Soy Flour Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 6.12 % |

| Fastest Growing Market | North America |

| Largest Market | Asia Pacific |

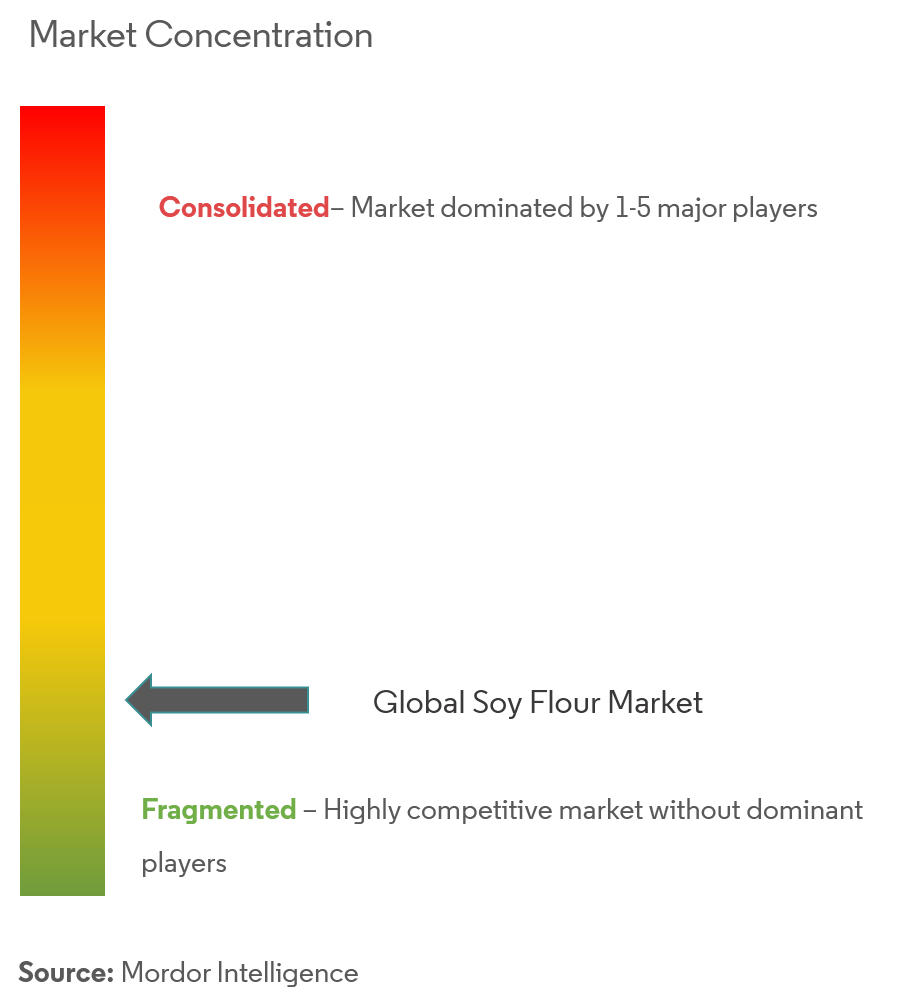

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Soy Flour Market Analysis

The Global Soy Flour Market is expected to register a CAGR of 6.12%, during the forecast period of 2019–2024.

- Growing demand for soy-derived flour in processed baked items owing to its nutritional qualities including gluten-free, trans-fat free, and whole-grain food products are fueling the soy flour market growth.

- Additionally, the rising popularity of a vegan diet is expected to propel the demand for soy flour owing to its nutritional value such as high dietary fiber and bioactive components including isoflavones. Moreover, flour derived from soy has a gluten-free property and it acts as a prime source of protein in a vegan diet, this, in turn, boosting the soy flour market globally.

