Smart Space Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 18.40 % |

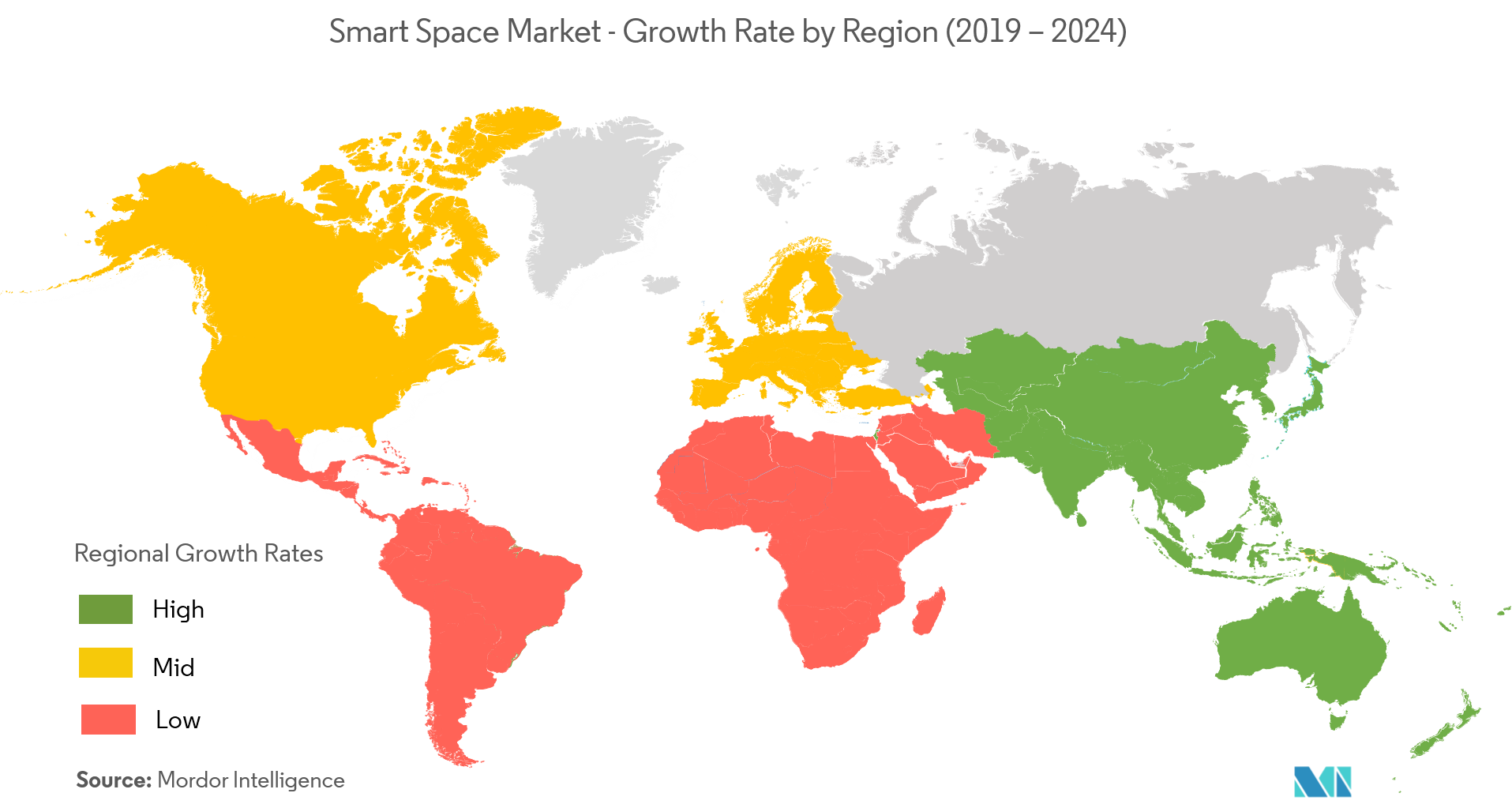

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

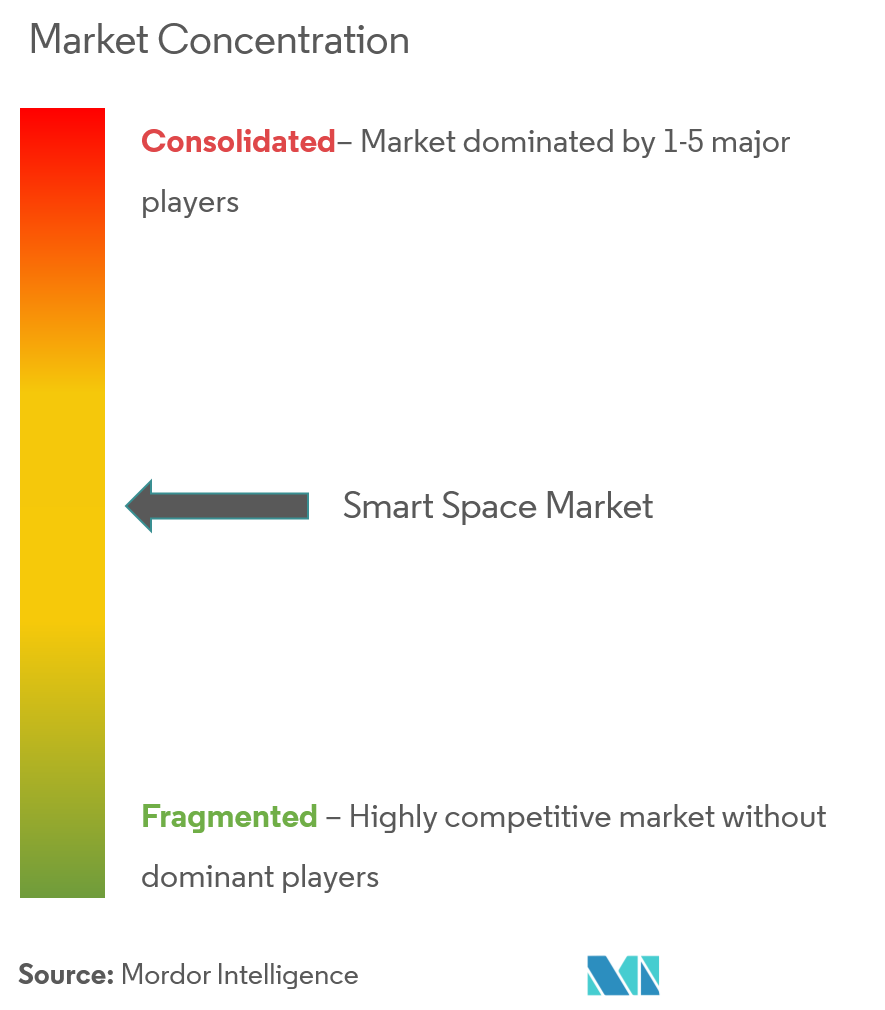

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Smart Space Market Analysis

The smart space market is expected to witness a CAGR of 18.4% over the forecast period (2021 - 2026). Smart space allows users or organizations to attain revenue growth, by allowing them to set a strategy and helps in improving decision making. It also allows a better understanding of demand patterns and business trends and it improves efficiency and financial results, through higher conversion and better space utilization.

- The increasing demand for IoT and increase in environmental concerns are some of the factors contributing to the growth of the smart space market over the forecast period.

- For instance, in September 2018, Microsoft announced Azure Digital Twins that allows the user to create digital replicas of spaces and infrastructure with the help of the cloud, AI, and IoT.

- With benefits, such as flexibility and scalability, being the core of the smart space solution offered by the providers, it is expected to fuel the growth of the smart space market during the forecast period.

- The rapid increase in urbanization, coupled with the advent of new technologies, like 5G, is expected to augment the growth of the smart space market over the forecast period.

- IBM's cognitive building solutions give the real estate and facilities management professionals with required tools necessary for the reduction of operating costs. It offers benefits, like better management of energy, optimizing space, and simplifying the real estate planning and management.

- However, the high initial capital investment required may act as the restraining factor for the growth of the smart space market.

Smart Space Market Trends

This section covers the major market trends shaping the Smart Space Market according to our research experts:

Commercial Segment Estimated to Hold the Largest Market Share

- The commercial segment comprises office spaces, hotels, hospitals, malls, shopping complexes, and restaurants, among others. These organizations with the help of smart space solutions can monitor costs and revenue, develop business plans, and redefine financial goals.

