Spectrum and Signal Analyzers Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 8.00 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

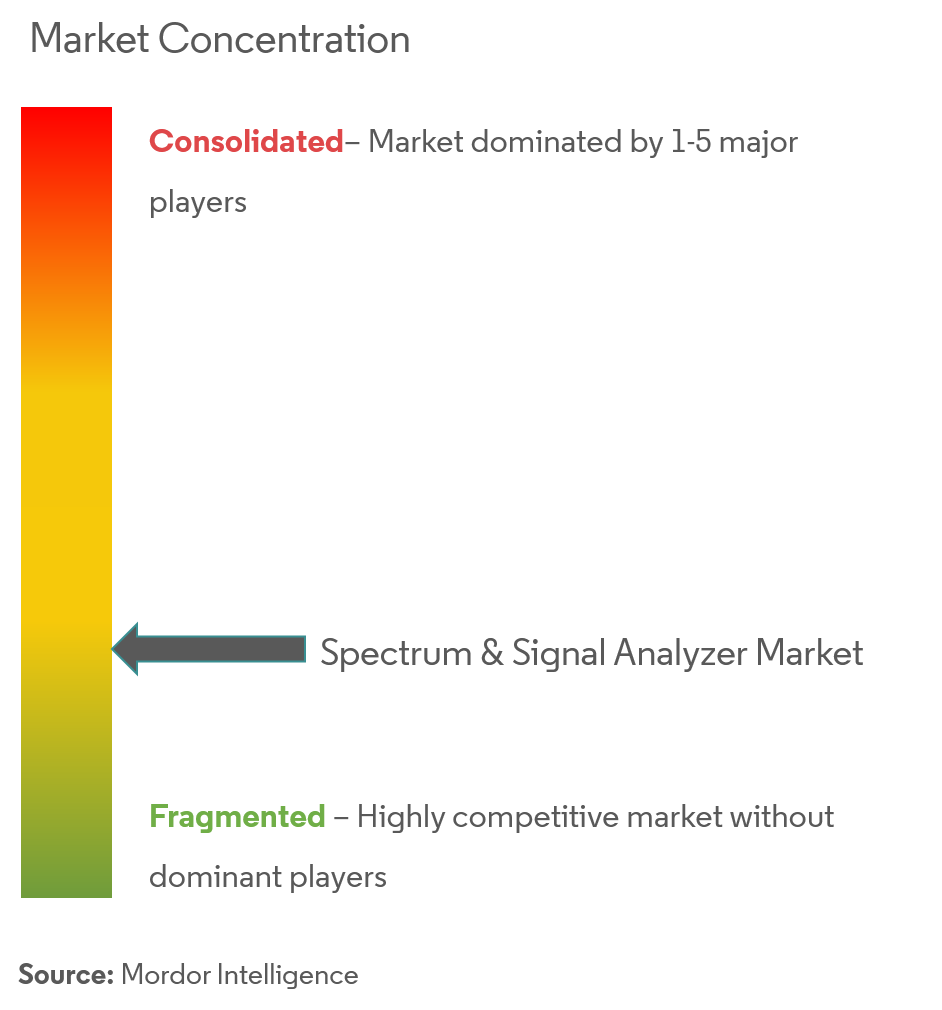

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Spectrum and Signal Analyzers Market Analysis

The spectrum and signal analyzer market is expected to register a CAGR of 8% over the forecast period. The increasing need for wireless technologies and increasing demand from the automobile sector for multitasking skills are expected to drive market growth. These analyzers serve various purposes in signal analysis for a wide range of applications such as audio, video, radar, communications, and other designs, which influences the market growth during the forecast period.

- Consumers' surging demand for wireless technology is responsible for the market's growth. The advancement in frequency and bandwidth, multitasking features, and growing acceptance of portable and handheld spectrum analyzers are some of the factors propelling the market growth.

- Additionally, the increasing application of spectrum analyzers in end-user industries, such as healthcare, is expected to act as a significant driver for the market. The use of ECG, EEG, and blood pressure monitors that need to be tested and calibrated before use requires testing devices like spectrum analyzers and signal generators for the same. Moreover, according to WHO, cardiovascular diseases remain the number one cause of death globally, and the use of this equipment in calibrating cardio monitoring devices is expected to augur well for the market.

- Signal Analyzer, launched nowadays, combines the superior dynamic range of a swept-tuned spectrum analyzer with vector signal analyzer capabilities facilitating in-channel measurements, like error vector magnitude (EVM), that require both magnitude and phase information. The versatility of signal analyzers is derived from implementing a fully digital IF that replaced the analog IF used in traditional spectrum analyzers.

- On the contrary, the factors responsible for hindering the market include the high cost of specialized spectrum analyzers. This has been a reason companies across the board have been trying to implement strategies to manage the costs of such equipment. Additionally, the costs of these analyzers have been rising due to the use of advanced and complex technologies for testing and measuring signals.

