Singapore Waste Management Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 1.25 % |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Singapore Waste Management Market Analysis

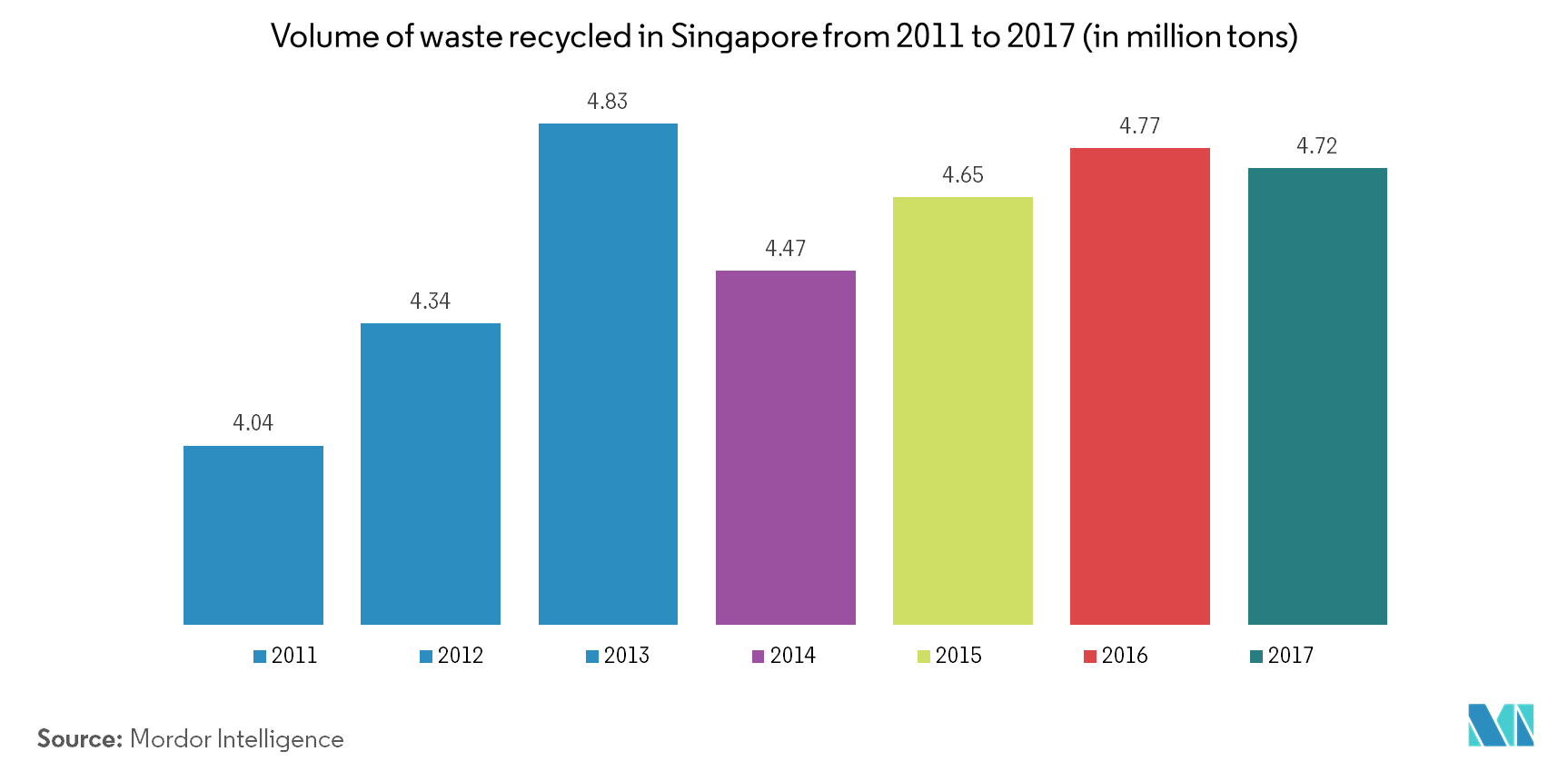

Singaporean waste management market is growing at a decent pace as the country's smaller size gives it a little room for waste disposal, and encourages recycling. In 2017, the country had recycled 61% of its waste, according to the National Environment Agency. The rest is incinerated, with a slight fraction sent to landfill. The landfill "island," called Semakau, was created in 1999 and extended in 2015, with enough space to meet Singapore's waste disposal needs until at least 2035.The waste management industry in Singapore majorly consists of all municipal solid waste (MSW) - including non-hazardous waste generated in households, commercial establishments and institutions, and non-hazardous industrial process wastes, agricultural wastes and sewage sludge. The industry's value represents the amount of total typical charge per ton for landfill multiplied by the volume of MSW generated. The industry's volume represents the total MSW generation. All currency conversions used in the creation of this report have been calculated using constant 2017 annual average exchange rates.