Soy Flour Market Trends

This section covers the major market trends shaping the Soy Flour Market according to our research experts:

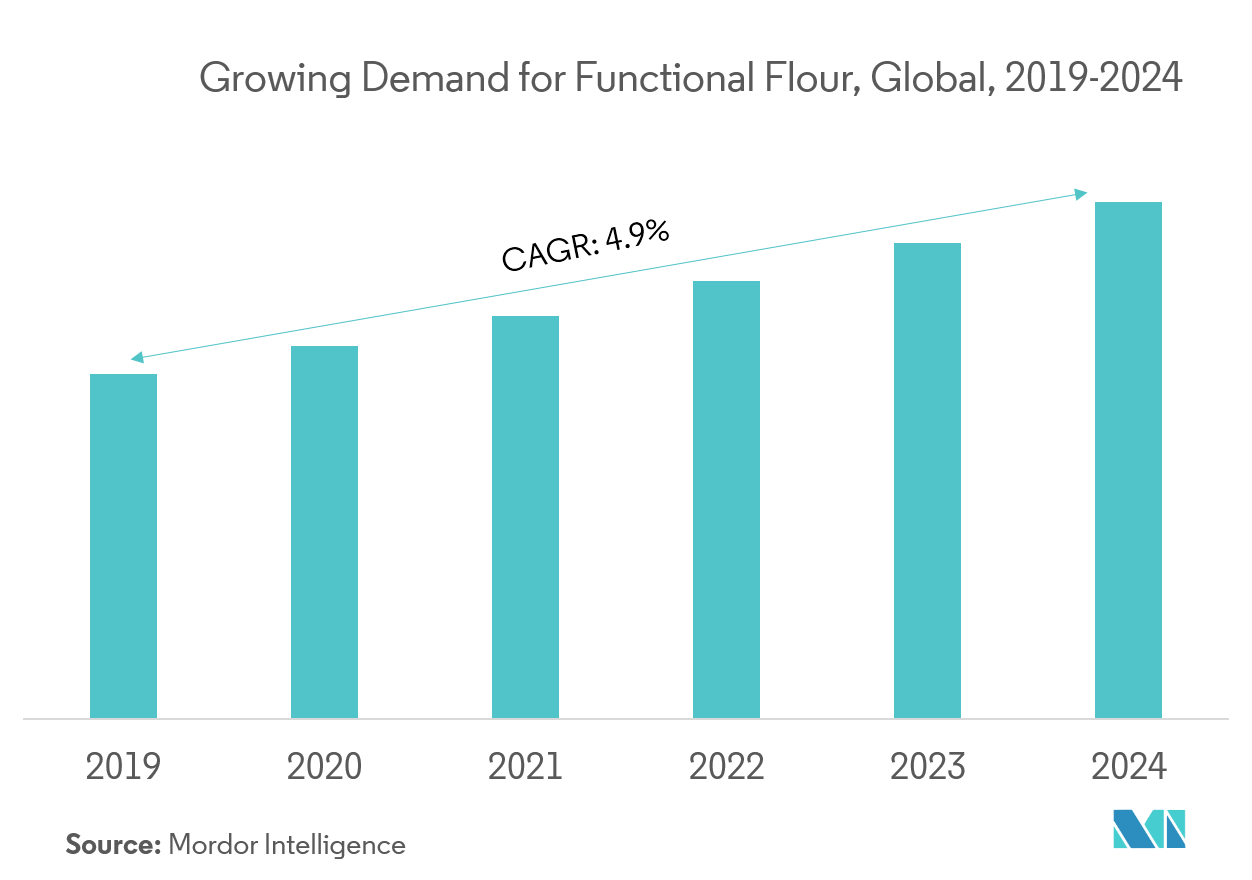

Growing Demand for Functional Flour

Soya flour has been gaining is gaining popularity in diverse food products and several industrial products. With beneficial properties, such as solubility and absorption abilities, modified soya flour significantly enhances the functional characteristics of the food items it is added to. Also, soy flour is considered as functional food ingredients. Additionally, the accelerating demand for functional flour can be attributed to the highly beneficial characteristics of functional flour. In recent times, several other industrial uses of modified soya flour have come to the fore, which in turn is expected to bring more traction to modified soya flour, thereby fueling growth in functional flour market in forecasted period.

