Sports Electronics Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 20.00 % |

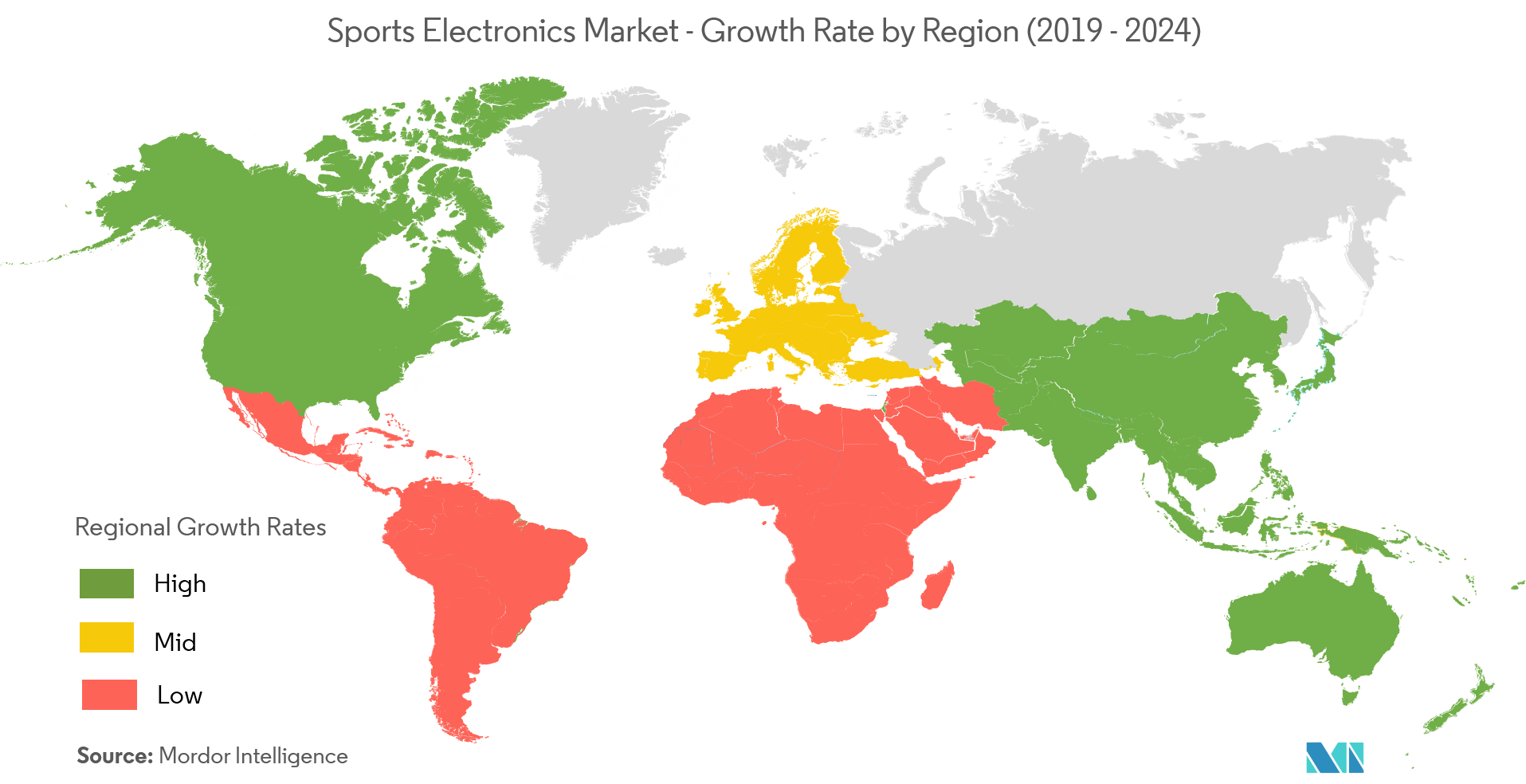

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Sports Electronics Market Analysis

The sports electronics market is expected to register a CAGR of 20%, during the forecast period 2021-2026. According to the World Health Organization, each week an adult should perform the moderate intensity of physical activities ( PA ) for 150 minutes. However, 25% of adults and more than 80% of adolescents fail to achieve the recommended PA targets. Thus, the need for monitoring the physical activities is increasing among the consumers, thereby increasing the adoption of the activity tracker.

- According to the Outdoor Industry Association, activewear was one of the most sold sports retail good in 2018. Activewear alone accounted for USD 53 billion in 2018. Observing the increasing demand for activewear, companies are investing in the segment and are introducing interactive activewear which is creating a positive outlook of the market.

- For instance, in November 2018, Pivot Yoga, a smart activewear company launched a smart activewear for yoga lovers which was equipped with artificial intelligence and motion sensor technology. This smart activewear helps in correcting yoga posture through the use of the Pivot app.

- Moreover, in a high-intensity interval training, injuries are common, owing to which the companies are working to design a device which directly identifies muscle strain thereby reducing any recurring injury. For instance, in 2017, the NFL Player's Association (NFLPA) formed a partnership with WHOOP to offer every player with a wearable device enabling monitoring features such as strain, recovery, and sleep.