Singapore Waste Management Market Trends

This section covers the major market trends shaping the Singapore Waste Management Market according to our research experts:

Recycling is a key trend in the Singaporean waste management industry

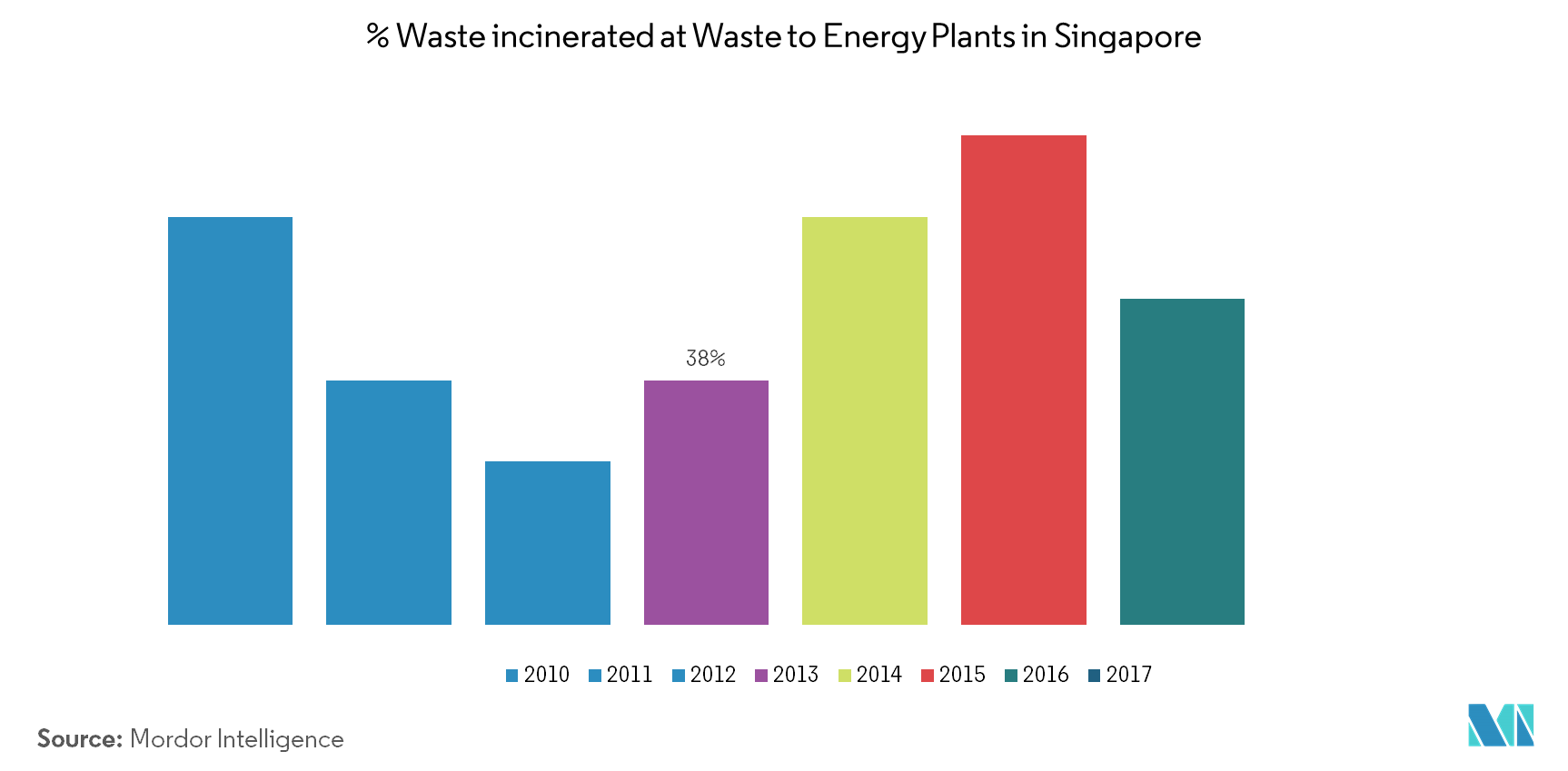

Insights on the Incineration practices in Singapore to deal with effective waste management

Owing to its limited land area and dense population, it is very important that Singapore has an efficient system for the collection and disposal of waste generated across the nation.

To meet this increasing need, Singapore has developed an advanced waste management system that minimises land use.

In Singapore, 92% of waste is incinerated, on the other hand, the remaining is landfilled at a unique offshore solid waste facility. Singapore’s four incineration plants serve as a land-efficient method of waste management, and they provide 3% of the island’s electricity needs.

Overall, Singapore’s integrated waste management system focuses on three areas: collection, recovery and treatment.

Core strategies for the sustainability of Singapore’s waste management include:

- Minimising waste through reducing, reusing and recycling (more than 50 per cent of Singapore’s waste is recycled)

- A push towards Zero Landfill

- Developing the waste management industry and positioning Singapore as a centre for waste management technology in the region

Singapore Waste Management Industry Overview

Building on their experience gained in Singapore, many local companies have been bringing their comprehensive suite of cost-effective value-add services to its clients around the world. Companies looking to tap into Singapore’s capabilities will find partners that are experienced, international and able to customise solutions to meet clients’ needs. The market for companies in Singapore however looks fragmented offering many opportunities for new companies to enter the market.

