Smart Learning Systems Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 22.50 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Smart Learning Systems Market Analysis

The smart learning systems market was valued at USD 29.98 billion in 2020, and it is expected to reach a value of USD 103.08 billion by 2026, at a CAGR of 22.5% during the forecast period (2021 - 2026). Schools and training centers are moving from the traditional blackboard approach to integrating smart technology into learning environments. The learning trend encompasses a broad range of activities, tools, and services, to improve the educational outcomes of students and employees directly.

- At the university level, institutions are adopting innovative methods, such as smart learning, to provide alternative pathways and opportunities for students to develop relevant and valuable skills in line with industry requirements.

- Software solutions provide institutions with well-organized enterprise resource planning (ERP) systems that help faculty members build improved courses and manage classrooms and schools proficiently. Online education platforms create virtual classrooms, enabling teachers to manage a large audience without any budget constraint.

- Moreover, in March 2020, Ellucian, a provider of software and services, announced that the Arkansas State University (ASU) System, a network of universities in Arkansas serving nearly 23,000 students, selected Ellucian Banner as its unified, cloud-based ERP solution. As part of the statewide effort to align higher education institutions, the ASU System would implement Banner to achieve a shared, scalable cloud platform, designed to increase collaboration, combine resources, and support future growth of the system's schools.

- The recent COVID-19 outbreak has impacted the global education industry. The pandemic is anticipated to have enormous economic consequences, and it is also having a devastating impact on global education. According to the latest figures released by the UNESCO, 1.3 billion learners around the world were not able to attend schools, as of March 23, 2020. Many schools, colleges, and universities are closed across the world.

Smart Learning Systems Market Trends

This section covers the major market trends shaping the Smart Learning Systems Market according to our research experts:

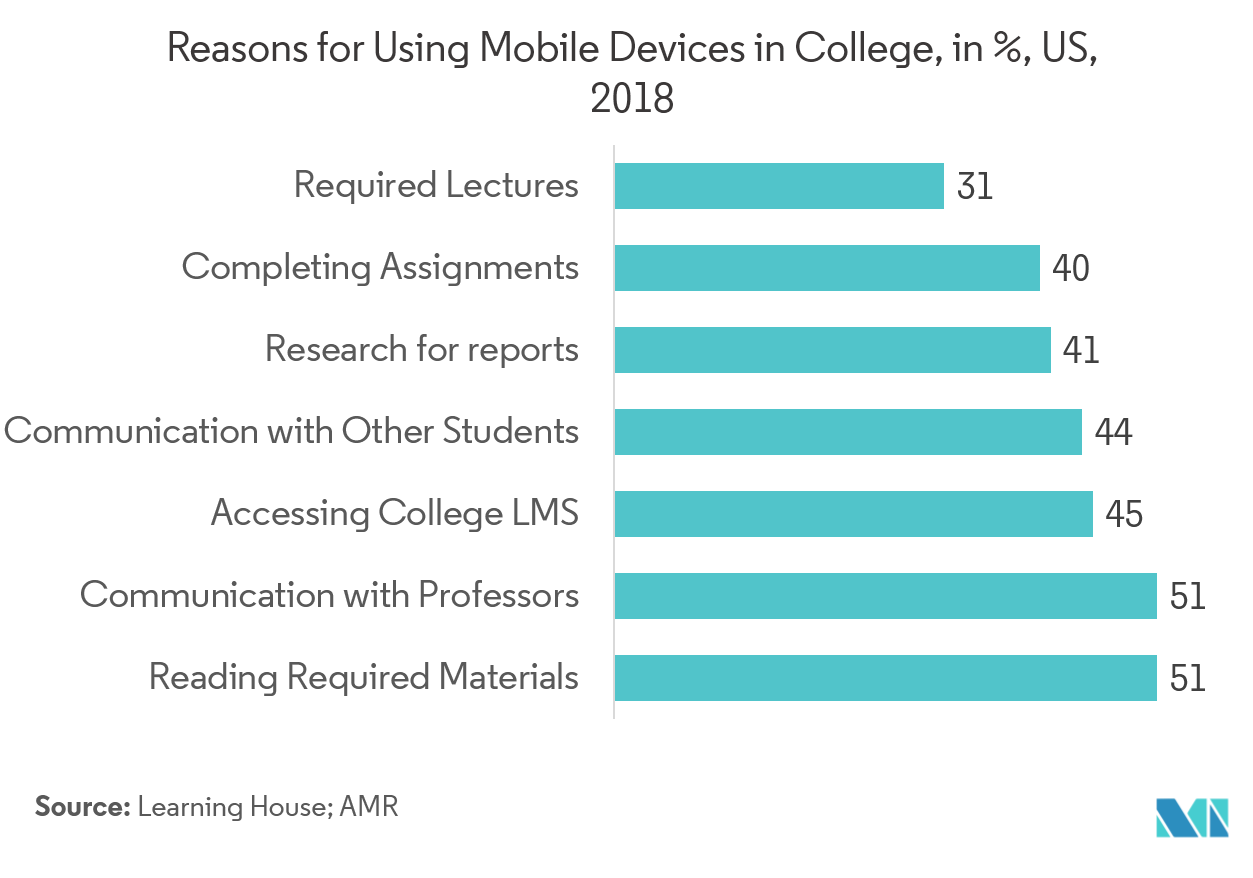

Mobile Devices are Expected to Witness Significant Growth

- Mobile devices for smart learning are growing, due to their portability and convenience regarding accessing content and social interactions. The number of smartphone users is also increasing every day.

