Silicone Fluids Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 5.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

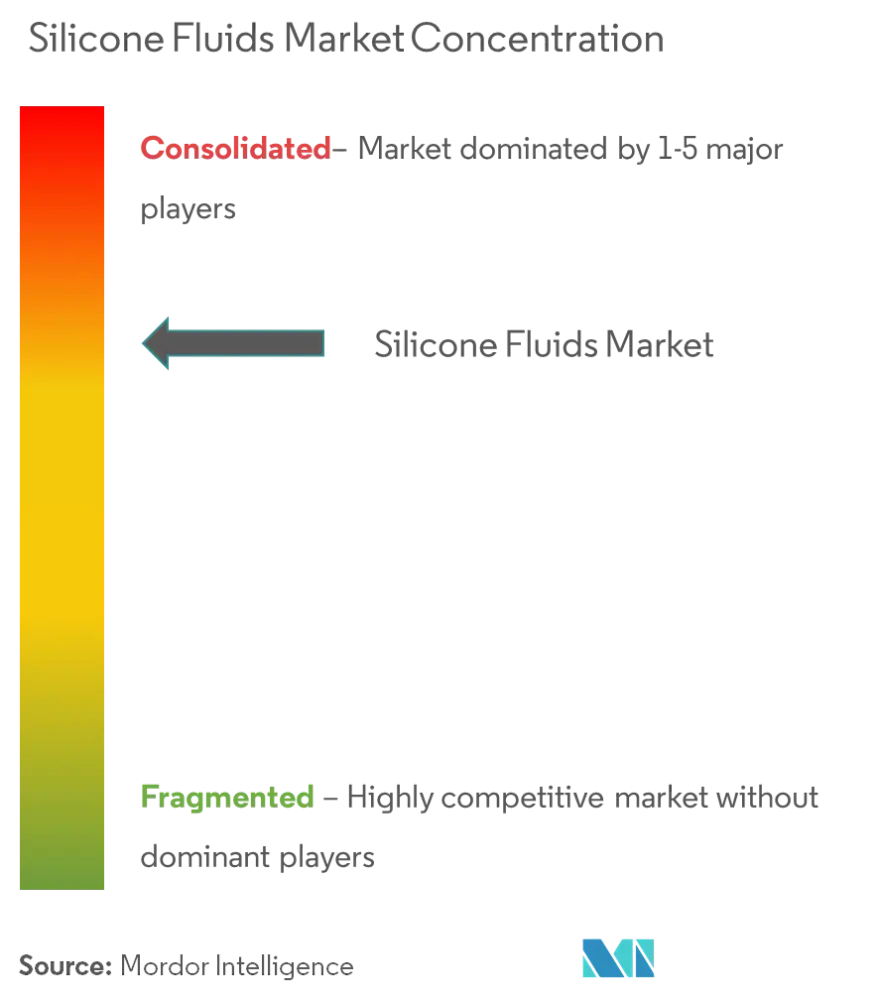

| Market Concentration | High |

Major Players*Disclaimer: Major Players sorted in no particular order |

Silicone Fluids Market Analysis

The global silicone fluids market is estimated to witness a healthy growth, at an estimated CAGR of around 5%, over the forecast period. Rising demand from personal care sector and technological developments in the United States are expected to drive the market growth.

- By application, the construction segment is expected to be the fastest growing segment, whereas the personal care and medical segment is estimated to have the largest share.

- Increasing usage in healthcare industry is projected to act as an opportunity for the market's growth in the future.

- By region, Asia-Pacific is expected to dominate the global silicone fluids market, with the growth of electrical, construction, and personal care sectors in emerging economies, such as China, India, and the ASEAN countries.

Silicone Fluids Market Trends

This section covers the major market trends shaping the Silicone Fluids Market according to our research experts:

Increasing Demand from Lubricants and Grease Manufacturing

- Silicone fluids or silicone oils are highly preferred for this application, as they offer excellent lubricating properties. They are used as a base fluid for lubricants.

- These fluids have a low thermal surface tension, low volatility, and excellent shearing resistance that further make them highly suitable.

- Due to the non-polar, non-reactive, and semi-inorganic structure of silicone fluids, a relative high incompatibility with chemicals results in their application as release agents and lubricants.

- Silicone fluids are mainly required for providing lubrication to steel-bronze, steel-aluminum, steel-zinc, and wood-wood interfaces and various plastics.

- Additionally, the demand for silicone fluids is likely to rise with the rising demand for lubricants across the world, from its end-user industries, including automotive and transportation, and heavy equipment.

- From the above-mentioned factors, the demand for silicone fluids is expected to increase in lubricants application, over the forecast period.

Asia-Pacific Region to Dominate the Market

- Construction sector in Asia-Pacific is the largest in the world. The increasing infrastructure construction activities are the major drivers for the Asia-Pacific construction industry. Rapid urbanization has led to a large number of construction projects majorly in China and India.

