Smart Fleet-On-Board Devices Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 8.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Smart Fleet-On-Board Devices Market Analysis

The smart fleet-on-board devices market is expected to grow at a CAGR of 8% over the forecast period (2021 - 2026). An efficient transportation system needs route scheduling, timetable and data analysis of fleet systems to uplift the market growth. The use of smartphones and smart devices provides a great growth opportunity to the fleet on-board devices for the coming years. Using GPS and GSM/GPRS location technology vehicles can be tracked and managed securely in real-time through a computer, tablet, or smartphone. In terms of analysis, data collected through AVL, APC, and ticketing solution is crucial. The growing use of modern transportation and technology advancements in ticketing devices are the major factors boosting the global smart fleet on-board devices market. At the same time, smart technology usage in logistics worldwide is helping the market to grow. However, data security is an issue, which shows up as a market difficulty.

Smart Fleet-On-Board Devices Market Trends

This section covers the major market trends shaping the Smart Fleet-On-Board Devices Market according to our research experts:

Technological Advancement in the Ticketing Systems will Drive the Market Growth

Owing to smart technologies and intelligent transport systems, the fleet on-board devices market has achieved significant growth. Transit fare collection or ticketing technology has evolved tremendously from manual-based systems to automated systems with computer-aided hardware and software. The technical enhancement of smart ticketing devices leads to a shift from cash to smart payment, as well as from mono application to multi-application system. The advancements in fare collection have been possible due to the changes in design media, use of microprocessor and software in fare collection equipment, and the development of sophisticated control, and data communications systems. Emergence of the smart ticketing system has continued to benefit the transportation industry significantly. Adoption of smart ticketing systems for the public transit system, such as buses, trains, and airplanes will continue to gain momentum attributed to quick access and robust security features.