- Owing to an exponential increase in ubiquity and computing capacity, today’s smartphones provide endless possibilities for higher engagement, enhancement of student understanding, and extension of learning beyond the classroom. Smartphones also offer an easy way for teachers to “facilitate and inspire students' learning and creativity” while increasing motivation.

- Students and teachers communicate effectively and efficiently with simple clicks to obtain feedbacks. The learning outcomes for both ability and knowledge can be smartly measured and observed through the latest ICT technologies.

- According to the latest survey by Learning House, 51% of respondents stated that they had used their phone or tablet device for reading the required materials. Moreover, According to Open Colleges, 81% of teachers in the United States opine that tablets can enrich classroom learning, and 86% of students believe that tablets can help them study more efficiently.

Asia-Pacific is Expected to Witness Significant Growth

- Asia-Pacific countries contribute significantly to the growth of the smart learning systems market. The adoption of smart learning solutions is explicitly deployed in this region to determine the power of innovative learning methodologies; the region's rapid economic growth is aiding it in becoming one of the fastest-growing education markets, internationally.

- India has the largest population in the age bracket of 5-24 years, globally, which presents a large number of opportunities in the education space. In a partnership with the Andhra Pradesh Government, Samsung announced the setting up of Samsung Smart Class at 14 government colleges across Andhra Pradesh, India, which offer Bachelors of Education (B.Ed) and Diploma in Education (D.Ed) courses.

- The Chinese government is funding technology initiatives that are aimed at narrowing the gap between the quality of education in rural and urban areas. There is a live-streaming network that connects hundreds of students spread across a vast area of China’s countryside.

- In 2018, Nanyang Technological University, Singapore (NTU Singapore), launched a new learning hub as part of the NTU Smart Campus vision. The learning hub is equipped with the latest technologies to support the flipped classroom pedagogy, wherein students learn the course content online before class and the face time with professors and classmates is devoted to collaborative learning.

Smart Learning Systems Industry Overview

The market is highly competitive, primarily owing to the presence of multiple players in the market operating in the domestic and international markets. The market appears moderately concentrated, with small and large players offering learning strategies supporting smart learning, such as formal/informal, personalized, adaptive, social, and self-directed. The players in the market are adopting strategies, like partnerships and expansions, in order to increase their products' functionality and expand their geographical reach.

- Feb 2020 - Pearson and Washington State University announced the renewal and expansion of their longstanding online degree partnership with the Carson College of Business. In an intensely competitive market, where general trends around MBA application volume are less and many programs are challenged to fight enrolment declines, Washington State University's online program continues to increase enrolment.

- Mar 2019 - Blackborad Inc. launched Instituto de Educação Superior de Brasília (IESB), a center for higher education located in Brasilia (Brazil), and implemented the company's flagship learning management system (LMS) - Blackboard Learn Ultra.

Smart Learning Systems Market Leaders

-

Blackboard Inc.

-

Pearson PLC

-

Ellucian Company

-

Smart Technologies Inc.

-

Promethean World

*Disclaimer: Major Players sorted in no particular order

Smart Learning Systems Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Growing Adoption of Digital Learning Solutions

- 4.2.2 Growing Concept of BYOD

-

4.3 Market Restraints

- 4.3.1 Lack of Infrastructure and Limited Awareness about E-learning

-

4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Product

- 5.1.1 Hardware

- 5.1.1.1 Interactive Display

- 5.1.1.2 Student Response System

- 5.1.1.3 Mobile Devices

- 5.1.1.3.1 Smartphones

- 5.1.1.3.2 Tablets

- 5.1.2 Software

- 5.1.3 Service

-

5.2 End User

- 5.2.1 Academic

- 5.2.2 Corporate

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle-East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Blackboard Inc.

- 6.1.2 Pearson PLC

- 6.1.3 Ellucian Company

- 6.1.4 Smart Technologies Inc.

- 6.1.5 Promethean World

- 6.1.6 Desire2learn

- 6.1.7 Dell EMC

- 6.1.8 Citrix Systems Inc.

- 6.1.9 Microsoft Corporation

- 6.1.10 SAP SE

- 6.1.11 Cisco Systems Inc.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablitySmart Learning Systems Industry Segmentation

Businesses are changing and becoming more competitive, so end users are demanding more effective database solutions that can increase productivity. At the university level, institutions are adopting innovative methods, such as smart learning to provide alternative pathways and opportunities for students to develop relevant and valuable skills in line with industry needs.

| Product | Hardware | Interactive Display | |

| Student Response System | |||

| Mobile Devices | Smartphones | ||

| Tablets | |||

| Product | Software | ||

| Service | |||

| End User | Academic | ||

| Corporate | |||

| Geography | North America | ||

| Europe | |||

| Asia-Pacific | |||

| Latin America | |||

| Middle-East and Africa |

Smart Learning Systems Market Research FAQs

What is the current Smart Learning Systems Market size?

The Smart Learning Systems Market is projected to register a CAGR of 22.5% during the forecast period (2024-2029)

Who are the key players in Smart Learning Systems Market?

Blackboard Inc., Pearson PLC, Ellucian Company, Smart Technologies Inc. and Promethean World are the major companies operating in the Smart Learning Systems Market.

Which is the fastest growing region in Smart Learning Systems Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Smart Learning Systems Market?

In 2024, the North America accounts for the largest market share in Smart Learning Systems Market.

What years does this Smart Learning Systems Market cover?

The report covers the Smart Learning Systems Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Smart Learning Systems Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Smart Learning Systems Industry Report

Statistics for the 2024 Smart Learning Systems market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Smart Learning Systems analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.