- China dominated the Asia-Pacific market share. The continuous improvements in economic conditions in the region have enhanced the financial status of the consumers, in turn, boosting the demand for buildings and other infrastructural activities in the country.

- China’s 13th Five Year Plan started in 2016 as it was an important year for the country’s engineering, procurement, and construction (EPC) industry. In addition to this, the country ventured into new business models domestically and internationally, during the year. Although the construction sector slowed down after 2013, it is still a major contributor to the GDP of the country.

- China is the largest lubricant consumer in the region and the world. The rate of consumption is expected to remain the same in the country, irrespective of the economy witnessing a slow growth.

- China is the largest textile producing and exporting country in the world. With its rapid growth over the last two decades, the Chinese textile industry has become one of the main pillars of the country’s economy and contributes ~7% to China's GDP.

- Owing to all these factors, the market for silicone fluids in the region is likely to increase in the coming years.

Silicone Fluids Industry Overview

The market for silicone fluids is partially consolidated in nature. The major players include DuPont, GELEST, INC., KCC Basildon, Shin-Etsu Chemical Co., Ltd., and Wacker Chemie AG, among others.

Silicone Fluids Market Leaders

-

DuPont

-

GELEST, INC.

-

KCC Basildon

-

Shin-Etsu Chemical Co., Ltd.

-

Wacker Chemie AG

*Disclaimer: Major Players sorted in no particular order

Silicone Fluids Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

-

4.1 Drivers

- 4.1.1 Rising Demand from Personal Care Sector

- 4.1.2 Technological Developments in the United States

-

4.2 Restraints

- 4.2.1 Impact of COVID-19 Pandemic on Global Economy

- 4.3 Industry Value-Chain Analysis

-

4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5. MARKET SEGMENTATION

-

5.1 Product Type

- 5.1.1 Straight Silicone Fluid

- 5.1.1.1 Poly-dimethyl Silicone Fluid

- 5.1.1.2 Methylphenyl Silicone Fluid

- 5.1.1.3 Methylhydrogen Silicone Fluid

- 5.1.1.4 Other Straight Silicone Fluids

- 5.1.2 Modified Silicone Fluid

- 5.1.2.1 Reactive Silicone Fluid

- 5.1.2.2 Non-reactive Silicone Fluid

-

5.2 Application

- 5.2.1 Lubricants and Greases

- 5.2.2 Damping Media

- 5.2.3 Liquid Dielectrics

- 5.2.4 Hydraulic Fluids

- 5.2.5 Defoamers

- 5.2.6 Personal Care

- 5.2.7 Paints and Coating Additives

- 5.2.8 Textile

- 5.2.9 Pharmaceuticals

- 5.2.10 Other Applications

-

5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

-

6.4 Company Profiles

- 6.4.1 CHT UK Bridgwater Ltd

- 6.4.2 DuPont

- 6.4.3 GELEST, INC.

- 6.4.4 KCC Basildon

- 6.4.5 Momentive

- 6.4.6 Siltech Corporation

- 6.4.7 Shin-Etsu Chemical Co., Ltd.

- 6.4.8 Wacker Chemie AG

- 6.4.9 Evonik Industries AG

- 6.4.10 Supreme Silicones

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Usage in Healthcare Industry

Silicone Fluids Industry Segmentation

The global silicone fluids market report includes:

| Product Type | Straight Silicone Fluid | Poly-dimethyl Silicone Fluid |

| Methylphenyl Silicone Fluid | ||

| Methylhydrogen Silicone Fluid | ||

| Other Straight Silicone Fluids | ||

| Product Type | Modified Silicone Fluid | Reactive Silicone Fluid |

| Non-reactive Silicone Fluid | ||

| Application | Lubricants and Greases | |

| Damping Media | ||

| Liquid Dielectrics | ||

| Hydraulic Fluids | ||

| Defoamers | ||

| Personal Care | ||

| Paints and Coating Additives | ||

| Textile | ||

| Pharmaceuticals | ||

| Other Applications | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| ASEAN Countries | ||

| Rest of Asia-Pacific | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Geography | Europe | Germany |

| United Kingdom | ||

| France | ||

| Italy | ||

| Rest of Europe | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle-East and Africa | Saudi Arabia |

| South Africa | ||

| Rest of Middle-East and Africa |

Silicone Fluids Market Research FAQs

What is the current Silicone Fluids Market size?

The Silicone Fluids Market is projected to register a CAGR of greater than 5% during the forecast period (2024-2029)

Who are the key players in Silicone Fluids Market?

DuPont, GELEST, INC., KCC Basildon, Shin-Etsu Chemical Co., Ltd. and Wacker Chemie AG are the major companies operating in the Silicone Fluids Market.

Which is the fastest growing region in Silicone Fluids Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Silicone Fluids Market?

In 2024, the Asia Pacific accounts for the largest market share in Silicone Fluids Market.

What years does this Silicone Fluids Market cover?

The report covers the Silicone Fluids Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Silicone Fluids Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Silicone Fluids Industry Report

Statistics for the 2024 Silicone Fluids market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Silicone Fluids analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.