- The COVID-19 outbreak resulted in significant fluctuations in the market studied. The pandemic impacted each end-user differently. During the COVID-19 pandemic, the growing investments by governments to support scientific progress and infrastructure in several industries, coupled with the focus on R&D and automation, have significantly influenced the studied market.

Spectrum and Signal Analyzers Market Trends

This section covers the major market trends shaping the Spectrum & Signal Analyzers Market according to our research experts:

Automotive Segment is Expected to Witness Significant Growth

- The automotive industry is projected to witness considerable growth in the spectrum and signal analyzers market. The critical factor attributed to the development of spectrum analyzers in this sector is the rising demand for wireless technology, surging demand from the automotive industry with multi-tasking capabilities, and others. The spectrum analyzer's performance rises to meet automotive radar test requirements. The spectrum analyzer is equipment in the lab or production floor in these high-frequency applications.

- Additionally, precise verification of automotive radar systems is being undertaken strictly for heightened safety on the road. Several vendors, like Keysight, offer solutions for the same. The Keysight E8740A automotive radar signal analysis and generation solution facilitates the analysis and generation of automotive radar signals across the 24 GHz, 77 GHz, and 79 GHz radar frequencies and is capable of addressing growing bandwidths of 5 GHz and beyond.

- The growth of the automotive industry is also dependent on the growth of network and communication technologies such as 5G. In May 2022, Keysight Technologies, Inc., a technology company that delivers advanced design and validation solutions to help accelerate innovation to connect and secure the world; FormFactor, Inc., a provider of basic test and measurement technologies along the complete IC life cycle; DMPI Inc., a developer of millimeter-wave and terahertz probe technology; and Virginia Diodes, Inc., who designs and produces millimeter wave and terahertz devices, components, and systems, have joined forces to deliver a new 170 GHz / 220 GHz Broadband Vector Network Analysis (VNA) Solution that shortens design and verification cycles for 5G and emerging 6G applications.

- The joint solution, Keysight's new 220 GHz Broadband Network Analyzer, would enable customers to address the needs of 5G and future 6G technologies that will significantly impact communications through the internet of things and ubiquitous wireless connections.

- Further, the automotive test solutions of players like Anritsu validate the operation of connected car communications systems, ensuring that quality products reach the market on time. The company provides high-performance test solutions for a variety of automotive applications.

Asia-Pacific Expected to Witness Significant Growth

- The Asia-Pacific region is expected to grow at a considerable pace throughout the study period. The tremendous expansion of this area is being driven by important nations, including China, South Korea, Singapore, Japan, and India. Burgeoning infrastructures and an expanding population are also supporting the market. For instance, in September 2022, China transferred 300 billion yuan more earmarked for infrastructural projects via three state planning banks.

- There is an increasing demand for spectrum analyzers among automotive manufacturers and consumer electronics companies, further helping the market expand across the region. This has resulted in companies investing in the development of high-frequency spectrum analyzers.

- Anritsu Corporation, a Japanese company, has introduced wireless signal analyzer products from DC to 44.5 GHz and extendable to 325 GHz. Anritsu spectrum analyzers can capture wideband signals, but FFT technology supports multifunction signal analyses in both the time and frequency domains.

- Furthermore, product launches by major companies are also expected to contribute to market growth. For instance, in August 2022, Anritsu Corporation confirmed the release of its single initial sweep NVA-spectrum analyzer product, which supports frequencies from 70 kHz to 220 GHz.

- Due to the prominence of China and India's top semiconductor and electronics firms, the market in the Asia Pacific is expected to grow. The region's market will be driven by and contribute to market expansion through the widespread deployment of spectrum analyzers as a result of large expenditures in both IT & telecom and aviation & military industries. For instance, in September 2022, Start-up in space technology, Skyroot Aerospace, secured USD 51 million in a fundraising round headed by GIC India Direct Investment Group. According to the company, this is the most significant funding transaction in the Indian space-tech sector.

Spectrum and Signal Analyzers Industry Overview

The spectrum and signal analyzer market is fragmented. Mostly, increased R&D efforts, new technologies, and increased adoption of spectrum analyzers provide lucrative opportunities in the spectrum analyzer market. Overall, the competitive rivalry among the existing competitors is high. Moreover, the product innovation strategy of large companies is penetrating the market growth.

- September 2022 - Rohde & Schwarz introduced the R&S FSV and R&S FSVA signals and spectrum analyzers. The R&S FSVA3050 and R&S FSV3050 versions have been released with a frequency bandwidth of up to 50 GHz.

- September 2022 - Siglent introduced two fresh products to its Performance Series. The SSA5000A spectrum analyzer and the SSG5000A RF/MW signal generator are the first and second, respectively. With these two new items, Siglents' RF offering now includes frequencies over 20 GHz.

Spectrum and Signal Analyzers Market Leaders

-

Keysight Technologies Inc.