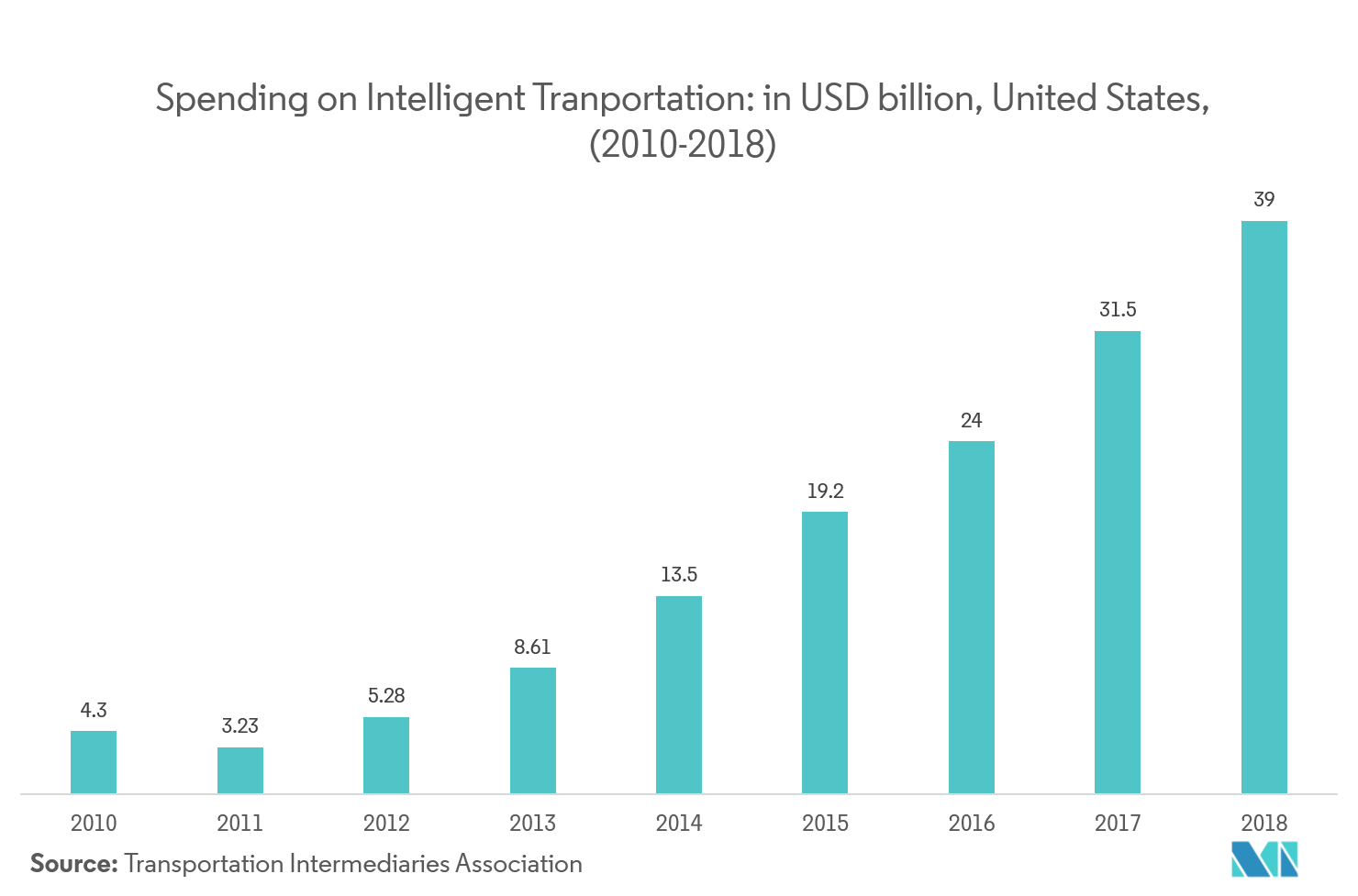

North America to account for a Major Share

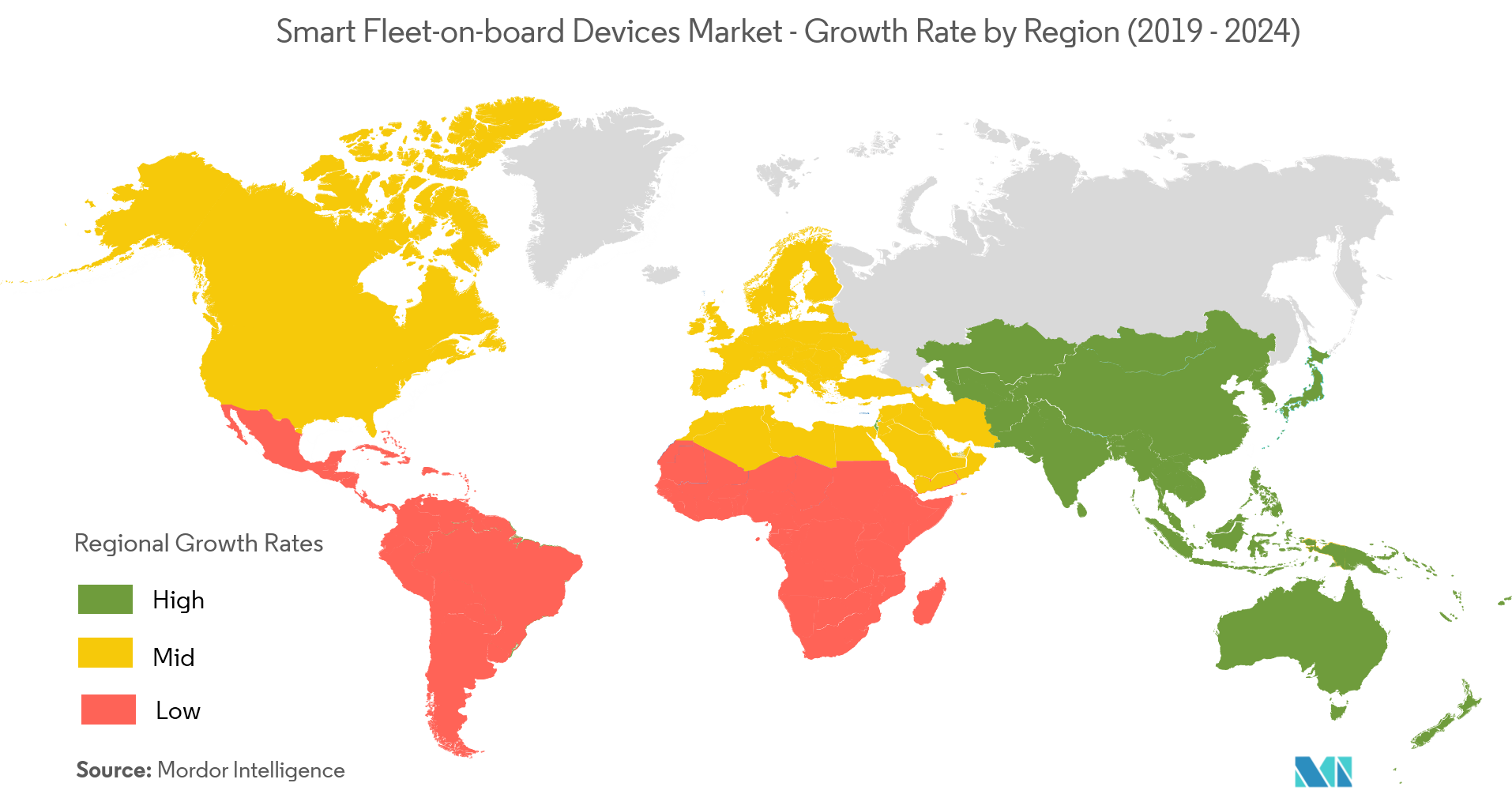

North American fleet management has developed over the past few years due to the adoption of various techniques, of which the on-board devices played a pivotal role. Due to the benefits of these on-board devices, they can schedule maintenance of the fleet in time for maximum life and efficient performance of the fleet, along with better returns and cost savings from breakdowns and other maintenance related issues. Moreover, increased spending in smart transportation solutions in the region, specifically in the US, will also result in the growth of the market. Furthermore, the region is also a prominent player in smart ticketing solutions, which has led to the growth of the market in the region. This is primarily attributed to factors such as the presence of a large number of technology companies with expertise in smart ticketing solution, such as Xerox Corporation, Cubic Transportation Systems, and Gemalto N.V., and growing demand for solutions that can streamline ticketing procedures.

Europe will closely follow attributing for the second largest market share. Among the developing regions, Asia-Pacific will experience the highest growth due to the increasing penetration of smart technologies across all major developing economies. The other driving factor will be the rapid development of transportation networks in this region owing to the massive investment in infrastructure that countries in this region are undertaking.

Smart Fleet-On-Board Devices Industry Overview

The major players in this industry provide various solutions like ticketing solutions, real-time fleet location data, automatic vehicle monitoring data and much more and hence this industry has some niche players who specialize in one or two technologies of the entire spectrum of fleet management software. Some of the major players are - Televic N.V.,Xerox Corporation,Trapeze Software Inc. (Constellation Software Inc.),Cubic Transportation Systems Limited,Clever Devices Ltd among others. Some of the recent developments in this industry are:-

- January 2018 - Clever Devices Ltd., the leading provider of ITS solutions in North America, announced the launch of a groundbreaking Disruption Management module for its CleverCADfleet management solution. The Disruption Management module enables CleverCAD users to react quickly to service disruptions that occur due to inclement weather, traffic or road conditions, or vehicle maintenance issues. Users can quickly make service changes to address issues, and all changes are immediately reflected on affected vehicles and in Clever Devices' real-time passenger information system. This ensures that both operators and passengers get the updated information, in real-time.

