Smart Bed Market Size

| Study Period | 2020 - 2029 |

| Market Size (2024) | USD 3.02 Billion |

| Market Size (2029) | USD 3.81 Billion |

| CAGR (2024 - 2029) | 4.80 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Smart Bed Market Analysis

The Smart Bed Market size is estimated at USD 3.02 billion in 2024, and is expected to reach USD 3.81 billion by 2029, growing at a CAGR of 4.80% during the forecast period (2024-2029).

COVID-19 has had an exceptional and catastrophic worldwide impact, with smart bed products having a beneficial influence across all regions during the epidemic.

Smart beds are available for residential and commercial purposes, with a range of features that can enhance the user experience in ways not possible otherwise. The demand for a higher level of comfort from the developed areas is driving the market studied. Smart beds meet such demand by helping users sleep better.

The rising adoption of smart beds in the healthcare sector is impelling the growth of the smart bed market, as they offer benefits, such as enhanced and intensive care of patients in hospitals and health benefits for residential consumers. New entrants can have a glimpse of the advancements in this emerging market. The semi-automatic type segment is leveraging the growth of the market.

The growing young population and rise in disposable income are mainly driving the growth of the market. However, a lack of expertise in manufacturing smart beds in various regions is a drawback for market growth. The low availability of these beds in the stores and lower production rates restrain the market growth.

Smart Bed Market Trends

This section covers the major market trends shaping the Smart Bed Market according to our research experts:

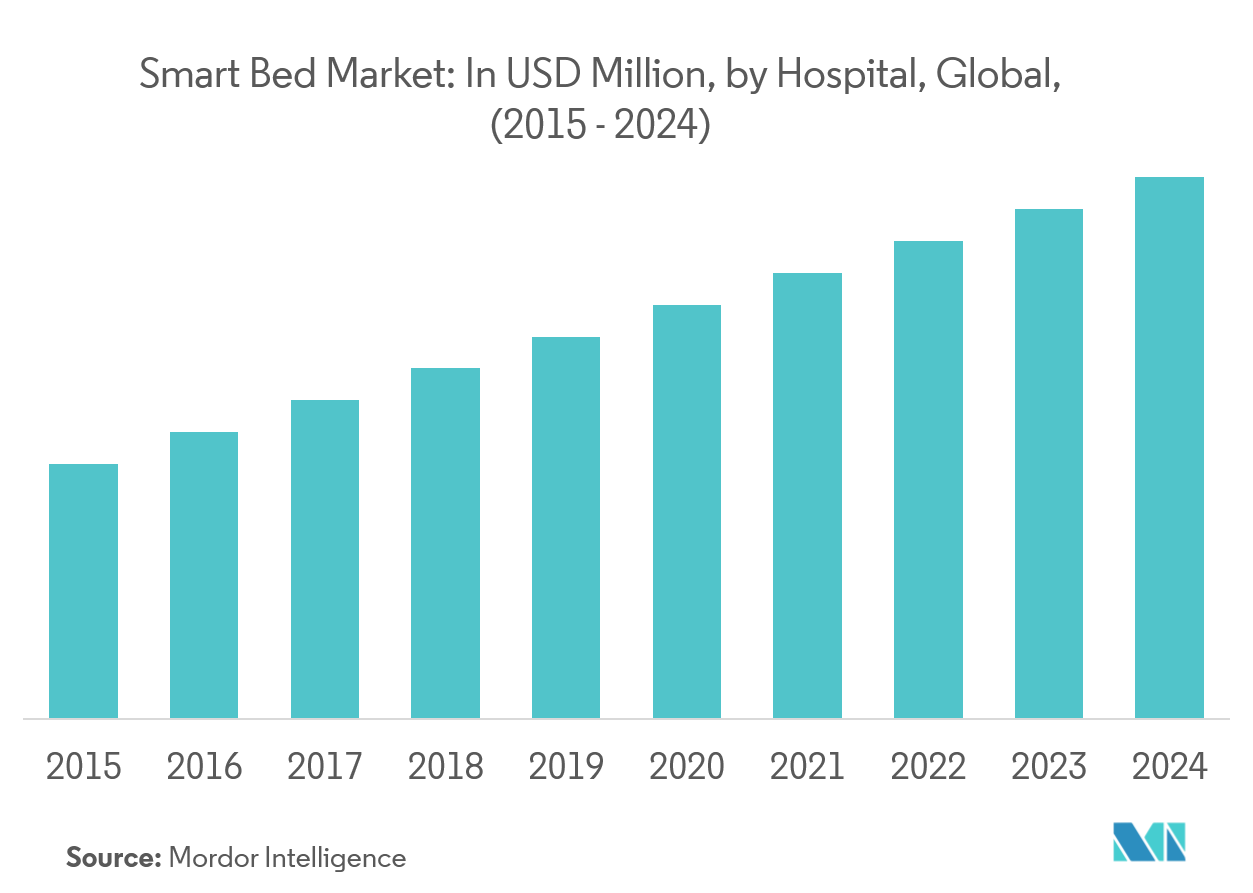

The Hospital Segment is Anticipated to Grow at a Higher Rate

Smart beds used in hospitals are majorly focused on improving patient management and helping patients recover better. The market has gained significant traction in the healthcare sector, owing to continuous advancement in smart bed technologies, enabling hospitals to deliver enhanced healthcare service to the patient. The rise in government investments in the hospitals to establish the latest technology equipment and smart beds may lucratively boost the market's growth. The segment is projected to grow rapidly during the forecast period, owing to the shift in patient preference and surge in demand for advanced healthcare facilities. Cardiovascular disorders are anticipated to drive the demand for smart beds, as these beds are embedded with integrated cardio monitoring sensors and devices that raise the alarm if a patient has a heart attack.