- However, lack of awareness about the importance of the product, coupled with the high cost of smart sports electronics product is restraining the growth of the market.

Sports Electronics Market Trends

This section covers the major market trends shaping the Sports Electronics Market according to our research experts:

Smartwatch is Expected to Register a Significant Growth

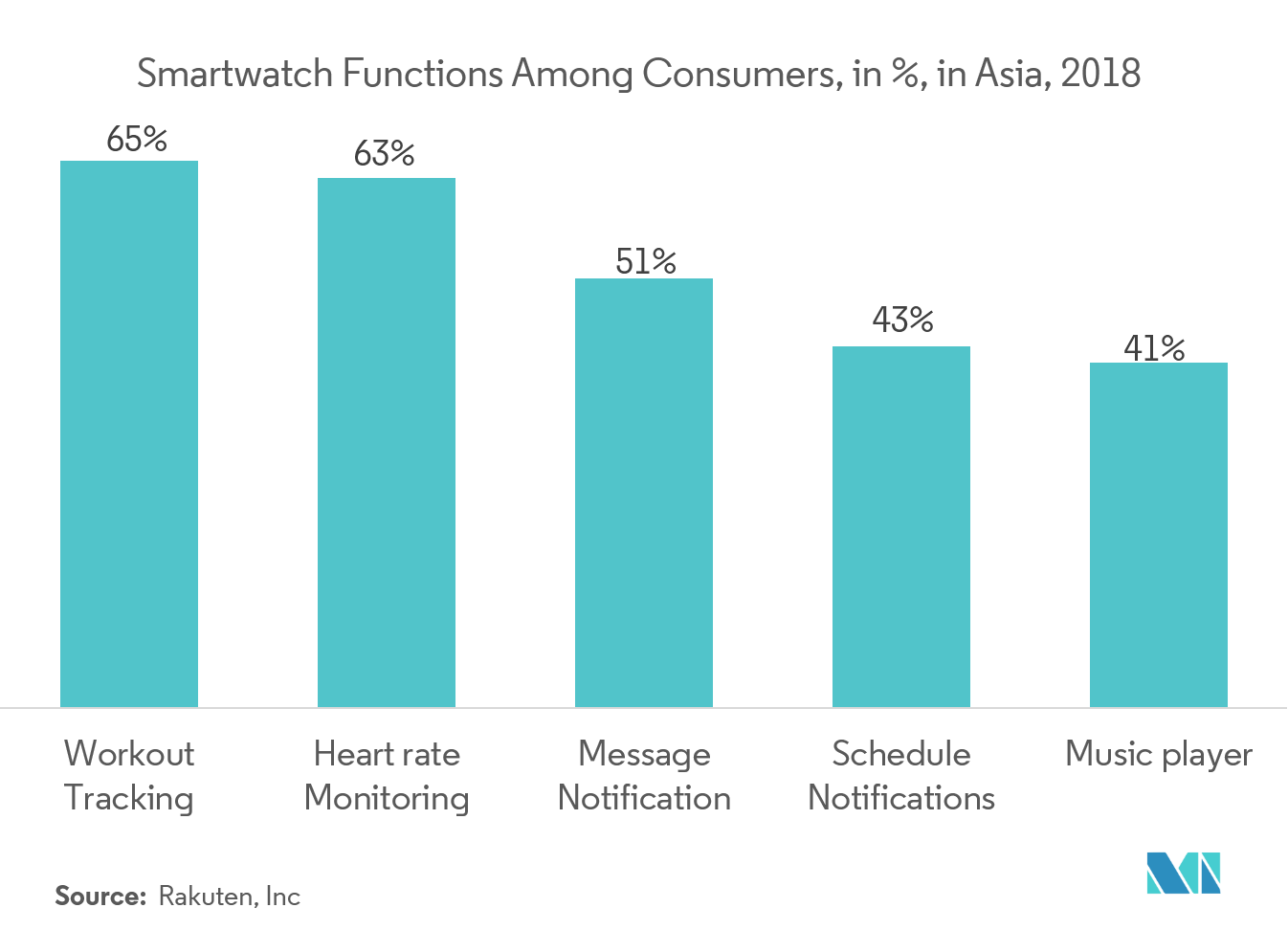

- According to the Consumer Technology Association, the sale of the smartwatch in the United States increased from 12.1 million units in 2017 to 15.3 million units in 2018. Smartwatches are capable of monitoring physical activities such as heart rate.

- Heart rate monitors are being widely used by sportsperson and athletes to improve their performance. This popularity has opened new avenues for industry players to invest in the competitive market. For instance, in September 2018, Polar introduced an enhanced heart rate monitor with the company’s wearable series, Vantage.

- Further, with the increasingly competitive nature among the players, smartwatches are now being used to collect different data such as running power, blood pressure, and calories burned, etc., during the match, that can be analyzed further.

- For instance, in October 2018, Huawei launched GT smartwatch which gathers and analyzes data, and transforms it into personalized feedback for improving fitness and well-being. Such innovations have a positive outlook on smartwatches globally.

