South America Snack Bar Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| Forecast Data Period | 2024 - 2029 |

| Historical Data Period | 2019 - 2022 |

| CAGR | 9.34 % |

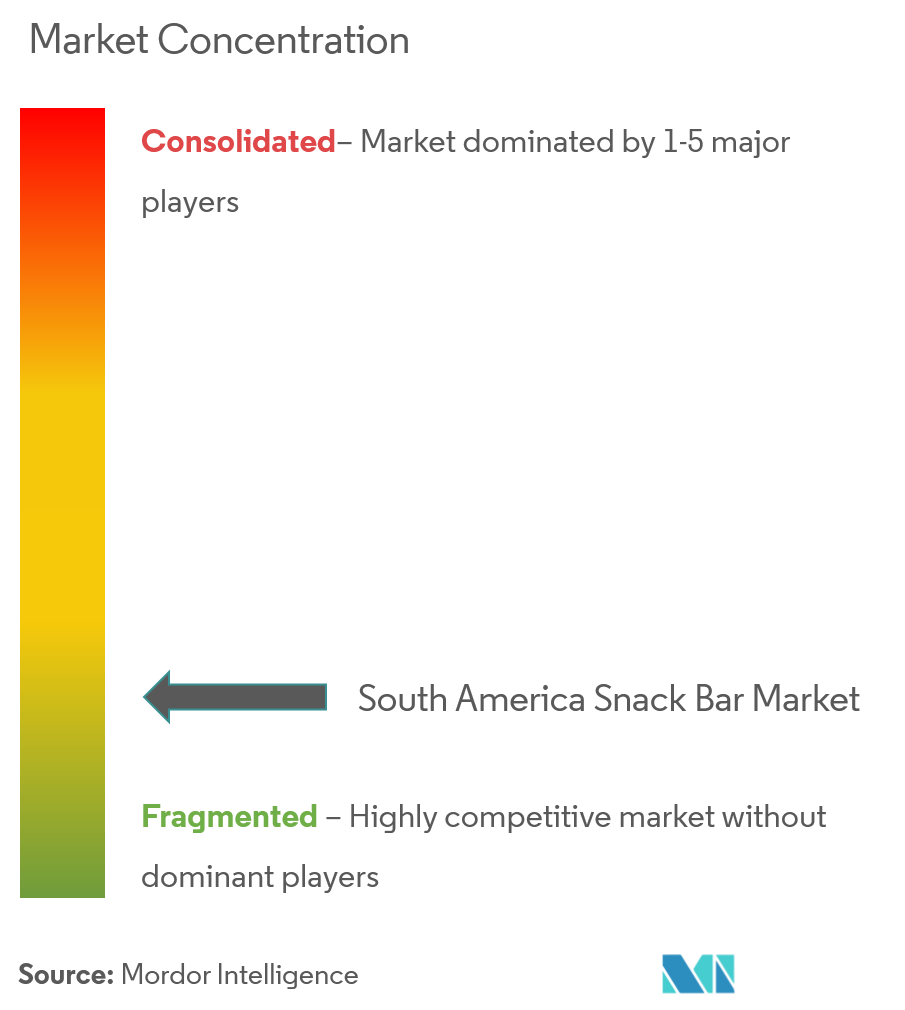

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

South America Snack Bar Market Analysis

South America snack bar market is projected to grow at a CAGR of 9.34% during the forecastperiod (2020- 2025).

- The South American snack bar market is driven by rapidly growing economic scenario that has heightened the spending on indulgent and snacking options.

- The rising health consciousness amid increasing prevalence in the lifestyle diseases has enabledSouth American consumers to opt for healthy and sustainable snacking options.

- The free-from categories of snack bars that are devoid of ingredients, such as sugar, gluten and GMO, which carry negative public-health opinions, are expected to significant sales in countries, such as Brazil and Argentina.

South America Snack Bar Market Trends

This section covers the major market trends shaping the South America Snack Bar Market according to our research experts:

