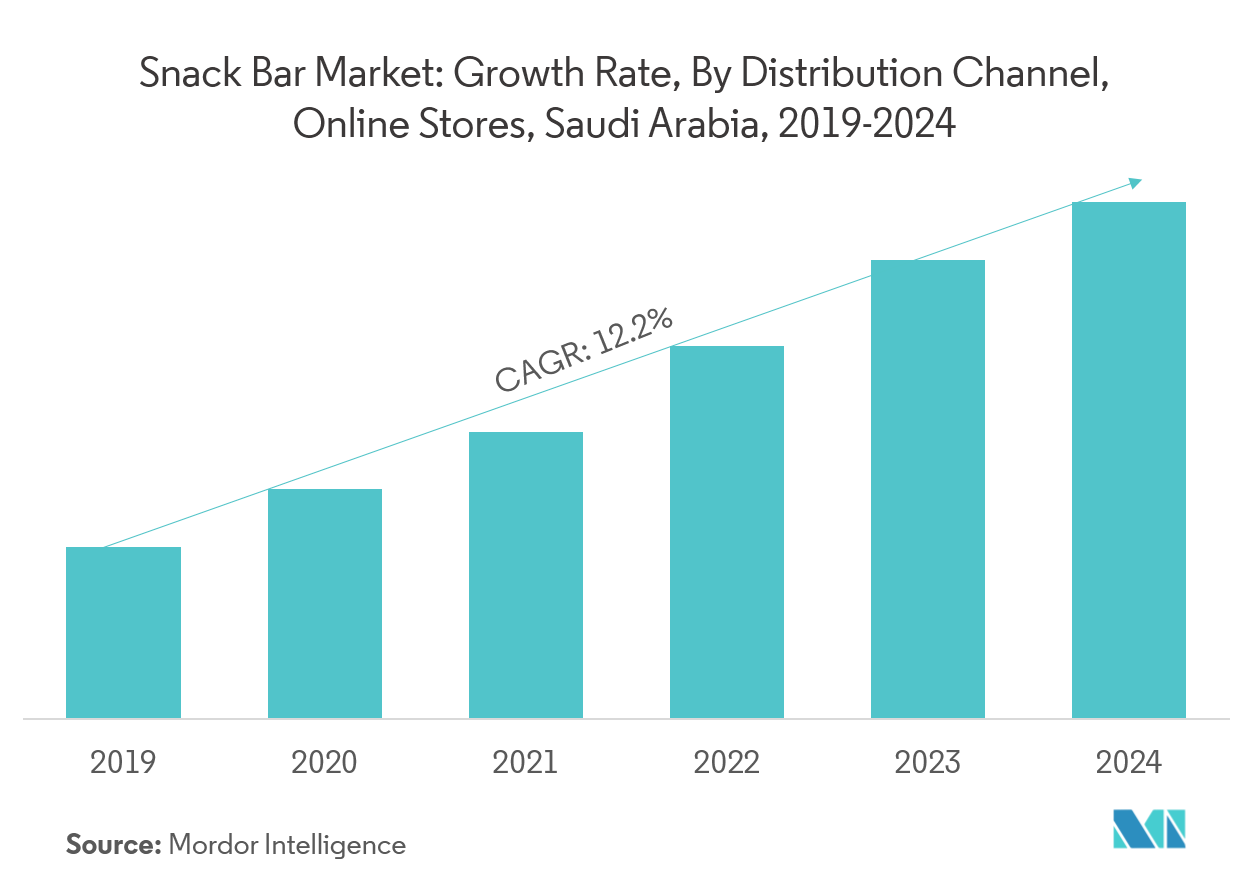

Online Retail is Driving the Market

Changing lifestyles in Saudi Arabia have driven the sales in modern retail channels, such as supermarkets/hypermarkets and online stores. The availability of multiple branded products, at discounted prices, offers an opportunity for the companies to expand their sales. The online retail platform has successfully established itself as a convenient marketplace, offering a wide range of snack bars, ranging from meal-replacement options to the indulgent ones. Prominent online channels, such as Souq.com, evitamins.com, and mezmiz.com, offer discounts and convenience. These factors have supported the market growth and have reportedly led to a surge in the sales of functional snack bars. This was also a result of packaging design, label claims, and a repetitive pattern of snack consumption.

KSA Snacks Bar Industry Overview

Saudi Arabian snack bar market is highly fragmented with the presence of seevral players. New product launch is the major strategy adopted by the players, followed by the introduction of new packaging. Companies are focusing on health and wellness products, such as high protein energy bars with reduced calories, for the targeted young population. The European and American brands, such as Cliff bar, Quest Nutrition, and Nature’s Plus, hold dominant positions in the market.

KSA Snacks Bar Market Leaders

-

General Mills Inc.

-

Kellogg Company

-

Premier Nutrition Corporation

-

Clif Bar & Company

-

GoMacro LLC

*Disclaimer: Major Players sorted in no particular order

KSA Snacks Bar Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Cereal Bars

- 5.1.1.1 Granola Bars

- 5.1.1.2 Others

- 5.1.2 Energy Bars

- 5.1.3 Other Snack Bars

-

5.2 By Distribution Channel

- 5.2.1 Hypermarket/Supermarkets

- 5.2.2 Convenience Stores

- 5.2.3 Speciality Stores

- 5.2.4 Online Channels

- 5.2.5 Other Distribution Channels

6. COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Most Adopted Strategies

- 6.3 Market-share Analysis

-

6.4 Company Profiles

- 6.4.1 General Mills Inc.

- 6.4.2 Kellogg Company

- 6.4.3 Premier Nutrition Corporation

- 6.4.4 Clif Bar & Company

- 6.4.5 GoMacro LLC

- 6.4.6 NuGo Nutrition Inc.

- 6.4.7 Power Crunch

- 6.4.8 Simply Good Foods Co.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablityKSA Snacks Bar Industry Segmentation

The Saudi Arabian snack bar market is segmented on the basis of type including cereal bars, energy bars, and other snack bars. The cereal bars further includes granola bars and other cereal bars. Based on distribution channel, the market is segmented into supermarkets/hypermarkets, convenience stores, specialty stores, online stores, and other distribution channels.

| By Product Type | Cereal Bars | Granola Bars |

| Others | ||

| By Product Type | Energy Bars | |

| Other Snack Bars | ||

| By Distribution Channel | Hypermarket/Supermarkets | |

| Convenience Stores | ||

| Speciality Stores | ||

| Online Channels | ||

| Other Distribution Channels |

KSA Snacks Bar Market Research FAQs

What is the current Saudi Arabia Snack Bar Market size?

The Saudi Arabia Snack Bar Market is projected to register a CAGR of 12% during the forecast period (2024-2029)

Who are the key players in Saudi Arabia Snack Bar Market?

General Mills Inc., Kellogg Company, Premier Nutrition Corporation, Clif Bar & Company and GoMacro LLC are the major companies operating in the Saudi Arabia Snack Bar Market.

What years does this Saudi Arabia Snack Bar Market cover?

The report covers the Saudi Arabia Snack Bar Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Saudi Arabia Snack Bar Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

KSA Snacks Bar Industry Report

Statistics for the 2024 KSA Snacks Bar market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. KSA Snacks Bar analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.