- For instance, Adappt, an Indian smart space solution company, is able to redefine the way organizations are adapting their workplace assets by using an integrated systems approach. The Adappt Cognitive Premise solution provides analytics, control, applications, and optimization to tailor each organization workplace according to its unique personality.

- The companies are looking forward to expanding their business footprint across different geographical region. This is one of the major factors contributing to the growth of the smart space market over the forecast period.

- For instance, in May 2019, Mitsubishi Electric Corporation announced a complete takeover of ICONICS Inc. This would allow Mitsubishi to strengthen its software portfolio and technology.

Europe is Expected to Hold a Significant Market Share

- The Northwest European region faces a great challenge, due to a shift toward a low carbon footprint economy. Municipalities play a pivotal role, as they account for 70% of the NWE energy consumption and CO2 emission. Especially, standard public street lighting accounts for approximately 30% of municipalities‘ total electricity consumption.

- Smart space solution aims to promote the usage of smart lighting in small-/mid-size municipalities, along with the sensors attached to light poles. With this arrangement, energy efficiency can be enhanced, CO2 emissions can be reduced, and street lighting can be adjusted as per requirements. This could augment the growth of the smart space market across the region.

- As European cities are expected to become “SMART” in the future, the market studied is expected to grow in the forecast period. For instance, the European Smart Space project aims at increasing the innovation capabilities of industrial SMEs, by exploiting the potential of intelligent and digital technologies.

Smart Space Industry Overview

Thesmart space market remains fairly competitive for the vendors,owingto the presence of some key players, such as ABB and Siemens, among others. Due to their ability to continually innovate their products and a good supply chain presence, the market has allowed the players to gain a competitive advantage over their competitors. Hefty investments in R&D and strategic partnerships haveallowed the players to gain a strong foothold in the market.

- May 2019 - Spacewell released a new service app, Work Assistant for cleaning, which is a mobile touchpoint of its Cobundu smart building platform. Work Assistant supports service providers to deliver activity-based services, based on live IoT-data. Work orders can be created in a variety of ways, for instance, through sensor triggers, user feedback, help desk tickets, and service scheduling.

- Apr2019 - DVI Communications partnered with Spacewell, to offer advanced smart building services to the US market. Thelong-term partnership will allow DVI to introduce Spacewell’s smart building solutions to a growing number of US businesses.

Smart Space Market Leaders

-

ABB Ltd

-

Siemens AG

-

Adappt Intelligence Inc.

-

Spacewell Faseas

-

Cisco Systems Inc.

*Disclaimer: Major Players sorted in no particular order

Smart Space Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Increasing Adoption of IoT

- 4.3.2 Increasing Urban Population

-

4.4 Market Restraints

- 4.4.1 High Initial Infrastructure Expenditure

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Value Chain Analysis

5. MARKET SEGMENTATION

-

5.1 By Type

- 5.1.1 Solutions

- 5.1.2 Services

-

5.2 By End-user Industry

- 5.2.1 Commercial

- 5.2.2 Residential

-

5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 Siemens AG

- 6.1.3 Adappt Intelligence Inc.

- 6.1.4 Spacewell Faseas (Nemetschek Group)

- 6.1.5 Cisco Systems Inc.

- 6.1.6 ICONICS Inc.

- 6.1.7 Ubisense Limited

- 6.1.8 Hitachi Vantara Corporation

- 6.1.9 SmartSpace Software PLC

- 6.1.10 Microsoft Corporation

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablitySmart Space Industry Segmentation

Smart space is a physical environment deployed with technologies, such as monitors and sensors, which allow humans to interact with the technology-enabled systems.

| By Type | Solutions |

| Services | |

| By End-user Industry | Commercial |

| Residential | |

| By Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Smart Space Market Research FAQs

What is the current Smart Space Market size?

The Smart Space Market is projected to register a CAGR of 18.40% during the forecast period (2024-2029)

Who are the key players in Smart Space Market?

ABB Ltd, Siemens AG, Adappt Intelligence Inc., Spacewell Faseas and Cisco Systems Inc. are the major companies operating in the Smart Space Market.

Which is the fastest growing region in Smart Space Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Smart Space Market?

In 2024, the North America accounts for the largest market share in Smart Space Market.

What years does this Smart Space Market cover?

The report covers the Smart Space Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Smart Space Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Smart Space Industry Report

Statistics for the 2024 Smart Space market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Smart Space analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.