Singapore-based companies operate across the entire waste management value chain, from collection and recycling, to waste treatment, energy recovery and landfill management. They offer integrated services to optimise efficiency and deliver long-term, sustainable solutions.

ecoWise - The company’s wholly owned subsidiary, Bee Joo Industries Pte Ltd is the first Singapore-based company to successfully register a Clean Development Mechanism project and complete the Emissions Reduction Purchase Agreement. The carbon credits generated from its energy recovery activity in the biomass cogeneration plant in Singapore were sold to Kansai Electric of Japan.

Many pre-qualified waste collection companies compete to provide collection services for the designated domestic and trade premises in the nine geographical sectors of Singapore.

Singapore Waste Management Market Leaders

-

Sembcorp Environmental Management Pte. Ltd. (Singapore)

-

Veolia Environmental S.A

-

Colex Holdings Limited

-

ECO Industrial Environmental Engineering Pte Ltd

*Disclaimer: Major Players sorted in no particular order

Singapore Waste Management Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Key Deliverables of the Study

- 1.3 Study Assumptions

2. RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3. EXECUTIVE SUMMARY

4. MARKET OVERVIEW

- 4.1 Market Overview

- 4.2 Market Trends

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Brief on Vietnamese government regulations and initiatives

- 4.5 Value Chain/ Supply Chain Analysis

5. MARKET DYNAMICS and INSIGHTS

- 5.1 Introduction

- 5.2 Drivers

- 5.3 Restraints

- 5.4 Opportunities

- 5.5 Insights on the Logisitcs support and development in the waste management industry in Singapore

- 5.6 Insights on the strategies of the rising startups venturing into the Singaporean waste management industry

- 5.7 Technological advancement and innovation in the effective waste management

6. MARKET SEGMENTATION

-

6.1 By Waste type

- 6.1.1 Industrial waste

- 6.1.2 Municipal solid waste

- 6.1.3 E-waste

- 6.1.4 Plastic waste

- 6.1.5 Bio-medical waste

-

6.2 By Disposal methods

- 6.2.1 Collection

- 6.2.2 Landfill

- 6.2.3 Incineration

- 6.2.4 Recycling

7. INVESTMENT ANALYSIS

8. COMPETITIVE LANDSCAPE

- 8.1 Overview (Market Concentration and Major Players)

-

8.2 Company Profiles

- 8.2.1 Singapore Waste Management Industry

- 8.2.2 Sembcorp Environmental Management Pte. Ltd. (Singapore)

- 8.2.3 Veolia Environmental S.A

- 8.2.4 Colex Holdings Limited

- 8.2.5 ECO Industrial Environmental Engineering Pte Ltd

- 8.2.6 Envipure

- 8.2.7 RICTEC PTE LTD

- 8.2.8 Indsutrial Wastes Auction

- 8.2.9 Recycling Partners Pte. Ltd.

- 8.2.10 CH E-Recycling

- 8.2.11 CITIC Envirotech Ltd*

- *List Not Exhaustive

9. FUTURE GROWTH PROSPECTS OF SINGAPORE WASTE MANAGEMENT INDUSTRY

10. APPENDIX

- 10.1 Statistics on the state-wise solid waste generation in urban areas

- 10.2 Singapore size of population (million), 2013-17

- 10.3 Singapore gdp (constant 2005 prices, $ billion), 2013-17

- 10.4 Singapore gdp (current prices, $ billion), 2013-17

- 10.5 Singapore inflation, 2013-17

- 10.6 Singapore consumer price index (absolute), 2013-17

- 10.7 Singapore exchange rate, 2013-17

11. DISCLAIMER AND ABOUT US

** Subject To AvailablitySingapore Waste Management Industry Segmentation

A complete background analysis of the Singapore waste management market, which includes an assessment of the economy and contribution of sectors in the economy, market overview, market size estimation for key segments, and emerging trends in the market segments, market dynamics is covered in the report.

| By Waste type | Industrial waste |

| Municipal solid waste | |

| E-waste | |

| Plastic waste | |

| Bio-medical waste | |

| By Disposal methods | Collection |

| Landfill | |

| Incineration | |

| Recycling |

Singapore Waste Management Market Research FAQs

What is the current Singapore Waste Management Market size?

The Singapore Waste Management Market is projected to register a CAGR of 1.25% during the forecast period (2024-2029)

Who are the key players in Singapore Waste Management Market?

Sembcorp Environmental Management Pte. Ltd. (Singapore), Veolia Environmental S.A, Colex Holdings Limited and ECO Industrial Environmental Engineering Pte Ltd are the major companies operating in the Singapore Waste Management Market.

What years does this Singapore Waste Management Market cover?

The report covers the Singapore Waste Management Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Singapore Waste Management Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Waste Disposal in Singapore Industry Report

Statistics for the 2024 Waste Disposal in Singapore market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Waste Disposal in Singapore analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.