-

Anritsu Corporation

-

Yokogawa Electric Corporation

-

National Instruments Corporation

-

B&K Precision Corporation

*Disclaimer: Major Players sorted in no particular order

Spectrum and Signal Analyzers Market News

- August 2022 - Yokogawa introduced two unique optical spectrum analyzers (OSAs) to address industry demand for a device that can measure a wide variety of wavelengths in order to satisfy new requirements in optical device innovation and production. The Yokogawa AQ6375E and AQ6376E were the unique grating-based OSAs with top-tier optical performance that span SWIR over 2 m & MWIR beyond 3 m.

- June 2021 - Signal Hound, a producer of highly optimized systems for RF signal test and measurement, has unveiled the SM435B 43.5 GHz RF spectrum analyzer and monitor receiver. This advanced production unit extends the company's penetration into this new segment of the industry with its wide range of applications, including 5G cellular, aerospace, military, and a variety of other purposes.

- June 2021 - Signal Hound, a producer of highly specialized products for RF test and measuring equipment, has announced the BB60D, a 6 GHz real-time spectrum analyzer with considerable performance enhancements over the market favorite BB60C. The new BB60D offers a 10dB higher dynamic range, 10dB improved phase distortion from 100 Hz to 10 kHz offsets, and a wholly incorporated preselector covering 130 MHz to 6 GHz.

Spectrum and Signal Analyzers Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Growing Demand for Spectrum Analyzers With Multi-Tasking Capabilities

- 4.2.2 Technological Advancement Leading to Innovation in Spectrum Analyzer Offering

-

4.3 Market Restraints

- 4.3.1 Requirement of Cost-Effective Spectrum Analyzers With Maximum Features

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5. TECHNOLOGY SNAPSHOT

6. MARKET SEGMENTATION

-

6.1 By Frequency Range

- 6.1.1 Less than 6 GHz

- 6.1.2 6-18 GHz

- 6.1.3 More than 18 GHz

-

6.2 By End-user Industry

- 6.2.1 IT & Telecommunication

- 6.2.2 Automotive

- 6.2.3 Aerospace & Defense

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

-

6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7. COMPETITIVE LANDSCAPE

-

7.1 Company Profiles

- 7.1.1 Keysight Technologies Inc.

- 7.1.2 Anritsu Corporation

- 7.1.3 Yokogawa Electric Corporation

- 7.1.4 National Instruments Corporation

- 7.1.5 B&K Precision Corporation

- 7.1.6 Rohde & Schwarz GmbH & Co.

- 7.1.7 Advantest Corporation

- 7.1.8 Teledyne Lecroy, Inc.

- 7.1.9 LP Technologies Inc.

- 7.1.10 Stanford Research Systems, Inc.

- 7.1.11 Avcom of Virginia Inc.

- *List Not Exhaustive

8. INVESTMENT ANALYSIS

9. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablitySpectrum and Signal Analyzers Industry Segmentation

A spectrum analyzer is a measuring instrument that displays an electrical signal according to the frequency of the electrical signal. Each frequency component contained in the input signal is displayed as a signal level corresponding to that frequency. The spectrum analyzer measures the amplitude of an input signal against frequency within the full frequency range of the instrument. With the advent of digital technologies, modern spectrum analyzers possess enhanced functionality and added capabilities.

The Spectrum and Signal Analyzers Market is segmented by Frequency Range (less than 6 GHz, 6-18 GHz, more than 18 GHz), End-user Industry (IT & Telecommunication, Automotive, Aerospace & Defense, Healthcare, Other End-Use Industries (Educational Institutes, Semiconductor, Electronics, Government Sector)), and Geography (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa).

| By Frequency Range | Less than 6 GHz |

| 6-18 GHz | |

| More than 18 GHz | |

| By End-user Industry | IT & Telecommunication |

| Automotive | |

| Aerospace & Defense | |

| Healthcare | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Spectrum and Signal Analyzers Market Research FAQs

What is the current Spectrum and Signal Analyzers Market size?

The Spectrum and Signal Analyzers Market is projected to register a CAGR of 8% during the forecast period (2024-2029)

Who are the key players in Spectrum and Signal Analyzers Market?

Keysight Technologies Inc., Anritsu Corporation, Yokogawa Electric Corporation, National Instruments Corporation and B&K Precision Corporation are the major companies operating in the Spectrum and Signal Analyzers Market.

Which is the fastest growing region in Spectrum and Signal Analyzers Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Spectrum and Signal Analyzers Market?

In 2024, the North America accounts for the largest market share in Spectrum and Signal Analyzers Market.

What years does this Spectrum and Signal Analyzers Market cover?

The report covers the Spectrum and Signal Analyzers Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Spectrum and Signal Analyzers Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Spectrum and Signal Analyzers Industry Report

Statistics for the 2024 Spectrum and Signal Analyzers market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Spectrum and Signal Analyzers analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.