- Moreover, governments across the Asia-Pacific region are increasing the sports budget allocation, thus creating more opportunity for different sports in the region. As a result, increasing sports activity in the region will have a positive impact globally.

Asia-Pacific to Witness Fastest Growth

- Asia-Pacific is expected to witness the fastest growth because of the presence of two highly populated countries i.e. China and India. According to a survey by Aegon in India, 46% of respondents believed that the tools to monitor health goals were beneficial in 2018. Therefore, it can be inferred that the people in this region are preferring smart wearable to monitor their health goal which in return is creating an opportunity for the sports electronic market.

- Moreover, favorable laws for setting up a business is acting as catalysts for the growth of many wearable medical device startups and witnessing the huge market base, many global players are expanding their geographical base in the region.

- For example, "Made in India" initiative by the government is supporting many startup to come up with innovative products, which is driving the market in the region.

Sports Electronics Industry Overview

Thesports electronics market is fragmented due to the presence of global players such asFitbit, Inc.,Garmin Ltd,Apple, Inc, Catapult Sports,Under Armour, etc. Moreover, according to the Consumer Technology Association, therevenue from wearables sales increased from USD 4 billion in 2014 to USD 22 billion in 2017, globally. Thus, the companies are working on various strategies, such as expansions, new product launches, partnerships, agreements, joint ventures, and acquisitions, amongothers, to increase their footprints in this market. Some of the recent developments are:

- June 2019 -Garmin Indialaunched an update of Forerunnerseries watch i.e. Forerunner 245 and Forerunner 245 Music. Thislightweight smartwatch is loaded with advanced features such as, incident detection, body battery, race predictor, and are available in different colors.

- June 2019 -Garmin International, Inc. launched the Approach X10, a comfortable golf band that is preloaded with data for over 41,000 courses around the world. Golfers of all levels can easily see precise distances to the front, back and middle of the green, as well as hazards on the touch-screen display.

Sports Electronics Market Leaders

-

Fitbit, Inc

-

Garmin Ltd

-

Apple Inc

-

Under Armour, Inc

-

Catapult Sports

*Disclaimer: Major Players sorted in no particular order

Sports Electronics Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

-

4.3 Market Drivers

- 4.3.1 Technological Advancements in Wearable Sports Devices

- 4.3.2 Rising Demand for Round-The-Clock Monitoring

-

4.4 Market Restraints

- 4.4.1 High Cost of Wearable Devices

- 4.5 Industry Value Chain Analysis

-

4.6 Industry Attractiveness - Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

-

5.1 By Product Type

- 5.1.1 Wearable Devices

- 5.1.1.1 Pedometers

- 5.1.1.2 Activity Monitors

- 5.1.1.3 Smart Fabrics

- 5.1.1.4 Fitness and Heart Rate Monitors

- 5.1.1.5 Other Wearable Devices

- 5.1.2 Standalone Devices

- 5.1.2.1 Electronics Scales

- 5.1.2.2 Cameras

- 5.1.2.3 Cycling Computers

- 5.1.2.4 Other Standalone Devices

-

5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East & Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 Fitbit, Inc

- 6.1.2 Garmin Ltd

- 6.1.3 Apple, Inc

- 6.1.4 Catapult Sports Pty Ltd.

- 6.1.5 Under Armour

- 6.1.6 Zepp US Inc.

- 6.1.7 StretchSense Ltd.

- 6.1.8 SZ DJI Technology Co., Ltd

- 6.1.9 Polar Electro Oy

- 6.1.10 Adidas AG

- 6.1.11 Nike, Inc

- 6.1.12 Giant Manufacturing Co. Ltd.

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

** Subject To AvailablitySports Electronics Industry Segmentation

The sports electronics devices are an important part of the sports industry because the devices help the sportsperson to track their fitness activities and further helps in providing relevant information regarding the different parameters. With the commercialization of the sports industry, manufacturers are innovating and launching new products to cater to every demand in the industry.

| By Product Type | Wearable Devices | Pedometers |

| Activity Monitors | ||

| Smart Fabrics | ||

| Fitness and Heart Rate Monitors | ||

| Other Wearable Devices | ||

| By Product Type | Standalone Devices | Electronics Scales |

| Cameras | ||

| Cycling Computers | ||

| Other Standalone Devices | ||

| Geography | North America | |

| Europe | ||

| Asia-Pacific | ||

| Latin America | ||

| Middle East & Africa |

Sports Electronics Market Research FAQs

What is the current Sports Electronics Market size?

The Sports Electronics Market is projected to register a CAGR of 20% during the forecast period (2024-2029)

Who are the key players in Sports Electronics Market?

Fitbit, Inc, Garmin Ltd, Apple Inc, Under Armour, Inc and Catapult Sports are the major companies operating in the Sports Electronics Market.

Which is the fastest growing region in Sports Electronics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Sports Electronics Market?

In 2024, the North America accounts for the largest market share in Sports Electronics Market.

What years does this Sports Electronics Market cover?

The report covers the Sports Electronics Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Sports Electronics Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Sports Electronic Devices Industry Report

Statistics for the 2024 Sports Electronic Devices market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Sports Electronic Devices analysis includes a market forecast outlook 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.