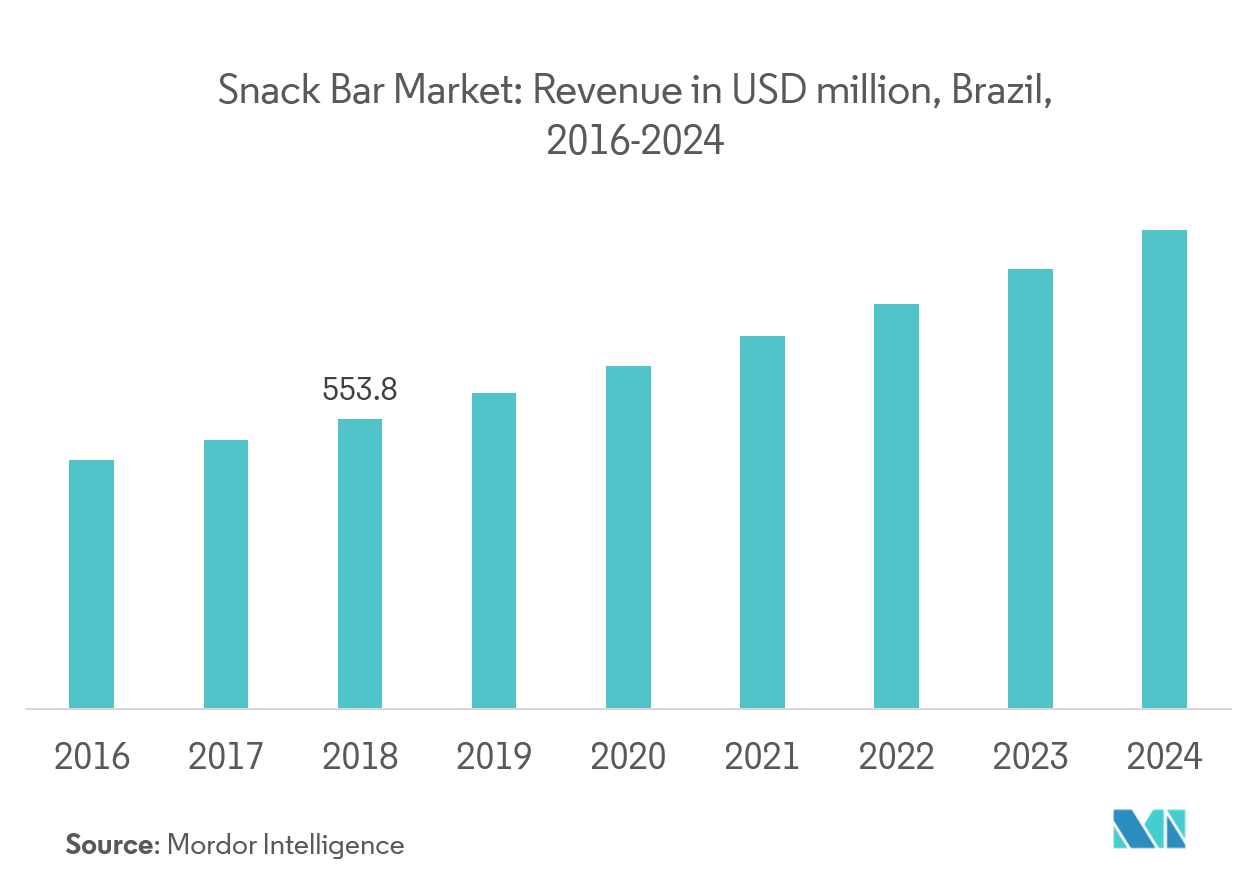

Brazil Dominates the Market

Brazil snack bar market is driven by increasing demand for healthy indulgence and rise in the new product development of different snack bars. The increase in dual-income households has prompted consumers to divert their spending on convenience and better-for-you foods. Gluten-free and low-sodium claims are fetching increasing popularity in the Brazilian snack bar market. Recently, Kobber, a Brazilian manufacturer of bakery and snack products, launched a line of snack bars, based on tapioca, which is free-from labelling claims. The flavorful innovation is evident in almost all the varieties of snack bars i.e. cereal bars, snack bars, fruit bars, and nut bars.

