Smart Space Industry Overview

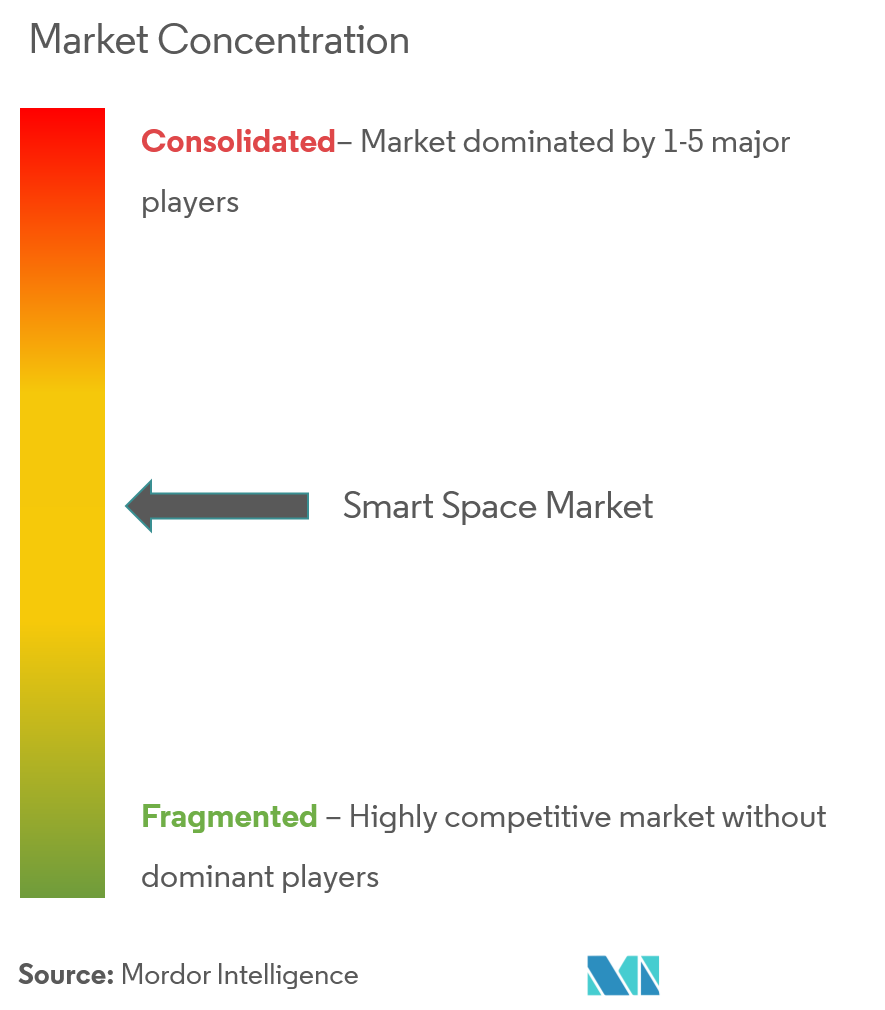

Thesmart space market remains fairly competitive for the vendors,owingto the presence of some key players, such as ABB and Siemens, among others. Due to their ability to continually innovate their products and a good supply chain presence, the market has allowed the players to gain a competitive advantage over their competitors. Hefty investments in R&D and strategic partnerships haveallowed the players to gain a strong foothold in the market.

- May 2019 - Spacewell released a new service app, Work Assistant for cleaning, which is a mobile touchpoint of its Cobundu smart building platform. Work Assistant supports service providers to deliver activity-based services, based on live IoT-data. Work orders can be created in a variety of ways, for instance, through sensor triggers, user feedback, help desk tickets, and service scheduling.

- Apr2019 - DVI Communications partnered with Spacewell, to offer advanced smart building services to the US market. Thelong-term partnership will allow DVI to introduce Spacewell’s smart building solutions to a growing number of US businesses.

Smart Space Market Leaders

-

ABB Ltd

-

Siemens AG

-

Adappt Intelligence Inc.

-

Spacewell Faseas

-

Cisco Systems Inc.

- *Disclaimer: Major Players sorted in no particular order