- October 2017 - Cubic Corporation’s Cubic Transportation Systems (CTS) business division was selected by the New York Metropolitan Transportation Authority (MTA) to replace the iconic MetroCard with a proven, next-generation fare payment system similar to that used on the bus, Tube and rail services operated by Transport for London (TfL). The new system enabled customers to create personalized transit accounts to see ride history, check balances, add value as well as report lost or stolen cards to protect their funds.

Smart Fleet-On-Board Devices Market Leaders

-

Televic N.V.

-

Xerox Corporation

-

Trapeze Software Inc. (Constellation Software Inc.)

-

Cubic Transportation Systems Limited

-

Clever Devices Ltd

*Disclaimer: Major Players sorted in no particular order

Smart Fleet-On-Board Devices Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Dynamics

-

4.3 Market Drivers

- 4.3.1 Technological Advancement in the Ticketing Systems will Drive the Market Growth

- 4.3.2 Increase in Adoption of Telematics and Growing Use of Autonomous and Electric Vehicles

-

4.4 Market Restraints

- 4.4.1 Security and Management of Huge Data Generated Everyday

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Devices

- 5.1.1 AVL

- 5.1.2 APC

- 5.1.3 Ticketing Solution

-

5.2 By Technology

- 5.2.1 GPS

- 5.2.2 GSM/GPRS

-

5.3 By Solution

- 5.3.1 Vehicle Tracking

- 5.3.2 Vehicle Diagnostics

- 5.3.3 Vehicle Performance

-

5.4 By Application

- 5.4.1 Buses

- 5.4.2 Trains

-

5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 South America

- 5.5.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Televic N.V.

- 6.1.2 Xerox Corporation

- 6.1.3 Trapeze Software Inc. (Constellation Software Inc.)

- 6.1.4 Cubic Transportation Systems Limited

- 6.1.5 Clever Devices Ltd

- 6.1.6 DILAX Intelcom GmbH

- 6.1.7 Eurotech, Inc.

- 6.1.8 21st Century Technology plc

- 6.1.9 Hella Aglaia Mobile Vision GmbH

- 6.1.10 Acorel B.V.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablitySmart Fleet-On-Board Devices Industry Segmentation

An efficient transportation system results in the efficient dynamic movement of people and goods, which extensively contribute to the quality of life in society. Using GPS and GSM/GPRS location technology, vehicles can be tracked and managed securely in real-time through a computer, tablet, or smartphone. In terms of analysis, data collected through AVL, APC, and ticketing solution is very crucial.APC gives data about the passenger count on-board. This also includes data about the number of passengers boarded at every station at a given time. AVL provides real-time location of the fleet, data that can help in setting the time table for fleets. Fleet optimization is also verified with the ticketing revenue generated on-board with the help of ticketing devices

| By Devices | AVL |

| APC | |

| Ticketing Solution | |

| By Technology | GPS |

| GSM/GPRS | |

| By Solution | Vehicle Tracking |

| Vehicle Diagnostics | |

| Vehicle Performance | |

| By Application | Buses |

| Trains | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| South America | |

| Middle East and Africa |

Smart Fleet-On-Board Devices Market Research FAQs

What is the current Smart Fleet-on-board Devices Market size?

The Smart Fleet-on-board Devices Market is projected to register a CAGR of 8% during the forecast period (2024-2029)

Who are the key players in Smart Fleet-on-board Devices Market?

Televic N.V., Xerox Corporation, Trapeze Software Inc. (Constellation Software Inc.), Cubic Transportation Systems Limited and Clever Devices Ltd are the major companies operating in the Smart Fleet-on-board Devices Market.

Which is the fastest growing region in Smart Fleet-on-board Devices Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Smart Fleet-on-board Devices Market?

In 2024, the North America accounts for the largest market share in Smart Fleet-on-board Devices Market.

What years does this Smart Fleet-on-board Devices Market cover?

The report covers the Smart Fleet-on-board Devices Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Smart Fleet-on-board Devices Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Smart Fleet-on-board Devices Industry Report

Statistics for the 2024 Smart Fleet-on-board Devices market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Smart Fleet-on-board Devices analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.