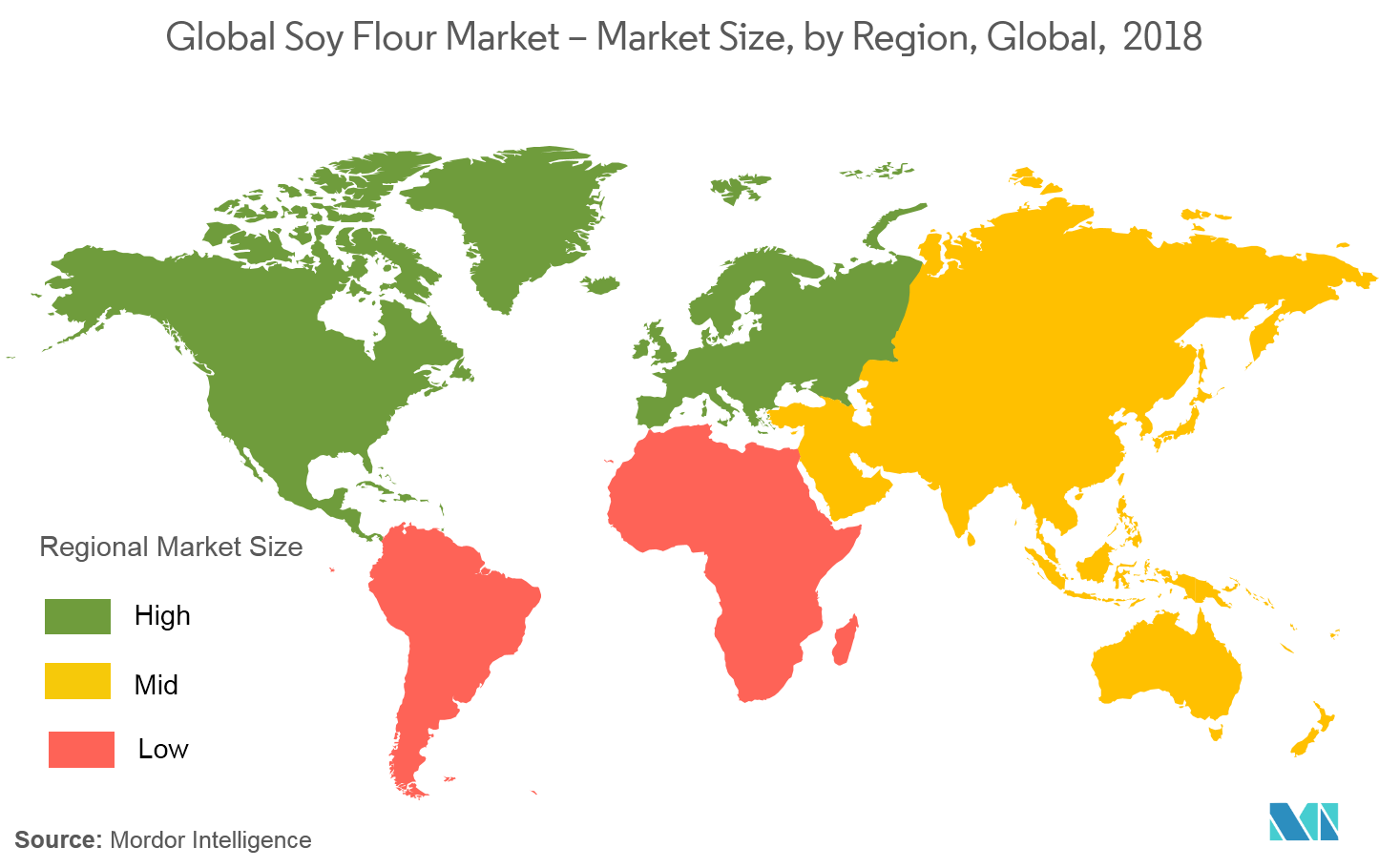

North America Dominated the Market

North America dominated the market in 2018 and held the significant market share over the forecast period. United States is the largest contributor to the market growth in the region. The growth of the market is attributed to rising importance of vegan diet among consumers in the country. Asia Pacific is the fastest growing region in the market. Japan is one of the largest consumers of soy based flour in Asia Pacific as it is one of the largest consumed traditional foods. Major companies are offering new products in order to gain a competitive edge in the market as well as to cater to the changing food preferences of the consumers. For instance, February 2019, Otsuka Pharmaceutical Co., Ltd. has introduced ‘SOYJOY Crispy Sakura’, whole soy nutrition bars. These new products are anticipated to increase the scope of soy based flour in the food industry over the forecast period.

Soy Flour Industry Overview

The global soy flour market is highly fragmented. Some of the major companies in the doy flour market, globally includes Archer Daniels Midland Company, Cargill, Incorporated, CHS Inc., DuPont, The Scoular Company, SunOpta, and Foodchem International Corporation, among others.

Soy Flour Market Leaders

-

Archer Daniels Midland Company

-

Cargill, Incorporated

-

CHS Inc.

-

DuPont

-

SunOpta

*Disclaimer: Major Players sorted in no particular order

Soy Flour Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

- 3.1 Market Overview

4. MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

-

4.3 Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 Type

- 5.1.1 Defatted

- 5.1.2 Full Fat

-

5.2 Application

- 5.2.1 Bakery & Confectionery

- 5.2.2 Meat Substitute

- 5.2.3 Meat and Poultry

- 5.2.4 Soups and Sausages

- 5.2.5 Others

-

5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 UAE

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East & Africa

6. COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

-

6.3 Company Profiles

- 6.3.1 Archer Daniels Midland Company

- 6.3.2 Cargill, Incorporated

- 6.3.3 CHS Inc.

- 6.3.4 DuPont

- 6.3.5 Foodchem International Corporation

- 6.3.6 SunOpta Inc.

- 6.3.7 Vippy Industries Ltd

- 6.3.8 Devansoy Inc.