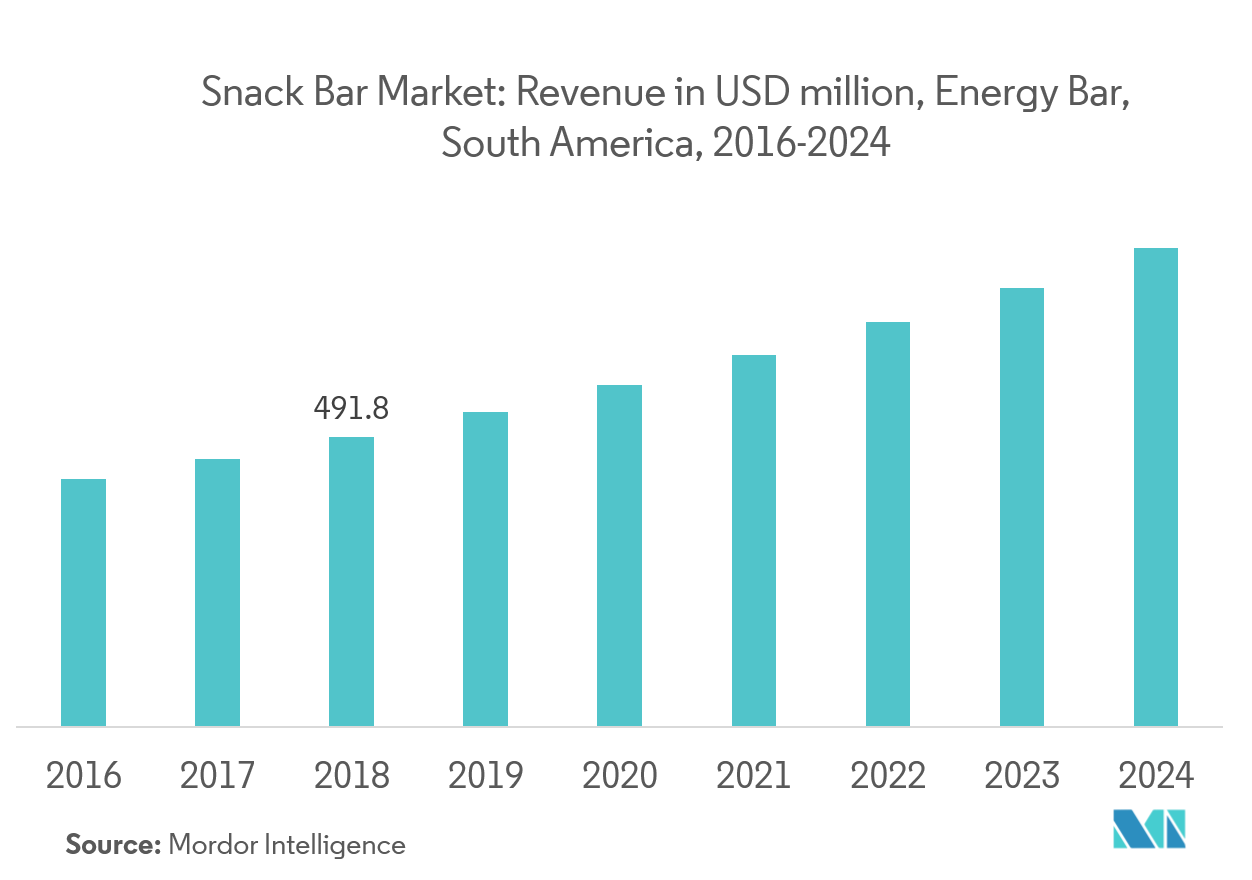

Energy Bars Emerge as the Most Preferred Snack Bar

The region is experiencing a robust preference for energy bars outstripping two major snacking categories i.e. cookies and confectionery. The diet trends are catching rapid attention among health conscious population, especially women consumers. South American cuisines, such as empanadas and tacos, provide exotic flavour options in snack bars including energy bars. Moreover, the locally grown ingredients, such as quinoa and amaranth, are widely utilized in different varieties of snack bars.

South America Snack Bar Industry Overview

South America snack bar market is higly fragmented owing to a large number of manufacturers present in the market. Some of the key players in the market are Kellogg Company, General Mills Inc., Nestle, and PepsiCo Inc. Companies in South America have been even observed to enter strategic partnership for expanding their presence in other regions to increase their product visibility.

South America Snack Bar Market Leaders

-

Kellogg Company

-

General Mills Inc.

-

Nestle

-

PepsiCo Inc.

-

Post Holdings

*Disclaimer: Major Players sorted in no particular order

South America Snack Bar Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Product Type

- 5.1.1 Cereal Bars

- 5.1.1.1 Granola/Muesli Bars

- 5.1.1.2 Other Cereal Bars

- 5.1.2 Energy Bars

- 5.1.3 Other Snack Bars

-

5.2 Distribution Channel

- 5.2.1 Supermarket/Hypermarket

- 5.2.1.1 Convenience Store

- 5.2.1.2 Specialty Stores

- 5.2.1.3 Online Stores

- 5.2.1.4 Others

-

5.3 Geography

- 5.3.1 South America

- 5.3.1.1 Brazil

- 5.3.1.2 Argentina

- 5.3.1.3 Rest of South America

6. COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Active Companies

- 6.3 Most Adopted Strategy

-

6.4 Company Profiles

- 6.4.1 Kellogg Company

- 6.4.2 General Mills Inc.

- 6.4.3 Nestle

- 6.4.4 PepsiCo Inc.

- 6.4.5 Post Holdings

- 6.4.6 Natural Balance Foods

- 6.4.7 Mars Inc.

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablitySouth America Snack Bar Industry Segmentation

South America snack bar market offers a range of product types including cereal, energy and other snack bars. The cereal bars section is further divided into granola/muesli bar and other cereal bars.Based on distribution channel, the market is segmented into supermarket/hypermarket, convenience store, specialty stores, online stores, and others. The report also covers the country level analysis for the major countries in the region such as Brazil, Argentina and rest of South America.

| Product Type | Cereal Bars | Granola/Muesli Bars |

| Other Cereal Bars | ||

| Product Type | Energy Bars | |

| Other Snack Bars | ||

| Distribution Channel | Supermarket/Hypermarket | Convenience Store |

| Specialty Stores | ||

| Online Stores | ||

| Others | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America |

South America Snack Bar Market Research FAQs

What is the current South America Snack Bar Market size?

The South America Snack Bar Market is projected to register a CAGR of 9.34% during the forecast period (2024-2029)

Who are the key players in South America Snack Bar Market?

Kellogg Company, General Mills Inc., Nestle, PepsiCo Inc. and Post Holdings are the major companies operating in the South America Snack Bar Market.

What years does this South America Snack Bar Market cover?

The report covers the South America Snack Bar Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the South America Snack Bar Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

South America Snack Bar Industry Report

Statistics for the 2024 South America Snack Bar market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. South America Snack Bar analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.