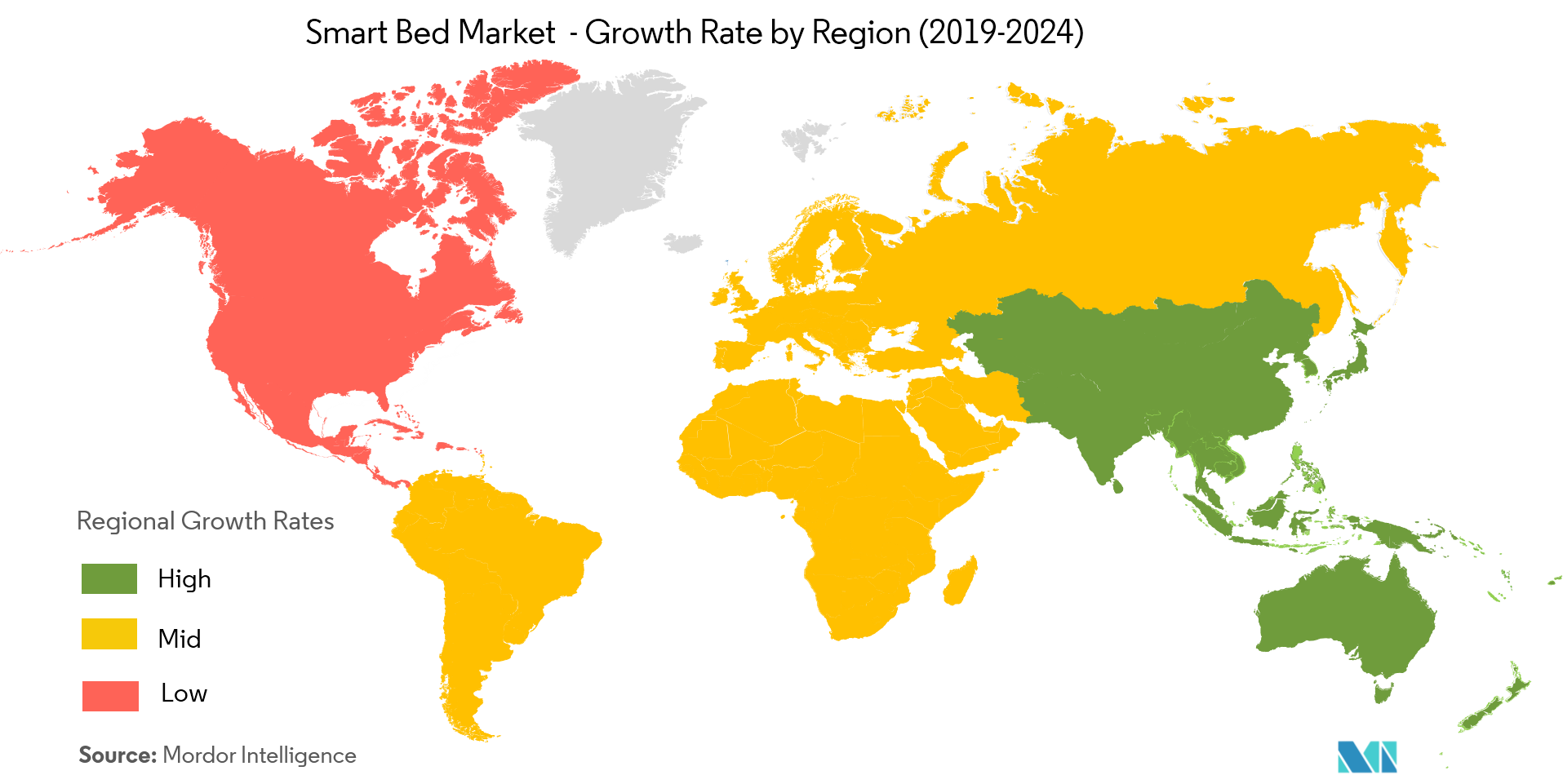

Asia-Pacific is Expected to Witness the Highest Growth

Asia Pacific is expected to record the fastest CAGR of 5.6% from 2022 to 2027, generating revenue of USD 375.7 million by 2027. China accounts for a major share in the regional market owing to major home improvement projects undertaken by consumers owing to rapid urbanization, and the growing purchasing power of the people in the region is boosting the demand for smart beds. Over the past few years, Asia Pacific has been moving toward digital transformation and driving technology trends across the globe. The region has some of the most technology-driven countries, including China, Japan, South Korea, Singapore, and India. These technology giants are introducing cutting-edge technology in home automation and smart gadgets. These industry trends are anticipated to boost the demand for smart clocks in the region over the forecast period.

Smart Bed Industry Overview

The report covers major international players operating in the market studied. The market is dominated by players such as Paramount Bed Co., Stryker Corporation, BodiTrak, Hill Rom Holdings Inc., and others. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Smart Bed Market Leaders

-

Paramount Bed Co.

-

Stryker Corporation

-

The BodiTrak

-

Hill Rom Holdings Inc.

-

Invacare Corporation

*Disclaimer: Major Players sorted in no particular order

Smart Bed Market News

On March 21, 2022, Invacare Corporation announced the appointment of Aron I. Schwartz, age 51, to its Board of Directors, previously the managing director of ACON Investments.

In 2021, features including sleep tracking, automatic mattress firmness adjustment, climate control, smart fabric technology, adjustable bases, anti-snoring feature, IoT, and smart home connectivity were the new advancements in the Smart Bed Market.

Smart Bed Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

-

4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Trends Shaping the Smart Bed Market

- 4.7 Technological Innovations in the Market

- 4.8 Impact of COVID-19 on the Market

5. MARKET SEGMENTATION

-

5.1 By Product

- 5.1.1 Manual

- 5.1.2 Semi-automatic

- 5.1.3 Fully -automatic

-

5.2 By End User

- 5.2.1 Residential

- 5.2.2 Hospital

- 5.2.3 Other End Users

-

5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Specialty Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

-

5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Paramount Bed Co.

- 6.1.2 Stryker Corporation

- 6.1.3 BodiTrak

- 6.1.4 ArjoHuntleigh AB

- 6.1.5 Hill Rom Holdings Inc.

- 6.1.6 Sleepnumber

- 6.1.7 Invacare Corporation

- 6.1.8 Responsive Surface Technology

- 6.1.9 Hi-Interiors SRL

- 6.1.10 BAM Labs*

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

8. DISCLAIMER AND ABOUT US

** Subject To AvailablitySmart Bed Industry Segmentation

A complete background analysis of the smart bed market, which includes an assessment of the parental market, emerging trends by segments and regional markets, and significant changes in market dynamics and market overview, is covered in the report. The report also features qualitative and quantitative assessments by analyzing the data gathered from industry analysts and market participants across key points in the industry's value chain. The Smart Bed Market is Segmented by Product (Manual, Semi-automatic, and Fully-automatic), by End User (Residential, Hospital, and Other End Users), by Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online, and Other Distribution Channels), and by Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa).

| By Product | Manual |

| Semi-automatic | |

| Fully -automatic | |

| By End User | Residential |

| Hospital | |

| Other End Users | |

| By Distribution Channel | Supermarkets/Hypermarkets |

| Specialty Stores | |

| Online | |

| Other Distribution Channels | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| South America | |

| Middle-East and Africa |

Smart Bed Market Research FAQs

How big is the Smart Bed Market?

The Smart Bed Market size is expected to reach USD 3.02 billion in 2024 and grow at a CAGR of 4.80% to reach USD 3.81 billion by 2029.

What is the current Smart Bed Market size?

In 2024, the Smart Bed Market size is expected to reach USD 3.02 billion.

Who are the key players in Smart Bed Market?

Paramount Bed Co., Stryker Corporation, The BodiTrak, Hill Rom Holdings Inc. and Invacare Corporation are the major companies operating in the Smart Bed Market.

Which is the fastest growing region in Smart Bed Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Smart Bed Market?

In 2024, the North America accounts for the largest market share in Smart Bed Market.

What years does this Smart Bed Market cover, and what was the market size in 2023?

In 2023, the Smart Bed Market size was estimated at USD 2.88 billion. The report covers the Smart Bed Market historical market size for years: 2020, 2021, 2022 and 2023. The report also forecasts the Smart Bed Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Smart Bed Industry Report

Statistics for the 2024 Smart Bed market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Smart Bed analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.