- 6.3.9 The Scoular Company

- 6.3.10 Harvest Innovations

- *List Not Exhaustive

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablitySoy Flour Industry Segmentation

Global Soy Flour Market is segmented by type, application, and geography. On the basis of type, the market is segmented intodefatted and full-fat. On the basis ofapplication, the market is segmented intobakery & confectionery, meat substitutes, meat and poultry, soups and sausages, and others.By geography, the study provides an analysis of the soy flour market in the emerging and established markets across the globe, including North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

| Type | Defatted | |

| Full Fat | ||

| Application | Bakery & Confectionery | |

| Meat Substitute | ||

| Meat and Poultry | ||

| Soups and Sausages | ||

| Others | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Geography | Europe | United Kingdom |

| Germany | ||

| France | ||

| Russia | ||

| Italy | ||

| Spain | ||

| Rest of Europe | ||

| Geography | Asia Pacific | China |

| India | ||

| Japan | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| Geography | South America | Brazil |

| Argentina | ||

| Rest of South America | ||

| Geography | Middle East & Africa | UAE |

| Saudi Arabia | ||

| Rest of Middle East & Africa |

Soy Flour Market Research FAQs

What is the current Soy Flour Market size?

The Soy Flour Market is projected to register a CAGR of 6.12% during the forecast period (2024-2029)

Who are the key players in Soy Flour Market?

Archer Daniels Midland Company, Cargill, Incorporated, CHS Inc., DuPont and SunOpta are the major companies operating in the Soy Flour Market.

Which is the fastest growing region in Soy Flour Market?

North America is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Soy Flour Market?

In 2024, the Asia Pacific accounts for the largest market share in Soy Flour Market.

What years does this Soy Flour Market cover?

The report covers the Soy Flour Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Soy Flour Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Soy Flour Industry Report

Statistics for the 2024 Soy Flour market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Soy Flour analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.